To see this Digest in full please click here.

As highlighted in our recent Say-on-Pay alert, the Securities and Exchange Commission has adopted new rules to require companies to disclose "golden parachute" compensation arrangements and, under certain circumstances, conduct a separate shareholder advisory vote to approve golden parachute compensation. This vote is non-binding. The rules implement new Section 14A(b) of the Securities Exchange Act of 1934 ("Exchange Act") enacted pursuant to the Dodd-Frank Wall Street Reform and Consumer Product Act.

We discuss here these new rules in more detail.

New Item 402(t)

Pursuant to Section 14A(b) of the Exchange Act, a registrant must now provide expanded disclosure in connection with solicitations of its shareholders' approval of mergers, acquisitions, consolidations, sales of all or substantially all of its assets and other similar filings. A registrant must provide expanded disclosure of compensation payable to named executive officers (NEOs) that is based on or otherwise relates to such transaction.

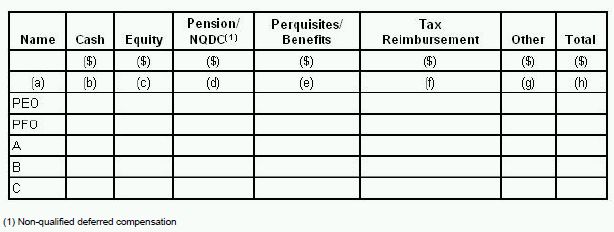

Therefore, the Commission has adopted a new Item 402(t) to Regulation S-K which sets forth the required disclosure of named executives' golden parachute arrangements in both tabular and narrative formats.

The table requires disclosure of the individual elements of golden parachute compensation as follows:

- Column (b) includes cash severance (base salary, bonus, non-equity incentive plan payments). This column can be split so as to show cash severance separately from other cash payment.

- Column (c) includes the dollar value of accelerated stock awards, in-the-money options with accelerated vesting, and payments for cancellation of stock or option awards.

- Column (d) includes pension and non-qualified deferred compensation enhancements.

- Column (e) includes perquisites, health and welfare benefits and other personal benefits (no de minimis exceptions).

- Column (f) includes tax reimbursements, such as Section 280G tax gross ups.

- Column (g) is a catch-all category for which separate footnotes identify the form of compensation is required.

Item 402(t) requires that all parachute compensation be disclosed whether or not it discriminates in favor of the NEO or is de minimis in amount. Separate footnote disclosure of amounts attributable to single-trigger vs. double-trigger parachutes is required.

It is important to note that only compensation that is based on or relates to the proposed transaction is required to be disclosed in the table. For example, options or stock awards that have already vested need not be disclosed, as the vesting is neither based on, nor related to, the transaction. A bona fide posttransaction employment agreement with the target or acquirer need not be disclosed in the table. Nevertheless, narrative disclosure would still be required under other applicable disclosure requirements such as interest of certain parties in the transaction under Schedule 14A - Item 5. Any material conditions to receipt of the compensation must also be disclosed, e.g. non-compete, non-solicitation, confidentiality agreements. Narrative discussion of the triggers for payment, how the payments are made (lump sum or over time), and who is making the payments is required.

The actual dollar amount of the consideration per share will be used to calculate the compensation in the table above if it is a fixed amount. Otherwise, the average closing price per share over the first five business days following the first public announcement of the transaction will be used. If the Item 402(t) disclosure is included in an annual meeting proxy statement, the price per share amount should be calculated based upon the closing market price per share of the issuer's securities on the last business day of the issuer's last completed fiscal year.

Disclosure must be made with respect to each named executive officer of the target company and the acquiring company regarding any arrangement between such named executive officer and the target or acquiring company that is based on or otherwise relates to an acquisition, merger, consolidation, sale or other disposition of all or substantially all assets of the issuer.

Filings Requiring Item 402(t) disclosure

Schedules 14A, 14C, 14D-9, and 13E-3, as well as Item 1011 of Regulation M-A have all been amended to include 402(t) disclosure. However, Item 402(t) disclosure is not required in third-party bidder tender offer statements so long as the transaction is not also a Rule 13e-3 going private transaction. However, target companies will be required to include Item 402(t) information in their Schedule 14D-9 filings. Furthermore, an instruction to Item 402(t) provides that no 402(t) disclosure is required with respect to NEOs of a foreign private issuer, whether it is the target or acquirer.

Proxy statements to solicit shareholder approval of a new issuance of shares or a reverse stock split required to conduct a merger transaction must include Item 402(t) information. The shareholder advisory vote required by Section 14A(b)(2), however, will not be extended to transactions beyond those specified in that section.

Advisory Vote on Golden Parachute Compensation

Generally, Section 14A(b)(2) requires a shareholder vote on certain parachute arrangements. This vote is non-binding. New Rule 14a-21(c) implements and expands this requirement.

No vote is required if Item 402(t) information (discussed above) has been included in the executive compensation disclosure that was subject to a prior vote under Section 14A(a)(l) and Rule 14a-21(a), whether or not approved. Issuers should consider this alternative to streamline acquisition disclosures. However, changes in existing arrangements or the addition of new arrangements after the prior vote would trigger the disclosure for the modified or new arrangements in the transaction disclosure proxy statement. In such case, only the new arrangements would be subject to a vote. The disclosure would include a table of all parachute compensation as well as a table showing only the new arrangement. However, changes that result only in the reduction of the value of total compensation payable will not require a new vote.

The Commission decided not to exempt small reporting companies from shareholder advisory votes on golden parachute payments. This new advisory vote raises a number of questions. What happens if the transaction is approved but not the parachute compensation? What should a seller's board do in this case? What should a buyer be considering as conditions to closing?

Effective Date

Compliance with the new requirements relating to golden parachute disclosure and shareholder vote will be required for initial filings on and after April 25, 2011. If you would like to discuss how these new rules will affect your company, please contact one of the authors of this alert.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.