On January 10, 2013, the US Federal Trade Commission ("FTC") announced the new, revised jurisdictional thresholds for reporting transactions pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976 ("HSR Act"), and for triggering the prohibition on interlocking directorates, which are governed by Section 8 of the Clayton Act. The new thresholds for HSR notification will become effective 30 days after publication in the Federal Register. The revisions to Section 8 will become effective upon publication in the Federal Register. The new Section 8 thresholds should be published before the end of January and the HSR changes should be effective before the end of February 2013.

Changes to the Hart Scott Rodino Reporting Thresholds

Filing Threshold

Section 7A of the Clayton Act, which is more commonly known as the HSR Act, requires all persons contemplating certain mergers, acquisitions, joint ventures and corporate and non-corporate formations (e.g., LLCs and LPs), which meet or exceed the HSR Act's jurisdictional thresholds, to (1) notify the FTC Bureau of Competition and the U.S. Department of Justice Antitrust Division and (2) wait the statutory 30-day period before consummating the transaction (unless early termination of the waiting period is granted). Pursuant to the 2000 Amendments to Section 7A, the FTC is required to revise the jurisdictional thresholds annually based on the change in gross national product.

Not Reportable

No transaction resulting in an acquiring person holding an aggregate total amount of voting securities or assets in the acquired party of less than $70.9 million (up from the prior level of $68.2 million) will need to be reported under the rules. (Please note, however, that transactions with values falling below this threshold are still potentially subject to antitrust review by the FTC or the DOJ's Antitrust Division).

Always Reportable

All acquisitions that result in an acquirer holding an aggregate total amount of the voting securities or assets of the acquired party in excess of$283.6 million (formerly $272.8 million) will be reportable, unless otherwise exempted.

"Size of the Person" Test

Acquisitions valued between $70.9 million and $283.6 million are reportable based on the size of the acquiring person and the size of the acquired person (i.e., "size of the person test"). Generally, the "size of the person test" will require that one side of the transaction have sales or assets of at least$14.2 million (up from $13.6 million) and the other side have sales or assets of at least$141.8 million (up from $136.4 million).

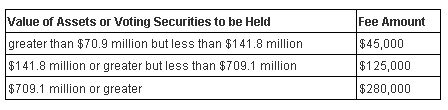

The filing fees will remain the same, and will apply to the revised thresholds as follows:

Changes to the Thresholds Triggering the Prohibition on Interlocking Directorates

Section 8 of the Clayton Act prohibits a person from serving as a director or an officer of two competing organizations if two thresholds relating to (1) capital, surplus and profits of a certain value; and (2) sales of a certain level. The reason for this prohibition is that if competing organizations share officers or directors, there is a high likelihood that the organizations will not compete with one another, or not compete aggressively.

Pursuant to the 1990 Amendment to Section 8, the FTC is required to revise the Section 8 jurisdictional thresholds annually based on the change in gross national product. Effective as of the date the new thresholds are published in the Federal Register, no person can serve as a director or officer of two competing organizations if each competitor has capital, surplus, and undivided profits aggregating more than $28,883,000, except that neither corporation is covered if the competitive sales of either corporation are less than $2,888,300. Failure to comply with the prohibition on triggered by these thresholds could result in liability under the antitrust laws.

Further information regarding these revisions to the HSR Act and Section 8 of the Clayton Act are available on the FTC website.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.