The year 2012 witnessed several notable developments in the enforcement of the Foreign Corrupt Practices Act (FCPA). This alert discusses these developments, which collectively illuminate the priorities of the U.S. Department of Justice (DOJ) and the U.S. Securities and Exchange Commission (SEC), provide insight into likely future trends in settlements and judicial decisions, and serves as a road map for the government's expectations regarding compliance programs and their implementation. Finally, we look ahead to possible developments in 2013.

1. Enforcement Trends

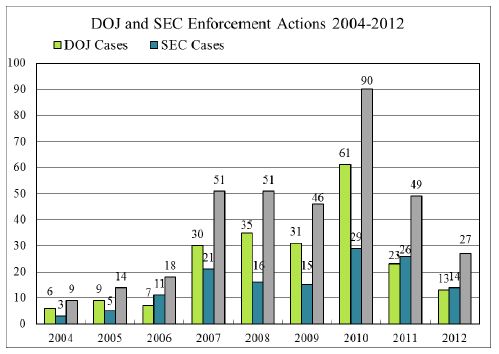

2012 saw a decline in the number of new cases publicly initiated by DOJ and the SEC; they together brought only 27 total cases in 2012.1 Enforcement, however, remains a stated priority: DOJ announced in 2012 that it had more than 150 open FCPA investigations and both DOJ and the SEC have signaled they will continue their aggressive prosecution of FCPA cases. It appears that the decline in new cases in 2012 can be attributed to factors such as the government's focus on resolving previously initiated investigations and continuing high-profile investigations, such as inquiries into Wal-Mart Stores, Inc.'s foreign subsidiary's business practices in Mexico and elsewhere,2 Alcoa Inc.'s dealings with a majority state-owned company in Bahrain,3 efforts related to the dismissal of the so-called "Africa Sting Case" 4 and other unsuccessful prosecutions of 2012,5 and Avon Products, Inc.'s compliance with the FCPA and foreign laws in China and elsewhere.6 Moreover, government representatives have noted that some DOJ/SEC resources were also diverted away from cases and instead focused on the production of the long-awaited FCPA "guidance," discussed below.7

2. DOJ/SEC Guidance

On November 14, 2012, the DOJ Criminal Division and SEC Enforcement Division published A Resource Guide to the Foreign Corrupt Practices Act (the Guide).8 The Guide is organized into 10 chapters and offers a plain-language explanation of the FCPA and its relevance to international business and corporate compliance programs. While the non-binding, 120-page Guide is not an FCPA watershed that announces revamped enforcement priorities or alters the government's previously stated positions on controversial issues related to the statute, it offers unprecedented insight into DOJ's and the SEC's joint FCPA enforcement approach and priorities. For a more detailed analysis of the Guide, see WilmerHale Foreign Corrupt Practices Act Alert, DOJ and SEC Issue Much Anticipated FCPA Guidance, Nov. 19, 2012.

3. Morgan Stanley and Compliance

In April 2012, DOJ announced that Garth Peterson, a former managing director for Morgan Stanley's Real Estate Group in Shanghai, China, had pleaded guilty to a one-count criminal information charging him with conspiracy to circumvent internal controls in a scheme he orchestrated to provide a $2.88 million benefit to a Chinese government official.9 In announcing the settlement with Peterson, DOJ went to great lengths to detail the comprehensiveness of Morgan Stanley's compliance program and internal controls and Morgan Stanley's due diligence processes, including:

- Between 2002 and 2008, Morgan Stanley employed over 500 "dedicated compliance officers";

- Morgan Stanley's compliance department had "direct lines" to Morgan Stanley's Board of Directors and "regularly" reported through the Chief Legal Officer to the Chief Executive Officer;

- Morgan Stanley employed "dedicated anti-corruption specialists" who drafted and maintained policies and procedures;

- Morgan Stanley provided its employees with a toll-free compliance hotline;

- Morgan Stanley's Code of Conduct specifically addressed corruption risks and conduct that would violate the FCPA;

- Between 2002 and 2008, Morgan Stanley held at least 54 trainings on anti-corruption for groups of Asia-based employees;

- Between 2002 and 2008, Morgan Stanley trained Peterson on the FCPA at least seven times and provided Peterson at least 35 FCPA compliance reminders; and

- Morgan Stanley required Peterson to certify his compliance with the FCPA on multiple occasions.10

In determining that "Morgan Stanley continually evaluated and improved its compliance program and internal controls,"11 DOJ seemingly reviewed Morgan Stanley's conduct regarding the business dealings exploited by Peterson and found that Morgan Stanley acted appropriately. Indeed, the DOJ charged Peterson with circumventing internal controls, which itself is a concession that Morgan Stanley maintained an appropriate compliance program. The DOJ press release announcing Peterson's guilty plea explained that, after examining all of the facts and circumstances, DOJ "declined to bring any enforcement action against Morgan Stanley."12 The DOJ's determination to decline to prosecute Morgan Stanley was no doubt influenced by its conclusion that Peterson "actively sought to evade Morgan Stanley's internal controls" and "used a web of deceit to thwart Morgan Stanley's efforts."13 Another reading of the case is that, rather than declining to prosecute a viable case as a reward for Morgan Stanley's robust internal controls, the government did not prosecute Morgan Stanley because it had engaged in no illegal conduct and was itself a victim of Peterson's misconduct.14 The SEC, which also entered into a settlement with Peterson, similarly acknowledged Morgan Stanley's internal controls regime and declined to charge Morgan Stanley.15 In any event, the Morgan Stanley case provides useful insight into what kind of compliance measures will be considered robust by DOJ and the SEC, particularly in the financial services industry.

