EDITOR'S NOTE

In this first issue of our fourth volume of Tax Talk, we cover a flurry of capital markets guidance recently issued by the Internal Revenue Service ("IRS"). In particular, the IRS issued a chief counsel advice addressing whether variable prepaid forward contracts treated as open transactions can remain open if settled with borrowed securities. The IRS also issued a private letter ruling to a corporate taxpayer that wanted to repurchase outstanding equity units. Another IRS private letter ruling addressed the federal income tax treatment of repurchase premium and consent fees paid in connection with the repurchase and modification of certain debt. The IRS also released a generic legal advice memorandum ("GLAM") about withholding on ADR fees. Finally, our regular features – Press Corner and MoFo in the News – are also included.

IRS REVERSES ITS POSITION ON CLOSING A FORWARD WITH BORROWED STOCK

In Chief Counsel Advice 201104031 (the "CCA"), the IRS concluded that a variable prepaid forward contract settled with borrowed stock cannot be treated as an open transaction by the seller. Alternatively, the CCA concluded that gain should be recognized under the constructive sale rules of Section 1259.1 The CCA reverses a position that the IRS had taken in 2004 in a similar situation.

Background

The IRS has issued a number of revenue rulings and one private letter ruling ("PLR") that are of importance in light of the CCA and on which the taxpayer sought to rely. First, the IRS held in Revenue Ruling 2003- 7 that a variable prepaid forward contract does not result in a current common law or constructive sale. Second, in Revenue Ruling 2004-15, the IRS held that where a taxpayer settles a short sale with borrowed stock from a separate short sale, the settlement is not an event that closes the initial short sale, thereby resulting in the continuation of open transaction treatment. Third, in Revenue Ruling 72- 478, the IRS held that a taxpayer's short position with respect to certain securities in his brokerage account should not be treated as consummated or closed even though the taxpayer maintained a long position in identical securities in a different account with the same broker (provided the broker did not borrow the securities in the taxpayer's long account for delivery to the purchaser with respect to the short position). Finally, the IRS addressed, in PLR 200440005, a situation in which a taxpayer had entered into certain post-paid variable forward contracts over shares of stock it held. Upon settlement of the forward contracts, the taxpayer, instead of delivering the shares of stock it held, borrowed shares from a third party to settle the contract. In connection with this transaction, the IRS ruled that the forward contracts were not closed out by delivery of the borrowed shares; that the delivery of the borrowed shares did not result in a constructive sale of the forward contracts; and that the delivery of the borrowed shares and retention of the existing shares resulted in a constructive sale. Accordingly, the taxpayer was not required to include the entire gain on its historic stock position, which it had "locked in" through the forward contract, but rather only gain equal to the current (lower) market price of its historic shares position less the taxpayer's basis.

Facts

In simplified form, the facts of the highly redacted CCA are as follows: the taxpayer entered into variable prepaid forward contracts with a bank. The taxpayer received cash in exchange for the forward contracts to deliver a variable number of shares of stock at a specified future time. The taxpayer owned such shares at the time it entered into the forward contracts. The taxpayer treated the forward contracts as open transactions. At the settlement date, rather than settling the forward contracts with the shares the taxpayer already held, the taxpayer settled the forward contracts with newly borrowed shares.

Relying on the authorities mentioned above, the taxpayer argued that, despite delivering the shares to the counterparty, the forward contracts remained open for federal income tax purposes, and that it was permitted to keep the forward contracts open indefinitely until the short sale was closed. The taxpayer acknowledged that the short sale caused a constructive sale under Section 1259 resulting in the taxpayer recognizing gain. Since the amounts in the CCA were redacted, it is not possible to determine what exactly was at stake, but the following is an example of what may have been at issue. At the time the forward contracts were entered into, the taxpayer owned the shares with a basis of $10 and a fair market value of $100. The taxpayer received $80 from the bank pursuant to the forward contracts. On the settlement date of the forward contracts, the fair market value of the shares had decreased to $30. The delivery by the taxpayer of the borrowed shares (causing a constructive sale of the shares owned by the taxpayer) resulted in recognized gain equal to $20 (i.e., the fair market value of the borrowed shares, $30, minus the basis of the shares owned, $10). The taxpayer, however, had received $80 and, under the taxpayer's theory, could delay recognizing any additional gain until the short sale would be closed out.

