- within Litigation, Mediation & Arbitration, Real Estate and Construction, Food, Drugs, Healthcare and Life Sciences topic(s)

By Bradley A. Heys and Mark L. Berenblut1

Introduction

In 2012, there were nine new securities class actions filed in Canada - down from 15 new cases in 2011. Six of these nine new cases involve companies in the mining and oil and gas sectors. Our database now includes 100 Canadian securities class actions filed over the 16-year period from 1997 to 2012. Three cases were settled and two were dismissed during 2012, leaving a total of 51 active securities class actions, representing more than $23 billion in total claims, as of 31 December 2012.2

There were eight new filings of claims under the secondary market civil liability provisions of the provincial securities acts ("Bill 198" cases), in line with the nine new cases filed in 2011 and eight filed in 2010. There have now been a total of 43 Bill 198 cases filed since the statutory amendments came into force in Ontario at the end of 2005. Of these, 28 cases (or 65%), representing more than $19 billion in total claims, remain unresolved. Twelve Bill 198 cases (28% of those filed) have settled, and three (7%) have been dismissed - including two that were dismissed in 2012.

Perhaps the most notable development during 2012 was the agreement by Ernst & Young to pay $117 million to settle claims in relation to its role as auditor of the Toronto Stock Exchange (TSX)-listed Chinese company Sino-Forest. Although this represents only a partial settlement of that case (claims against other defendants are still pending), and is still subject to court approval, it is the largest total settlement in any Bill 198 case to date, exceeding the $28 million settlement in 2010 in the case against Novagold.

Also notable in the Canadian securities class action arena during 2012 were the court rulings in the actions involving Timminco, CIBC, and IMAX, each of which concerned the limitation period for obtaining leave of the court to pursue Bill 198 claims; the ruling in the case against Western Coal, for which the court both denied leave and refused class certification; and the ruling in the case against Canadian Solar, which addressed the statutory definition of a "responsible issuer." In their own way, each of these rulings may impact future trends.

In past years Canadian filings have tended, at least to some extent, to reflect the major trends in filings observed in the US. Consistent with the experience south of the border during 2012, it seems we have now seen the last of the credit crisis-related class actions in Canada. Also, last year's surge of filings against Chinese companies did not continue in 2012 on either side of the border. However, none of the new filings in Canada are similar to the merger objection cases which had a significant influence on filings south of the border in 2012.3

Trends in Filings

The total of nine new securities class actions filed in 2012 is down from the all-time high of 15 new cases filed in 2011, and less than the average of 12 new cases per year in the period since 2008. See Figure 1. Our database now includes data for 100 Canadian securities class action cases. More than half of these (57%) were filed within the last five years.

Shareholder Class Actions

Each of the nine new filings in 2012 is a shareholder class action. This is in contrast to recent years which also saw filings of new cases involving Ponzi schemes and/or investment funds. For example, two cases in 2011 were filed in relation to investment funds and two others involved allegations of Ponzi schemes.

Eight of the nine cases filed in 2012 involved issuers with securities listed on the TSX (the other one involved an issuer whose shares are not listed in Canada). These eight companies represent approximately 0.6% of the 1,287 companies listed on the TSX.4 Over the past five years (i.e., 2008 through 2012), a total of 40 cases have been filed against TSX-listed companies, representing approximately 3% of the average number of companies listed over that period. In other words, averaged annually, filings are less than 1% of TSX-listed companies. In addition, over the same five-year period, filings have been brought against five companies listed on the TSX Venture Exchange ("TSX-V"), being a very small percentage of the roughly 2,200 TSX-V listed companies.

Reflections of US Trends

In previous years, trends in US securities class action filings have tended to be reflected in Canadian filings. For example, last year we noted that the three Canadian filings against Chinese companies with securities listed on North American exchanges - Sino-Forest, Cathay Forest Products, and Zungui Haixi Corporation - reflected one of the trends driving filings in the US. Trends in US filings from 2008 to 2010 relating to options manipulation, Ponzi schemes, and the credit crisis were also reflected to some extent in Canadian filings.