4. Pfizer Settlement and Alternative Jurisdiction

The largest settlement announced in 2012 was Pfizer Inc.'s settlement of a trio of FCPA cases with DOJ and the SEC for $60 million, including a $15 million criminal fine and $45 million in disgorgement.16 The charges against Pfizer stemmed from approximately $2 million in bribes allegedly paid in high-risk countries (including Russia, Kazakhstan, and China) to healthcare practitioners at government-owned hospitals responsible for prescribing medications and to officials of government healthcare committees responsible for drug-related approvals.

Notably, the Pfizer settlement marks the first time DOJ explicitly relied on the FCPA's alternative jurisdiction provision to charge a U.S. company. The alternative jurisdiction provision, 15 U.S.C. § 78dd- 2(i), provides: "It shall be unlawful for any United States person to corruptly do any act outside the United States in furtherance of a [bribe to a foreign official]." While the provision was invoked against an individual in United States v. Salam, No. 06-CR-157 (D.D.C. June 7, 2006), it had not previously been used to charge a U.S. company with an FCPA violation where there was no territorial nexus to the United States. Previously, DOJ cited the alternative jurisdiction provision when charging Willbros Group Inc. and its subsidiary with violating the FCPA, but then proceeded to allege that Willbros committed the violative acts in the United States.17 In the Pfizer case, none of the corrupt conduct was alleged to have occurred in the United States or to have involved the use of the mails or any means or instrumentality of interstate commerce.18 As a result, the Pfizer settlement illustrates the FCPA's potential breadth for a U.S. company, which may be subject to the FCPA even if improper conduct occurs wholly outside the United States.

5. Eli Lilly Settlement and the Importance of Due Diligence

In December 2012, the SEC announced that it had charged Indianapolis-based pharmaceutical company Eli Lilly with FCPA violations for improper payments its subsidiaries allegedly made to foreign government officials to win millions of dollars of business in Russia, Brazil, China, and Poland. Without admitting or denying the SEC's allegations, Eli Lilly agreed to pay more than $29 million in disgorgement, prejudgment interest, and civil penalties, and to comply with certain undertakings, including the retention of an independent consultant to review and make recommendations about the company's anti-corruption policies and procedures.

In announcing the settlement, the SEC cautioned that the case demonstrates why company officials may not avert their eyes "from what they do not wish to see" and should eschew a "check the box" approach to compliance, and in particular to third-party due diligence.19 While the settlement papers did not specifically note the link, among the improper payments made by Eli Lilly were charitable contributions made from 2000 to 2003 to the same Polish charity headed by the Polish government official that led to Schering-Plough's FCPA settlement in 2004.20 That aspect of the Eli Lilly settlement is a salient reminder that companies should be alert to industry developments, and to potential repercussions of settlements and prosecutions that relate to countries where they do business, customers to whom they sell, and third parties with whom they work.

6. Mergers & Acquisitions Lead to Significant Settlements and at Least One Non-Public Declination

In the mergers and acquisitions context, two public settlements and at least one non-public declination from 2012 reflect situations in which acquirers were charged with bribes paid by newly acquired entities. These settlements underscore the importance of conducting thorough FCPA due diligence to the extent feasible before closing a deal and, equally, of rolling out with alacrity a strong compliance program once a deal has closed.

- Pfizer: The Pfizer settlement discussed above reflects the inheritance by Pfizer of liability for both pre- and post-closing improper payments by Pharmacia Corporation, acquired by Pfizer in 2003. Although Pfizer's Croatian subsidiary ended the majority of the improper payments upon acquisition in 2003, Pfizer HCP Croatia permitted the problematic program to continue for one Pharmacia product until 2005.21 The charging papers indicate that DOJ and the SEC found fault with the nature and depth of Pfizer's FCPA due diligence for the Pharmacia acquisition, and that DOJ and the SEC concluded that Pfizer may not have implemented an effective anti-corruption compliance program at the newly acquired Pharmacia entities quickly enough. By contrast, substantial post-closing due diligence and compliance program integration by Pfizer following its acquisition of Wyeth (maintained as a wholly owned subsidiary) in 2009 appears to have largely insulated Pfizer from liability for improper payments by Wyeth.