IRS Analysis

The CCA rejected the argument that entering into a short sale and settling the forward contracts with borrowed shares entitled the taxpayer to keep the transaction open. While entering into a variable prepaid forward contract may not result in a taxable event, the CCA reasoned that the settlement of such a forward contract is, in fact, a taxable event under Section 1001. In addition, the IRS argued that the taxpayer's attempt to defer gain recognition by delivering borrowed shares lacked economic substance. It is not entirely clear from the CCA what the amount of the taxpayer's recognized gain is under the IRS's theory. As noted above, in our simplified example, $20 of gain is recognized as a result of the constructive sale. Presumably, the IRS would view the remaining $50 (i.e., the total amount of locked-in gain of $70 minus the gain recognized as part of the constructive sale, $20) as being recognized as a result of the settlement of the forward contract.2

The IRS further argued3 that the taxpayer's reliance on previous short sale guidance, including Revenue Ruling 72-478 and Revenue Ruling 2004-15, was misplaced on the basis that such guidance is limited to short sales and inapplicable to the closing of forward contracts that terminate all rights and obligations of the parties under such contracts. The CCA also noted that the taxpayer cannot rely on PLR 200440005, as private letter rulings are issued with regards to a particular situation and to a specific taxpayer and are not general advice for all taxpayers. In addition, the CCA noted discontent with the reasoning of PLR 200440005, as conclusions of private letter rulings may change due to various factors, including policy over time. In fact, approximately one month later, the IRS issued a private letter ruling withdrawing PLR 200440005.4

In the alternative, the IRS argued that the constructive sale rules of Section 1259 should cause the taxpayer to recognize gain based on the amount of cash received from the bank (as opposed to the value of the shares based on market prices). In our example, this would mean that the taxpayer would recognize gain equal to $70 (i.e., the $80 cash received less the $10 basis). The IRS based this argument on the theory that the $80 should be treated as the "fair market value" of the shares (despite a lower stock market value at that time) since the fixed price of $80 was determined between a "willing buyer" and a "willing seller."

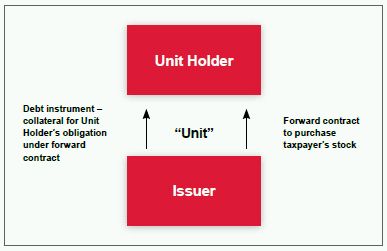

EQUITY UNITS EXCHANGE OFFER

During the first quarter, the IRS issued PLR 201105030, addressing the repurchase by a corporate taxpayer of its outstanding equity units ("Units"). The Units, which the taxpayer had issued earlier in accordance with the requirements of Revenue Ruling 2003-97, consisted of an undivided beneficial interest in certain notes issued by the taxpayer and a forward contract to purchase the taxpayer's stock.5 The taxpayer paid, on a quarterly basis to Unit holders, interest on the notes and a fee pursuant to the forward contract. The notes were pledged to secure a Unit holder's obligations to perform under the stock purchase contract. (See diagram.) After a certain number of years following the issue date and pursuant to the terms of the Units, the taxpayer was required to attempt to remarket the notes to generate proceeds in an amount sufficient to satisfy the Unit holder's obligation under the stock purchase contract. Following the remarketing and settlement of the stock purchase contract, the notes were intended to remain outstanding for another few years.

Following the issue date of the Units, however, the taxpayer's financial position had deteriorated, its credit rating had been downgraded significantly and it had experienced a steep drop in its stock price. Considering these circumstances, the taxpayer made an exchange offer to each Unit holder prior to the remarketing date pursuant to which (i) the taxpayer would repurchase the notes in exchange for a number of shares of its common stock plus an amount in cash, and (ii) each Unit holder would pay an amount in cash to the taxpayer for settlement of the stock purchase contract. The fair market value of the common stock plus the amount of cash offered by the taxpayer equaled the adjusted issue price of the notes plus accrued but unpaid interest.

The IRS provided the following rulings with respect to the exchange offer: (i) the taxpayer's gain resulting from the cash settlement of the stock purchase contract is not recognized pursuant to Section 1032(a), (ii) because the taxpayer paid each Unit holder an amount equal to the notes' adjusted issue price plus accrued but unpaid interest, the taxpayer was neither entitled to deduct interest expense (except for accrued but unpaid interest) nor to recognize cancellation of indebtedness income, (iii) no amount paid by the taxpayer pursuant to the exchange offer was deductible, except for the amount paid for the accrued but unpaid interest, (iv) the exchange offer did not prevent the Units from complying with the requirements of Revenue Ruling 2003-97, and (v) the foregoing rulings were not affected by the fact that the payments pursuant to the exchange offer were netted. The taxpayer did have to make a number of representations to obtain these rulings, including that, on the original issue date, it satisfied the requirements of Revenue Ruling 2003-97; that it had not treated the fee payments under the stock purchase contracts as deductible items; that, as of the original issue date of the Units, it did not intend to tender for the notes, or otherwise seek to repurchase the notes with the result that the notes would not be outstanding for at least two years following exercise of the stock purchase contract; that it believed that a remarketing would have a negative impact on its credit rating which could substantially jeopardize its operations; and that, as of the original issue date of the Units, the taxpayer did not reasonably foresee that its financial position and credit rating would deteriorate as it did. Issuers that have instruments such as the Units outstanding with upcoming remarketing dates should keep the facts and circumstances of PLR 201105030 in mind in mapping out their options.

REPURCHASE PREMIUMS AND CONSENT FEES

In February, the IRS released a private letter ruling (PLR 201105016) addressing the federal income tax treatment of repurchase premium and consent fees in connection with the repurchase and modification of certain debt instruments issued by a corporate taxpayer. Simplified, the facts were as follows: the taxpayer had senior unsecured notes (treated as debt for federal income tax purposes) outstanding. The taxpayer announced a tender offer and a consent solicitation to obtain the consent of the note holders to certain amendments to the note indenture. Pursuant to the tender offer, the taxpayer offered to purchase a certain percentage of the outstanding notes for a specified price in excess of the notes' adjusted issue price. With respect to the notes that were not repurchased pursuant to the tender offer, the taxpayer represented that the consent fee payment and amendment to the indenture did not result in a "significant modification" of the notes under Section 1.1001-3 and, therefore, did not result in a deemed exchange for federal income tax purposes.

With respect to the repurchase premium (i.e., the amount paid by the taxpayer for the notes in excess of their adjusted issue price), the IRS ruled that such amount was deductible as interest. This result isn't too surprising since Section 1.163-7(c) specifically so provides.6

With respect to the consent fee, the IRS ruled that such payments are treated as payments on the notes and must, therefore, be taken into account in determining the yield on the "modified notes." This is relevant because if the yield of the modified notes varies from the yield on the unmodified notes (determined as of the date of the modification) by more than the greater of (1) 0.25%, or (2) 5% of the annual yield of the unmodified instrument, this would result in a significant modification of the debt instrument and, therefore, a deemed exchange for federal income tax purposes. Notwithstanding this ruling, the taxpayer represented that the payment of the fee and the amendments to the indenture did not result in a significant modification of the notes. Further, the IRS ruled that the consent fees are treated first as payments of accrued interest (to the extent of any accrued interest on the notes at the time of payment of the consent fees), and second as payments of principal on the notes.7 The IRS further clarified that to the extent any consent fee was treated as payment of principal on the notes, such amount would decrease the adjusted issue price of the notes with the result that a subsequent repurchase of the notes for an amount in excess of the reduced adjusted issue price would result in repurchase premium deductible as interest (consistent with the IRS's first ruling).

The private letter ruling leaves unanswered the question of the federal income tax treatment applicable to the interest accrued as of the date the consent fee was paid. An example: a taxpayer has a note outstanding with a principal amount and adjusted issue price equal to $100 and which pays an annual coupon of $7. Interest in an amount equal to $3 has accrued at a particular point in time. At that time, the taxpayer, in connection with an amendment of the note indenture, pays a consent fee of $5 to the consenting note holder. According to the ruling, $3 of the $5 consent fee is treated as interest and the remaining $2 reduces the adjusted issue price of the note to $98. But what happens when the annual $7 coupon is paid? One option would be that of the $7 coupon, $4 is treated as interest when paid (i.e., the portion of the coupon accrued after the consent fee was paid) and the remaining $3 is treated as further reducing the note's adjusted issue price to $95. Economically, this would mean that the entire amount of the consent fee would be treated as a return of capital resulting in gain or loss to the holder upon maturity or upon earlier disposition. Alternative treatments may also be possible. For example, the entire $7 coupon may be treated as interest income when paid. This alternative, however, would cause different tax results depending on the amount of accrued interest at the time the consent fee is paid.

REPORTING OBLIGATIONS FOR CORPORATE ACTIONS CONTINUED

In the last edition of Tax Talk8 we discussed the new tax reporting obligations with respect to certain organizational actions (such as a stock split, a merger or an acquisition) affecting tax basis, effective as of January 1, 2011.9 Generally, these tax reporting obligations require an issuer of stock to file a return with the IRS describing any organizational action which affects the basis of a specified security.10 In 2011, a specified security is limited to stock in a corporation.11 The issuer is required to file the return within 45 days after the organizational action, as well as furnish a corresponding statement to each shareholder (or nominee of a shareholder) by January 15th of the year following the calendar year of the organizational action. In lieu of filing such return with the IRS, the issuer may post the return on its primary public website by the filing date.12 A penalty will be imposed on any issuer of stock that does not timely file a correct issuer return with the IRS.

Despite the effective date of January 1, 2011 for the reporting requirements, the IRS has yet to develop the form and manner of the issuer return. While the issuer return is a work in progress, the IRS released Notice 2011-18 (the "Notice") which provides transitional relief from the information reporting requirements in 2011. Until the IRS provides the form of the issuer return, compliance can only be satisfied through the public reporting of information. Under the Notice no penalties will be imposed for failure to file an issuer return with the IRS within 45 days of an organizational action taken in 2011, provided that the issuer files the issuer return with the IRS (or posts the return to its website) by January 17, 2012.

WITHHOLDING ON ADR FEES

In GLAM 2010-006, released December 17, 2010, the IRS concluded that payments by a domestic depositary institution ("DI") to or on behalf of a foreign corporation for expenses of a sponsored American Depository Receipts ("ADR") program are includible in the foreign corporation's gross income and are subject to U.S. federal withholding tax.

ADR programs exist in both a sponsored and unsponsored form. The GLAM only addresses payments to corporations in sponsored programs. A sponsored ADR program is one in which the foreign corporation registers with the Securities and Exchange Commission and chooses an exclusive DI.13 ADR programs are designed to simplify the U.S. trading of stock of foreign corporations. Under such a program, the foreign corporation's stock is placed, maintained and controlled with a domestic financial institution that acts as a DI. The DI will subsequently offer interests in the corporation's stock in the form of ADRs to investors in the U.S. market. ADRs are priced in U.S. dollars and the DI makes dividend equivalent payments in U.S. dollars to the investors based on dividends paid in foreign currency by the corporation to the DI. U.S. investors can also trade ADRs, similar to shares of domestic corporations, on U.S. exchanges and over-the-counter markets. ADRs help to meet the needs of U.S. investors who want to invest easily in foreign companies, without the inconveniences of cross-border or cross-currency transactions. Investors in sponsored ADRs (in contrast to unsponsored ADR programs) have rights similar to stockholders, including the right to receive reports, vote their shares, and receive dividends.

To institute an ADR program, the corporation incurs expenses and to induce a corporation to have an exclusive arrangement with a DI for a sponsored ADR program, it is common for a DI to pay a portion of the expenses the corporation will incur in setting up the program.14

Referring to case law, the IRS argued that the payment of expenses of a taxpayer by another is includible in the taxpayer's gross income and that the payments are includible regardless of whether they are made directly to the taxpayer or to a third party on the taxpayer's behalf. The IRS referred to four factors in determining that the expenses paid by the DI are in fact those of the foreign corporation: (1) the payments are for expenses any corporation would expect to incur to sell its stock in the United States; (2) the DI does not have a pre-existing obligation to incur these and the source of its obligation being solely by virtue of its agreement with the corporation; (3) the corporation has discretion over which accounting firm, law firm, vendor, etc., to use in instituting its ADR program when it incurs the expenses; and (4) the DI does not pay all of the expenses necessary to set up the ADR program, but only an agreed upon or capped amount, leaving the balance payable by the foreign corporation. The IRS also noted that under the generic facts of the GLAM, the DI has not paid any direct consideration for the exclusive right to serve as the depositary for the corporation's ADR program, thus suggesting that the DI's payments of the corporation's expenses are intended to compensate the corporation for its agreement to deal exclusively with the DI. Finally, the DI's payments to, or on behalf of, the corporation are primarily and directly for the corporation's benefit in instituting the ADR program. They are not primarily for the DI's benefit. Therefore, the IRS concluded the payments by the DI to the corporation, or to third parties on behalf of the corporation, of the corporation's expenses incurred to institute an ADR program are gross income to the foreign corporation.

After determining that such payments are includible as gross income to the foreign corporation, the GLAM addresses whether the payments are subject to U.S. federal withholding tax. The IRS reasoned that because the DI obtains, for a period of time, the right to profit from the distribution of shares of the corporation in the U.S. market without competition from other DIs (which includes the right to benefit from the use of the corporation's trade name and reputation in marketing the ADRs), it has obtained an interest in intangible property with the result that the payments should be treated as royalties. These royalties, according to the IRS, should be treated as U.S. source because the rights are used in the U.S. Since U.S. source fixed or determinable annual or periodical income of a foreign corporation is subject to a 30% U.S. federal withholding tax, the IRS concluded that the ADR program payments should be subject to the 30% withholding tax, unless the corporation is engaged in a trade or business in the U.S. or that amount is otherwise reduced by a treaty.

A GLAM is informal advice on a tax issue given by the IRS National Office to the IRS field offices based on a generic set of facts. It is not taxpayer-specific advice. While it represents the IRS's position, it is not legal precedent. It is possible that a DI will challenge the conclusions of the GLAM based on legal and factual grounds if the issue is pursued by the IRS upon audit. In the meantime, however, a DI may seek to withhold on the payment of ADR program expenses because of the GLAM and thereafter pursue a refund claim pursuant to Section 1.6414-1 with respect to the withholdings it pays over in conjunction with the Form 1042.

REPEAL OF EXPANDED FORM 1099 INFORMATION REPORTING REQUIREMENT

The expanded Form 1099 information reporting requirement enacted last year as part of the 2010 Patient Protection and Affordable Care Act (aka the "Healthcare Reform Bill") was repealed by Congress. Under prior law Form 1099 reporting generally did not apply to corporations nor the purchase of goods. The expanded requirement extended Form 1099 to any person in a trade or business making payments of $600 or more to one person. Congress had previously attempted on several occasions to repeal the expanded Form 1099 reporting requirements but to no avail. Despite past failed attempts, in early March the House of Representatives passed H.R. 4, the Comprehensive 1099 Taxpayer Protection and Repayment of Exchange Subsidy Overpayments Act of 2011, which would repeal the expanded Form 1099 reporting requirement, scheduled to commence in 2012. The Senate passed H.R. 4 on April 5, 2011 by an 87-12 vote. Nine days later, President Obama signed the legislation into law. The cost of the repeal, estimated to be $24.7 billion, will be paid for by modifying the limitations on amounts required for repayment of advance premium assistance tax credits for health insurance.

ANOTHER DERIVIUM CAPITAL CASE

On April 4th the Tax Court decided another Derivium Capital case: Solleberger v. Comm'r, T.C. Memo 2011-78. Earlier we reported on Calloway,15 the first Derivium case decided by the Tax Court.16 Derivium offered a taxpayer with appreciated securities a non-recourse loan for 90% of their value. The notion was that the taxpayer could extract money from its stock position, hedge the downside risk (through the non-recourse feature) and not create a recognition event for federal income tax purposes. Why would the lender do this? The lender would (i) loan money to the taxpayer on the 90% basis and (ii) buy a put on the stock with a $90 strike to hedge its risk. It would charge the taxpayer interest equal to the cost of money plus the cost of the put. Both charges would be part of the loan interest. Unfortunately, it turned out that Derivium did not have any money to lend, instead it sold the taxpayer's stock to get the money to lend. The IRS has been successful in the various Derivium cases in arguing that the loans were shams and that the taxpayer recognized gain on the transactions in question. Note that in Solleberger, instead of stock the taxpayer borrowed against bank notes. The taxpayer had sold its business to an ESOP and rolled over the gain into so-called ESOP notes under Section 1042.

It borrowed against the ESOP notes, however, the Tax Court granted summary judgment for the government on the grounds that all benefits and burdens had passed to the lender, a Derivium affiliate. Therefore, the notes had been sold rather than pledged; this in turn triggered gain under Section 1042.

PROPOSED REGULATIONS FOR COD INCOME EXCEPTIONS

The IRS issued proposed regulations providing guidance in applying the bankruptcy and insolvency exceptions for cancellation of debt ("COD") income to grantor trusts and disregarded entities. While COD income is generally included in a taxpayer's gross income, if the discharge of debt occurs in a Title 11 case (the "bankruptcy exception") or to the extent the taxpayer is insolvent when the discharge occurs (the "insolvency exception"), such income is excluded from gross income.17 The COD income provisions of the Code use the term "taxpayer," which is generally defined as any person subject to any internal revenue tax.18 The question, therefore, is how the insolvency and bankruptcy exceptions apply with respect to COD income resulting from the discharge of debt owed by a grantor trust or disregarded entity since such entities are not treated as "taxpayers" for purposes of the Code. The proposed regulations provide that, for purposes of applying the insolvency and bankruptcy exceptions to COD income of a grantor trust or a disregarded entity, the term "taxpayer" refers to the direct or indirect owner(s) of the grantor trust or disregarded entity.19 As a result, under the proposed regulations, if a grantor trust or disregarded entity is under the jurisdiction of a bankruptcy court or is insolvent while its owner is not, the bankruptcy and insolvency exceptions would not be available. The proposed regulations would apply to COD income occurring on or after the date final regulations are published in the Federal Register.

PRESS CORNER

Will the Internal Revenue Code be overhauled in 2012? The possibility exists as the Senate is planning a year-long series of hearings on the Code. The Senate Finance Committee Chairman, Max Baucus (D., Mont.), and top Republican, Orrin Hatch (R., Utah), indicated the first hearing, "How Did We Get Here?," will examine economic and policy changes that have occurred since 1986, the last time the Code was substantially overhauled. Senator Hatch confirmed the Committee will spend "the next year fully examining our tax code." See "Senate Plans Year-Long Series of Hearings on Tax Code," WSJ Online, February 22, 2011.

Updating the Code is not the only tax-related issue on the Senate's mind. Senators John Kerry (D., Mass.) and Mike Crapo (R., Idaho) introduced the Brewer's Employment and Excise Tax Relief Act, or BEER Act, in early March. Under the bill small craft brewers would pay an excise tax of $3.50 per barrel on the first 60,000 beer barrels produced annually, which is half of what is currently paid. Barrels 60,001 through two million would be taxed at $16 per barrel. Currently all brewers pay $18 per barrel on barrels in excess of 60,000. Small craft breweries are currently defined by the federal government as those that produce less than two million barrels annually. The BEER Act proposes to expand the definition to six million barrels, at which point certain prominent breweries, such as The Boston Beer Company (maker of the Sam Adams label), would qualify for the proposed tax relief. It is, therefore, no surprise that the company supports the legislation. See "BEER Bill Aims to Cut Taxes," WSJ Online, March 15, 2011.

As the filing deadline for individual tax returns quickly approaches, many taxpayers are thinking about one thing: refunds. The IRS is sympathetic and recently announced its first smartphone application, the IRS2GO phone "app," which allows taxpayers to check the status of their tax refund, as well as obtain tax tips. The free app works with both the iPhone and Android phones. E-filers are able to check the status of their refund with use of the app within 72 hours after receiving email confirmation from the IRS that their tax return has been received. Those who file paper tax returns will have to wait slightly longer – three to four weeks prior to checking their refund status. See Maya Jackson Randall, "IRS Announced Tax Refund 'App' for iPhone," WSJ Online, January 25, 2011.

In a previous edition of MoFo Tax Talk, we discussed the whistleblower provisions under federal law, where a whistleblower who blows the whistle against tax cheats could receive as an award an amount in the range from 15% to 30% of the collected proceeds resulting from an action brought by the IRS based on information provided by the whistleblower. On April 8, 2011, an unidentified in-house accountant of a "Fortune 500" company who blew the whistle on his employer apparently received the first IRS whistleblower award. The accountant's tip resulted in the IRS collecting approximately $20 million in taxes and interest from the unnamed financial services firm according to the accountant/whistleblower's counsel. The accountant netted $3.24 million, which equals 22% of the taxes recovered by the IRS. The accountant originally filed a complaint with the IRS in 2007, when the IRS Whistleblower Office opened, but had not received a response for two years. The accountant hired counsel to further pursue the matter. In fiscal years 2008 and 2009, the IRS Whistleblower Office received nearly 1,000 tips involving more than 3,000 taxpayers. See "IRS Awards $4.5M to Whistleblower," Fox News, April 8, 2011.

MoFo IN THE NEWS

On February 3, 2011, MoFo partners Peter Green, Jeremy Jennings-Mares and Anna Pinedo spoke at the IFLR Structured Products and Derivatives Forum in London. The half-day event covered EU regulatory developments and their effect on the OTC derivatives market, impacts of Dodd Frank & Basel III, CCPs, use of ratings in the future, and issues that retail providers and distributors of structured products should focus on in light of regulatory developments.

Later the same day, Peter Green, Jeremy Jennings-Mares and Anna Pinedo held two "bootcamp sessions" at the MoFo London office. In the first session, the panelists discussed Basel III developments, including the definition of capital and minimum capital requirements, the capital conservation buffer and countercyclical buffer, leverage ratio and new liquidity ratios, the effect of proposals on capital instruments, and the effect of these proposals on financing plans. In the second session, the panelists compared the U.S. Dodd-Frank Act and EU regulatory reform, including proposals in relation to OTC derivatives, the impact of the Volcker rule and swaps push out rule, systemically important institutions, the effect of EU AIFM Directive and U.S. Private Fund Advisers Registration Act, and the impact of provisions on institutions with cross-border activities.

MoFo London partner Jeremy C. Jennings- Mares presented at the 8th Annual StructuredRetailProducts.com Conference in London on February 9-10, 2011. The conference touched on independent valuations, latest developments in indexing, the impact of new regulations on the industry, debates on the role of education, and examining developments in both retail and private banking distribution and in listed products.

At an ALI-ABA webinar titled "Developments in Covered Bond Markets," on February 17, 2011, MoFo partners Anna Pinedo and Jerry Marlatt presented. The speakers reviewed developments in the covered bond markets in Europe and the United States, including the opening of the U.S. market in 2010 by Canadian and European issuers. There have also been several developments toward enactment of legislation for covered bonds in the United States. They discussed those developments, the current draft of the statute, and prospects for enactment by the new Congress.

MoFo partners Peter Green, Jeremy Jennings-Mares, Jerry Marlatt, and Anna Pinedo gave a presentation at the Morrison & Foerster London office titled "Accessing the U.S. Covered Bond Market" on February 28, 2011. Topics included how foreign banks can access U.S. investors through 3(a)(2) and 144A issuances of covered bonds, setting up a program specifically designed for issuances into the United States as well as issuing into the United States through an existing program, documentation requirements for foreign issuers, the merits of 3(a)(2) versus 144A programs, disclosure issues, liability concerns, ratings, and other recent developments affecting covered bonds.

Anna Pinedo spoke at the Global Association of Risk Professional's 12th Annual Risk Management Convention, on March 7-9, 2011. At the convention, events included classes in advanced risk management and global regulation of systemic risk, an energy risk forum, presentation of GARP Risk Manager of the Year Award, concurrent track sessions, keynote speakers and plenary sessions, and exhibitions.

Thomas A. Humphreys presented at the Structured Products Association's 2011 Spring Conference on March 8, 2011. Mr. Humphreys joined a legal and compliance panel to discuss tax issues in the structured products industry.

Morrison & Foerster attorneys Charles Horn, Thomas A. Humphreys, Oliver Ireland, David Kaufman, David Lynn, Jerry Marlatt, Anna Pinedo, Dwight Smith, and Jim Tanenbaum presented in Charlotte, North Carolina at a Regulatory Update seminar on March 9, 2011. The seminar included an overview of Basel III; Basel numerator and capital issues post Dodd-Frank and Basel III; Basel denominator and liquidity issues; guidance on systemic designation; an overview of rulemaking since enactment of Dodd- Frank; developments related to ratings, mortgage reform, and developments affecting securitization; covered bonds; and an update on the Volcker Rule and OTC derivatives.

On March 15, 2011, MoFo hosted a panel presentation in collaboration with the Association of German Pfandbrief Banks titled "Are Covered Bonds a Step Closer to Reality?" Senior Of Counsel Jerry Marlatt joined the panel discussion. Topics included current trends in Pfandbrief/ covered bonds, an update on the Pfandbrief Act, foreign bank issuance of covered bonds in the United States and issuance by foreign bank branches and agencies in the United States and U.S. covered bond legislation in re of FDIC concerns and policy considerations.

Peter Green and Jeremy C. Jennings-Mares led a teleconference on EU derivatives regulation on March 16, 2011. Topics discussed included an outline of the EU proposals on OTC derivatives and some of the relevant issues that are likely to arise, comparisons between the EU proposals and relevant provisions in the Dodd-Frank Act, and extra territorial issues.

On April 2, 2011, Anna Pinedo joined a panel presentation at the 2011 Harvard Business Law Review Symposium to discuss derivatives regulation.

Anna Pinedo and Nilene Evans led a teleconference in connection with Blake, Cassels & Graydon LLP on April 5, 2011, to discuss the rules of the road for securities offerings by non-Canadian issuers into Canada. Topics included shareholder approval requirements for privates, PIPE transactions and registered direct offerings; special considerations for Canadian-listed issuers participating in these offerings or in at-the-market offerings; filing or approval requirements; investor withdrawal issues; and reconciling the withdrawal right with wall-crossed offerings.

Charles Horn, Jeremy Jennings-Mares and David Lynn spoke at an IFLR webinar on executive compensation on April 6, 2011. Speakers discussed the regulatory guidelines and best practices that have developed, as well as alternatives for public companies, including financial institutions, to consider.

On April 7, 2011, Lloyd Harmetz, Jeremy Jennings-Mares and Anna Pinedo spoke at a West Legalworks webinar titled "U.S. and EU Regulatory and Legal Developments Affecting the Structured Products Market."

Materials from any of the sessions mentioned above are available to clients. If you would like to receive copies, please send a request to Diane Kolanovic at DKolanovic@mofo.com.

International Financial Law Review magazine held its annual Americas Awards on March 31, 2011. MoFo partner Bruce Alan Mann received the Lifetime Achievement Award in recognition of Bruce's contributions to the profession and the exceptional caliber of his securities and M&A work. Morrison & Foerster received the Securitization and Structured Finance Firm of the Year award. Three of the firm's securitization deals were shortlisted. The award recognizes the innovative nature of the firm's work.

FRANK'N'DODD

Morrison & Foerster is pleased to announce the launch of our platform for all things relating to the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"). FrankNDodd is an online resource that tracks rulemaking pursuant to the Dodd-Frank Act, including rule proposals, rulemaking, and publication of study results and public comments, as well as key dates for comment deadlines, enactment deadlines, and effective dates. FrankNDodd also provides our color commentary and links to relevant articles, alerts, PowerPoint presentations and other resources. Contact questions@frankndodd.com for more information and to receive a password.

Footnotes

1 All Section references are to the Internal Revenue Code of 1986, as amended, and the Treasury regulations promulgated thereunder.

2 Another way of looking at it, which the IRS alludes to, is to take the full amount of cash received by the taxpayer ($80) less the offsetting obligation as a result of the short sale ($30) for a gain of $50.

3 The IRS also argued that the taxpayer could not rely on the open transaction doctrine following the settlement of the forward contract because the taxpayer's retention of the cash was not contingent on any future performance or event.

4 See PLR 201109017. The revocation of PLR 200440005 was applied without retroactive effect.

5 In Revenue Ruling 2003-97, the IRS ruled that an instrument, such as the Units, should not be treated as a single instrument for federal income tax purposes, but should be treated as consisting of two separate components (i.e., a debt instrument and a forward contract).

6 An exception would be if the premium was paid upon the repurchase of notes that are convertible into the stock of the taxpayer. See Section 249(a). However, the notes addressed in the private letter ruling were not convertible into the stock of the taxpayer.

7 In this regard, the IRS pointed to Section 1.446- 2(e)(1).

8 See MoFo Tax Talk, Volume 3, Issue 4.

9 Or, in the case of regulated investment companies, January 1, 2012.

10 See Section 6045B.

11 See Sections 6045B(d) and 6045(g)(3)(B).

12 See Treas. Reg. section 1.6045B-1(a)(3).

13 An unsponsored ADR program does not require the corporation to agree to an exclusive DI.

14 For example, accounting fees, Securities and Exchange Commission registration costs, marketing expenses, expenses for participating in investor conventions, costs for acquiring and maintaining electronic communications systems, exchange and listing fees, filing fees, underwriting fees, mailing and printing costs in connection with sending out financial reports, annual reports, proxy mailings, and other administrative costs. These expenses are typically subject to a cap, either a fixed dollar amount or an amount calculated by reference to the size of the ADR program. Also, the expenses must be of the kind that the corporation would not have incurred but for the depositary receipts program.

15 Calloway v. Commissioner, 135 T.C. No. 3 (2010).

16 See MoFo Tax Talk, Volume 3, Issue 2.

17 See Sections 108(a)(1)(A) and (a)(1)(B).

18 See Section 7701(a)(14).

19 As already provided for in Section 108(d)(6), the proposed regulations include a provision that in the case of a partnership, the bankruptcy and insolvency exceptions apply at the partner, rather than the partnership, level.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved