Introduction

The years since the financial crisis have seen a flurry of new mortgage REITs, most of which are pursuing a simple but compelling business strategy: buy high-yielding or distressed mortgage assets at a bargain price, leverage them with debt financing at historically low interest rates, and realize profits as the assets pay off or liquidate, all while conducting this business through a tax-advantaged vehicle. This strategy has encompassed the full spectrum of mortgage asset types, ranging from single-family residential mortgage loans to commercial mortgage loans, from private-label mortgage-backed securities ("MBS") to government-guaranteed MBS, and from whole loans to complex securitized and derivative interests. Most of the new mortgage REITs focus on one or more of these asset types, and pursue strategies ranging from holding assets to maturity to aggressively foreclosing upon and liquidating defaulted mortgage loans.

With a large amount of high-yielding and distressed mortgage assets from before the financial crisis still available in the marketplace and "new" distressed assets still coming online as a result of the continuing residential real estate recession, and with the prospect of substantial government mortgage holdings being sold into the private markets, this trend shows no sign of weakening. Indeed, mortgage REITs reportedly raised a notable $6.6 billion of capital between December 2010 and March 31, 2011, which would support purchases of $40 – $65 billion of mortgage assets at normal leverage rates.1

While we expect this trend to continue for the foreseeable future, this bulletin focuses on a slightly different mortgage REIT strategy that has not yet been widely pursued in the post-crisis environment, but which we fully expect to take off as the recovery of U.S. residential real estate markets materializes. Specifically, this alert addresses mortgage REITs as players in the "new," post-crisis housing finance market, participating in some or all of the roles of an integrated mortgage lending business.

This is not a novel idea. Indeed, many of the largest lenders that failed during the financial crisis—such as New Century Financial Corporation and Thornburg Mortgage—were in fact mortgage REITs pursuing this strategy. As discussed below, however, there are good reasons to believe that "this time is different." As a general matter, nonbank lenders and securitizers, and particularly tax-advantaged mortgage REITs, are emerging from the crisis well positioned compared to regulated banks to participate profitably in the New Mortgage Market. As a result, we expect the mix of mortgage lending activity to include more significant participation by mortgage REITs as the recovery in the U.S. residential real estate markets takes hold.

A Historic Opportunity

The U.S. residential mortgage market was decimated in the financial crisis, and its remnants have for all intents and purposes been nationalized. More than 90% of all new residential mortgage originations in the U.S. are originated or guaranteed by the U.S. government.2 To most Americans, the prospect of the U.S. government, and thus the U.S. taxpayer, remaining the principal U.S. mortgage lender over the long term is untenable. There is widespread, bipartisan support for substantially reducing the role of the government in the residential mortgage markets and increasing the participation of the private markets.3 If one assumes that government efforts to reduce the size and influence of government-sponsored lenders are even halfway successful, and that the residential mortgage markets are restored to even one-quarter or one-third of their pre-crisis size, the size of the future U.S. mortgage market would still be immense by virtually any measure.

Moreover, historically, the U.S. residential mortgage lending markets have been fiercely competitive, with a large number of players battling for homeowner borrowers, due in part to the relatively low cost of entry. At this point in history, however, there is very little meaningful competition in the marketplace, with the vast majority of new mortgages being effectively originated by or on behalf of the two giant government-sponsored secondary mortgage market enterprises ("GSEs"), Fannie Mae and Freddie Mac—both of which are federally administered conservatorships, and effectively owned by the U.S. taxpayers. Large numbers of former market participants have gone bankrupt or shut down. Non-bank lenders have all but disappeared, and regulated bank lenders have consolidated largely within the largest U.S. banks. Additionally, almost all of the remaining significant participants are saddled with substantial potential liabilities as a result of existing representation and warranty liabilities, with distressed assets, and, in the case of servicers, with legal contracts that require performance on non-economic terms. Even if the future U.S. mortgage market is not as diverse and crowded as the pre-crisis market, U.S. residential mortgage lending market is wide open for participation by new players.

Non-Banks and Banks

The state of affairs described above provides a rationale for any serious new participant to enter the U.S. residential mortgage market as a lender or securitizer. There are now arguably even more compelling reasons for a non-bank entity to participate. The level of regulation of all participants in the mortgage origination and securitization process—bank and non-bank—has stepped up considerably in the wake of the financial crisis, but there is no question that the burden of the new requirements is substantially higher on banks. At the margin, one can therefore reasonably expect that a non-bank should be able to achieve a break-even or a profitable position in a securitization before a similarly situated bank due to the significantly higher aggregate costs faced by banks in complying with the incremental bank regulations.

The emerging relative advantage of non-bank mortgage market participants over banks has been recognized by influential investors and issuers. For example, in the May 20, 2011 preliminary prospectus for its pending $600 million IPO, PIMCO REIT, Inc., a new mortgage REIT sponsored by Pacific Investment Management Co., the world's largest fixed-income manager, made the following disclosure:

"Significant increases in regulation and public policy are influencing which investors will have the financial ability to hold real estate-related assets. We believe that private non-bank capital will represent an increasing share of these assets in the years to come."4

Banks are subject to increasingly onerous regulatory capital requirements with respect to their holdings of securitized assets. Banks are also required to maintain loan loss reserves against mortgage assets in accordance with rigorous regulatory requirements, which have the effect of additional capital requirements. These existing capital burdens will likely only increase as U.S. bank regulators adopt the increased capital standards imposed under the Basel II and Basel III accords, reinforced by the formidable minimum standard imposed by the socalled Collins Amendment provision of the Dodd-Frank Act. In addition to requiring increased capital for holding mortgage loans and MBS, proposed Basel III rules would severely reduce the amount of mortgage servicing rights that banks may count towards Tier 1 capital requirements.

In this regard, it should be noted in fairness that, while non-banks are not subject to the same formal capital requirements as banks, their capital and leverage ratios will be closely monitored by lenders, credit rating agencies, and, in the case of publicly held mortgage companies, Wall Street stock analysts, all of whom will impose a discipline on the capital structure of the non-bank lender. Nonetheless, it is reasonable to assume that these market-imposed constraints will not be as strictly applied as bank regulatory standards, and will permit substantially more flexibility by permitting consideration of offsetting strengths and other factors.

Additionally, U.S. banks that transfer assets into securitization vehicles must comply with the FDIC's safe harbor securitization rule set forth at 12 C.F.R. § 360.6 if the securitization is to be rated by nationally recognized credit rating agencies and accepted by securitization investors. This inordinately burdensome rule, applicable only to U.S. banks, imposes a number of costly and, in many cases, arbitrary restrictions that place banks at a marked disadvantage to non-banks in their securitization activities. These restrictions are at their most burdensome in the area of residential MBS ("RMBS"), and include such odd constraints as a limitation of RMBS securitization structures to six tranches and a prohibition on most forms of external credit enhancement. Bank regulations issued under Dodd-Frank and otherwise impose a considerable number of additional restrictions and requirements on bank originators, servicers and securitizers that do not exist for non-banks.

Moreover, as previously noted, many bank participants in the loan origination, servicing and securitization businesses have become increasingly consolidated in the several years since the financial crisis, with most of the activities now concentrated in the largest U.S. banks. These banks have multiple business opportunities around the globe, many of them in high-growth, emerging economies with high profit potential. It is conceivable that these banks, when prioritizing their business activities, will de-emphasize U.S. mortgage loan origination, servicing and securitization activities in favor of less regulated, more profitable activities. Particularly considering the high level of legacy liability that many of these banks now carry as a result of their participation in the mortgage market meltdown that marked the onset of the financial crisis, many of these banks are likely to sharply curtail new U.S. residential mortgage activity at least until the size and financial burden of their legacy portfolios and liabilities have dwindled relative to those of new, growing business lines.

There is at least one factor in the comparison of banks and non-banks that keeps the scale from tipping in favor of non-banks. Specifically, most banks have considerably more access to short- and long-term funding that gives them more flexibility to ride out an interest rate or liquidity dislocation in the capital markets than most nonbanks. History has shown that the significant challenges encountered by mortgage REITs and other non-bank mortgage companies over the past 50 years have usually been occasioned by disruptions in funding resulting from major moves in interest rates and/or liquidity disruptions. In these circumstances, non-bank lenders, including mortgage REITs, have seen their costs of financing increase dramatically relative to the yield on their mortgage assets, resulting in narrowing or reversed spreads that cannot sustain a business. For mortgage REITs and mortgage companies involved in origination, moreover, liquidity disruptions have resulted in the termination or reduction of warehouse lines of credit, and have thereby choked the supply lines of non-bank lenders, leading to many bankruptcies and closures during these episodes. During these periods, banks are able to resort to a broader and more stable source of funds that includes customer deposits and access to Federal Home Loan Bank ("FHLB") and Federal Reserve Bank ("FRB") advances, none of which are generally available to non-bank mortgage companies.

During each of the previous interest rate and liquidity crises, the strongest mortgage REITs and mortgage companies have survived. Accordingly, those considering the formation of a mortgage REIT or other non-bank mortgage operation must recognize that managing the liability structure of the mortgage REIT is at least as important as asset quality to the long-term success of the mortgage company. Successful operation of a non-bank mortgage company requires a sophisticated liability management program that emphasizes diversity of funding sources and the security of those sources during difficult periods.

Advantages of Mortgage REITs Over Non-REITS

Among non-bank entities, there are also compelling reasons for a mortgage REIT to participate than a non-REIT. When compared to banks, a mortgage REIT has the ability to hold mortgage assets in its portfolio for a long period of time. Indeed, it is this strength that provides mortgage REITs with a historic opportunity now to become involved in residential mortgage finance. As among non-bank entities, mortgage REITs stand out as an ideal business entity as the result of the tax advantages enjoyed by REITs in the U.S. These advantages are particularly meaningful for businesses that depend on net interest income, or "spread," since the imposition of normal corporate double taxation on this income source substantially reduces yields relative to the single level of taxation enjoyed by REIT shareholders. Moreover, the REIT structure is oriented toward long-term holding of mortgage and real estate assets, reducing the imperative faced by many non-REIT companies to constantly sell assets and take short-term profits.

Prior to the financial crisis, there were numerous balance sheets available to hold residential mortgage assets. These included the immense balance sheets of the GSEs—Fannie Mae, Freddie Mac and Ginnie Mae—with the capacity to hold several trillion dollars' worth of mortgage assets, the combined balance sheets of U.S. and global banks, and the balance sheets of institutional investors, including governments, pension funds, insurance companies and hedge funds (most of which prefer to invest in securitized interests with more certain credit and maturity characteristics than borne by raw mortgage loans).

The capacity or interest of most of these balance sheet providers to invest in long-term U.S. mortgage assets is much less now than it was prior to the financial crisis. The GSEs are, indeed, under pressure to reduce their portfolios substantially and relatively quickly, which is likely to result in additional supply of mortgage assets to the marketplace over the next five to 10 years. Thus, the unwinding of the GSEs will, for perhaps up to a decade, increase the need for additional balance sheet capacity in the capital markets to hold U.S. mortgage assets, rather than provide a source of balance sheet capacity.

Moreover, as previously noted, banks are subject to ever-increasing capital requirements for holding mortgage assets long term, and are thus incentivized to sell assets quickly upon origination, rather than to hold them. Importantly, many of the new mortgage market restrictions such as the FAS166/167 accounting rules that generally preclude sale treatment and recognition of gain on sale for U.S. issuers, and the 5% risk retention requirement imposed on U.S. and European issuers by their respective regulatory authorities, apply only to securitized loans. Accordingly, a bank may originate and sell whole loans without the risk retention requirement, and still be able to recognize an accounting sale and gain upon a transfer. Thus, banks are increasingly incentivized to originate and sell loans promptly, and to leave the securitizing to someone else.

Institutional investors were sufficiently "burned" in the financial crisis to not come back as major balance sheet providers for U.S. residential assets. When they do return, it will likely be under much stricter investment guidelines, resulting in a lower overall capacity to hold mortgage assets. When one considers these factors together, it is evident that perhaps the largest challenge facing the reinstitution of a robust secondary mortgage market for U.S. residential mortgage loans is the lack of balance sheet capacity to hold these assets for an extended period of time.

REIT Basics

A REIT is an investment vehicle designed to allow investors to pool capital to invest in real estate assets. It has certain advantages over other investment vehicles; in particular a REIT generally may qualify for pass-through taxation even if its equity is publicly traded. However, it also has disadvantages, including tax restrictions that limit the REIT to passive investments in qualifying assets (i.e., its assets must primarily consist of real estate related assets) and certain distribution requirements (i.e., it must distribute income to its shareholders currently).

There are three general types of REITs: equity REITs, mortgage REITs, and hybrids. As one might imagine, equity REITs are REITs that invest in equity interests in real property and mortgage REITs are REITs that invest in mortgages and interests in mortgages. Hybrids invest in a combination of the two.

Mortgage REITs generally finance their activities through equity and debt offerings. Debt offerings provide leverage, such as through short-term debt (but subject to short-term liquidity risk), which is then used to purchase higher-yielding assets. Leverage generally provides greater yields to equity investors. However, leverage also increases risk, as the recent financial crisis has illustrated.

REIT Tax Advantages

For federal income tax purposes, a REIT is a corporation that receives special tax treatment. The special tax treatment is an exemption from federal income tax at the corporate level to the extent the REIT distributes its income annually. A REIT is subject to normal corporate tax on any income that it retains.

In order to qualify as a REIT for tax purposes, substantially all of the entity's assets must be held in real estate related investments. It also must earn, each year, at least 95% of its gross income from passive sources and at least 75% of its gross income from real estate related sources. Real estate mortgages constitute "good" REIT investments under the asset test and produce "good" income for both the 95% and 75% tests.

A REIT is subject to a 100% penalty tax on income from sales of "dealer property" (generally meaning the sale or disposition of property held by the taxpayer as inventory or primarily for sale to customers in the ordinary course of its trade or business, excluding certain foreclosure property). In general, therefore, a mortgage REIT is limited to passive investments in mortgage loans. However, as discussed below, many mortgage REITs have adopted securitization structures in the last 20 years. In these structures, the mortgage REIT originates mortgages and then finances them by offering MBS that are treated as borrowings against the mortgages for federal income tax purposes.

A REIT can own a taxable REIT subsidiary ("TRS"). The TRS does not qualify as a REIT itself but instead is subject to a corporate level tax. A REIT's investment in all TRSs cannot exceed 25% of its total gross assets. Accordingly, the use of a TRS can allow a REIT to engage in otherwise prohibited transactions without losing its preferential tax status. REITs may conduct REIT-compliant activities either directly or through another type of subsidiary known as a "qualified REIT subsidiary" ("QRS"). Because the operation of a mortgage lending and investment business often involves a mix of activities and assets, some of which are REIT-compliant and some of which are not, many mortgage REITs create and operate through multi-entity structures that include the principal, often publicly held, REIT, and one or more wholly owned TRSs and QRSs.

Regulatory Advantages

In addition to a REIT's special federal income tax treatment, a REIT has certain regulatory advantages. For example, a REIT may qualify for an exemption under section 3(c)(5)(C) of the Investment Company Act of 1940 (the "40 Act"), which is available for entities primarily engaged in the business of purchasing or otherwise acquiring mortgages and other liens on and interests in real estate. This exemption generally applies if at least 55% of the REIT' assets are comprised of qualifying assets and at least 80% of its assets are comprised of qualifying assets and real estate-related assets. For these purposes, qualifying assets generally include mortgage loans and other assets that are the functional equivalent of mortgage loans. Particularly in light of current regulatory uncertainty, these regulatory advantages may prove useful.

The advantage provided by the 40 Act is a two-edged sword, however. Failure to comply with the strict asset composition tests of the Section 3(c)(5)(C) exemption can result in a determination that the REIT is an "investment company" subject to operating restrictions that are inconsistent with the operations of a normal mortgage REIT. Moreover, the 40 Act tests applied by the SEC to entities holding mortgage securities—whether GSE-guaranteed or private-label—are extremely technical and difficult to monitor. Accordingly, most mortgage REITs must monitor their 40 Act compliance with the same level of diligence they apply to monitoring REIT tax compliance, as violation of either set of rules can lead to catastrophic consequences.

History of Mortgage REITs

The earliest mortgage REITs were construction loan REITs that were formed by several major banks in the 1960s and 1970s. These construction loan REITs, most notably the Chase REIT, went bankrupt in spectacular fashion in the mid-1970s. More than a dozen other REITs went bankrupt during this period.

The next wave of mortgage REITs began with Strategic Mortgage Investment, Inc. ("SMI"), a Genstar Mortgage Corporation-sponsored residential mortgage REIT, in 1982. SMI's strategy was to originate non-conforming mortgage loans and sell a 90% senior interest in the loan to investors while retaining a 10% subordinated interest. SMI obtained a private letter ruling from the Internal Revenue Service ("IRS") that, so long as it sold its senior interest for par, there would be no gain recognized on the sale. SMI was followed by a number of other mortgage REITs, all aimed at the same niche: non-conforming mortgages. Each received its own IRS private letter ruling. These REITs included a REIT sponsored by Countrywide, which later became IndyMac REIT (and then IndyMac Bank, FSB). They also included Capstead Mortgage Corporation, among others.

The rulings these REITs received were later revoked by the IRS in 1985 after the IRS reconsidered the technical basis for the rulings. In response, rather than selling senior participations, mortgage REITs began to adopt a different strategy beginning with the Countrywide REIT. The Countrywide REIT originated residential mortgage loans and then sold them at cost to a taxable subsidiary. The subsidiary then securitized the loans. In this way, profit from securitizing the loans was not earned at the REIT level and no prohibited transaction tax was triggered. Around the same time, the Countrywide REIT began to issue collateralized mortgage obligations ("CMOs") directly out of the REIT. These transactions were treated as borrowings rather than sales for federal income tax purposes, resulting in no gain (and, again, no prohibited transactions tax). This bifurcation between conducting taxable activities in a TRS and REIT-compliant activities in the REIT (or in a QRS) continues to provide the structural basis for an "operational" mortgage REIT to the present day.

In the Tax Reform Act of 1986, Congress enacted the Real Estate Mortgage Investment Conduit ("REMIC") legislation. A REMIC is a pass-through vehicle designed to facilitate mortgage loan securitization. Congress wanted a REMIC to be the sole vehicle for securitizing multiple-class mortgages. Congress also decided to treat REMIC transactions as sales for federal income tax purposes. This meant that a REIT securitizing mortgages through a REMIC could potentially be subject to a 100% prohibited transactions tax on any gain realized on the sales. However, Congress provided a path for REITs to securitize mortgages. Instead of using a REMIC, the REIT issues mortgage-backed securities that are treated as debt for federal income tax purposes, in effect an "old style" CMO. The chief consequence, however, is that residual income from the CMO when paid to REIT shareholders is treated as "excess inclusion income," which cannot be offset by the shareholder's net operating losses.

In the 1990s and 2000s prior to the financial crisis, mortgage REITs boomed. Large mortgage REITs, such as American Home Mortgage, Impac, and others, created successful businesses originating and securitizing residential and commercial mortgages. A few REITs suffered in the mid-1990s. This general boom period was marred, however, by one significant hiccup—the global liquidity crisis of 1998 associated with the failure of the Long-Term Capital Management hedge fund and Russian bond defaults. This liquidity crisis culminated in the restriction or termination of credit lines to a number of mortgage REITs and non-REIT mortgage banking companies, resulting in the failure of a number of mortgage companies.

Another notable burst of activity during this boom period was a flurry of mortgage REIT formations, restructurings and IPOs in the early and mid-2000s largely oriented toward the financing of subprime or "nonprime" mortgage loans. Beginning in early 2007, mortgage REITs once again began to feel the heat. The financial crisis wiped out an entire segment of these REITs, including most of the new entrants which were in the business of subprime lending.

The New Crop of Mortgage REITs

The new crop of mortgage REITs generally have one of three investment strategies, with some overlap among the three.

In the first strategy, the REIT acquires government-backed MBS and other high-quality MBS with leverage. The mortgage securities are good REIT assets, and the REIT earns an arbitrage spread. The assets employed in this strategy are principally RMBS and in some cases, commercial MBS ("CMBS").

The second type of mortgage REIT invests in distressed mortgage loans. This can be somewhat tricky for a REIT because of the so-called foreclosure property rules. In general, a REIT can foreclose on a mortgage loan and, for a temporary period, can earn income on the foreclosed real estate which it can pass through to shareholders. The REIT, however, cannot take advantage of the foreclosure property rules if it has acquired the mortgage loan with an intent to foreclose. Accordingly, these REITs will have to make decisions about which mortgage loans to purchase. Alternatively, they can acquire the properties in a TRS to avoid foreclosure property issues.

The third type of mortgage REIT both acquires and originates residential or commercial mortgage loans. It uses a TRS for its non-qualifying activities. These REITs may securitize the mortgage loans to enhance returns. This is the type of mortgage REIT with which this bulletin is principally concerned, and which promises to play a key role in the re-emerging U.S. mortgage market.

Many new mortgage REITs are externally managed, meaning that the REIT pays a fee to a manager to manage the REIT's portfolio of assets. This management method contrasts with the more traditional internal management model, in which the REITs own officers and employees manage the portfolio. There has been some debate over which management method is preferential, with recent evidence indicating a demand for internal management in the market for publicly traded REITs. The controversy has centered on which method of management produces higher returns for investors, with some arguing that conflicts in interest underpinning compensation arrangements for external managers create incentives not necessarily in the best interest of the shareholders.

How It Works

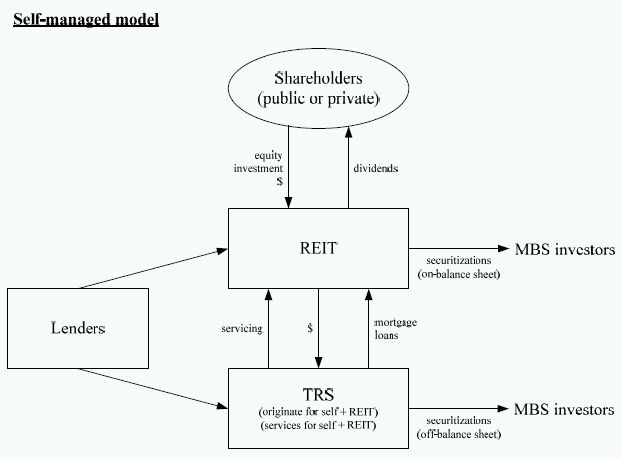

The structure of any mortgage REIT must take into account tax and operational considerations, and actual structures are often quite complex. The following two scenarios demonstrate the most common and straightforward structural configurations, first for a self-managed mortgage REIT and second for an externally managed mortgage REIT.

Essentially the same principles apply in either structure:

REIT or QRS activities: A parent REIT or a QRS may originate mortgage loans for its portfolio and may service its own loans. However, in structures in which a TRS will be used to originate mortgage loans for sale, it will generally be more efficient to conduct all origination and servicing activities through the TRS, since a TRS can originate for portfolio or for sale, and can service for the REIT, the TRS or third parties.

A REIT or QRS is well equipped to hold mortgage loans or MBS for long periods on-balance sheet, and may securitize mortgage loans in debt-like structures in which the underlying mortgage loans remain on the REIT's or QRS's balance sheet. A REIT or QRS can borrow to finance its own origination, warehousing and long-term investment needs and can relend funds, or loan funds in the first instance, to a TRS affiliate.

TRS: A TRS can originate mortgage loans for sale to its parent REIT or an affiliate QRS, or to hold in its own portfolio. A TRS can service mortgage loans for itself, its parent REIT or affiliate QRS, or for third parties (including buyers of mortgage loans or MBS sold by the TRS). A TRS can also borrow to fund its own origination, warehousing and investment activities, or to lend to others, including its affiliates.

Transactions between REIT or QRS and TRS

Perhaps the most sensitive structuring challenge in an operating mortgage REIT is to provide properly for the interface between the REIT-compliant entities (the REIT and any QRS), on the one hand, and the TRS, on the other. In order to avoid prohibited transactions or non-qualifying income "spilling over" from the TRS to the REIT-compliant entities, it is critical that the price that the REIT or QRS pays for mortgage loans acquired from the TRS, and any servicing or management compensation and the allocation of shared expenses such as shared employees, facilities, computer software and hardware and advertising, be structured on an arm's length basis. The structuring of contracts among the companies in an overall mortgage REIT structure should be reviewed by competent REIT tax counsel, and may be supported by external cost studies to minimize the probability of a successful challenge by the IRS.

Confronting the Perils of Warehouse Funding and Finance

As noted in the introductory paragraphs of this alert, the challenge of maintaining the availability of long-term financing and, where applicable, short-term mortgage warehouse funding, is one of the most critical challenges facing mortgage REITs. Indeed, in the decades-old debate whether it is better to conduct a mortgage business through a mortgage REIT or a bank, the bank side scores substantial points for a bank's ability to access customer deposits and FHLB and FRB advances.

In this regard, it is instructive to review the history of the IndyMac REIT, referenced above for its role in obtaining seminal tax rulings and establishing key operating strategies for mortgage REITs during the 1990s. IndyMac REIT was one of several mortgage REITs and mortgage companies that narrowly escaped bankruptcy in the 1998 liquidity crisis. It is rumored that this near-death experience prompted IndyMac REIT's management to seek out more stable sources of funding and, eventually, to acquire a small bank in 2000 to which it contributed its mortgage operations, whereupon it terminated its REIT status and thereafter operated as a bank.

A well-managed mortgage REIT should be able to arrange its liability structure in a manner that gives it an excellent chance of surviving a major credit disruption. A key to the successful strategy is maintaining a diversity of funding and financing sources, with as much capacity as is economically available. It is also important that these sources be legally committed to the extent possible, as the termination or suspension of uncommitted warehouse lines has historically been one of the most destabilizing events to befall a mortgage REIT. Some of the potential sources of funds include:

- bank term loans

- bank revolving lines of credit

- bank-supplied warehouse lines of credit

- warehouse lines supplied by non-bank finance companies, hedge funds or asset-backed commercial paper vehicles

- the issuance of commercial paper at the corporate level

- the issuance of public debt securities

- the issuance of senior securitization interests, which constitute debt on the mortgage REIT's balance sheet

- equity offerings by the REIT

In addition, it is critical that the interest rate and maturity profiles of the mortgage REIT's assets be appropriately matched to the liability structure through the closely monitored use of interest rate swaps and other derivative instruments. If the liability side of the REIT's balance sheet is professionally and diligently managed, there is no reason why a mortgage REIT cannot survive the next credit crisis.

Case Study: Redwood Trust

In April 2010, Redwood Trust Inc., a California-based mortgage REIT ("Redwood Trust"), attracted the attention of many investors by successfully sponsoring the first publicly offered, private-label (i.e., non-government sponsored) RMBS since October 2008. This transaction, issued by Sequoia Mortgage Trust 2010-H1, raised $238 million in the securitization of jumbo (i.e., having loan amounts above the GSEs' maximum "conforming" purchase amounts) prime home loans originated by a unit of Citigroup Inc. between May 2009 and December 2009. The average outstanding balance for each of these 255 mortgage loans was $933,000 and thus exceeded the conforming loan limits established by the GSEs.

Building on the success of this issuance, Redwood Trust sponsored another series of private-label RMBS in March 2011 and recently announced that it anticipates closing two additional private-label RMBS transactions in 2011.

From these three offerings, Redwood Trust estimates that it will achieve the securitization of a total of $800 million to $1 billion in jumbo mortgage loans in 2011. Redwood Trust has benefited from its status as a mortgage REIT in connection with its recent RMBS transactions. For instance, Redwood Trust has enjoyed the advantage of having the ability to purchase and hold mortgage loans on its balance sheet without the imposition of the stringent regulatory constraints imposed on banks. At the same time, Redwood Trust's status as a mortgage REIT enables it to access the capital markets to finance mortgage loan purchases. Moreover, as a purchaser of newly originated jumbo loans, Redwood Trust has reportedly started developing strategic relationships with banks and other loan originators. By creating a market for these loans, Redwood Trust has enabled these banks and loan originators to sell mortgage loans with the potential of recognizing gains upon the sales. In light of the aforementioned benefits, Redwood Trust's recent RMBS transactions appear to be paving the way for the next generation private-label RMBS.

Conclusion

The private market for U.S. residential mortgage loans remains crippled in the wake of the financial crisis. The outlines of a new private mortgage market are beginning to emerge as new regulations are adopted and as politicians and regulators close in on a plan for downsizing the GSEs and reducing the government's dominant role in housing finance.

One can readily envision a new mortgage market landscape in which mortgage REITs play an increasingly important role due to their advantages as long-term portfolio investors and as securitizers and servicers of loans with less onerous regulation than banks. Now is an opportune time for new and existing market participants to position themselves to take advantage of a new mortgage market landscape in which mortgage REITs will play an essential role.

Footnotes

1 Barclays Capital, "Mortgage REITs take aim at agency MBS," April 1, 2011.

2 Congressional Budget Office, Fannie Mae, Freddie Mac and the Federal Role in the Secondary Mortgage Market (Dec. 2010).

3 For a discussion of government initiatives to downsize Fannie Mae and Freddie Mac, see our client alert, "The Obama Administration's Housing Finance Reform Proposal: Opportunity for the Private Markets," March 16, 2011.

4 PIMCO REIT, Inc., Preliminary Prospectus dated May 20, 2011, included in Amendment No. 1 to Registration Statement on Form S-11, SEC Registration Statement No. 333-173321 (May 20, 2011).

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved