As many of our clients and colleagues know, Institutional Shareholder Services (ISS), a U.S. proxy advisory firm, has issued its final U.S. corporate governance policy (i.e., proxy voting guidelines) for 2012. The changes are significant in many instances and provide insights into the ISS's evolving vision for 2012. Grant Thornton has reviewed the changes based on how they might affect ISS recommendations regarding a company's say-on-pay votes and annual nominations and elections for members of boards of directors, particularly those who also serve on a company's compensation committee.

While the ISS is only one voice among many participants in the executive compensation and proxy voting processes, the organization's voting recommendations can influence the way in which institutional investors cast their ballots during proxy season. Thus, our public company clients are interested in how the ISS develops its recommendations in order to better evaluate potential proxy voting outcomes and, when possible, to proactively align company practices and programs with ISS guidance. In addition to summarizing the new ISS guidelines, this article will explore how some of those guidelines might coincide with the implementation of executive compensation programs that are effective and likely to appeal to shareholders.

Summary of ISS 2012 proxy voting guidelines and the pay-for-performance evaluation methodology

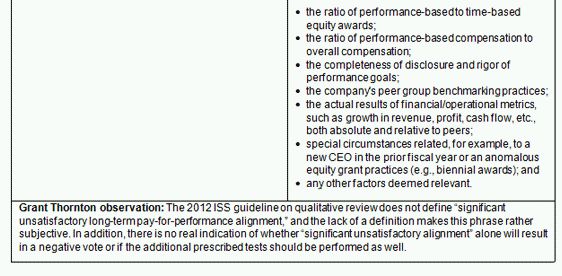

The following table summarizes the key changes in ISS 2012 proxy voting guidelines and includes an observation regarding each change:

We believe that companies would benefit from becoming more familiar with the ISS white paper "Evaluating Pay for Performance Alignment: ISS' Quantitative and Qualitative Approach," dated Dec. 20, 2011. The white paper focuses on the ISS's 2012 perspective regarding the alignment between compensation and performance for public companies.

In response to the 2012 ISS proxy voting guidelines, we offer public companies the following suggestions:

- Companies should consider the mix of performance-based compensation relative to total compensation and whether the performance measures associated with wealth accumulation link to or align with shareholder return over the same performance period.

- Although some companies may hesitate to disclose long-term incentive performance measures in light of potential competitive disadvantages, we would encourage companies to reflect on their position and, whenever possible, embrace the more-transparent approach of full disclosure.

- Companies should select performance measures that can be easily disclosed and understood by shareholders and advisory companies like the ISS in order to avoid confusion and to promote the overall goal of the CD&A process (i.e., to promote transparency in the compensation disclosure process).

The ISS's 2012 incentive bonus plans and tax deductibility

proposals for post-IPO companies

The ISS's 2012 guidelines included its new perspective on how

it will evaluate equity plan say-on-pay votes that are presented to

the shareholders immediately after an initial public offering

(IPO). In particular, the ISS indicated it will subject the

proposed plan as presented to shareholders to "full equity

plan evaluation under the same guidelines as a standard equity

plan."

Additionally, the ISS stated it will recommend a vote for proposals to approve or amend executive incentive bonus plans under those circumstances if the shareholder proposal:

- includes only administrative features;

- caps the annual grants any one participant may receive to comply with the provisions of Section 162(m);

- adds performance goals to existing compensation plans to comply with the provisions of Section 162(m), unless they are clearly inappropriate; or

- covers cash or cash and stock bonus plans that are submitted to shareholders for the purpose of exempting compensation from taxes under the provisions of Section 162(m) if no increase in shares is requested.

Furthermore, ISS will recommend a vote against such shareholder proposals if:

- a compensation committee does not fully consist of independent outsiders, or

- the plan contains excessive "problematic" [emphasis added] provisions.

The ISS will evaluate proposals to amend executive compensation plans on a case-by-case basis if:

- in addition to seeking Section 162(m) tax treatment on the compensation, the amendment may cause the transfer of additional shareholder value to employees (e.g., by requesting additional shares, extending the option term or expanding the pool of plan participants).

We believe the 2012 ISS policy enables shareholders of new public companies to identify whether a proposed executive incentive plan includes any problematic features such that first-time approval of the plan design for Section 162(m) purposes would not benefit shareholders. In addition, it is worth noting that the IRS proposed a new rule in June 2011 and clarified two issues under Section 162(m) recently. In particular, the IRS clarified that qualified performance-based compensation attributable to stock options and stock appreciation rights plans must specify the maximum number of shares that can be granted to each individual employee, and the IRS clarified cases in which the transition relief rule can be applied to new public companies via an IPO.

We recommend that new public companies seeking initial shareholder approval for Section 162(m) purposes consider incorporating the ISS policy in their initial design. In particular, companies should limit any change-in-control provisions to double-trigger events following actual changes in control of the company.

Board response to high levels of say-on-pay opposition

Under the 2012 policy, for any company that received less than 70

percent support on its previous say-on-pay vote, the ISS will make

its recommendation on a case-by-case basis regarding the election

of compensation committee members (or, in exceptional cases, the

full board) and the current management say-on-pay (MSOP)

proposal.

According to the policy, the ISS will take into account:

- the company's response including:

-

- the disclosure of engagement efforts with major institutional investors regarding the issues that contributed to the low level of support,

- the specific actions taken to address the issues that contributed to the low level of support, and

- other recent compensation actions taken by the company;

- the frequency of issues raised (recurring or isolated);

- the company's ownership structure; and

- the support level (less than 50 percent would warrant the highest degree of responsiveness).

Any company that may have previously failed to receive at least 70 percent of shareholder support related to the precatory say-on-pay votes might consider enhancing its disclosures regarding elements included in the new ISS policy. Companies that include some discussion about the institutional investors who have participated in any conversations regarding the plans and how the companies responded to any feedback they may have received will demonstrate a proactive response to an apparent concern by the ISS that a lack of support by more than 30 percent of the company's shareholders indicates a need for concern.

Board response to frequency of say-on-pay vote

Pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the SEC required U.S. public companies not only to present shareholders with a precatory or advisory MSOP vote but also to provide shareholders with an advisory vote to select the preferred frequency for MSOP votes at the first annual shareholder meeting occurring on or after Jan. 21, 2011, and at least every six years thereafter.

According to the ISS's 2012 policy regarding the implementation of the Dodd-Frank "frequency" provision:

- the ISS will recommend an against vote for the entire board (except new nominees, who should be considered case by case), if the board implements the advisory say-on-pay vote on a less frequent basis than the frequency that received the majority of the votes cast by shareholders; and

- the ISS will evaluate votes on the entire board on a case-by-case basis when the board implements the advisory say-on-pay vote on a less-frequent basis than the frequency that received a plurality, but not a majority, of votes cast by shareholders. The ISS will take into account:

-

- the board's rationale for selecting a frequency that differs from the frequency that received a plurality,

- the company's ownership structure and vote results,

- the ISS's analysis of whether there are compensation concerns or a history of problematic compensation practices, and

- the previous year's support level on the company's say-on-pay proposal.

The new ISS policy calls for board responsiveness to the "preferences" of most shareholders regardless of the costs associated with administering proposed programs or suggested practices. Indeed, despite the precatory nature of the votes under the actual law, the ISS will clearly be gauging its support according to how well board decisions align with votes on the issue of say-on-pay frequency.

Proxy access

According to the 2012 ISS guidelines, in the absence of a uniform standard for enacting proxy access proposals, the ISS evaluates proposals to enact proxy access on a case-by-case basis, taking into account factors such as:

- company specifics; and

- proposal specifics, including:

-

- the ownership thresholds proposed in the resolution (i.e., percentage and duration),

- the maximum proportion of directors that shareholders may nominate each year, and

- the method of determining which nominations should appear on the ballot if multiple shareholders submit nominations.

The 2012 policy change lacks specific guidance on key terms such as "favorable" or "unfavorable" terms, and it also moves the ISS away from a prior policy that seemed to emphasize the shareholder's rationale for the need, as opposed to the company's explanation for current practices or rationale for opposing the proposal.

Conclusion

Public companies will benefit from familiarizing themselves with the new ISS guidelines and, in particular, with the ISS's attempt to better gauge the link between executive pay and company performance. While the current approaches improve upon prior practices, they also continue to lack some of the practical and day-to-day considerations in determining how executive compensation programs reward success and align with long- and short-term goals for an individual company, as opposed to the prototypical company that these types of methodologies seek to define and replicate.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.