First published in Westlaw Journal (formerly

Andrews Litigation Reporter)

April 12, 2011

Although there has been significant reporting on the turmoil that has affected the auto loan industry over the past three years, there has not been much discussion about how auto lenders can use various types of insurance to protect against losses and lawsuits that have been, or may yet be, caused by that turmoil.1

This article briefly summarizes the various types of insurance and some of the coverage issues that may arise. The article also briefly discusses steps that auto lenders can take to put themselves in good position to access insurance if and when the need arises.2

INSURANCE FOR LENDER LIABILITY AND OTHER LAWSUITS

As in the real estate mortgage sector, rising loan defaults and repossessions in the auto finance sector over the past three years have increased the potential for consumer, shareholder and investor lawsuits. Borrowers may file individual complaints or class actions, alleging inadequate disclosures or misrepresentations regarding loan details and/or discriminatory or predatory lending practices.

Shareholders may allege that a lender's directors and officers gained profits through improper means. And investors may allege breach of contract and/or misrepresentation regarding the risk of the loans in which they invested. In defending against such lawsuits, auto lenders can spend large amounts of money on litigation costs and on any judgments or settlements.

The principal types of insurance policies that can help protect against losses associated with these lawsuits are:

- Errors and omissions policies.

- Directors and officers liability policies.

- Commercial general liability policies.

E&O policies cover liability arising from actual or alleged wrongful acts committed in rendering, or in failing to render, professional services. Courts typically define "professional services" as those "arising out of a vocation, calling, occupation or employment involving specialized knowledge, labor or skill," which can encompass the underwriting and servicing of auto loans.3

E&O coverage can be particularly useful in addressing lender liability claims. For example, in one case, an auto lender was able to access coverage for class actions that accused the lender of racially discriminatory lending practices.4

D&O policies cover liability arising from actual or alleged wrongful acts committed by directors and officers in carrying out their corporate duties. In addition to covering directors and officers, these policies also often cover companies for losses that they sustain, either directly, such as in securities lawsuits, or when the companies indemnify their directors and officers.

D&O and E&O policies tend to complement each other; one typically covers losses that insurance companies contend are not covered by the other. For example, even if an insurer could establish that a D&O policy's "professional services" exclusion barred coverage for a particular claim, the auto lender's E&O coverage should fill that gap.

Finally, although commercial general liability policies are best known for covering claims alleging "bodily injury" and "property damage," they also typically cover claims involving "personal and advertising injury." This separate coverage grant is important; courts have interpreted "personal and advertising injury" coverage as extending to claims alleging racial discrimination, which could include claims alleging discriminatory lending practices.

SECURED VALUE AND RESIDUAL VALUE INSURANCE

Although there has been some improvement lately, high repossession rates over the past three years, along with high oil prices and tight credit for car buyers, have hurt used-vehicle values, which has put auto lenders at greater risk of suffering "secured value" losses and "residual value" losses.5

A secured value loss occurs when an auto lender sells a repossessed vehicle for less than the outstanding balance on the defaulted loan. A lender sustains a residual value loss when it sells an off-lease vehicle for less than the projected end-of-lease value, or residual value, that the lender used at lease inception to price the lease.

The principal types of insurance that can help protect against these losses are secured value insurance policies and residual value insurance policies.

For both types of policies, there are potential coverage issues regarding both loan origination and post-loan loss calculation.

For loan origination, if an auto lender purchases insurance for loans that are "in force," that is, already in place, the insurance company has provided insurance for those loans as the lender underwrote them. Thus, there should not be disputes about the placement of those loans.

Disputes can arise, however, when an auto lender purchases insurance, sometimes known as an "enrollment policy," to cover loans that the lender will issue during the policy period.

For secured value policies, these disputes typically relate to a lender's loan underwriting guidelines; insurers sometimes claim that the lender was too lenient in its loan placement, thus increasing the risk of an insurance claim.

For residual value policies, the disputes typically relate to a lender's setting of residual values on its leases; insurers sometimes claim that the lender set its residual values high to increase its leasing business, thus creating greater risk of residual value losses.6

When purchasing enrollment policies, auto lenders should try to reach clear understandings with their insurers up front regarding the lender's loan underwriting guidelines and their setting of residual values. Some secured value policies, for example, incorporate the lender's loan underwriting guidelines as part of the policy. Further, some residual value policies will specify the maximum residual values that the insurance company will insure.

Reaching these agreements up front protects the lender from later attempts by the insurer to "underwrite at the point of claim." Up-front agreements also allow lenders to make informed business decisions regarding, for example, whether they want to be more aggressive on sales by setting higher residual values than the insurer will cover, appreciating that there will not be coverage for the difference between the established residual value and the maximum insured residual value.

There also can be disputes about how to measure secured value or residual value losses after the loan terminates. Covered "loss" typically is measured as the outstanding balance on the loan (for secured value policies) or the established residual value (for residual value policies) minus the greater of the vehicle's resale price or the vehicle's average wholesale value as reflected in some objective guidebook, such as Black Book.

There sometimes are disputes about which guidebook value to use. For example, because vehicles are depreciating assets, insurers typically want to use the Black Book value on the lease termination (or repossession) date, rather than the vehicle's subsequent resale date; the value on the lease termination (or repossession) date likely will be higher, thus reducing the amount of covered loss. Lenders, by contrast, typically will prefer to use the guidebook value as of the resale date.

If the insurance policy does not provide explicit rules on how to calculate guide-book values, courts may determine that the policy is ambiguous. If the policy is ambiguous, then, under well established insurance law principles, a court likely would decide the issue in favor of the auto lender.

Using the guidebook value as of the resale date also makes economic sense. Because, as noted earlier, typical policies use the higher of the sales price and the guidebook value to help measure covered loss, these two values should be measured as of the same date. Indeed, in one residual value insurance case, the parties used the guidebook value as of the resale date, even though the policy specified measuring the guidebook value as of the lease termination date.7

There also are disputes about whether auto lenders have obtained the maximum sales proceeds reasonably possible when they sell repossessed and/or off-lease vehicles. Insurers sometimes argue that sales outside of traditional auction channels, such as sales through Internet platforms like cyber-lots and sales to "grounding" dealerships where leased vehicles are returned, are not "commercially reasonable" because of the lack of competitive bidding.

Many policies, however, do not define the term "commercially reasonable" and do not expressly exclude non-auction sales. Under long-standing insurance law principles, if an insurance company could have explicitly excluded non-auction sales at the time of contracting and failed to do so, a court likely will not find such an exclusion by implication later.

Further, lenders have a persuasive argument that because typical policies use the higher of the sales price and the guidebook value to help measure covered loss, insurers should not be able to second-guess lenders' sales decisions and results. This "market value" formula is designed precisely to limit disputes between lenders and insurers over whether a lender obtained sufficient sales proceeds.8

This formula should avoid such disputes because it caps an insurer's exposure whenever sales proceeds drop below the objective market value reflected in the pertinent guidebook, such as Black Book.

PRACTICAL POINTERS FOR PRESERVING INSURANCE RIGHTS

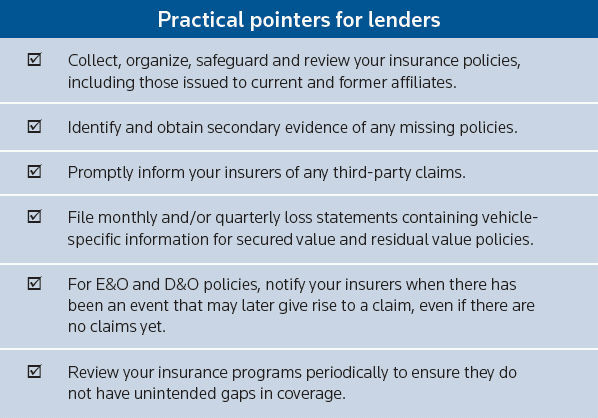

There are steps that all lenders can take now to put themselves in the best possible position to secure coverage if and when the need arises.

First, lenders should collect, organize, safeguard and review their insurance policies so that they have the necessary proof of coverage. This process should include an effort to identify and obtain policies issued to other companies, such as current and former affiliates, that may also provide coverage to the lender.

The process also should include an effort to identify and obtain secondary evidence of any missing policies, such as proof of premium payments and correspondence with brokers. Also, lenders' prior policies, and not just their current ones, may provide coverage depending on the circumstances.

Second, most insurance policies require timely notice of claims and losses. Thus, if and when a lender receives claims from third parties, the lender should promptly provide notice of the claims, absent relatively rare, business-specific reasons for refraining from giving notice.

Similarly, secured value and residual value policies often require lenders to file monthly and/or quarterly loss statements containing vehicle-specific information. Further, E&O and D&O policies also typically require policyholders to give notice when there has been an event that may later give rise to a claim, such as an investigation of allegedly improper lending practices, even if there are no claims yet.

Giving this type of notice, sometimes called "notice of circumstances," is important because it may allow a lender to obtain coverage for a claim that is not made until after the policy period, as long as the event, and notice of the event, occurred during the policy period.

Third, as noted above, various types of insurance interact with each other to form a complete coverage program. For example, as noted, E&O policies may fill coverage gaps created by exclusions in D&O policies. Lenders should conduct periodic reviews of their insurance programs to ensure that they do not have unintended gaps in their insurance protection.

CONCLUSION

The coverage provided by an auto lender's insurance policies can be an extremely valuable business asset. Lenders can maximize the benefits of that asset by acting proactively to preserve their rights and by refusing to take coverage denials from their insurers at face value.

NOTES

1 See, e.g., Dan Strumpf & Dee-Ann Durbin, Car-loan market is loosening up, Seattle Times, Jan. 5, 2010, available at http://seattletimes.nwsource.com/html/businesstechnology/2010708251_ autofinancing06.html; Roland Jones, Auto sector feels pinch of credit crunch, MSNBC.com, Apr. 2, 2008, available at http://www.msnbc.com/id/23879390.

2 Although the article provides an overview of general principles, actual legal advice should be based upon an evaluation of all facts and circumstances, including specific policy language, which may vary.

3 See PMI Mortgage Ins. Co. v. Am. Int'l Specialty Lines Ins. Co., 394 F.3d 761, 766 (9th Cir. 2005).

4 See WFS Fin. Inc. v. Progressive Cas. Ins. Co., 232 F. App'x 624 (9th Cir. 2007). There was no real dispute that the auto lender's policies covered losses from the class actions. Instead, the primary dispute was whether the auto lender could access the policy limits of two policies or of only one policy. For reasons that are beyond the scope of this article, the court found that the limits of one policy applied. Materials from this case, including briefs filed by the parties, are on file with the author.

5 See, e.g., Chris Woodyard, Repo lots overflow with reclaimed cars, USAToday, Feb. 14, 2008, available at http://www.usatoday.com/money/autos/2008-02-13-repo-man_N.htm; Jim Henry,

Home to Roost: Used SUVs Will Hurt Leasing Companies, BNETIndus., June 20, 2008, available at http://www.bnet.com/blog/auto-business/home-to-roost-used-suvs-will-hurt-leasing-companies/135?tag=content;drawer-container.

6 Because a residual value is what a lender expects a vehicle to be worth at the end of a lease based on the expected rate of depreciation over the lease term, the lender sets the lease payment based, in large part, on the residual value. Thus, the higher the lender sets the residual value, the lower the expected rate of depreciation is, and thus the lower the lease payments will be.

7 See First Union Corp. v. Gulf Ins. Co., No. 00 CVS 3558, complaint filed (N.C. Bus. Ct. Mar. 14, 2000). Materials from this case are on file with the author.

8 See, e.g., Randall McCathren, A Shopper's Guide To Residual Insurance (Part 1), 13Auto Finance Update 7 (March 1999).

Barry I. Buchman, a partner in Gilbert LLP in Washington, represents companies on a wide variety of insurance issues and has extensive experience representing automotive industry companies in particular, including one of the nation's largest leasing and finance firms.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.