Published in The Practical Tax Lawyer

AN EMPLOYEE STOCK OWNERSHIP PLAN (ESOP) is a qualified defined contribution retirement plan, much like a profit-sharing or 401(k) plan. An ESOP, however, is designed to invest primarily in employer securities. The Employee Retirement Income Security Act of 1974 (ERISA) and the Internal Revenue Code of 1986 (Code), provide substantial tax incentives and planning opportunities for employers that sponsor ESOPs. Besides providing retirement benefits, ESOPs can address corporate finance and other business objectives, including resolving ownership succession issues; diversifying investments; planning their estates and charitable donations; borrowing funds to finance transactions or refinance debt; reducing or eliminating federal income tax; and increasing employee benefits and productivity incentives. ESOPs are attractive to employers for many reasons, but they have special characteristics and requirements that distinguish them from other defined contribution plans.

ESOP AS DEFINED CONTRIBUTION PLAN - The Code divides all qualified deferred compensation plans into two categories — defined contribution plans (Code §414(i); ERISA §3(34)) and defined benefit plans (Code §414(j); Treas. Reg. §1.401‑1(b)). A defined contribution plan provides benefits equal to a participant's account balance, which may include employer contributions, participant contributions, forfeitures, and a participant's pro rata share of the income, loss, and expenses applicable to the trust. A defined benefit plan provides annuity benefits on a formula, typically based on service and compensation.

An ESOP is another type of defined contribution retirement plan, which contains a stock bonus plan element. A stock bonus plan is a plan established and maintained to provide benefits similar to those provided by profit‑sharing plans, but distributable in employer stock. Treas. Reg. §1.401‑1(a)(2) (iii) and (b)(1)(iii). ESOPs are subject to the same general qualification requirements as profit-sharing and other defined contribution plans, but there are several special rules that distinguish them.

SPECIAL ESOP QUALIFICATION REQUIREMENTS - An ESOP must be identified in the plan document as an employee stock ownership plan Treas. Reg. §54.4975-11(a)(2), and designed to invest primarily in employer securities, Treas. Reg. §54.4975-11(b). The Internal Revenue Service (IRS) has not interpreted the phrase "designed to invest primarily in employer securities," but the phrase implies that an ESOP must be intended to permit the plan trustees to invest or hold most of the plan assets in employer securities without specific duration or percentage requirements. Similarly, Department of Labor (DOL) guidance does not establish a specific standard for the "primarily invested" requirement, but instead looks to facts and circumstances. DOL Advisory Opinion 83‑6A (Jan. 24, 1983). In Advisory Opinion 83-6A, DOL stated that neither ERISA nor the regulations impose a maximum or minimum percentage on the amount of plan assets that must be invested in employer securities under ERISA §407(d)(6). Code section 409(l) defines "employer securities" as common stock issued by an employer that is readily tradable on an established securities market. If an employer's common stock is not publicly traded, the term means common stock issued by the employer that has a combination of voting powers and dividend rights equal to or greater than the powers and rights of the class of common stock of the employer that has the greatest voting powers and the class of common stock that has the greatest dividend rights. "Employer securities" also include non-callable preferred stock if such stock is convertible into the qualified common stock described above at a reasonable conversion price (as of the date of acquisition by the ESOP). Code §409(l)(3). For a discussion of employer security design, see Kim Schultz Abello and Gregory K. Brown, ESOPs and Security Design: Common Stock, Super Common or Convertible Preferred? 23 J. Pens. Plan. & Compliance 99 (Summer 1997). The term "employer securities" also includes, for a non-publicly traded company, securities issued by any member of the employer's controlled group of corporations. Under Code section 409(l)(4), the phrase "controlled group of corporations" has the meaning set forth in Code section1563(a) (disregarding subsections (a)(4) and (e)(3)(C)), except that the parent company must own only 50 percent (rather than 80 percent) of the stock of a subsidiary for that subsidiary and those below it to be members of the controlled group.

Code §415 Limitations for ESOPs

Code §415(c)(1) generally provides that the contributions that may be credited as "annual additions" to a participant's defined contribution plan accounts in a limitation year may not exceed the lesser of (i) $49,000 (for 2011), or (ii) 100 percent of the participant's compensation. "Annual additions" are employer contributions, employee contributions, and forfeitures for the year to all defined contribution plans sponsored by an employer. Code §415(c)(6) contains a special limitation rule for leveraged ESOPs sponsored by C corporations. Under this special rule, if no more than one‑third of the employer ESOP contributions are allocated to highly compensated employees (as defined in Code §414(q)), the employer contributions to the ESOP that are used to pay interest on the ESOP loan and reallocated forfeitures of employer securities that were acquired with the proceeds of the loan are excluded from the annual addition limitation calculation.

The IRS final regulations issued in April 2007 provide that annual additions under an ESOP for purposes of the Code §415 limits may be calculated based on employer contributions used to repay an exempt loan or based on the fair market value of the employer securities allocated to participant accounts. See 72 Fed. Reg. 16,878 (Apr. .If the annual additions are calculated based on employer contributions, appreciation in the value of the employer securities from the time they were purchased and placed in the suspense account is not counted for Code §415 purposes. Treas. Reg. §54.4975-11(a)(8) (ii).Dividends paid on employer securities held by an ESOP generally are treated as plan earnings and do not count against the Code §415 annual addition limits. See, e.g., Treas. Reg. §1.415(c)-1(b)(1)(iv).

Dividends

Unlike other defined contribution plans, ESOPs may make tax-advantaged distributions of dividends paid on employer securities. A C corporation may deduct dividends paid on employer securities held by a leveraged ESOP maintained by the corporation or a controlled group member, provided that the dividends are paid in cash directly or through the ESOP to ESOP participants or their beneficiaries; reinvested in employer securities, if participants have been given the election to receive the dividends in cash or to reinvest them in employer securities; or used to repay an ESOP loan. Code §404(k). The IRS has published proposed regulations that would deny a deduction to a U.S. subsidiary of a foreign parent for dividend payments made by the parent. Prop. Treas. Reg. §1.404(k)-2. In addition, the IRS has the authority to disallow a dividend deduction that constitutes an avoidance or evasion of taxation. Code §404(k)(5)(A). The special dividend distribution rules are not available to S corporations. Any S corporation distributions that are passed through an ESOP in a manner similar to C corporation dividends will be treated as distributions from the plan. The 10 percent penalty tax on early distributions will apply, withholding will be required, participants whose account balances exceed $5,000 must consent in writing to receive the distribution, and the distribution will be eligible for rollover to an IRA or a qualified plan. Corporate law "dividends" in an S corporation may not be treated as "dividends" for tax purposes because a "dividend" for tax purposes must be paid from current or accumulated earnings and profits, which an S corporation does not have (unless it carries over accumulated earnings and profits from a prior status as a C corporation). Code §§316 and 1371(c).

Dividends Paid To Participants

Dividends paid to ESOP participants or their beneficiaries are deductible if they are paid in cash directly or paid to the ESOP with a subsequent distribution to participants or beneficiaries within 90 days after the end of the plan year in which the dividends are paid. Code §404(k)(2)(A)(i) and (ii). The corporation paying the dividends is entitled to take a deduction in the year in which the ESOP participants or beneficiaries have a corresponding income inclusion. Code §404(k)(4)(A). Code section 404(k) dividends paid in cash to ESOP participants and beneficiaries constitute ordinary income to the participants and beneficiaries, and they are exempt from the 10 percent penalty tax on early distributions from qualified plans. Code §72(t)(2) (A)(vi).They are not eligible for the 15 percent tax rate on qualified dividends. Jobs and Growth Tax Relief Reconciliation Act of 2003, Pub. L. No. 108-27, Code §1(h)(11)(B)(ii)(III).Tax withholding is not required with respect to such dividend payments Code §3405(e)(1)(B)(iv) and the payments are exempt from the $5,000 mandatory distribution restrictions. Code §411(a)(11)(C). However, they are not eligible for tax-free rollover to an IRA or another qualified plan. Treas. Reg. §1.402(c)-2, Q&A- 4(e).

Dividends Reinvested In Employer Securities

Under Code §404(k)(2)(A), an ESOP sponsor may allow participants and their beneficiaries to elect to reinvest applicable ESOP dividends in qualified employer securities through their accounts in the ESOP without causing the employer to lose the dividend deduction. An ESOP sponsor that offers such an election must allow participants to elect:

- Either (i) payment of dividends in cash or (ii) payment to the ESOP and distribution in cash (not later than 90 days after the close of the plan year in which the dividends are paid by the corporation); or

- Payment of dividends to the ESOP for reinvestment in employer securities.

Notice 2002-2, 2002-1 C.B. 285, Q&A-2.

An ESOP may offer participants a choice among the two cash payment options and the reinvestment option, and may provide that one of the options will be the default election for participants who fail to submit their dividend elections.

