Every year, we survey Morrison & Foerster's Global Sourcing Group lawyers in Asia, Europe, and the United States to create a snapshot of the current state of the world's outsourcing market and to identify emerging trends that are likely to shape that market over the next 12 months. In this year's update, our lawyers comment on the overall state of the outsourcing market, the importance of multisourcing, today's interest in business transformation, the growing use of strategic global sourcing strategies, and trends affecting the market in specific geographic areas.

GLOBAL TRENDS

Cautious Optimism Takes Root

As the economic recovery slowly moves forward, outsourcing is taking a more prominent place on many agendas. Companies and outsourcing providers are adjusting to an environment where there is still significant uncertainty and where new approaches are being adopted to address new challenges—and they are moving ahead with great care.

Companies thinking about outsourcing today face continued uncertainty on many fronts. Nevertheless, in recent months outsourcing activity has increased, up from the precipitous, recession-driven drop-off of the previous three years. The health of the economy— and outsourcing activity—varies from one place to another. But growth, or at least modest growth, is expected to continue in many regions and sectors in 2012.

The uncertainty comes from various quarters. Many organizations are worried about the slow pace of economic recovery, or even the possibility of a double-dip recession. Added to that are the worries about the European Union's financial difficulties, fluctuating global stock markets, and political indecisiveness and election-year politics in the U.S. that often make it difficult for businesses to plan ahead.

But those concerns are just part of the story; a range of other factors are prompting companies to outsource. For one thing, corporate profits in many sectors are rebounding, giving companies more capital to work with than in recent years. For another, many parts of the outsourcing market are seeing pent-up demand. After several years of belt-tightening and holding off on large projects and capital investment, many companies need to catch up in terms of improving systems and processes. This is especially true in industries such as financial services, where technological sophistication is key to the creation of new products. In general, companies are finding it is getting difficult to put improvements off any longer, and outsourcing often provides a vehicle for moving those improvements forward.

From our perspective, we have certainly seen an increased flow of outsourcing deals, with more emphasis on new deals and less on renegotiating existing deals to cut costs. Indeed, the number of outsourcing arrangements that we've worked on has grown throughout the year, and the past 12 months have been the most active of the previous four years. Our experience is shared by others. In the third quarter of 2011, ISG reported a 41% year-to-year increase in the global outsourcing market, and a 38% rise in the number of "new scope" deals.

However, the renewed interest in outsourcing is tempered by a definite sense of caution. There are fewer megadeals being done. Instead, companies are often engaging in smaller deals, focused on specific, carefully defined areas. Thus, where a large deal a few years ago might have been worth $1 billion or more, today's larger transactions tend to be valued at $100 million and above. There are exceptions, of course, but in general, companies are showing a heightened aversion to risk and are not outsourcing anything more than seems necessary.

Divide and Conquer

As a result, companies are tending to rely on several smaller providers to handle work, rather than one large provider responsible for a multifaceted engagement. Single "tower" projects are more prevalent. We continue to see greater use of multisourcing, with different towers of services handled separately by different providers, all under one framework managed by the client company. At the same time, providers are enabling this trend with a growing array of "as a service" offerings, designed to provide a menu of service offerings from which customers can choose.

Companies see the use of several providers as a way not only to cut costs, but also to have greater flexibility to tap the marketplace for different skills as needs evolve. In addition, companies often value the opportunity to have greater visibility with their provider, compared to what they might have with a large Tier 1 provider. This multisourcing approach lets companies take advantage of the cost-effectiveness related to the commoditization of some services, such as certain help-desk activities and PC break-fix, thus reducing the costs of the outsourced services.

In a related vein, we are also seeing the increased use of "outsourcing panels." Here, companies assemble a group of providers to focus on a given task and establish a financial framework for working with each one. Then, as projects come up, the company can "bid" the work to the panel members. For example, a company might have a panel of three providers it uses for application-development work. When such work is needed, the company asks all three for a proposal and selects one. The vendors benefit from always being on the short list and not having to go through lengthy, repeated sales cycles; the company benefits from a shortened buying process and competition among the vendors.

Extensive IT, Focused BPO

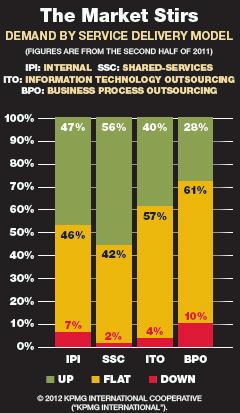

The current atmosphere of cautious optimism is also reflected in the types of activities being outsourced. For example, ITO is showing stronger growth than BPO, and we expect that to continue in the coming year. When a KPMG survey asked large companies what they see as effective ways to improve service delivery, "outsourcing more IT" ranked second, behind improving governance processes. "ITO is a mature operating model now, where executives believe that a big proportion of IT could and should be outsourced," says Bill Thomas, a partner at KPMG UK.

That is not to say that there are no BPO deals taking place. As a general rule, however, BPO tends to be used for specific activities or functions, rather than broad enterprise processes. Thus, rather than all of finance or HR, a company might outsource accounts payable or benefits management. Overall, buyers are typically taking a careful, tactical approach to BPO.

Meanwhile, outsourcing arrangements that target business transformation appear to be coming back—and some are of significant size. This is a shift from the past several years, when companies were primarily interested in labor arbitrage and driving out costs. In part, this could be due to companies wanting to prepare themselves to weather the next economic storm and to use outsourcing as a tool for changing their businesses and strategically positioning themselves for the future.

Increased interest in transformation may also be the next natural step in the evolution of outsourcing markets. Many companies have now gone through several rounds of outsourcing (and internal cost-cutting) and have become more sophisticated in their understanding of the strategic benefits outsourcing can provide.

Shaping the Deal

In forging outsourcing contracts, costs have always been a central point of negotiation and concern. That will continue, and perhaps become more of an issue in the coming year, with buyers putting more pricing pressure on vendors. Having learned from recent recessions, customers will focus on pricing models with a high degree of flexibility, allowing the customer to shed costs and renegotiate terms in the event of future downturns.

At the same time, we are seeing more performance-based contracting, with companies moving away from headcount-or requirements-based contracts to agreements based on delivering desired outcomes. For example, instead of spelling out the number of technology personnel involved and the steps they will take to manage an IT infrastructure, an agreement might call for "keeping the system running well," with the emphasis on achieving specific performance standards. How that will be done is left to the vendor. Ideally, this will help align the parties' activities.

There are other points where achieving such alignment can be more complicated. Companies often want to spell out what they will get and how they will get it. Vendors, on the other hand, want as much flexibility as possible, particularly in an uncertain and changing market. They want to be able to move operations to low-cost countries and to take advantage of new technologies, such as cloud computing, when appropriate. As a result, we find that vendors are increasingly interested in limiting their customers' ability to dictate how the services are going to be provided.

As they were in 2011, data privacy and security remain key issues. Vendors continue to push hard to limit their obligations and exposure as they contend with burgeoning amounts of electronically stored personal information, growing regulatory requirements for data security, and customers demanding full accountability. To some extent, vendors are gaining ground, with agreements that cap vendor liability for data breaches and replace blanket guarantees of data security with the need to comply only with specific operational requirements. In 2011, however, we saw customers pushing back and pressuring vendors to assume more accountability. Customers have made clear that this is a C-level issue in their organizations. We routinely hear from companies that this is their biggest deal issue, and we have seen the issue elevated to the board level for resolution. We expect this to remain a critical issue in 2012.

The Cloud Arrives

A great deal of discussion has been devoted to cloud computing in outsourcing, and in 2011, those discussions continued to be reflected in deal activity. Many companies have established plans for the cloud, and many have a clear grasp of the benefits that cloud-based delivery of services can provide, such as reduced costs and the flexibility to scale capacity up and down, quickly and easily—and they are ready to move forward. But they also need to understand that this differs from traditional outsourcing and brings with it some additional risks that need to be managed up front.

For example, companies need take a planned approach that matches the right type of cloud—private, public, hybrid—to the processes that will be delivered via the cloud, so that critical processes aren't being managed in an insufficiently robust environment. Business continuity and data security—and who is responsible for those items—also need to be clearly understood. When services are delivered via the cloud, companies typically lose a significant measure of control over various aspects of those services. Vendors are able to provide cost-effective cloud-based operations by having customers share servers and other infrastructure, as well as offering standard terms and conditions that customarily are not modified on a customer-by-customer basis. With greater competition among vendors, however, customers are starting to successfully negotiate several of the key terms of their agreements.

The move toward cloud computing also highlights the need for internal governance over how the organization uses and controls the services being delivered. Policies need to address a number of issues: Who can access which cloud-based services? How will provisioning, versioning, and upgrading of services be controlled? Does the cloud environment have adequate audit capabilities to comply with requests from regulators and litigants? Without clear answers to these types of questions, companies moving to cloud-based services may actually be increasing costs and risk.

It is clear that outsourcing customers and providers alike will face a complex and shifting landscape in the coming year. Finding the opportunities in that landscape will take insight and careful planning, but experience has shown that it will be worth it—and that the right approach to outsourcing can bring significant value.

The Rise of the Global Perspective

Today, many companies are looking to outsourcing or to internal shared-services organizations to help streamline operations. More important, many have started to combine both approaches.

Traditionally, sourcing approaches have been fragmented, with different functions, business units, and geographic groups establishing their own service delivery models. Now, however, some companies are taking a more strategic approach.

"We see strong growth in 2012 and beyond for outsourcing and shared services. Some companies are taking a very strategic view and creating 'global business services' organizations," says Derek Sappenfield, global strategy and enterprise transformation advisor at PwC. "They are pulling together all their shared services and outsourcing initiatives" and "rationalizing the sourcing strategy, putting in place the appropriate performance measurements and the proper governance structure under a strategic umbrella organization. This enables the organization to align its global sourcing initiatives with its global corporate strategy, thus creating greater agility and internal alignment. Then, if a company pivots its strategy five degrees, it has a business-support organization that can move along with it."

To thrive in that environment, vendors will have to work under that strategic umbrella organization. At the same time, the growing interest in shared services may be to their benefit—sometimes, the process discipline and rationalization that goes into creating a shared services organization can set the stage for outsourcing those processes.

Beyond the Basics

Outsourcing providers continue to develop new ways to meet companies' needs, often by bringing more sophistication to the table. For example, we are seeing the increased offering of integrated facilities management. Rather than dealing separately with activities such as maintenance, security, food service, groundskeeping, and so forth, companies contract with a master facilities manager.

For the provider, this can be more complex than it might sound. A single agreement may cover many geographically dispersed facilities of varying types, from office buildings to manufacturing plants and warehouses. The vendor may have to manage different workforces and functions and be responsible for activities, such as storing spare parts, maintaining backup heating and cooling systems, and helping to formulate cost-cutting strategies.

Integrated facilities management can also entail some fairly sensitive work. In the pharmaceuticals industry, for example, vendors might be responsible for labs and R&D facilities as well as office space. They may have to comply with various regulatory standards and even get involved in security, equipment calibration, environmental controls, and tracking product-pedigree information during storage and distribution—things that require significant training. Not long ago, pharmaceutical companies would have considered such activities as too "core" to be handled by a facilities management company, but that is changing. Indeed, we are seeing companies in various regulated industries beginning to take advantage of these integrated, sophisticated offerings.

EUROPE

Caution, Concern— and an Interest in Innovation

Risk-averse companies are slow to return to outsourcing across much of the market, but in the U.K., the government is showing renewed interest—and trying out some new approaches.

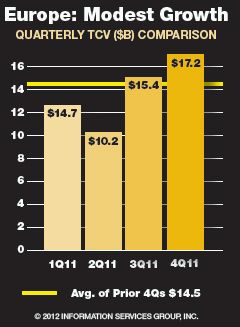

In Europe, the outsourcing market is seeing modest growth, with some industries and sectors more active than others. Uncertainty seems to be the prevailing sentiment, driven largely by the troubled overall macroeconomic outlook for the eurozone. In addition, after three years of corporate cost-cutting, the low-hanging fruit has been picked. It is the more challenging projects that remain, and this contributes to the view that outsourcing may be relatively risky at the moment. Many outsourcing service providers note that their pipeline of possible work is increasing; the question is how to convert that pipeline to actual contracted services.

Meanwhile, more companies in Europe seem to be open to adopting shared-services models. Certainly many regard the use of offshore captive organizations as increasingly risky, and the onshore, shared-services model could provide an attractive alternative. We have also found that in many cases companies view the shared-services option as a precursor to outsourcing.

One of the more significant developments to watch is public-sector outsourcing in the U.K. That sector saw a significant decrease in activity through the early part of 2011—the effect of a clampdown announced by the government in May 2010. At that time, the government stopped deals that were in the works, limited new deals to £1 million, and called for the rebidding of existing deals.

By mid-2011, however, we began to see the U.K. government reopening the door to outsourcing, relying on a handful of key approaches. One is to divide what would once have been "megadeals" among several providers—a trend that is reflected in market statistics. According to ISG, the number of outsourcing contracts signed by midyear in the U.K. was 70% higher than the previous year, but the total value of those deals was 47% lower.

Another approach is the use of mutuals—essentially joint ventures run for the benefit of the organization's members. With the mutual approach, a government operation is spun off into a separate entity that is owned by the government and an outsourcing provider.

This mutual approach represents a significant change for the British government, which has traditionally been one of the biggest outsourcing customers in Europe, and something of a pioneer in both ITO and BPO. If this approach proves effective, it may become widespread in the U.K. and have ramifications for government outsourcing in general.

Europe's Bright Spot

The main bright spot in the European outsourcing market is the financial services industry, which has begun to emerge from the shock of the past several years.

Financial services organizations have been through massive waves of cost cutting and mergers, both of which have had an impact on their IT landscapes. They are now finding that they need to turn their attention back to the evolving application of IT, which is critical to product innovation, services delivery, and efficiency in the industry. ITO provides a way to quickly access the infrastructure and expertise they need—not just to catch up, but also to compete in the future. "The financial sector in Europe is in major transformation. If you think of 21st-century banks and insurers, they will have a very different operating model from their traditional operations," says Bill Thomas, a partner at KPMG UK. "That type of transformation tends to drive outsourcing."

On the other end of the spectrum is government outsourcing. "It's interesting to note that the public sector is still lagging far behind the corporate sectors in outsourcing," Thomas says. But that may change as governments work through financial issues that are troubling the EU. "If one thinks of the things going on in Europe at the moment," he says, "one would expect to see more public-sector transaction activity on the way."

UNITED STATES

Increasing Activity— and Changing Attitudes

The U.S. outsourcing market has been showing improvement across the board—as well as some evolving challenges for vendors and public-sector organizations.

The U.S. outsourcing market is recovering, with the financial services segment leading the pack. For all industry sectors, however, 2011 activity was essentially at or above the five-year average, which we take as an indication of a broad-based increase in overall economic strength— and a rising tide that is lifting all boats.

Beyond the overall market statistics, we also see a change in attitude, with companies showing a greater willingness to switch providers when it is time to renew an outsourcing contract. Some companies may be interested in the favorable upfront terms offered by a new vendor, while others may feel that their incumbent vendor has squeezed out all the costs it can and it is time for a new approach. In addition, extensive experience with outsourcing has given more companies the confidence and sophistication to deal with change.

Looking ahead, we are likely to see evolving attitudes in the public-sector market as well. In a number of states, political considerations and some negative outsourcing experiences have created deep—and often vocal— opposition to the outsourcing of public-sector activities. Now, however, that opposition is running into the hard economic realities of revenue shortfalls and severe budget constraints. State governments need to reduce their expenses. But they also have to deal with IT infrastructure that is often rapidly becoming old and obsolete.

Outsourcing, which would enable states to access upgraded technology and processes without large upfront investments, offers a potential solution. As a result, the once resolute "no" attitude is shifting toward a subtle "maybe," and we are seeing some states tentatively moving forward. Often, they are outsourcing smaller pieces to different providers—mainframe operations, perhaps, or the midrange environment.

As state governments increase their use of ITO, they may run into complications. For example, in a private-sector deal, a vendor would likely consolidate operations into its own data center. In a public-sector deal, that might be politically difficult if the center—and its jobs—is located out of state. Political concerns can make it difficult for states to use offshore operations, which are key to significant cost savings.

Overall, ITO is once again on the table. But if state governments are to meet the intense budget pressures they face in the coming year and beyond, they will need to find ways to balance political considerations with economic realities.

The Return of the Election Cycle

With the U.S. in a presidential election year, we are seeing a familiar pattern beginning to repeat itself. In 2004 and 2008 there was an increased focus on limiting offshoring and passing anti-offshoring legislation. Now, with unemployment remaining high and candidacies in full swing, the topic is once again coming to the fore.

One notable example: a recently proposed bill, the U.S. Call Center Worker and Consumer Protection Act. This bill calls for limiting the ability of companies to get federal loan guarantees if they outsource call centers to countries outside the U.S. It would also require companies with offshore call centers to register with the Department of Labor—a move that would publicize those companies' use of offshore resources. While this type of legislation is not likely to become law, it is indicative of the rhetoric that can be expected in an election year.

Meanwhile, we have seen a growing number of deals involving U.S. companies that include a mix of onshore, near-shore, and offshore functions, as opposed to just moving an entire process offshore. This may be due in part to political pressure and public opinion, but there are other, and probably more important, factors at play. For example, many companies prefer to avoid sending sensitive data overseas. And growing inflation and wages in countries such as India, combined with sluggish job growth in the U.S., are making the economics more favorable for keeping at least some aspects of work closer to home.

ASIA

China: Outsourcing as a Strategic Imperative

With designated "hub" cities, cloud server farms, and more, China is showing it's serious about becoming a major outsourcing player.

The world has been watching China make rapid progress in many areas of business, and the outsourcing arena is no exception. For the Chinese government, in fact, the fostering of outsourcing and technology services is a key strategic initiative and a vital element in its current five-year plan for development.

Today, the Chinese outsourcing industry is roughly a $20 billion business, and the government is clearly intent on growing that number. In the past year or so, we saw several developments that underscore China's interest in outsourcing. For example:

- g The country's list of designated outsourcing "hub" cities was expanded from 10 to 21. Companies providing offshoring services in these locations receive various tax breaks through 2013.

- g More large Chinese outsourcing firms have emerged, due to mergers among domestic firms and between Chinese and foreign firms and to Chinese companies expanding their access to capital by registering on the New York Stock Exchange.

- g Strong investment in cloud server farms is likely to result in a huge amount of cloud capacity coming online in the coming year. Cloud computing is considered an emerging strategic technology by the government.

The government is encouraging the outsourcing of a broad range of technology services. These include not only traditional services such as application development and maintenance, but also animation and special effects for the television and video-game industries and R&D services for the pharmaceuticals industry. Foreign companies considering these offerings still have to consider the complexity of intellectual property protection, be it improved software or a new drug developed with a Chinese outsourcer. But those issues can be overcome, not only through contracts, but also through the use of practices such as the compartmentalization of information and data security measures.

Perhaps the most fundamental development is a sea change in the government's attitude toward outside companies. China has long had tight restrictions on foreign involvement in certain industries, but those have been loosened somewhat—largely in order to gain know-how and build brand awareness rather than bring in foreign capital. For example, in telecom, which is critical to an outsourcing industry, foreign companies can now apply for licenses (offered on a trial basis) that make it possible to invest in, say, a Chinese contact-center business. Such moves would have been unthinkable just a few years ago—and they underscore China's seriousness about becoming a major player in the outsourcing arena.

Shadows on the Cloud

Across the Asia-Pacific region, countries see great potential in providing cloud computing infrastructure, and in some ways, many are well positioned for the trend. "If you set aside Australia and Japan, most of the countries do not have a built-up IT infrastructure," says Michael Rehkopf, partner and director, North Asia, at ISG. "So instead of migrating to the cloud, they can start with it. That's a huge benefit, because they don't have all that legacy technology to deal with."

But there are obstacles as well. In the U.S. and Europe, privacy and data protection laws are fairly consistent and clear. "But in Asia- Pacific, there is not that kind of harmonization," says Rehkopf. That leaves companies with significant concerns about the security of the data they send to cloud providers, as well as issues around business continuity and complex legal landscapes.

Such problems are significant enough that several IT companies, including Cisco, EMC, Microsoft, and Verizon, have created the Asia Cloud Computing Association, a collaborative forum that is addressing cloud issues. The association notes that across much of the region, there is the potential for cloud computing to grow at 40% a year over the next few years. But, the group says, "security concerns, data storage regulations, low penetration of bandwidth in some countries, and government policies oriented to traditional computing models are inhibiting market growth."

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved