NERA has developed a proprietary database of settlements and judgments in Securities and Exchange Commission (SEC) enforcement actions since the passage of the Sarbanes-Oxley Act ("SOX") by reviewing every litigation release and administrative proceeding document published since July 21, 2002. This paper provides an update on trends in the number of settlements and settlement values in fiscal year 2012 ("FY12").

FY12 (10/1/11–9/30/12) Highlights

- The total number of settlements rose 6.6% to 714 in FY12, up from 670 in FY11, and was the highest number since 2007.

- The total number of settlements with individuals reached 537 in FY12, up 14% from 473 in FY11, and the highest level since 2005.

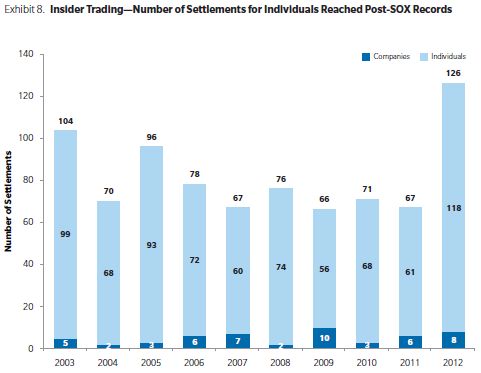

- The SEC Settled a record number of insider trading allegations in FY12, reaching 118 settlements with individuals and eight with companies, almost double the total number of settlements from last year.

- Median settlement values for companies fell back to $1.0 million in FY12 from $1.4 million in FY11.

- Median settlement values for individuals have more than doubled since 2009 from $103,000 to $221,000, a post-SOX high.

- The high number and value of settlements with individuals are consistent with the SEC's continued commitment to hold individuals accountable for corporate decisions.

- Six of the 10 largest settlements in FY12 were against individuals.

- The highest value settlement of the year was the $285 million settlement with Citigroup Global Markets, Inc., which is still under appeal.

- The percentage of SEC settlements that had an attached monetary penalty increased to 69% in FY12, above the 57% rate in FY11 and the 59.5% average rate between 2003 and 2010.

Top 10 Settlements and Judgments

The 10 largest settlements and judgments of FY12 ranged from $285 million to just over $46 million. While our database includes both settlements and judgments in cases brought by the SEC, the vast majority of cases are settled, and we use the term "settlements" throughout this paper to describe the full set of cases resolved. Six of the top 10 settlements were against individuals and three of the top 10 settlements involved allegations of misrepresentations to customers by financial services providers. No settlement in FY12 enters the SEC's top 10 settlements of all time.

The highest value settlement of FY12 was the $285 million settlement with Citigroup Global Markets, Inc., announced on October 19, 2011. As discussed in detail in our 1H12 Update, the settlement is still under appeal after its initial rejection by Judge Jed Rakoff. The SEC alleged that Citigroup materially misled investors by marketing a $1 billion CDO while failing to disclose that Citigroup had a short position against the offering and that Citigroup had selected the assets comprising the CDO. Various individuals and other corporations affiliated with the CDO offering also agreed to settle charges with the SEC in related administrative actions. If it is upheld by the Second Circuit, it would be the 12th largest settlement with the SEC in the post-SOX era.

The second highest settlement of FY12 was the $127.5 million settlement with Mizuho Securities USA, a subsidiary of the Japanese banking giant Mizuho Financial Group. The SEC alleged that Mizuho misled investors in a CDO by submitting for rating a portfolio that included millions of dollars of "dummy" assets, superior in quality to those that had been acquired for the CDO. $115 million of the settlement comes in the form of a civil penalty, and only $10 million represents disgorgement of ill-gotten gains.1

The third-highest settlement of the fiscal year was against Amanda Knorr, Tony Wragg, and their Mantria Corporation. Ms. Knorr and Mr. Wragg allegedly ran Mantria as a Ponzi scheme, promising investors returns from "green energy" project investments in biofuel and carbon-negative housing. The SEC claims that the two executives promised enormous returns on their investments, while in reality they were simply paying existing investors with money from new investors, in classic Ponzi scheme fashion. Mr. Wragg and Ms. Knorr each agreed to over $37 million in civil penalties, and are jointly liable, along with Mantria Corporation, for another $40.7 million in disgorgement and pre-judgment interest.

In the highly publicized Galleon Management, LP case, the SEC obtained a $92.8 million civil penalty against Raj Rajaratnam for insider trading violations. In addition to this civil penalty, the Justice Department levied over $60 million in criminal fines and disgorgement, along with 11 years of imprisonment, in the parallel criminal case. Mr. Rajaratnam was accused of trading on material, non-public information obtained through paid networks of informants. The SEC's investigation of Mr. Rajaratnam has spawned dozens of settlements and on-going investigations against individuals associated with the scheme.

Trends in the Number of Settlements

The total number of settlements in FY12 was the highest number since 2007. There were 714 cases settled in FY11, 44 more cases than in FY11 and FY10 and 108 more cases than in FY09. The SEC reached settlements in 537 cases with individuals, the highest number since 2005, and an increase of 14% from FY11. There were 177 settlements with companies in FY12, 20 fewer cases than in FY11.

The number of settlements with individuals increased, hitting or approaching post-SOX highs in several allegation categories including settlements in financial services misrepresentation and misappropriation, illegal securities offerings, insider trading, and Ponzi schemes.

Trends in Settlement Values

Median values in settlements with companies fell 28% to $1.0 million in FY12 from $1.4 million, the second highest level since SOX in FY11.

The median settlement values for individuals continued to increase and reached a new post-SOX high for the third year in a row. Median settlements with individuals have more than doubled since 2009 from $103,000 to $221,000. High-value settlements with individuals rose for the third year in a row to reach new post-SOX highs, when measured at 75th and 90th percentiles. These results are consistent with the SEC's continued commitment to hold individuals accountable for corporate decisions.2

The percentage of SEC settlements that had an attached monetary penalty increased to 69% in FY12, above the 57% rate in FY11 and the 59.5% average rate between 2003 and 2010. Financial penalties remain more likely against corporations than individuals, a trend that has occurred in recent years, even as individual actions continue to comprise the majority of all settlements. The percentage of non-zero dollar settlements against companies increased to more than three-quarters of all settlements in FY12, up from 62% in FY11 and the 56% average rate from 2003 to 2010.

Insider Trading

In the wake of the $92.8 million settlement with Galleon hedge fund manager Raj Rajaratnam announced in November 2011, the SEC settled a record number of insider trading allegations in FY12. The SEC settled with 118 individuals and eight companies in FY12, almost double the total number of settlements from last year, and 20% more than the previous post-SOX record of 99 insider trading settlements with individuals in 2003.

Since FY10, the median settlement value for insider trading cases has remained above the FY2003-2009 levels, indicating larger settlements across the board. That said, the median settlement value decreased from the post-SOX high of $237,000 in FY11 to $197,000 in FY12. The mean settlement values in FY12 reached $2.2 million, almost double that of last year. These values, coupled with the record-breaking number of settlements reached in FY12, support the increasing importance of insider trading in the SEC's enforcement activities.

Misrepresentations to Customers and Misappropriation of Funds by Financial Services Firms

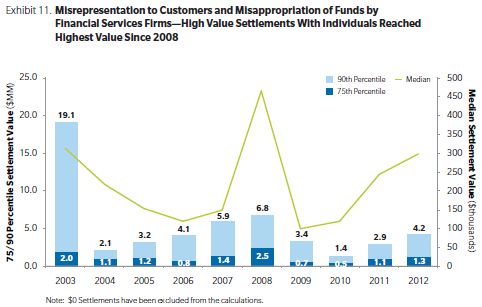

Settlements over allegations of misrepresentation and misappropriation by financial services firms and their employees reached a post-SOX high of 208 cases in FY12. This is the third year in a row that the number of settlements has reached a post-SOX record. Unlike FY11, where the growth was driven by settlements with companies, this year's increase was driven by rising settlements with individuals, from 138 in FY11 to 151 in FY12. This compares with an average of 88 settlements per year against individuals for misrepresentation and misappropriation over FY2003-09.

The value of settlements with individuals for financial services misstatements and misrepresentations rose for the second straight year in FY2012, whether measured at the median, 75th, or 90th percentiles. Median settlements for individuals reached $297,643, the highest value since 2008.

Illegal Securities Offerings, Market Manipulation, and Microcap Fraud

SEC settlements over allegations of illegal securities offerings, market manipulation, and microcap fraud continued to climb, hitting levels not seen since 2005 with 189 total settlements and 147 individual settlements. Median settlement values for individuals reached $320,308, a post-SOX high.

Ponzi Schemes

The number of total settlements over allegations of Ponzi schemes reached 92, hitting a new post-SOX record for the third year in a row. These include 63 settlements with individuals—also a post-SOX high—up 17% from last year and almost double the number of settlements in 2009. Settlements with companies also hit a post-SOX high of 29 in FY12.

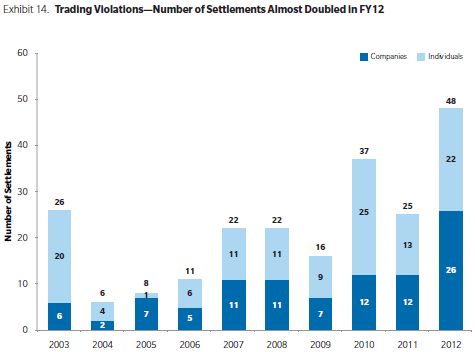

Trading Violations (Other Than Market Manipulation and Insider Trading)

Settlements for trading violations hit a post-SOX high in FY12, with 48 total settlements, almost doubling from 25 settlements last year. Settlements with companies more than doubled, while settlements with individuals rose nearly 70%. Trading violations include all other trading restrictions, which are not covered under market manipulation or insider trading, that are placed on firms or individuals by regulators. Violations include engaging in short sales during a restricted period (such as directly after an IPO), rigging auction bids, inappropriately providing market access to unauthorized traders, and exploitation of small order execution systems. The effect of trading violations in this category is to profit through regulatory violation, not distortion of markets, while for market manipulation violations the effect is to make profit (or avoid losses) by distorting price information.

The settlement values were larger as well, with individuals facing the highest mean settlement value since 2006 ($1.1 million) and companies facing the highest mean settlement value since SOX was implemented ($17.6 million).

In the tenth largest settlement of the year and the largest trading violations settlement post-SOX, the SEC settled with Wachovia Bank for over $46 million over allegations of bid-rigging in the municipal bond market. Wachovia has entered into agreements with the Office of the Comptroller of the Currency, the Justice Department, the Internal Revenue Service, and at least 26 state attorneys general for additional payments totaling $102 million.

A single case was responsible for eight of the trading violation settlements in FY12. According to the SEC's allegations, four trading firms, none of which were registered broker-dealers, extended their sponsored market access to individual traders for a fee. One such individual, the "Latvian Trader," allegedly used this market access to hijack brokerage accounts and trade directly with the ill-gotten shares. By facilitating this direct market access, processing trades and extending credit to individual traders, the four trading firms and their principals acted as unregistered broker-dealers in violation of Commission regulations. SEC actions against other firms involved in the scheme remain ongoing.

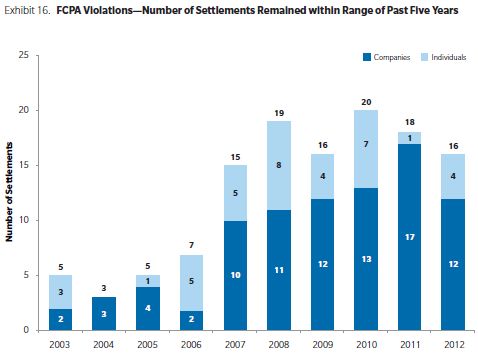

FCPA Violations

FY12 settlements with individuals and companies for Foreign Corrupt Practices Act (FCPA) violations seem to have returned to levels in line with those observed in the 2007-2010 period. There were 16 settlements for alleged FCPA violations in FY12, a decrease from the post-SOX record of 20 settlements in FY10 and 18 settlements in FY11. While lower than the last two years, the number of settlements remains within the range observed in the past five years. The primary mechanism by which the SEC has become aware of a potential FCPA violation is through corporate self-reporting. In the past year, at least 11 of the 12 settlements between the SEC and corporate defendants were the result of self-reporting. In addition, SEC Enforcement Division Director Robert Khuzami highlighted the importance of whistleblower tips, particularly with respect to developing FCPA cases.3 In determining whether or not to accept a settlement offer, the SEC considers the quality of the company's cooperation with Commission staff and the extent of remedial acts taken by the defendant.

One effect of recent SEC actions related to FCPA enforcement has been for corporations to devote more resources to ensuring compliance with FCPA rules.4 A recent survey of corporate compliance officers found that more than half of the survey respondents reported increasing their budgets for anti-bribery compliance.5 While increased compliance efforts should reduce the number of FCPA violations in the future, the new whistleblower rule and increased government emphasis on FCPA enforcement may result in more detection, making the immediate future trend in settlements uncertain.

The median company settlement value in FCPA cases decreased for the second straight year, to just over $5.5 million. The average settlement was substantially higher, buoyed by the $90.8 million settlement with Magyar Telecom, a subsidiary of Deutsche Bank (which also settled for $4.4 million).

Whistleblower Activity

One area of expanded SEC authority under the Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank") has been the enhanced protection for eligible whistleblowers who come forward and cooperate in SEC investigations and proceedings involving the corporation that employs them. Dodd-Frank also authorized the SEC to provide incentives in the form of financial awards to eligible whistleblowers who voluntarily provide the Commission with original information about a violation of federal securities laws that leads to successful enforcement proceedings. The SEC's second annual report on the Dodd-Frank whistleblower program, released in November 2012, covered the first full year of the program.6 In the report, the SEC stated that it had received 3,001 whistleblower tips for the fiscal year ending on September 30, 2012.7 As was the case in 2011, the year the program was launched, the largest four categories of whistleblower tips involved allegations related to corporate disclosure and financials (547 tips), offering fraud (465 tips), manipulation (457 tips), and insider trading (190 tips). The remaining tips involved a wide variety of other allegations, including FCPA violations, trading and pricing violations, unregistered offerings, and municipal securities and public pension violations.

During the 2012 fiscal year, the SEC made its first whistleblower incentive award. On August 21, 2012, a whistleblower who helped stop an ongoing multi-million dollar fraud was paid 30% of the amount of court-ordered sanctions that had been collected. The amount paid to the whistleblower may increase if there are additional collections or an increase in the sanctions ordered and collected.8 Under Dodd-Frank, the SEC may make incentive awards to whistleblowers of up to 30% of monetary sanctions collected in SEC enforcement actions that result in sanctions exceeding $1 million.

Over 10% of the whistleblower tips originated from abroad. During fiscal year 2012, the SEC received 324 tips originating from 49 countries outside of the United States. The largest number of tips came from the United Kingdom (74) followed by Canada (46) and India (33). One issue emerging with whistleblower complaints originating from abroad is the extraterritorial reach of the whistleblower program's provisions.

In the case of Asadi v. G.E Energy (USA), LLC, decided on June 28, 2012 in the US District Court for the Southern District of Texas,9 the question of the extraterritorial application of the Dodd-Frank whistleblower protections was addressed. Khaled Asadi brought a whistleblower claim under Dodd-Frank alleging that GE Energy had terminated his employment after Mr. Asadi had informed his supervisors that he had observed conduct which he believed potentially violated the FCPA and GE Energy's company policies. Mr. Asadi was employed by GE Energy as the GE-Iraq Country Executive, a position that required him to coordinate with Iraq's governing bodies to secure and manage energy service contracts for GE. In the complaint, Asadi alleged that he was terminated from GE Energy in illegal retaliation for reporting his concerns of potential FCPA violations related to GE's hiring of an Iraqi national in order to curry favor with the Senior Deputy Minister of Electricity, while negotiating a joint venture agreement between GE Energy and the minister.

Although the court noted that the case involved other issues besides extraterritoriality,10 it concluded that the question of extraterritorial application of Dodd-Frank's whistleblower protections was a threshold matter to address the defendant's motion to dismiss the case. The court held that the Anti-Retaliation Provision of Dodd-Frank did not extend to or protect Mr. Asadi's extraterritorial whistleblowing activity.

To reach this conclusion, the court relied upon the holding of the Supreme Court in Morrison v. National Australia Bank, Ltd., reaffirming that US statutes do not apply outside the United States "unless a contrary intent appears."11 The court held that the presumption against extraterritoriality means that, (using the Supreme Court's language in Morrison) "When a statute gives no clear indication of an extraterritorial application, it has none."

The court held that the language of the Dodd-Frank Anti-Retaliation Provision was silent regarding whether it applies extraterritorially. The court therefore applied the presumption that the Provision did not govern conduct outside the United States. As in Morrison, the court proceeded to consider the Provision's "context" and found that their conclusion against extraterritorial application was reinforced by Section 929P(b) of Dodd-Frank, which explicitly addresses extraterritorial scope of the statute in a limited context. The court found that Section 929P(b) gives the district courts extraterritorial jurisdiction, but only over certain enforcement actions brought by the SEC or the United States. Quoting the Supreme Court's reasoning in Morrison, the court concluded that "when a statute provides for some extraterritorial application, the presumption against extraterritoriality operates to limit that provision to its terms." The court reasoned that the language of Dodd-Frank's Section 929P(b) thus strengthened the conclusion that the Anti-Retaliation Provision does not apply extraterritorially.

Ten Years of Fair Funds as Part of SEC Settlements

2012 marks the 10th anniversary of the Sarbanes-Oxley Act that included many reforms aimed at addressing alleged corporate misdeeds in the wake of large-scale corporate bankruptcies such as those of Enron and WorldCom. These reforms included a provision, known as the Fair Fund provision, allowing the SEC to combine civil monetary penalties with disgorgement funds to help provide restitution to investors who were harmed as a result of securities violations.12 During the past 10 years, Fair Funds have become a common feature of SEC settlements.

The SEC's Office of Collections and Distributions (OCD) is responsible for monitoring Fair Funds. A Fair Fund can be created by the SEC in cases involving administrative proceedings, or by the courts in SEC cases involving litigation. Once a Fair Fund is ordered, OCD manages the collection of penalties and disgorgement and then administers the process of returning money to harmed investors. Administering the process includes approving the appointment of a plan administrator, a claims administrator, a distribution agent, and the distribution plan.

The US Government Accountability Office (GAO) offers an overview of how Fair Funds have operated since 2002.13 The GAO analyzed SEC data on Fair Funds cases including the dollar amounts of Fair Funds ordered, amounts collected, and amounts distributed. The GAO found that from 2002 through February 2010, 199 Fair Funds had been ordered. Of these, 73 were established through SEC administrative proceedings and 126 were established by the courts. The dollar value of the 199 Fair Funds ordered totaled $9.5 billion. Of the ordered $9.5 billion, $9.1 billion had been collected and $6.9 billion had been distributed as of February 2010. The GAO also found that since 2006, amounts ordered returned to harmed investors through Fair Funds had declined, with $521 million of Fair Funds ordered between May 2007 and February 2010. This decline in the amounts of Fair Funds ordered corresponds with a decline in dollar value of corporate settlements across this same period.

The GAO also reported that many Fair Funds can remain open for years; it found that in 2010, of the 128 then-ongoing Fair Fund cases, 114 had been ongoing for more than two years and 66 had been ongoing for at least four years. Fair Funds can remain open because of difficulties in obtaining investor information or because of legal objections or appeals that must be settled. A Fair Fund can be closed prior to all funds being returned to harmed investors. In these cases residual funds are transmitted to the US Treasury.

Although the total dollars ordered distributed under a Fair Fund appears to have declined since 2006, recent large SEC settlements have established Fair Funds. For example, the SEC's $525 million settlement with BP in November 2012 establishes a Fair Fund to distribute funds to harmed investors.14 The BP Fair Fund ranks as the third-largest Fair Fund ever. In 2010, the SEC's $550 million settlement with Goldman Sachs specified that $250 million would be returned to harmed investors through a Fair Fund distribution and $300 million would be paid to the US Treasury. Goldman's $250 million Fair Fund does not make the top-10 list of Fair Funds ordered.

Settlement Activity during the Schapiro Years

Mary Schapiro was appointed by President Obama on January 20, 2009 and sworn in as Chairman of the SEC on January 27, 2009. After almost four years in office, Chairman Schapiro stepped down on December 14, 2012. She was the first woman to serve as the agency's permanent Chairman and was appointed to lead the SEC in the wake of the credit crisis.

During her Chairmanship, the SEC changed in many ways, through organizational restructuring, shifting budget priorities, Dodd-Frank mandates, and responding to court decisions vacating SEC rules. According to the SEC itself, over the course of Chairman Schapiro's tenure, "the SEC brought a record number of enforcement actions; pursued scores of individuals and entities in connection with the financial crisis; put in place a series of measures to bolster the resilience of U.S. equity market structure and reduce the likelihood of another 'flash crash;' presided over one of the busiest rulemaking agendas in the agency's history; obtained significant responsibilities for derivatives, hedge funds and credit rating agencies as a result of financial reform legislation; and underwent a comprehensive restructuring to become more effective in its investor protection mission."15 In looking back on the Schapiro years, we observe what the data say about changes in SEC settlement trends during this time.

We compared settlement trends in SEC enforcement actions between the period from the passage of Sarbanes-Oxley to Chairman Schapiro's appointment, from July 21, 2002 to January 26, 2009 (pre-Schapiro era), and the period of her tenure, from January 27, 2009 and September 30, 2012 (Schapiro era). We present the data on an annualized basis.

Overall, the number of settlements per year declined from 751 in the pre-Schapiro era to 680 in the Schapiro era. The decline was both for settlements with companies and individuals. However, using settlement data from the entire pre-Schapiro era obscures the fact that the Schapiro era average of 680 settlements per year is virtually unchanged from the average of 682 settlements per year observed in three years immediately prior to the Schapiro Chairmanship. We note that FY 2012 saw a significant increase in settlements compared to prior years, jumping to 714 settlements, the highest level since 2007. Because of the lengthy gestation period for many cases, it may be that many of the settlements in the first years of the Schapiro era simply reflected the inherited pipeline of cases that were working their way towards resolution. If so, the settlement figures for 2012 may turn out to reflect enforcement priorities and efforts initiated during the Schapiro era, particularly for cases originating during the financial crisis of 2008. It is not possible to discern a trend from a single year of data. Therefore, the question of whether settlement figures for 2012 represent an outlier or the beginning of a trend cannot yet be answered.

Likewise, the composition of settlements between companies and individuals remained remarkably stable during the first three years of the Schapiro era relative to the three previous years. In the three fiscal years before assuming the Chairmanship, company settlements represented 27.7% of the total number of settlements compared to 27.8% for the first three fiscal years of the Schapiro Chairmanship. However, in 2012, the composition of cases shifted abruptly where company settlements represented only 24.5% of the total, meaning that an increasing number of settlements were with individuals. As with the figures for total settlements, a single year of data is insufficient to establish a trend, although the shift is consistent with the stated objectives of some SEC officials to place greater emphasis on individual accountability.

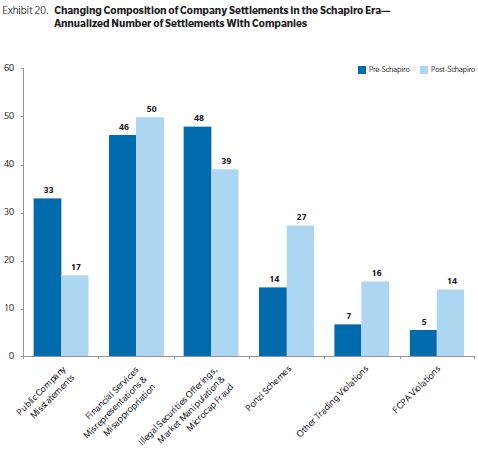

The Schapiro era has seen some substantial shifts in enforcement focus, measured by the frequency of settlements by allegation. For example, insider trading settlements in 2012 jumped to 126, far exceeding the yearly average of 71 settlements for this activity over the preceding six years. There was also a large increase in number of settlements with companies on matters related to Ponzi schemes. The number of yearly settlements for this type of allegation nearly doubled from 47 cases in the pre-Schapiro era to 79 cases during the Schapiro era. Exhibits 19 and 20 show the changing composition of company and individual settlements, by allegation type.

Another area of focus for the SEC under the Schapiro Chairmanship has been enforcement actions related to the Foreign Corrupt Practices Act (FCPA). The SEC created a special investigative unit within its Division of Enforcement for this activity. Since the creation of this unit, however, FCPA settlements have remained relatively stable, maintaining the higher level of FCPA enforcement activity that began in 2007. The SEC averaged 17 FCPA settlements per year during 2007 and 2008, and 18 per year during the Schapiro era. Before 2007, settlements for allegations related to FCPA violations were rare, averaging only five per year from the passage of Sarbanes-Oxley to the end of 2006.

In contrast, settlements for allegations of public company misstatements declined sharply, both with companies and with individuals. Public company misstatement settlements with companies fell from an average of 33 cases per year in the pre-Schapiro era to 17 cases per year in the Schapiro era, while the mean number of settlements with individuals dropped from 109 to 79 cases. SEC Enforcement Division director Robert Khuzami has observed that there been competing theories offered to explain this decline. Mr. Khuzami suggested that the decline may be due to the fact that "people are considering things better, or the economic shakeout has resulted in people being more candid, or maybe everybody's communal efforts from SOX on down, and more conscientiousness and more attention in board rooms and amongst auditors result in fewer [re]statements."16

Reflecting the SEC's emphasis on individual accountability under Chairman Schapiro, the value of settlements with individuals increased substantially, when measured at the median or 75th percentile, and more modestly at the 90th percentile. The median settlement with individuals increased by nearly 40%, from $110,000 to $152,667.

The increase in settlement values for individuals is consistent across most major allegation types, with the notable exception of financial services misstatements and misrepresentations.

Company settlements similarly rose at the median, from $993,542 to $1,075,000, and 75th percentile, but declined at the 90th percentile. However, the trend varies across allegation types. Median settlement values more than tripled for illegal securities offerings from $250,000 to $836,000, while the median settlement involving public company misstatements fell 70% from $12 million to $3.5 million.

In summary, it may be too early to identify signature trends in settlement activity to define the Schapiro era. If the settlement activity observed during 2012 turns out to reflect enforcement priorities and efforts initiated during the Schapiro era, it can be said that the total number of settlements increased, and the composition of settlements has shifted towards activity related to insider trading and Ponzi schemes and shifted away from activity related to public company misstatements. Settlement activity related to FCPA violations has continued at the pace seen in the two years prior to the Schapiro era. Also noticeable is an apparent shift in settlement activity and settlement amounts with individuals, a result consistent with a focus on individual accountability.

During the Schapiro era, the Dodd-Frank Act gave the SEC expanded authority and expanded the range of market participants subject to SEC registration, oversight, and enforcement. As we discussed in our 2H11 Update, the full scope of the impact of Dodd-Frank on the SEC's authority will not be fully known until the Commission completes its rulemaking process implementing the law. However, the actions taken during the Schapiro era to implement Dodd-Frank will in the future likely result in more enforcement proceedings and more settlements. These actions will likely be an important contributor to the legacy of the Schapiro era.

Dr. Buckberg is a Senior Vice President, Dr. Overdahl is a Vice President, and Jorge Baez is a Senior Consultant with NERA Economic Consulting. Dr. Overdahl previously served as Chief Economist and Director of the Office of Economic Analysis for the SEC. The authors thank Svetlana Starykh for database and research management, and Jason Copelas, Tyler Wood, Carlos Soto, and Nicole Roman for excellent research assistance.

Footnotes

1 The remaining $2.5 million is pre-judgment interest.

2 See Luis A. Aguilar, SEC Commissioner, Speech at Third Annual Fraud and Forensic Accounting Education Conference, Atlanta, Georgia, "Combating Securities Fraud at Home and Abroad" (May 28, 2009), available at http://www.sec.gov/news/speech/2009/spch052809laa.htm. See also, SEC Division of Enforcement Director Robert Khuzami, who stated "...at the end of the day, regardless of the consequences, pursuing individuals is the most important thing..." Comments from "Bingham Presents 2011: Enforcement After Dodd-Frank," SEC Historical Society, September 13, 2011.

3 "Bingham Presents 2011: Enforcement After Dodd-Frank," SEC Historical Society, September 13, 2011. http://c0403731.cdn.cloudfiles.rackspacecloud.com/collection/programs/sechistorical-09132011-transcript.pdf.

4 For a description of the SEC's role in FCPA enforcement, see "FCPA Settlements: It's a Small World After All," by Raymund Wong and Patrick Conroy, http://www.nera.com/extImage/Pub_FCPA_Settlements_0109_Final2.pdf.

5 Kroll Advisory Solutions, "2012 FCPA Benchmarking Report," p. 10.

6 The first annual report, released in November 2011, covered only the first seven weeks of the whistleblower program between August 12, 2011, when the program was launched, and September 30, 2011, the end of the SEC's fiscal year. See US Securities and Exchange Commission, Annual Report on the Dodd-Frank Whistleblower Program, Fiscal Year 2011, November, 2011, http://www.sec.gov/about/offices/owb/whistleblower-annual-report-2011.pdf.

7 See US Securities and Exchange Commission, Annual Report on the Dodd-Frank Whistleblower Program, Fiscal Year 2012, November, 2012, http://www.sec.gov/about/offices/owb/annual-report-2012.pdf.

8 See page 8 of US Securities and Exchange Commission, Annual Report on the Dodd-Frank Whistleblower Program, Fiscal Year 2012, November, 2012, http://www.sec.gov/about/offices/owb/annual-report-2012.pdf.

9 See http://www.leagle.com/xmlResult.aspx?xmldoc=In%20FDCO%2020120628E20.xml&docbase=CSLWAR3-2007-CURR.

10 The court noted that Mr. Asadi furnished his information about alleged FCPA violations not to the SEC, but rather to his supervisor and to GE's ombudsperson, and therefore did not fit within Dodd-Frank's definition of a whistleblower.

11 Morrison v. National Australia Bank, Ltd., 130 S. Ct. 2869, 2877 (2010).

12 The "Fair Fund" provision is formally known as the Federal Account for Investor Restitution provision, from Section 308(a) of the Sarbanes-Oxley Act.

13 See GAO-10-448R SEC Fair Fund Collections and Distributions at: http://www.gao.gov/new.items/d10448r.pdf.

14 See http://www.sec.gov/news/press/2012/2012-231.htm.

15 SEC, "SEC Biography: Chairman Mary L. Schapiro," http://sec.gov/about/commissioner/schapiro.htm.

16 Bingham Presents 2011 Enforcement After Dodd-Frank, Audiocast, SEC Historical Society, September 13, 2011.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.