- Orthofix: Orthofix International N.V., a Texas-based orthopedic products-maker, agreed to pay $7.4 million to resolve DOJ and SEC FCPA enforcement actions. Orthofix settled books and records and internal controls violations charges with the SEC and paid $5.2 million in disgorgement and prejudgment interest. Orthofix also entered into a three-year deferred prosecution agreement with DOJ and agreed to pay a $2.2 million criminal fine. The settlement related to improper payments made by Orthofix's wholly owned Mexican subsidiary, Promeca S.A. de C.V. The DOJ alleged that "Orthofix N.V., which grew its direct distribution footprint in part by purchasing existing companies, often in high-risk markets, failed to engage in any serious form of corruption-related diligence before it purchased Promeca."22 When the improper payments were made, "Promeca was subject to Orthofix's control, including the implementation of internal controls at Promeca."23

- Non-Public Declination: A U.S.-based issuer acquired a non-issuer U.S. company with a large international footprint. During the course of substantial pre-closing due diligence into the acquired company, the acquiring issuer uncovered several instances where potentially improper payments and travel and entertainment had been provided to government officials by the acquired company. Immediately upon closing, the acquiring issuer made a voluntary disclosure to DOJ and the SEC, conducted additional post-closing investigative work, fully remediated the potentially improper payment issues at the acquired company, and integrated the acquired company into the acquiring issuer's robust compliance and training program. Neither the SEC nor DOJ brought charges and the latter issued a formal declination letter to the acquiring issuer.24

7. Allianz and Issuer Status

In December 2012, the SEC announced that it had charged German-based insurance and asset management company Allianz SE with violating the books and records and internal controls provisions of the FCPA in connection with improper payments by an Allianz Indonesian subsidiary to government officials in Indonesia from 2001 to 2008.25 Without admitting or denying the SEC's findings, Allianz agreed to pay more than $12.3 million in disgorgement, prejudgment interest, and civil penalties.

This settlement is noteworthy because Allianz voluntarily delisted its stock from U.S. securities exchanges (and therefore had ceased to be an issuer) some six months before the SEC initiated its investigation and some three years before the settlement with the SEC. The SEC premised jurisdiction on the allegation that the misrecordings in Allianz's books and records and the internal controls deficiencies arose when Allianz was an issuer. It is worth noting that, according to the SEC's Cease-and-Desist Order, allegations of improper conduct had been raised with the company in 2005, but the company did not fully remediate the problems.26 This alleged failure, while the company was an issuer, may have been relevant to the SEC's decision to pursue the matter after Allianz had delisted. The settlement underscores that, as has been seen in other FCPA matters, the SEC will not flinch from exercising jurisdiction to enforce the FCPA whenever the SEC may have some jurisdictional ground to stand upon.

8. Noble Executives - Ruling on Motion to Dismiss

On December 11, 2012, U.S. District Court Judge Keith Ellison ruled on motions to dismiss filed by two former Noble Corp. executives, Mark Jackson and James Ruehlen.27 He granted the motion to dismiss the SEC's claims seeking monetary damages on statute-of-limitations grounds while denying the motion to dismiss the agency's claims seeking injunctive relief. The monetary damages dismissal was without prejudice, giving the SEC an opportunity to file an amended complaint, which the agency filed on January 25, 2013.28 Like the original complaint filed in February 2012, the SEC's amended complaint against Jackson and Ruehlen alleges that they violated the FCPA by "participating in a bribery scheme to obtain illicit permits for oil rigs in Nigeria in order to retain business under lucrative drilling contracts."29 The claim was principally based on the same core set of facts as the November 2010 DOJ/SEC enforcement action against their former employer, Noble Corp. Of particular interest:

- Statute of Limitations: Judge Ellison rejected the SEC's argument that the statute of limitations should be tolled because of tolling agreements between the parties, the fraudulent concealment doctrine, and the continuing violations doctrine. The court granted the SEC leave to amend its complaint to cure pleading failures regarding the statute of limitations.

- Facilitating Payments: After concluding that the legislative history of the FCPA "strongly supports" the conclusion that the SEC bears the burden of negating the facilitation payments exception, Judge Ellison granted leave to the SEC to amend its complaint in order to adequately plead that the behavior sought in exchange for the payments at issue were "discretionary functions" that would render them outside the facilitation payments exception.

- Which Foreign Official?: Judge Ellison's decision concluded that the identity of the foreign official receiving alleged bribes, or his day-to-day duties, need not be pleaded with specificity. In so concluding, Judge Ellison acknowledged his disagreement with U.S. District Court Judge Lynn Hughes, who came to the opposite conclusion in DOJ's unsuccessful prosecution of John O'Shea, a former general manager and vice president of a unit of ABB Ltd., in Texas.30

9. SEC Policy Developments

Neither Admit Nor Deny: 2012 marked the end of the SEC's use of the "neither admit nor deny" approach to settlements "where a defendant has admitted violations of the criminal law."31 A neither admit nor deny settlement allowed a defendant to settle SEC charges while neither admitting nor denying civil liability. This change affects SEC settlements that involve parallel DOJ criminal convictions or settlement agreements that include admissions or acknowledgments of criminal conduct.32

Whistleblower Provisions: 2012 was the first full year of the whistleblower provisions of the Dodd-Frank Act,33 and the impact of the SEC's whistleblower program on FCPA enforcement thus far remains unclear. The SEC's 2012 whistleblower program report, released in November 2012, announced that from October 1, 2011, through September 30, 2012, the SEC had received 3,001 whistleblower tips, including 115 that were FCPA-related.34 To date, it remains unclear whether any of the FCPA complaints may qualify for an award. It is nevertheless evident that the existence of the program has generated interest among attorneys who specialize in representing whistleblowers and has created new considerations for companies evaluating whether and when to make proactive voluntary disclosures of potential FCPA issues to enforcement authorities.

10. Trend Away from Imposition of Compliance Monitors

Starting at the end of 2009, both DOJ and the SEC appeared to begin moving away from their regular imposition of external compliance monitors, and that trend continued through 2012. Indeed, there were no FCPA settlements in 2011 and only four settlements in 2012 (two of which involved medical device companies, discussed below) in which either a compliance consultant or a compliance monitor was imposed as a term of settlement.35

The waning use of compliance monitors in the past few years suggests that both agencies are moving in certain cases toward alternatives in FCPA settlements, including allowing companies to "self-report" to the government on their implementation of enhanced FCPA controls. The decline in the use of monitors may, at least in part, be the result of judicial and other criticisms leveled against DOJ regarding the selection of some monitors, which resulted in DOJ adopting guidelines in 2008 for selecting monitors.36 The government has also noted that, over time, the quality of compliance programs overall has improved, suggesting that there may be fewer cases in which monitors are needed.37

It appears that DOJ and the SEC were willing to allow companies to self-report on their compliance and remediation efforts largely in cases in which the companies had voluntarily disclosed the conduct at issue, had cooperated with the government's investigation, and had made significant improvements to their FCPA compliance regimes prior to and during the course of the investigation. In a number of these cases, the voluntary disclosure was described as "timely" and "complete,"38 the cooperation provided to the government as extraordinary, and remedial measures undertaken as "extensive."39 The extensive remediation and improvements to the compliance systems and internal controls were explicitly cited in a 2012 settlement as one of the reasons why the company was not required to retain a compliance monitor.40 The company that did not voluntarily disclose the conduct under investigation was nonetheless not required to retain a compliance monitor as part of its settlement in 2012; DOJ praised the company for initiating an internal investigation and providing real-time reports following the receipt of subpoenas in connection with the government's investigation, as well as its "extraordinary" cooperation, "extensive, thorough, and swift internal investigation," and "extensive remediation."41

The Guide reaffirmed that when determining whether to impose a compliance monitor or compliance consultant requirement, DOJ and the SEC take into account the quality of the company's compliance program at the time of the misconduct and subsequent remediation efforts.42 According to the Guide, other relevant factors include the seriousness of the offense, the duration of the misconduct, the pervasiveness of the misconduct, including whether the conduct cuts across geographic and/or product lines, and the nature and size of the company.43 "[C]ompanies are sometimes allowed to engage in selfmonitoring, typically in cases when the company has made a voluntary disclosure, has been fully cooperative, and has demonstrated a genuine commitment to reform."44

11. Medical Device Industry Settlements

The medical device industry has been among the industries targeted by FCPA enforcement officials since 2007 when a number of companies settled domestic bribery cases. Joint DOJ and SEC investigations of the industry yielded FCPA settlements with three medical device companies in the past year.

- Smith & Nephew: In February 2012, Smith & Nephew Inc., the Tennessee-based subsidiary of British medical device manufacturer Smith & Nephew plc, admitted to bribing publicly employed Greek healthcare providers to induce them to purchase Smith & Nephew products.45 As part of a deferred prosecution agreement with DOJ, Smith & Nephew agreed to pay a $16.8 million criminal penalty and to retain a compliance monitor for 18 months. The company also disgorged $4 million in profits and paid $1.4 million in prejudgment interest to resolve related charges brought by the SEC.46

- Biomet: In March 2012, medical device manufacturer Biomet Inc. entered into a deferred prosecution agreement with DOJ under which Biomet agreed to pay $17.28 million to resolve charges that its agents and employees bribed publicly employed healthcare providers in Argentina, Brazil, and China.47 Like Smith & Nephew, Biomet agreed to engage a compliance monitor for 18 months and also agreed to disgorge $5.4 million in profits and prejudgment interest to resolve related SEC charges.48

- Orthofix: As noted above, in September 2012, Texas-based medical device company Orthofix International, N.V. agreed to pay $7.4 million to settle SEC and DOJ charges that its Mexican subsidiary bribed Mexican officials to secure lucrative sales contracts with Mexico's healthcare and social services institution and falsely recorded the bribes as cash advances and promotional and training costs. 49

Looking ahead to 2013, we may see several of the following developments:

- The continuation and outcome of SEC "sweeps" related to financial institutions' dealings with sovereign wealth funds, movie studios' operations in China, and oil and gas companies' business in Libya;

- Developments in one or more of the more notable FCPA investigations involving companies such as Alcoa, Avon, News Corp. and Wal-Mart;

- Judicial developments, including:

- A decision from the 11th Circuit in the Haiti Teleco/Esquenazi appeal on whether personnel of a government-owned and -controlled company are covered by the FCPA's definition of "foreign official."

- A decision from a district court in New York in the Straub/Magyar Telekom cases on the question of whether sending and receiving emails routed through or stored on U.S. computer servers is sufficient to establish a "territorial act" giving rise to territorial jurisdiction, even where the sender of the email did not foresee that the email would transit the U.S. server. The court will also likely address pending statute of limitations issues. The defendants in this case have raised statute of limitations defenses, arguing that the SEC's claims are time barred. The SEC has responded that because the defendants have remained outside of the United States since their participation in the scheme, the limitations period has not yet begun to run.

- Possibly increased scrutiny of SEC settlements, including Judge Richard Leon's pending approvals of the SEC's proposed settlements with IBM and Tyco. Judge Leon stated during a December 2012 hearing that he was one of "a growing number of district judges who are increasingly concerned" that the SEC's settlement practices are too lenient.50

- Probable rise in the number of publicly known declinations;

- Possible expansion of the Magnitsky Act, which bans certain Russian officials accused of corruption from entering the United States and streamlines the legal process to freeze their U.S. assets. In a December 2012 statement on the Senate floor, Senator John McCain called for expansion of the law to a global scale;

- Compliance challenges related to planning for hospitality packages at the 2014 Olympics in Sochi, Russia and the 2014 World Cup in Brazil;

- Criminal enforcement actions, including deferred prosecution agreements, by U.K. authorities under the U.K. Bribery Act;

- Possible focus by enforcement officials on the technology industry, as evidenced by the number of investigations initiated against technology companies in 2012;

- New leadership at DOJ and the SEC. On January 30, 2013, DOJ announced that Lanny A. Breuer, Assistant Attorney General for the Criminal Division, would leave the Department on March 1, 2013.51 Robert Khuzami stepped down from his role as Director of the SEC's Division of Enforcement in early January 2013. As evidenced over their tenure and reiterated by their foreword to the 2012 Guide, both Breuer and Khuzami took an expansive view of FCPA interpretation and enforcement. A successor has not been named for either Breuer or Khuzami. In further change at the SEC, former chairwoman Mary Schapiro stepped down on December 14, 2012, and, on January 24, 2013, President Obama nominated Mary Jo White, a former United States Attorney for the Southern District of New York, to succeed her as chairwoman.52

Footnotes

1. Initiated cases reflected in the chart below include indictments, criminal informations, complaints or other charges (including those that are simultaneously settled) filed by DOJ and the SEC. Where charges are asserted against multiple entities (e.g., both a parent and subsidiary) or multiple individuals, each is counted as a separate initiated action. Although 2010 was undeniably a banner year for the initiation of FCPA enforcement actions, it bears mention that 22 of the enforcement actions commenced in 2010 were individuals indicted in connection with the Africa Sting Case.

2. In May and November 2012 filings with the SEC, Wal-Mart noted that the Audit Committee of its Board of Directors was "conducting an internal investigation into, among other things, alleged violations of the [FCPA] and other alleged crimes or misconduct in connection with foreign subsidiaries including Wal-Mart de Mexico, S.A.B. de C.V. . . . and whether prior allegations of such violations and/or misconduct were appropriately handled by the Company" and that it had "been informed by the DOJ and the SEC that it is also the subject of their respective investigations into possible violations of the FCPA." See Wal-Mart Stores, Inc., Current Report (Form 8-K), at 2-3 (May 17, 2012); Wal-Mart Stores, Inc., Current Report (Form 8-K), at 1-2 (Nov. 15, 2012).

3. In February 2008, Alcoa Inc. (Alcoa) said it had received notice on February 27, 2008 that Aluminium Bahrain B.S.C. (Alba), a majority state-owned smelter in Bahrain, filed suit against Alcoa, Alcoa World Alumina LLC (AWA), William Rice, and Victor Phillip Dahdaleh, alleging that certain Alcoa entities and their agents, including Dahdaleh, engaged in a 15-year conspiracy to defraud Alba. After a four-year stay, concurrent government investigation, Alba's filing of an amended complaint, and a series of filings and hearings throughout 2012, Alcoa and Alba settled the civil lawsuit and, without admitting any liability, Alcoa agreed to make a cash payment to Alba of $85 million payable in two installments. The settlement only resolved Alba's claims against Alcoa, AWA and Rice; Alba's lawsuit against Dahdaleh remained. However, in November 2012, the federal judge presiding over the matter administratively closed the case while discovery was stayed pending Dahdaleh's criminal trial in the United Kingdom, as well as his petition for an interlocutory appeal. Alcoa said in its most recent regulatory filing that investigations by DOJ and the SEC into the matter were ongoing. See Alcoa Inc., Quarterly Report (Form 10-Q), at 12 (Oct. 25, 2012). As of this writing, the government's investigations are unresolved.

4. In February 2012, Judge Richard J. Leon granted DOJ's motion to dismiss the Superseding Indictment, and all underlying indictments, against the remaining 16 defendants pending trial in the FCPA Africa Sting Case. The motion noted that "the government has carefully considered (1) the outcomes of the first two trials in which, after extensive deliberations, the juries remained hung as to seven defendants and acquitted two defendants, and one defendant was acquitted on the sole charge against him . . . ; (2) the impact of certain evidentiary and other legal rulings in the first two trials and the implications of those rulings for future trials, including with respect to Rule 404(b) and other knowledge and intent evidence the government proposed to introduce; and (3) the substantial government resources, as well as judicial, defense, and jury resources, that would be necessary to proceed with another four or more trials, given that the first two trials combined lasted approximately six months. In light of all of the foregoing, the government respectfully submits that continued prosecution of this case is not warranted under the circumstances." In granting the motion, Judge Leon stated: "This appears to be the end of a long and sad journey in the annals of white collar prosecutions," and "I, for one, hope that this very long and, I suspect, very expensive ordeal will be a true learning experience for the department and the FBI as they regroup to prosecute FCPA cases against individuals." See Christopher M. Matthews, Government Drops High-Profile FCPA Sting Case, WALL ST. J., Feb. 21, 2012, available at http://blogs.wsj.com/corruption-currents/2012/02/21/government-drops-high-profile-fcpa-sting-case/.

5. In November 2009, former ABB Inc. general manager John J. O'Shea was indicted on 18 counts of substantive FCPA, conspiracy, money laundering, and obstruction-related offenses arising out of the government's investigation of his former employer, ABB, and its corrupt dealings with a state-owned electric utility company's employees in Mexico. O'Shea's trial began in Texas in January 2012, and ended swiftly after four days of government evidence presentation, at which time U.S. District Court Judge Lynn Hughes granted O'Shea's motion for a judgment of acquittal as to the 12 substantive FCPA counts. Judge Hughes expressed skepticism of the government's evidence that the payments at issue allegedly went to a government official, noting that DOJ's principal witness "knew almost nothing" and that his testimony "was abstract and vague, generally relating to gossip." Judge Hughes also commented on the difficulty of attributing particular payments to particular government officials beyond a reasonable doubt. O'Shea's prosecution ended unsuccessfully for the government in February, when Judge Hughes granted DOJ's motion to dismiss the remaining counts against him with prejudice. United States v. O'Shea, No. 09-CR-00629 (S.D. Tex. Jan. 16, 2012) (Trial Transcript at 248).

6. In a February 2011 filing with the SEC, Avon Products, Inc. (Avon) disclosed its three-year internal probe into possible FCPA violations in China and other countries, as well as its voluntary disclosure of the issues uncovered to DOJ and the SEC. See Avon Products, Inc., Annual Report (Form 10-K), at 14 (Feb. 24, 2011). The probe reportedly stemmed from a 2005 internal audit report that said Avon employees in China may have been bribing officials in violation of the FCPA. See Samuel Rubenfeld, Avon Bribery Case Presented to Grand Jury, WALL ST. J., Feb. 13, 2012, available at http://blogs.wsj.com/corruption-currents/2012/02/13/avon-bribery-case-presented-to-grand-jury/ . In a regulatory filing in October 2011, Avon said that it had received a subpoena from the SEC requesting certain documents and information in connection with the FCPA matters previously disclosed. See Avon Products, Inc., Quarterly Report (Form 10-Q), at 11 (Oct. 27, 2011). One of the latest developments in the long-running probe came in August 2012, when Avon said that it was in talks with DOJ and the SEC to settle their respective investigations. See Avon Products, Inc., Quarterly Report (Form 10-Q), at 11-12 (Aug. 1, 2012). Two months later, Avon announced that its Executive Chairman and member of the Board of Directors, Andrea Jung, would step down from her role at the end of 2012. See Avon Products, Inc., Current Report (Form 8-K), at 2 (Oct. 5, 2012). As of this writing, the government's investigation remained unresolved.

7. Indeed, Matthew S. Queler, Assistant Chief of DOJ's FCPA Unit, made this point in remarks given on January 29, 2013, at the C-5 Sixth Advanced European Forum on Anti-Corruption in Frankfurt, Germany.

8. U.S. Department of Justice & U.S. Securities and Exchange Commission, A Resource Guide to the U.S. Foreign Corrupt Practices Act (2012).

9. U.S. Department of Justice Press Release No. 12-534: Former Morgan Stanley Managing Director Pleads Guilty for Role in Evading Internal Controls Required by FCPA (Apr. 25, 2012); United States v. Peterson, No. 12-CR-224 (Apr. 25, 2012) (Information).

10. United States v. Peterson, No. 12-CR-224 (E.D.N.Y. Apr. 25, 2012) (Information at ¶¶ 13-28).

11. United States v. Peterson, No. 12-CR-224 (E.D.N.Y. Apr. 25, 2012) (Information at ¶ 23).

12. U.S. Department of Justice Press Release No. 12-534: Former Morgan Stanley Managing Director Pleads Guilty for Role in Evading Internal Controls Required by FCPA (Apr. 25, 2012); see also Lanny A. Breuer, Assistant Attorney General, U.S. Department of Justice, Prepared Address to IBC Legal's World Bribery & Corruption Compliance Forum (Oct. 23, 2012) ("A former managing director of Morgan Stanley, Peterson pleaded guilty to conspiring to evade the bank's internal FCPA controls and was sentenced to prison in August. Because Morgan Stanley voluntarily disclosed Peterson's misconduct, fully cooperated with our investigation and showed us that it maintained a rigorous compliance program, including extensive training of bank employees on the FCPA and other anti-corruption measures, we declined to bring any enforcement action against the institution in connection with Peterson's conduct.").

13. U.S. Department of Justice Press Release No. 12-534: Former Morgan Stanley Managing Director Pleads Guilty for Role in Evading Internal Controls Required by FCPA (Apr. 25, 2012).

14. It is worth noting that Peterson has challenged the government's conclusions regarding the sufficiency of Morgan Stanley's internal controls. Peterson criticized the government in an interview with CNBC the day before his sentencing. Responding to a question regarding whether Morgan Stanley threw him overboard, Peterson said, "Morgan Stanley got off scot-free. And I think, you know, I have no -- you know, desire for them to be harmed in any way, or you know. So -- it's not that. But what I feel bad about is -- the government lying to the -- to the public. And -- saying that -- they had this wonderful compliance -- program, when in fact the government knows that it wasn't getting into people's heads. Which is what really matters." CNBC Press Release, CNBC Exclusive: CNBC Senior Correspondent Scott Cohn Speaks with Former Managing Director Garth Peterson (Aug. 17, 2012), available at http://www.cnbc.com/id/48648151 .

15. SEC v. Peterson, No. 12-CV-02033 (E.D.N.Y. Apr. 25, 2012) (Complaint at ¶¶ 23-26); U.S. Securities and Exchange Commission Press Release No. 2012-78: SEC Charges Former Morgan Stanley Executive with FCPA Violations and Investment Adviser Fraud (Apr. 25, 2012).

16. U.S. Department of Justice Press Release No. 12-980: Pfizer H.C.P. Corp. Agrees to Pay $15 Million Penalty to Resolve Foreign Bribery Investigation (Aug. 7, 2012); U.S. Securities and Exchange Commission Press Release No. 2012-152: SEC Charges Pfizer with FCPA Violations (Aug. 7, 2012).

17. See United States v. Willbros Grp., Inc., No. 08-CR-287 (S.D. Tex. May 14, 2008) (Information).

18. For additional discussion of the Pfizer settlements, see R. Witten, K. Parker, J. Holtmeier, and T. Koffer, Perspectives on Recent Anti-Corruption Developments (Sept. 18, 2012), available at http://www.wilmerhale.com/pages/publicationsandnewsdetail.aspx?NewsPubId=110249.

19. U.S. Securities and Exchange Commission Press Release No. 2012-273: SEC Charges Eli Lilly and Company with FCPA Violations (Dec. 20, 2012).

20. U.S. Securities and Exchange Commission Litig. Release No. 18740: SEC Files Settled Enforcement Action Against Schering-Plough Corporation for Foreign Corrupt Practices Act Violations (June 9, 2004).

21. SEC v. Pfizer, Inc., No. 12-CV-1303 (D.D.C. Aug. 7, 2012) (Complaint at ¶¶ 33-35).

22. United States v. Orthofix Int'l, N.V., No. 12-CR-150 (E.D. Tex. July 10, 2012) (Information at ¶ 32).

23. SEC v. Orthofix Int'l, N.V., No. 12-CV-419 (E.D. Tex. July 10, 2012) (Complaint at ¶ 10); see also United States v. Orthofix Int'l, N.V., No. 12-CR-150 (E.D. Tex. July 10, 2012) (Information at ¶ 7) (Orthofix "personnel based in the United States oversaw Promeca's activities, reviewed and approved Promeca's annual budgets, and had the authority to hire and fire Promeca's officers").

24. WilmerHale is aware of this non-public declination as a result of its representation of the buyer.

25. U.S. Securities and Exchange Commission Press Release No. 2012-266: SEC Charges Germany-Based Allianz SE with FCPA Violations (Dec. 17, 2012).

26. In the Matter of Allianz SE, Exchange Act Release No. 68448 (Dec. 17, 2012) (Order Instituting Cease-and-Desist Proceedings).

27. SEC v. Jackson, No. 12-CV-0563 (S.D. Tex. Dec. 11, 2012) (Memorandum and Order on Motion to Dismiss).

28. SEC v. Jackson, No. 12-CV-0563 (S.D. Tex. Jan. 25, 2013) (Amended Complaint).

29. U.S. Securities and Exchange Commission Press Release No. 2012-32: SEC Charges Three Oil Services Executives with Bribing Customs Officials in Nigeria (Feb. 24, 2012).

30. See United States v. O'Shea, No. 09-CR-629 (S.D. Tex. Jan. 16, 2012) (Trial Transcript at 227: 19-23); see also SEC v. Jackson, No. 12-CV-0563 (S.D. Tex. Dec. 11, 2012) (Memorandum and Order on Motion to Dismiss at 25, n.10).

31. Robert Khuzami, Director of the SEC's Enforcement Division, Public Statement by SEC Staff; Recent Policy Change (Jan. 7, 2012), available at http://www.sec.gov/news/speech/2012/spch010712rsk.htm.

32. Robert Khuzami, Director of the SEC's Enforcement Division, Public Statement by SEC Staff; Recent Policy Change (Jan. 7, 2012), available at http://www.sec.gov/news/speech/2012/spch010712rsk.htm (explaining that it "seemed unnecessary for there to be a 'neither admit' provision in those cases where a defendant had been criminally convicted of conduct that formed the basis of a parallel civil enforcement proceeding").

33. Dodd-Frank Wall Street Reform and Consumer Protection Act, H.R. 4173, 111th Cong. (2010) § 922(a) (adding § 21F to the Securities Exchange Act of 1934, 15 U.S.C. § 78a, et seq.).

34. See U.S. Securities and Exchange Commission, Annual Report on the Dodd-Frank Whistleblower Program, Fiscal Year 2012, at Appendix A, available at: http://www.sec.gov/about/offices/owb/annual-report-2012.pdf.

35. SEC v. Eli Lilly & Co., No. 12-CV-2045 (D.D.C. Dec. 20, 2012) (Proposed Final Judgment at 6) (noting that Eli Lilly had retained FTI Consulting "as an Independent Review Organization"); United States v. Biomet, Inc., No. 12-CR-080 (D.D.C. Mar. 26, 2012) (Deferred Prosecution Agreement at ¶ 8) (requiring Biomet to engage an independent corporate compliance monitor for a period of not less than 18 months); SEC v. Biomet, No. 12-CV-454 (D.D.C. Mar.

27, 2012) (Final Judgment at 5) (Requiring Biomet to retain an independent corporate compliance monitor); United States v. Smith & Nephew, Inc., No. 12-CR-030 (D.D.C. Feb. 6, 2012) (Deferred Prosecution Agreement at ¶ 8) (requiring Smith & Nephew to engage an independent corporate compliance monitor for a period of not less than 18 months); SEC v. Smith & Nephew, Inc., No. 12-CV-187 (D.D.C. Mar. 6, 2012) (Final Judgment at 5) (requiring Smith & Nephew to retain an independent corporate compliance monitor); United States v. Marubeni Corporation, No. 12- CR-00022 (S.D. Tex. Jan. 17, 2012) (Deferred Prosecution Agreement at ¶ 10) (requiring Marubeni to engage a corporate compliance consultant for a term of two years to review the design and implementation of the company's compliance program).

36. See U.S. Department of Justice Memorandum of Craig S. Morford, Selection and Use of Monitors in Deferred Prosecution Agreements and Non-Prosecution Agreements with Corporations (Mar. 7, 2008).

37. Speaking at the C-5 Sixth Advanced European Forum on Anti-Corruption in Frankfurt, Germany on January 29, 2013, Charles Cain, Deputy Chief of the SEC's FCPA Unit, noted the improving quality of compliance programs.

38. See, e.g., U.S. Department of Justice Press Release No. 12-881: The Nordam Group Inc. Resolves Foreign Corrupt Practices Act Violations and Agrees to Pay $2 Million Penalty (July 17, 2012) (noting Nordam's "timely, voluntary and complete disclosure of the conduct").

39. See, e.g., U.S. Department of Justice Press Release No. 12-1149: Subsidiary of Tyco International Ltd. Pleads Guilty, Is Sentenced for Conspiracy to Violate the Foreign Corrupt Practices Act (Sept. 24, 2012) (noting Tyco International Ltd.'s extensive remediation, which included "the implementation of an enhanced compliance program, the termination of employees responsible for the improper payments and falsification of books and records, the severing of contracts with the responsible third-party agents and the closing of subsidiaries due to compliance failures").

40. See, e.g., U.S. Department of Justice Press Release No. 12-980: Pfizer H.C.P. Corp. Agrees to Pay $15 Million Penalty to Resolve Foreign Bribery Investigation (Aug. 7, 2012) ("Due to Pfizer Inc.'s [parent company] extensive remediation and improvement of its compliance systems and internal controls, as well as the enhanced compliance undertakings included in the agreement, Pfizer H.C.P. is not required to retain a corporate monitor, but Pfizer Inc. must periodically report to the department on implementation of its remediation and enhanced compliance efforts for the duration of the agreement.").

41. United States v. Data Systems & Solutions LLC, No. 12-CR-262 (E.D. Va. June 18, 2012) (Deferred Prosecution Agreement at ¶ 4).

42. U.S. Department of Justice & U.S. Securities and Exchange Commission, A Resource Guide to the U.S. Foreign Corrupt Practices Act (2012), at 7.

43. U.S. Department of Justice & U.S. Securities and Exchange Commission, A Resource Guide to the U.S. Foreign Corrupt Practices Act (2012), at 7.

44. U.S. Department of Justice & U.S. Securities and Exchange Commission, A Resource Guide to the U.S. Foreign Corrupt Practices Act (2012), at 7.

45. U.S. Department of Justice Press Release No. 12-166: Medical Device Company Smith & Nephew Resolves Foreign Corrupt Practices Act Investigation (Feb. 6, 2012).

46. U.S. Securities and Exchange Commission Litig. Release No. 22252: SEC Charges Smith & Nephew PLC with Foreign Bribery (Feb. 6, 2012).

47. United States v. Biomet, Inc., No. 12-CR-00080 (D.D.C. Mar. 26, 2012) (Deferred Prosecution Agreement at ¶¶ 5, 15-20).

48. U.S. Department of Justice Press Release No. 12-373: Third Medical Device Company Resolves Foreign Corrupt Practices Act Investigation (Mar. 26, 2012); U.S. Securities and Exchange Commission Press Release No. 2012-50: SEC Charges Medical Device Company Biomet with Foreign Bribery (Mar. 26, 2012).

49. SEC v. Orthofix Int'l, N.V., No. 12-CV-00419 (E.D. Tex. July 10, 2012); United States v. Orthofix Int'l, N.V., No. 12- CR-150 (E.D. Tex. July 10, 2012).

50. On January 15, 2013, Judge Leon denied the SEC and IBM's January 10, 2013 joint motion for a 30-day continuance of a status hearing set for February 4, 2013. SEC v. Int'l Business Machs., No. 11-CV-563 (D.D.C. Jan. 15, 2013) (Minute Order).

51. U.S. Department of Justice Press Release No. 13-128: Assistant Attorney General Lanny A. Breuer Announces Departure from Department of Justice (Jan. 30, 2013).

52. Jessica Holzer, SEC Nominee Signals Shift, WALL ST. J., Jan. 25, 2013.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.