The Financial Industry Regulatory Authority, Inc. ("FINRA") conducted a survey of common practices implemented by broker-dealer firms to prepare for the transition away from using the London Interbank Offered Rate ("LIBOR").1 On August 5, 2020, FINRA published Regulatory Notice 20-26, which lists important considerations when phasing out LIBOR, and summarizes the results of a recent survey of FINRA members to gauge their preparedness for the move away from LIBOR. Importantly, the Regulatory Notice identifies practices that firms have already undertaken to ease the transition.

Background

FINRA notes that there are LIBOR-based contracts with an estimated value of $35 trillion that extend past the December 31, 2020 phase-out date, which will have significant consequences for broker-dealers, as well as their customers and counterparties. LIBOR cessation may increase a broker-dealer's exposure to risks relating to compliance requirements, adverse financial and accounting issues, disruptions to business operations, and related litigation with customers, counterparties or third-party providers. It is therefore imperative that broker-dealers with exposure to LIBOR implement a plan to prepare for the LIBOR phase-out. To that effect, per its 2020 Risk Monitoring an Examination Priorities Letter, FINRA has engaged with firms to understand how they are preparing for the transition.2

Preparedness Considerations

FINRA surveyed firms on a number of matters they consider important in firms' preparations for the LIBOR phase-out. Although non-exhaustive, this list provides a framework for firms to consider as they design and implement their own phase-out plans.

- Has your firm evaluated the impact of the phase-out on your business, customers, counterparties, products and vendors and developed a plan to prepare for the phase-out?

- Can your firm measure its own exposure to LIBOR-linked products that expire after the phase-out date?

- Can your firm identify LIBOR-linked products that expire after the phase-out date in accounts customers hold at the firm?

- Has your firm evaluated potential risks related to fallback provisions (or the absence of such provisions) for securities and contracts referencing LIBOR and expiring after the phase-out date?

- Has your firm identified business processes, systems and vendors that may be affected by the phase-out, and developed plans to mitigate operational risks arising from the phase-out?

- Has your firm engaged in opportunities industry organizations have provided to learn about effective practices for transitioning to alternative reference rates to replace LIBOR, as well as other IBORs?

- Has your firm trained your associated persons and other staff about the potential impact of the phase-out on your firm's customers?

- Has your firm prepared guidance for associated persons and other staff relating to communicating to customers the impact of the phase-out for your firm, your firm's clients and customers, and any LIBOR-linked products that expire after the phase-out date?

- How is your firm preparing to supervise associated persons' recommendations relating to LIBOR-linked products?

FINRA Survey Results

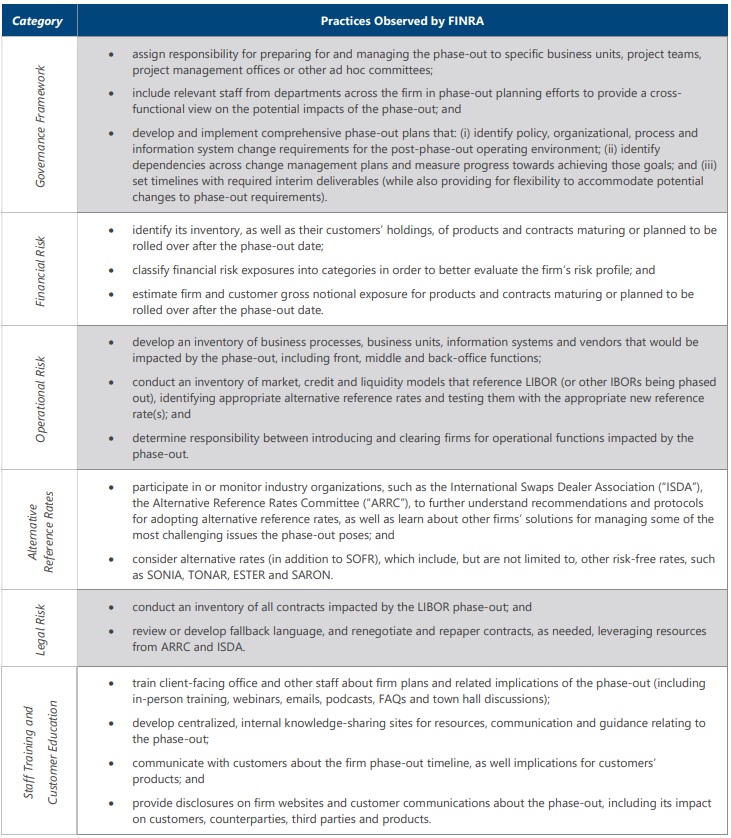

The results of FINRA's survey found that while some firms had taken material and concrete actions to prepare for LIBOR cessation, others had, as of yet, done little to prepare for the transition away from LIBOR. The chart that follows summarizes these results by categorizing certain common practices adopted by the surveyed firms.

If your firm has not already considered its approach to its transition away from LIBOR (or other IBORs), the time to begin is now. Regulators expect firms to be prepared for the December 31, 2021 phase-out date, and there is the potential for substantial exposure to risk if firms are not adequately prepared. The practices laid out by FINRA should serve as a good starting point, but each firm should tailor its LIBOR phase-out program to suit its needs.

Footnotes

1 FINRA, Regulatory Notice 20-06, FINRA Shares Practices Firms Implemented to Prepare for the LIBOR Phase-out (Aug. 5, 2020), https://bit.ly/3guzdrH.

2 See FINRA, 2020 Risk Monitoring and Examination Priorities Letter (Jan. 9, 2020), https://bit.ly/31o87w9.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.