In 2012, the abatement of these recent trends was evident on both sides of the border. In the US, only four cases filed in 2012 related to the credit crisis (down from a high of 103 in 2008), none of the filed cases involved allegations of a Ponzi scheme, and only 16 cases were filed against Chinese-domiciled companies (down from 37 in 2011).5 In Canada none of the cases filed in 2012 related to any of these trends.

The nine new Canadian filings in 2012 also appear to be unrelated to any new trends driving US filings. Notably, while there has been a surge in filings of merger objection related cases over the last three years in the US, to date we have not seen any reflection of that trend in Canada.6

Overall, the total number of filings in 2012 in both Canada and the US was at the low end of the range of annual filings seen in each country over the last five years. A summary of the recent trends in US securities class actions is appended to this report.

Bill 198 Cases

Eight of the nine new cases filed in 2012 are Bill 198 cases - one fewer than last year, but generally in line with the number of filings of such cases since 2008 and continuing the trend of a higher volume of cases following the introduction of the secondary market civil liability provisions into the provincial securities acts. See Figure 2.

Filings by Province

As we have noted in prior years, the vast majority of Canadian securities class actions are filed in Ontario, with several also having parallel filings in other provinces.7 The cases filed in 2012 continued that trend:

- Each of the nine new cases filed in 2012 was filed in Ontario.

- Two of these cases - the claims against SNC-Lavalin and Agnico-Eagle - were also filed in Québec.

- Two cases were also filed in British Columbia - namely, the claims against Facebook and GLG Life Tech Corp. A similar claim against Facebook was also filed in Saskatchewan.

- The case against BP p.l.c. was originally filed in Alberta, but was dismissed for jurisdictional reasons and subsequently re-filed in Ontario.

- The case against Poseidon was filed only in Ontario during 2012, but similar filings were made against the company in Québec and Alberta early in 2013.

Cross-Border Cases

Six of the nine new securities class action filings in 2012 also had parallel US filings: those against Agnico-Eagle, BP p.l.c., Facebook, GLG Life Tech, Kinross Gold, and Nevsun Resources.8

It is notable that shares of Facebook are not listed on a Canadian exchange. In addition to this case, there have been two other cases brought by shareholders of public companies whose securities were not listed on a Canadian exchange - namely, the cases against AIG and Canadian Solar. We noted last year that the Ontario Superior Court allowed the case against Canadian Solar to proceed despite the company's primary place of business being China and the fact that its shares are listed only on the NASDAQ in the US. During 2012, the Ontario Court of Appeal affirmed that decision finding that an issuer whose shares trade exclusively on a foreign exchange can fall under the definition of a "responsible issuer" and can be subject to civil liability under the Ontario Securities Act (OSA) provided that a "real and substantial connection to Ontario" is established.9

US Securities Class Actions against Canadian Companies

Securities class action filings were made against six Canadian-domiciled companies during 2012. These include:

- US cases against Kinross Gold and Nevsun Resources for which there are parallel Canadian securities class actions; and

- Cases against Magna International, Ã terna Zentaris Inc., Swisher Hygiene Inc., and Neptune Technologies & Bioresources Inc. for which no parallel claims were filed in Canada in 2012.

These filings continue the recent trend of about half of all US filings against Canadian companies also corresponding to a parallel claim in Canada. See Figure 3.

Note: If multiple US federal court cases are filed against the same defendant, are related to the same allegations, and are in the same circuit, we treat them as a single filing. However, multiple actions filed in different circuits are treated as separate filings. We have counted each US filing as having a parallel Canadian action where there is at least one Canadian action against the same defendant and involving similar allegations. In some instances, more than one US filing relates to a single Canadian action.

Industry Sectors

Two-thirds of the new cases filed in 2012 (i.e., six of nine cases) were brought against companies in the mining or oil and gas sectors, continuing a trend we have previously noted.10 As we have also previously noted, about one quarter of all cases are brought against companies in the finance industry. Bucking that trend in 2012, none of the new filings involve claims by shareholders of financial sector companies. Filings of Canadian securities class actions by industry sector for the period 1997 to 2012 are illustrated in Figure 4.

Twenty-seven of the 30 cases filed between 1997 and 2012 involving companies in the energy and non-energy minerals (oil & gas and mining) industries involve TSX- or TSX-V-listed companies.

Of the 21 filings against companies in these industries over the past five years, 18 were against TSX-listed companies (out of a total of about 500 TSX-listed companies in these industries), and two involve TSX-V-listed companies (out of a total of about 1,500 TSX-V listed companies in these industries).

Interestingly, of the 26 cases brought against companies in the finance industry since 1997, only six have involved claims by shareholders against publicly listed companies. Since 2008, only four TSX-listed finance companies have faced shareholder class actions - representing approximately 5% of the average number of TSX-listed companies in this industry over this period, or about 1% per year, on average.

Figure 4. Filings by Industry SectorFinance26.0

Time to Filing

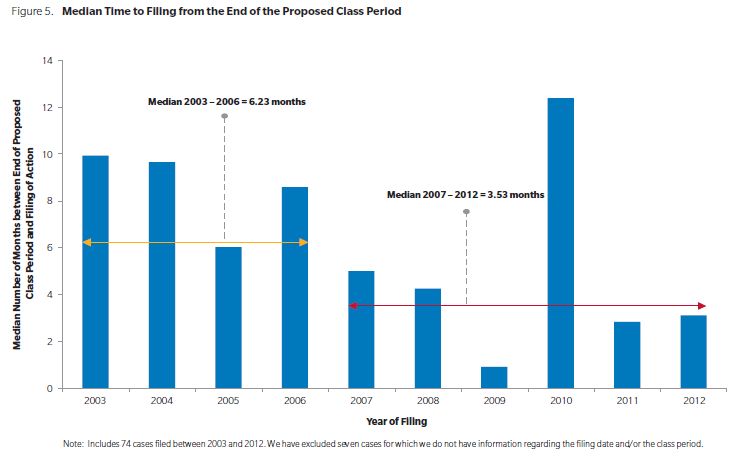

The median time from the end of the proposed class period to the date of filing for cases filed in 2012 was approximately 3.1 months, and the average was 4.6 months. The case with the longest time to filing is the claim against BP, which was filed approximately 17 months after the end of the proposed class period. All eight of the other cases filed in 2012 were filed within 10 months of the end of the proposed class period. Excluding the filing against BP, the average time to filing in 2012 was three months.

The median time to filing for 2012 is in line with recent history and seems to confirm our suggestion last year that the time to filing for cases filed in 2010 was an aberration in what is otherwise a trend towards faster filing.11 See Figure 5.

Trends in Resolutions

Settlements

As noted above, perhaps one of the more significant developments in 2012 is the agreement by accounting firm Ernst & Young to pay $117 million to settle claims made against it in relation to its role as the auditor of Sino-Forest. If approved by the court, that partial settlement alone would represent the largest settlement in a Bill 198 case to date. That case remains active against the company (which is in proceedings under the Companies' Creditors Arrangement Act (CCAA)) and other named defendants (including the company, various investment banks, and the audit firm BDO Limited). Plaintiffs in that case have claimed a total of approximately $9.2 billion in damages.

Audit firm defendants have reached settlements in only two other Bill 198 cases to date - being those involving Redline Communications (settled in 2010) and CV Technologies (settled in 2009). In each of these cases, the auditor defendants agreed to pay $500,000 to settle the claims.

Excluding partial settlements, three cases were settled during 2012 - two Bill 198 cases and one Ponzi scheme case. None of these was a cross-border case:

- Arctic Glacier settled for $13.8 million, about 5.6% of the $245 million claimed;

- Gammon Gold settled for $13.25 million, about 16.6% of the total claimed damages; and

- RBC paid $17 million - 42.5% of the $40 million in claimed damages - to settle a case relating to the Earl Jones Ponzi scheme.

The two Bill 198 settlements bring the total number of settlements in these cases to 12. The average settlement amount across these 12 settled Bill 198 cases is $10.5 million. The median settlement is $9.3 million. The average settlement as a percentage of compensatory damages claimed in these cases is 12.6% and the median is 8.9%.

As we noted last year, the average settlement in four Bill 198 cases which had a parallel US claim is $16.9 million and the median is $17.2 million (figures which are unchanged since there were no settlements in any cross-border cases in 2012). As a percentage of the compensatory damages claimed, the average settlement is 13.7% and the median is 11.0%.

The average of the settlements in the eight domestic-only cases is $7.4 million, and the median is $5.4 million. As a percentage of the compensatory damages claimed, the average is 12.1% and the median is 6.8%.

Our database now includes data for 38 Canadian securities class actions settlements (excluding partial settlements). The average settlement across all cases is $102.2 million - a figure which is heavily skewed by two large settlements in the class actions relating to Nortel. The median settlement is $13.0 million.

Dismissals

Two cases - namely, the cases brought against Western Coal and CIBC - were dismissed during 2012 (although these dismissals may yet be subject to appeal).

In the Western Coal case, the Ontario Superior Court dismissed the plaintiff's application for leave on the grounds that "the plaintiff's claim has no reasonable possibility of success at trial and that there is no reasonable possibility that a trial judge would accept [the evidence of the plaintiff's accounting expert] in preference to the defendants' expert evidence."12

In the case against CIBC, the court declined to grant the plaintiff's application for leave because the action was statute-barred by the three-year limitation period imposed by Section 138.14 of the OSA, but indicated that leave would otherwise have been granted.13

The ruling in CIBC reflected that of the Court of Appeal for Ontario in Timminco. In Timminco, the Court of Appeal overturned the Superior Court's 2011 ruling that the limitation period could be suspended.14 The Court of Appeal held that leave to pursue a claim under the secondary market civil liability provisions must be granted for the claim to be deemed to have been "asserted" for the purposes of the limitation period. Since leave in that case had not been granted within three years of the alleged misrepresentation, the statutory claims were dismissed. The case against Timminco is still considered to be "active" in our database since, notwithstanding the denial of leave to proceed with the statutory (Bill 198) claims, there are still outstanding common law misrepresentation claims against the company.

The denial of leave applications in Timminco and CIBC contrasts with the case against IMAX, in which the motions judge determined that she had the jurisdiction to amend the date of the leave order to a date prior to the expiry of the limitation period (notwithstanding that the limitation period had expired by the date leave was actually granted), thereby allowing the action to continue.15 Similarly, the motions judge in Celestica refused to strike the claim notwithstanding that the proposed class period ended on 31 January 2007 and leave has yet to be granted. He suggested that it would be an appropriate case in which to apply the "special circumstances" doctrine to retroactively grant leave.16

Status of Active Cases

With the nine new cases filed and resolutions in five cases during 2012, there are now 51 active Canadian securities class actions - four more than at the end of 2011, 16 more than at the end of 2010, and nearly double the number of active cases four years ago. See Figure 6.Figure 6. Active Cases as of 31 December 2012

These 51 active cases represent more than $23 billion in claims, including both compensatory and punitive damages. All but nine of the cases still active as at the end of 2012 were filed after 2007. See Figure 7.

Active Bill 198 Cases

Twenty-eight of these 51 active cases (or 55%) are Bill 198 cases representing more than $19 billion in claimed damages (about 84% of the total outstanding claims). Of these, 22 cases have not yet reached the leave application or class certification stage. As mentioned above, leave was denied in Timminco, but there remain unresolved common law claims that have not yet been certified. The case involving IMAX has been granted leave of the court and is certified as a class action. Similarly, the case in Québec against Theratechnologies has been authorized,17 although we understand this decision has been appealed. Leave to proceed has been granted by consent of the defendants in the actions involving easyhome and SNC-Lavalin, and both cases have been certified as class actions.18 In the matter involving Zungui Haixi, leave has been granted (which may be subject to appeal), but the claim has not been certified as a class action.19 A case involving Manulife was authorized as a class action in Québec, but motions for leave and certification have not yet been heard by the Court in Ontario.20

Of 23 Bill 198 cases which have not yet been granted leave of the Court, 10 have either already reached, or at some point during 2013 will reach, the three-year mark from the end of the proposed class period. For some of these cases, tolling agreements are in place which stop the clock running on the limitation period. However, to the extent some of these cases do not have such agreements we can expect to see more leave applications and rulings during 2013.

Active US Cases against Canadian Companies

As of 31 December 2012, there were also 17 active US cases against Canadian-domiciled companies.21 See Figure 8.

Looking Forward

Our database now includes 100 Canadian securities class actions, 51 of which remain active. Looking forward to 2013, it seems reasonable to expect to see these cases generally move at a more rapid pace.

The combination of the growing number of active Canadian securities class actions and the decisions in Timminco and CIBC may suggest that (notwithstanding the potential availability of the special circumstances doctrine in some cases) there may be impetus for more cases to proceed to the leave application stage over the next year.

More cases and a more rapid pace may also mean that we will see more settlements during 2013 than we saw in 2012.

To the extent that we do see more rulings at the leave stage, those decisions are likely to impact future trends in filings of Canadian securities class actions.

Footnotes

1 Bradley A. Heys is a Vice President and Mark L. Berenblut is a Senior Vice President with NERA Economic Consulting. We thank Andrea Laing and Ron Miller for helpful comments on earlier drafts. We also thank Jacob Dwhytie, James Mancini, and Brian Shaposhnik for valuable research assistance with this paper. We gratefully acknowledge the contributions of Svetlana Starykh to this and previous editions of this study. These individuals receive credit for improving this paper. All errors and omissions are our responsibility.

2 We record a case as dismissed based on the most recent ruling of the court even though such a dismissal may still be overturned on appeal.

3 Renzo Comolli, Sukaina Klein, Ron Miller, and Svetlana Starykh, "Recent Trends in Securities Class Action Litigation: 2012 Full-Year Review, Settlements Up; Attorneys' Fees Down," NERA report, 29 January 2013 (http://www.nera.com/nera-files/PUB_Year_End_Trends_01.2013.pdf ).

4 As of 31 December 2012. Excluding exchange-traded funds.

5 Note 3, pp. 5, 8.

6 Note 3, p. 5.

7 Bradley A. Heys and Mark L. Berenblut, "Trends in Canadian Securities Class Actions: 2011 Update, Pace of Filings Grows, Pace of Settlements Slows" NERA, 30 January 2012, p.5.

8 The US case against Agnico-Eagle was dismissed in early January 2013 with the Court finding that Plaintiffs' failed to adequately "plead fact supporting a strong inference of scienter." 11 Civ. 7968 (JPO), US District Court, SDNY.

9 Abdula v. Canadian Solar Inc., 2012 ONCA 211.

10 Note 7, p. 8.

11 Note 7, p. 8.

12 Gould v. Western Coal Corporation, 2012 ONSC 5184 (CanLII), ¶239.

13 Green v. Canadian Imperial Bank of Commerce, 2012 ONSC 3637 (CanLII).

14 Sharma v. Timminco Limited, 2011 ONSC 8024 (CanLII), rev'd, 2012 ONCA 107. Leave to appeal to the S.C.C. refused, [2012] S.C.C.A. No. 157.

15 Silver v. Imax Corp., 2012 ONSC 4881 (CanLII).

16 Trustees of the Millwright Regional Council of Ontario Pension Trust Fund v. Celestica Inc., 2012 ONSC 6083 (CanLII).

17 121851 Canada Inc. c. Theratechnologies Inc., 2012 QCCS 699.

18 The Trustees of the Drywall Acoustic Lathing and Insulation Local 675 Pension Fund v. SNC-Lavalin Group Inc., 2012 ONSC 5288. Sorenson v. easyhome Ltd., 2012 ONSC 1946.

19 Zaniewicz v. Zungui Haixi Corporation, 2012 ONSC 6061.

20 Comité syndical national de retraite Bâtirente inc. c. Société financière Manuvie, 2011 QCCS 3446., 2011 QCCS 3446.

21 Our US database records multiple filings where actions are filed against the same defendant in more than one federal court circuit (unless they are subsequently consolidated).

Global Trends:

Summary of other NERA Studies

NERA has been analyzing trends in shareholder class action litigation for more than 20 years, and we publish several studies annually examining class action litigation trends around the world. This overview summarizes the most recent edition of each of these reports.

Securities Class Actions: US

The year-end edition of NERA's semi-annual study of US federal securities class action filings showed that the number of securities class action cases resolved in 2012 plummeted to record lows. Co-authored by Senior Consultants Dr. Renzo Comolli and Svetlana Starykh, Vice President Dr. Ronald Miller, and Consultant Sukaina Klein, the study draws from more than 20 years of NERA research on case filings and settlements in US securities class actions. The authors find that 152 cases were dismissed or settled in 2012, compared to the 244 securities class actions resolved in 2011. Only 93 securities class actions were settled in 2012 - also a record low since 1996 and a 25% reduction over 2011. For the modest number of cases that were actually settled in 2012, settlement values were near their average level of recent years, up from the relatively low level of 2011. Plaintiffs' attorneys' fees, by contrast, have decreased.

Filings of securities class actions only slightly declined in 2012, with a total of 207 class actions filed in federal courts last year, compared to the average rate of 221 over the previous five years. The authors also observed a decline in the pace of filings over the course of 2012. Sizeable reductions of credit-crisis litigation and cases with a Chinese company defendant were largely offset by filings of merger objection cases, which accounted for 25% of new filings in 2012.

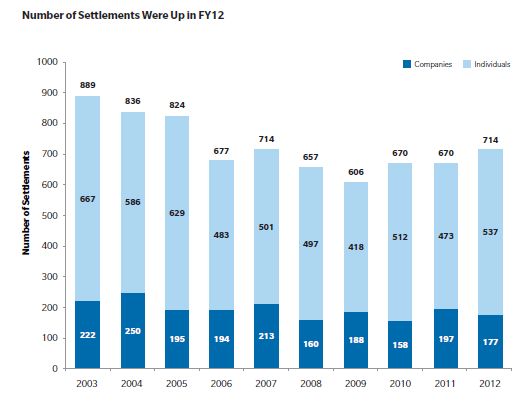

SEC Enforcement Actions: US

The latest report from NERA's ongoing analysis of trends in Securities and Exchange Commission (SEC) enforcement action settlements finds that settlements with the SEC continued their upward trajectory, reaching 714 in fiscal year 2012 (FY12), the highest number since 2007. This increase in total settlements represents a 6.6% increase over the 670 SEC settlements in fiscal year 2011 (FY11). The total number of settlements with individuals in FY12 reached the highest level recorded since 2005, with 537 - up 14% from 473 in FY11.

The authors - Vice President Dr. James Overdahl, Senior Vice President Dr. Elaine Buckberg, and Senior Consultant Jorge Baez - note that median settlement values for companies declined to $1 million in FY12 from the $1.4 million observed in FY11. Consistent with the SEC's emphasis on individual accountability, median settlement values for individuals reached a post-Sarbanes Oxley ("SOX") high in FY12, having more than doubled since 2009 from $103,000 to $221,000. The authors also find that settlements for several categories of allegations reached new highs in FY12. The SEC reached a record number of insider trading settlements in FY12, with 118 individuals and eight companies. Settlements involving allegations of misrepresentation and misappropriation by financial firms also hit a post-SOX record high in FY12, with 208 total cases.

Regulatory Enforcement Actions: UK

Five of the 10 largest Financial Services Authority (FSA) fines of all time have been levied since 1 January 2012, according to NERA's latest report. Authored by Vice President Paul Hinton and Senior Consultant Robert Patton, the report analyzes trends based on NERA's proprietary database of fines and other enforcement activity by the FSA. Among the report's findings are that fines imposed by the FSA since 1 January 2012 (through 20 December) have totaled £310 million, more than four times the total for 2011. This increase is due to a handful of very large fines, including the £160 million fine against UBS for LIBOR manipulation announced 19 December, which is the largest-ever FSA fine by a substantial margin. The number of fines assessed against firms, 25, was in line with last year. In contrast, the number of fines against individuals fell to its lowest level since 2009, and the aggregate fine amount imposed on individuals fell slightly compared to 2011.

According to the report, the dramatic increase in aggregate fines is the result of a few headline-grabbing penalties against banks, notably those against UBS and Barclays for manipulation of LIBOR and EURIBOR, and against UBS for failing to prevent unauthorized trading by a rogue trader, Kweku Adoboli. Those three fines alone totaled nearly £250 million. The NERA report also finds that, with £284 million in fines already imposed through the first three-quarters of the FSA's fiscal year (ending 31 March 2013), fines against firms have already exceeded the combined total from all previous fines against firms in the FSA's history.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.