Dividends that are paid or reinvested as provided in Code section 404(k)(2)(A)(iii) are not treated as annual additions under Code section 415(c), elective deferrals under Code section 402(g), elective contributions under Code section 401(k), or employee contributions under Code section 401(m). Notice 2002-2, Q&A-6.Dividends that are reinvested in qualifying employer securities at a participant's election must be nonforfeitable. Code §404(k) (4)(B) and (k)(7).This is without regard to whether the participant is vested in the stock for which the dividend is paid. An ESOP also may comply with the vesting requirement by offering an election only to vested participants. Notice 2002-2, Q&A-9. Participants must be provided a reasonable opportunity to make the election before the dividend is paid or distributed, must have a reasonable opportunity to change their dividend elections at least annually, and if there is a change in plan terms governing the manner in which the dividends are paid or distributed to participants, they must have a reasonable opportunity to make elections under the new plan terms before the date on which the first dividend subject to the new plan terms is paid or distributed. Notice 2002-2, Q&A-3.

Dividends Applied To Loan Repayments

Under a leveraged ESOP, dividends or distributions paid on employer securities held by the ESOP may be used to make loan repayments, provided employer securities with a fair market value of not less than the amount of the dividends or distributions are allocated to participant accounts for the year in which the dividends or distributions would have been paid to the participants. Code §404(k) (for C corporations); Code §4975(f)(7), as amended (for S corporations). Prior to the enactment of the American Jobs Creation Act of 2004, only C corporations could use dividends paid with respect to allocated shares to repay ESOP acquisition loans. The American Jobs Creation Act of 2004, Pub. L. No. 108-357, extended this rule to S corporations under Code §4975, effective as of January 1, 1998. This deduction applies only to dividends or distributions paid on employer securities (whether or not they are allocated to participant accounts) actually acquired with the proceeds of the loan that is being repaid. If an ESOP loan is refinanced, dividends or distributions on shares acquired with the original loan may be deducted or eligible for the qualification and prohibited transaction relief if they are used to pay the refinanced debt. Priv Ltr. Rul. 98- 47-005 (Aug. 11, 1998).

Other Dividend Issues

Under Code section 302, certain transactions that take the form of a corporation's redemption of its own stock are treated as dividends under the Code. For example, if the sole owner of a corporation causes the corporation to redeem some of his shares, still leaving him as the sole owner, that is the functional equivalent of a dividend and is treated as such under Code section 302.

One court has ruled that such a redemption can be treated as a dividend under Code §404(k). In Boise Cascade Corp. v. U.S., 329 F.3d 751 (9th Cir. 2003), the company authorized the issuance of convertible preferred stock to implement an ESOP. The stock could only be issued to the trustee of the plan's trust; if it were issued to any other person, it automatically converted into common stock. The trustee purchased all the shares of preferred stock from the company, financed with loans from institutional investors and from the company. When an employee terminated employment, the company redeemed shares of preferred stock held by the trust equal in value to the employee's vested account balance. In 1989, the company redeemed approximately 507 shares of preferred stock from the ESOP to provide it with cash to distribute to terminating employees, in a manner that would be deemed substantially equivalent to a dividend under Code section 302 if the ESOP (rather than the individual participants) were treated as the owner of the ESOP stock. In 1996, the company filed an amended return for 1989, claiming a deduction under Code section 404(k) for the payments made to the ESOP to redeem the 507 shares. The IRS disallowed the claim, and the company filed a refund suit.

Affirming the district court, the Ninth Circuit held that the redemption payments were deductible dividends under Code section 404(k). The government argued that Boise was not entitled to deduct the payments because the plan participants, not the trustee, were the actual owners of the stock, and therefore, the payments should be treated as a redemption, rather than a dividend. The court found that the district court correctly determined that the trust was the actual owner of the stock when it was redeemed, reasoning that the Code generally equates ownership with taxation and that Code sections 402 and 501 treat a trust as a separate entity, taxable on its earnings. The court also found that the incidents of stock ownership were all held by the trust.

The Ninth Circuit also determined that the lower court correctly concluded that the Boise deduction was not disallowed under Code section 162(k) (which disallows deductions "for any amount paid or incurred by a corporation in connection with the reacquisition of its stock") because the redemption payments made to terminating employees were separate from the 1989 dividend payments. The court explained that two separate transactions occurred: the stock redemption by the company and subsequent distributions to the plan participants by the trustee. The court noted that, although the plan provided that redemption of the convertible preferred stock was required on employment termination, distribution of the amount redeemed did not automatically occur. The court further noted that the redemption was not a prerequisite to the trustee's duty to make distributions under the terms of the plan.

Notwithstanding the Boise Cascade decision, the IRS continues to maintain that amounts paid to an ESOP in redemption of stock held by an ESOP that are then distributed to terminating employees are not deductible under Code section 404(k). In Rev. Rul. 2001-6, 2001-1 C.B. 491 the IRS held that such amounts are not deductible under Code §404(k) for three reasons:

- Code section 162(k) bars the deduction of such payments without regard to whether they would otherwise be deductible under Code section 404(k);

- Treatment of redemption proceeds as applicable dividends under Code section 404(i) (repealed) would produce such anomalous results that Code section 404(k) could not reasonably be construed as encompassing such payments, because it would allow employers to claim deductions for payments that do not represent true economic costs and would vitiate important rights and protections for recipients of ESOP distributions, including the right to reduce taxes by utilizing the return of basic provisions under Code section 72, the right to make rollovers of ESOP distributions received upon separation from service, and the protection against involuntary cash-outs; and

- Claiming a deduction for such amounts would constitute an "evasion of taxation" within the meaning of Code section 404(k)(5)(A).

Although the Boise Cascade decision explicitly rejected the IRS position on Code section 162(k), it never addressed the "anomalous results" or "evasion of taxation" grounds for Rev. Rul. 2001-6 because these arguments were not before the court. Therefore, an employer that relies on the Boise Cascade decision to claim Code section 404(k) deductions for amounts redeemed from an ESOP to facilitate distributions will still have to content with the contrary IRS position stated in Rev. Rul. 2001-6 and Notice 2002-2. 285.Also, the IRS publicly stated that it would fight the court's position outside of the Ninth Circuit. Chief Counsel Notice 2004-38 (Oct. 1, 2004).

Moreover, on August 30, 2006, the IRS released final regulations that cover two ESOP dividend deduction scenarios. First, it would not allow companies to deduct the cost of repurchasing shares distributed from the ESOP. It explains in detail that a corporation may not take a deduction of payments in redemption of its stock held by an ESOP used to make benefit distributions to participants or beneficiaries. 71 Fed. Reg. 51,471 (Aug. 30, 2006). Specifically, Treasury Regulation section 1.404(k)-3 is devoted exclusively to "disallowance of deduction for reacquisition payments." The regulation expressly states that dividend payments used to repurchase shares distributed from the ESOP do not constitute "applicable dividends" under the statue and that the treatment of such payments as applicable dividends constitutes an avoidance or evasion of taxes (and therefore subject to disallowance). Second, it states that deductions for qualifying dividends on ESOP shares much be taken at the parent company level, not the subsidiary level (which impacts foreign parent corporations). This means that a foreign corporation that sponsors a U.S. ESOP, such a DaimlerChrysler, BP, and others, will have to try to claim a deduction under the laws of their own country, something few, if any, can currently do. There appear to be very few U.S. subsidiaries of foreign companies that sponsor ESOPs. Two recent cases have also rejected the rationale of Boise Cascade and held that a dividend deduction is not allowed where a corporation redeemed its common stock to satisfy distributions to terminated employees who cash out of the company's ESOP. General Mills, Inc. v. U.S., 554 F.3d 727 (8th Cir. 2009) and Nestle Purina Petcare Co. v. Comm'r. 594 F.3d 968 (8th Cir. 2010), cert. denied, 131 S.Ct 86 (2010).

CODE SECTION 401(A)(28) DIVERSIFICATION - To provide an opportunity to diversify out of the employer securities that are the ESOP's primary investment, an ESOP must offer "qualified participants" — those who are at least age 55 and have at least 10 years of participation in the plan — an opportunity to "diversify" their holdings of employer securities to the extent acquired by the ESOP after 1986. Code §401(a)(28)(B).The ESOP must permit the qualified participants to direct the investment of a certain percentage of the employer securities held in their ESOP accounts into other investment options during the "qualified election period," which is the six-plan‑year period beginning with or after the plan year in which the participant attains age 55 (or, if later, beginning with the plan year in which the participant completes 10 years of plan participation). Code §401(a)(28)(B)(iii).

An ESOP may satisfy this diversification requirement in two ways. The plan may distribute to a participant, in stock or cash, the portion of the participant's account subject to the diversification requirement within 90 days after the period in which the diversification election may be made. Code §401(a)(28)(B)(ii)(I).If the ESOP distributes stock, the put option requirements apply and the stock may be rolled over into an IRA. An IRA that receives a rollover of ESOP stock retains the put option if the stock is not readily tradable on an established market at the time of distribution. If the ESOP distributes cash, the participant may roll the cash over into an IRA or another qualified plan that accepts rollovers. Code §402(c).Any portion of a diversification distribution that is not rolled over is subject to taxation, including the 10 percent early distribution penalty under Code section 72(v).

Alternatively the ESOP must make available to qualified participants at least three diversified investment options (other than employer stock). Code §401(a)(28)(B)(ii)(II). If the trustee prefers to minimize its fiduciary liability for the investment decisions made by participants in the selection of one of these funds, the plan should be designed to comply with ERISA §404(c) and DOL Regulation §2550.404c-1.An option to transfer assets to a plan that permits employee self‑direction of investments (such as the employer's 401(k) or profit-sharing plan) satisfies the diversification requirement. H.R. Rep. No. 99-841, at II-558 (1986), as reprinted in 1986 U.S.C.C.A.N. 4075, 4646.

The ESOP is required only to offer the distribution or investment options to qualified participants. A participant does not have to accept the diversification opportunity and may choose to stay fully invested in employer securities. IRS Notice 88-56, Q&A-15, 1989-1 C.B. 540.

Calculation Of Diversification Portion

The portion of a qualified participant's account that is subject to the diversification election during the qualified election period is equal to:

- 25 percent (for the first five years of the qualified election period) of the total number of shares of employer securities acquired by or contributed to the plan after 1986 that have ever been allocated to the qualified participant's account on or before the most recent plan allocation date; less

- The number of shares of employer securities previously distributed, transferred or otherwise diversified pursuant to a diversification election made after 1986.

The resulting number of shares may be rounded to the nearest whole number. In the sixth year of the qualified election period, "50 percent" is substituted for "25 percent" in determining the amount subject to the diversification election. Notice 88-56, Q&A- 9. The diversification computation is based solely on the number of shares allocated to the qualified participant's account. Other assets allocated to the account are not included in the computation.

Code §401(a)(35) And ERISA §204(j) Diversification

The Pension Protection Act of 2006 Pub. L. No. 109-280.required defined contribution plans that hold publicly traded employer stock to permit participants and certain beneficiaries to direct that the portion of their accounts invested in employer stock be reinvested in other investment options. Code §401(a)(35)(B); ERISA §204(j)(2). ESOPs that hold employer stock that is not publicly traded generally are not subject to the new diversification requirements. Code §401(a)(35)(E)(i); ERISA §204(j) (5)(A). If an ESOP sponsor or a member of the ESOP sponsor's controlled group has issued a class of stock that is publicly traded, that ESOP would be subject to the new requirements even if it does not hold publicly traded stock, unless the ESOP is a stand-alone plan (meaning that it is not combined with any other defined contribution or defined benefit plan) and cannot hold contributions, and earnings thereon, that are subject to the non-discrimination tests applicable to employee elective deferrals, employee after-tax contributions and employer matching contributions. Code §401(a)(35) (E)(ii); ERISA §204(j)(5)(B). If it is subject to these requirements, an ESOP must permit amounts that are attributable to elective deferrals and employee after-tax contributions that are invested in employer stock to be transferred to alternative investments by participants or beneficiaries who are permitted to exercise participant rights. Code §401(a)(35)(B); ERISA §204(j)(2).With respect to non-elective employer contributions and employer matching contributions that are held in employer stock, each participant who has completed at least three years of vesting service, a beneficiary of such a participant, and a beneficiary of a deceased participant must be permitted to transfer such amounts to other investment options under the plan. Code §401(a)(35)(C); ERISA §204(j)(3).

The diversification investment options must consist of at least three investment alternatives other than employer stock, each of which is diversified and has materially different risk and return features from the others. Code §401(a)(35)(D)(i); ERISA §204(j)(4).Diversification opportunities must be provided at least quarterly and at least as frequently as other investment changes are permitted under the plan. Code §401(a)(35)(D)(ii)(II); ERISA §204(j) (4)(B)(ii). These diversification provisions apply for plan years beginning after December 31, 2006. Pension Protection Act of 2006, P.L. 109-280, Section 901(c)(1).

Fiduciary Duty Under ERISA

An ESOP and its fiduciaries are subject to the general fiduciary rules of ERISA §404(a), although the application of such rules to an ESOP can differ from the application to other qualified plans. For example, ERISA provides special exemptions for ESOPs with respect to the investment diversification requirements and related rules.

Exclusive Purpose And Prudence Rules

Although an ESOP is subject to the "exclusive purpose" and "prudence" requirements of ERISA that apply to all qualified defined contribution plans subject to ERISA, the application of these rules to ESOP fiduciaries must take into account the special attributes of an ESOP as a plan "designed to invest primarily in qualifying employer securities." Code §4975(e)(7)(A) and ERISA §407(d)(6).Under ERISA section 404(a)(1), ESOP fiduciaries are responsible for acquiring employer stock for the benefit of participants in a manner that demonstrates compliance with the "exclusive purpose" and "prudence" rules under ERISA. The fiduciaries' responsibility is not to maximize retirement benefits through investments in assets other than employer stock, but to maximize the benefits that may be achieved by investing ESOP assets primarily in employer stock. ERISA §407(d)(6)(A).

Qualified plans are prohibited from investing in employer securities that are not "qualifying employer securities" and ERISA generally limits plan investments in qualifying employer securities to 10 percent of plan assets. ERISA §407(a)(1) and (2). However, the 10 percent limit does not apply to investments in qualifying employer securities (or qualifying employer real property) by an eligible individual account plan (EIAP). ERISA §407(b).EIAPs include profit-sharing, stock bonus, thrift and savings plans, ESOPs, and certain money purchase plans that were invested primarily in qualifying employer securities on September 2, 1974 (the date ERISA was enacted).Under these rules, an EIAP (including an ESOP) may invest 100 percent of its assets in qualifying employer securities (or qualifying employer real property). ERISA §404(a)(2).To the extent that an ESOP invests in assets other than qualifying employer securities or real property, the diversification requirements of ERISA §404(a)(1) (C) apply.

Directed Trustee

Like other defined contribution plans, an ESOP is required to have a trustee or custodian that manages or controls plan assets. ERISA §403(a).In many cases, the trustee is a "directed trustee" that conducts transactions according to instructions from a named fiduciary of the plan, such as the plan sponsor or a committee appointed by the plan sponsor. A plan trustee by definition always will have some fiduciary responsibility under ERISA because of its control over plan assets. However, in most cases the fiduciary responsibilities of a directed trustee are narrower than the fiduciary responsibilities generally held by a discretionary trustee.

There are special issues, particularly with respect to directions that relate to employer securities, which ESOP sponsors (as well as sponsors of other types of plans that invest in employer stock) need to consider as they appoint or monitor fiduciaries. DOL Field Assistance Bulletin 2004-03 (December 17, 2004).Despite a directed trustee's limited fiduciary responsibilities, the trustee is required to perform its duties prudently and solely in the interest of plan participants and beneficiaries. Given that an ESOP is designed to invest primarily in employer securities, the directed trustee must monitor company operations and investigate transactions and developments as they occur and carry out directions only if they are consistent with the ESOP terms and do not conflict with ERISA.

Special considerations arise when an ESOP has a directed trustee and a tender offer is made to purchase the employer securities held by the ESOP. The ESOP may allow participants to direct the trustee whether or not to tender employer stock allocated to their accounts. ERISA §403(a)(1) provides that a trustee may carry out the directions of named fiduciaries, including participants, if the directions are proper, made in accordance with plan provisions and not contrary to ERISA (for which there is little guidance). However, if a direction would result in a breach of a fiduciary duty, the trustee may be liable for any loss as a result of following the direction unless it seeks court instructions. See, e.g., DOL Regulation §2509.75-5, Q&A-FR-10. In Gen. Couns. Mem. 39,870, the IRS Chief Counsel advised that an ESOP provision that allowed the trustee to consider non-financial employment-related factors in tender offer situations, such as the continuing job security of participants, violates the exclusive benefit rule of Code §401(a)(2). The GCM noted that the DOL had concluded that this provision also violated the exclusive benefit rule of ERISA §404(a), but indicated that the IRS has independent authority to construe the disputed provision and impose the separate sanction of plan disqualification. Rev. Rul. 69-494, 1969-2 C.B. 88.

According to Treasury Department and DOL guidance, decisions relating to tender offers must be based on the economic best interest of an employee benefit plan that holds employer securities, recognizing that the plan's purpose is to provide retirement income. Joint Department of Labor/ Department of Treasury Statement of Pension Investments, 16 Pens. & Benefits Rep. (BNA) 215 (Jan. 31, 1989).Prudence also requires fiduciaries to make investment decisions, including tender offer decisions, based on the facts and circumstances applicable to a particular plan. Therefore, an ESOP trustee — particularly one that is directed by plan sponsor personnel who may be most concerned with keeping their jobs — must evaluate a tender offer based on all of its merits and disadvantages and weigh its fiduciary duties and the best interests of the plan participants against the directions imparted by another named fiduciary.

Employer Stock Litigation

The National Center for Employee Ownership (NCEO) has tracked litigation on these issues for its various publications and, using this data, has created a 36-page categorized listing of all the cases, except for a few on tangential issues. The report is summarized in this article. See http://www.nceo.org/main/pub.php/id/258. Listed in the report are the case citations entered by the category of decisions in both ESOPs and 401(k) plans. If a case had multiple issues decided, the decision on that issue is listed in a number of categories. Based on this listing, the NCEO report provides a basic statistical summary of key issues, albeit for some issues, the decisions are too varied and nuanced to make such simple analysis possible.

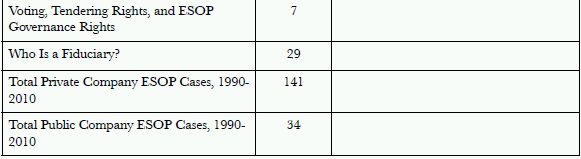

According to the NCEO report, employee stock ownership plans (ESOPs) are mostly in closely held companies, almost never require or even allow employee investments (they are funded by the company), and increasingly hold 100 percent of the shares, often as a result of buying out an owner. Many of these owners set up the plans not just for tax purposes, but also out of a commitment to employees and community. What is most striking is that over 20 years, there have been only 141 ESOP cases in closely held companies (plus 35 in public companies), not counting a handful not included in the report because they deal with issues tangential to current plans. The history makes it very clear that companies that hire qualified professionals, follow good plan practices, and are not using the ESOP to extract money from the company for the benefit of a few people (often by stretching the law), are very unlikely to be sued, much less lose in court. The table below summarizes the ESOPs the NCEO has reported on. It provides a quick summary of what issues come up most often and how they are resolved. Because many cases had decisions made by one or more courts on more than a single issue, the total number of decisions is much greater than the total number of cases filed (175). Where a company has been sued on similar issues by different plaintiffs, the NCEO counted that as one case.

Most of the decisions reported here were at the pleading stages. Relatively few cases actually ended up being decided at trial, as opposed to settled out of court. Many others are still in process. Because there are so many cross-cutting issues in these cases, it is often not practical to give a simple statistical summary of what ultimately was decided in each case. In those instances where there are clear cut issues, however, in column three of the table, NCEO reports the number of cases coming to one decision or another (such as the presumption of prudence of holding company stock or standing for former participants). In summarizing decisions, NCEO ignored lower court rulings when an appeals court ruled on the same subject, whether to accept or reverse. The one important exception is where a case was remanded to a lower court and the lower court reached a conclusion on a mater of law of some significance.

By contrast, company stock in 401(k) plans is almost exclusively in plans sponsored by public companies, most often is an option for employee investments (and sometimes a match as well), and almost never represents more than about 10 percent of the total stock ownership. Most often, it is in the plan because it is beneficial to the company to finance the plan this way more than because of a deep philosophical commitment to the concept. In the NCEO view, concentrating stock in a 401(k) plan is usually a dubious choice. In fact, most closely held ESOP companies have both an ESOP and a separate diversified retirement plan.

The lessons for 401(k) plans are more mixed than for ESOPs. If a plan mandates that employer stock either be a match and/or investment options, there is a good chance that even if the stock falls sharply, the fiduciaries not lose in court (but may end up settling outside of court). If it does not, the chances are about 50-50. NCEO found that in 25 of the 37 cases tracked, courts largely followed the so-called Moench doctrine that presumes holding employer stock in a plan is prudent. The doctrine says that fiduciaries of a plan with company stock are presumed to have made prudent choices unless they knew or had reason to know the company was in dire straits. The presumption was developed for ESOPs, however, and is granted less for 401(k) plans, especially where the plan does not mandate employer stock as an option. In addition, four cases were dismissed because the plan mandated investment in company stock. In these cases, the court did not have to apply the Moench presumption because the mandate was enough. These cases were dismissed on the theory that just offering a choice of investment was sufficient defense, but four were allowed to proceed. Thirteen courts concluded that fiduciaries could be required to disclose information that was not yet public about company stock to plan participants; 16 said they would not necessarily be required to do so (a few of these decisions were not just yes or no). Two-thirds of the courts have affirmed standing for former participants, while eight have not. Class certification issues have reached a variety of conclusions that are difficult to categorize simply. NCEO found 31 published settlements, although there are likely many more that may not be published. The typical settlements per employee have been small (averaging about $1,000), although some plans have also had to make changes in how they operate. What is no doubt more impressive (but not reported on Web sites by the various firms handling these cases) are the legal fees, which by now have likely reached hundreds of millions of dollars. While about 30 companies have succeeded in having the lawsuits dismissed at one stage or another, many other cases are still slowly making their way through the courts, so it may be years, and more hundreds of millions of dollars in legal fees, before we have conclusive guidance on these issues.

NCEO Summary of ESOP Decisions 1990-2010

Fiduciary Changes In Procedures To Limit Risk Exposure

The employer stock litigation summarized in the NCEO report has caused employer stock fiduciaries to pay more attention to their risk exposure and make changes to reduce the risks associated with acquiring and holding employer stock. For example, many plans have been amended to remove the fiduciary exposure of the employer and its board of directors by establishing plan committees and allocating to those committees in plan provisions the duty to administer the plans and select investment options. In doing so, many employers do not include the employer's CEO or CFO on the committee.

In addition, many employers have made a genuine effort to understand their fiduciary duties. This has been accomplished through fiduciary training, regular meetings and/or reviews of investments and other plan issues, having fully documented delegations of regular responsibilities to the employer's staff, preparation of committee charters detailing functions and responsibilities and carefully documenting the decision-making process on a contemporaneous basis. More attention is being paid to the adequacy of employer indemnification arrangements and fiduciary insurance for plan fiduciaries, as employers discover that the cost of defending a fiduciary breach claim can exceed the potentially liability associated with the claim.

As a further measure to reduce fiduciary exposure, some plan sponsors have turned to more careful drafting of plan documents in an attempt to reduce drafting errors and inconsistencies among various plan documents. For example, the plan and the trust agreement provisions relating to employer stock issues must be consistent. The document focus even extends to summary plan descriptions and releases provided to certain employees upon their termination of employment.

Employer Stock Contribution To Defined Benefit Plan

With so many corporate defined benefit plans being in a funding shortfall position (that needs to be reconciled by 2013) because of low interest rates and overall market volatility at a time when preservation of corporate cash is vitally important, plan sponsors are looking at many alternative solutions.

Some companies think that they have a solution by contributing their own employer stock to their defined benefit plan(s) in lieu of cash, particularly if they believe that the market is undervaluing their shares. This gives both the employer and the plan an opportunity to benefit by the return that is generated by the market and employer stock recovery, if all goes well.

There are a number of legal considerations to be dealt with before this solution can be implemented, however. Even after these are resolved, there are still pitfalls to be dealt with in terms of risk to the plan if the stock market drops and the company's stock along with it, especially if the company goes bankrupt and the stock becomes worthless.

Key among the legal hurdles are the 10 percent limit on employer stock holdings of a defined benefit pension plan ERISA section 407(a).and a Supreme Court holding that an employer's contribution of unencumbered property to defined benefit plan is a prohibited transaction if such contribution is made to satisfy the minimum funding obligation of the employer. Commissioner v. Keystone Consolidated Industries, 508 U.S. 152 (1993). In particular, ERISA section 407(a) provides that, at the time a defined benefit plan acquires employer stock, the fair market value of that stock cannot exceed 10 percent of the fair market value of aggregate plan assets. Further, section 4975(c)(1)(A) of the Code prohibits any direct or indirect sale or exchange of property between a plan and a disqualified person. Where a contribution of property is made to satisfy an obligation such as the minimum funding obligations of the employer under Section 412 of the Code, the contribution of property is considered a "sale or exchange." Thus, the contribution of employer stock must result in compliance with the 10 percent requirement and must not be made to satisfy the minimum funding obligation of the employer. Rather, the contribution must be for funding beyond the minimum required for a given plan year.

Other issues for implementation include review of the trust agreement(s) for the plan(s) to assure that holding employer stock is permissible and amending the trust agreement(s) where necessary. Careful review of the investment policy statement will also need to be done and any necessary revisions made.

Plan governance should also be reviewed. It may be advisable to remove the corporation's board of directors from the investment policy decision making process and allocate this to the plan committee. The decision to hold, sell, vote and tender the employer stock may either be vested in the plan committee or an independent fiduciary under the plan governance provisions. Federal securities laws should also be considered, including insider trading restrictions, SEC ownership filings and resales by the plan of registered shares of employer stock.

Fiduciary concerns must also be addressed. For example, the prudence of holding or selling employer stock requires adequate diversification of the total plan portfolio and the asset class and ongoing monitoring of appropriateness and allocation. If the plan committee has the hold, sell, vote and tender discretion, insider trading concerns and fiduciary conflict of interest (corporate versus participant interests) must be addressed.

If, on the other hand, the independent fiduciary is given this discretion, the plan committee's fiduciary and some federal securities law issues will be minimized. The plan committee must monitor the independent fiduciary and take action if appropriate.

Finally, there are valuation considerations for a contribution of employer stock. The corporate tax deduction is limited to fair market value on the date of the contribution, and the valuation for the federal income tax deduction, the actuarial funded status and the required minimum contribution may be determined by market price or appraised value (with the possibility of a discount to market price for a "block discount" or for unregistered stock). Rev. Rul. 73-583, 1973-2 CB 146. It should be noted that employer stock may be the corporation's common stock, a convertible preferred stock or corporate bonds so long as immediately following the acquisition of such bonds:

- No more than 25 percent of the aggregate amount of the bonds issued in such issue and outstanding at the time of acquisition is held by the plan; and

- At least 50 percent of the aggregate amount of the bonds are held by persons independent of the corporation.

ERISA §407(d)(5), Code §409(l)(3).

CONCLUSION " An ESOP is a unique form of qualified defined contribution retirement plan. It offers valuable retirement benefits and an equity interest in the company to a broad base of employees while providing corporate finance alternatives and/ or fulfilling other objectives. ESOPs present many complexities with respect to plan design and operational compliance, and those counseling employers that are considering establishing ESOPs, as well as those that have implemented them, must take special care to ensure that they consider all the special ESOP requirements under the Code and ERISA.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.