Employee...or Independent Contractor? Many logistics companies "engage" individuals to work for them, classifying them as independent contractors rather than employees.

The nuanced distinctions between employees and independent contractors matter greatly, and recent court opinions and legislative actions have challenged these classifications. In the event misclassification is determined, employers may be liable for back wages like unpaid overtime, business-related expenses, and benefits dating back a number of years. Logisyn and Benesch have collaborated to tackle this topic to make sure you have the tools you need to prepare for a future M&A event.

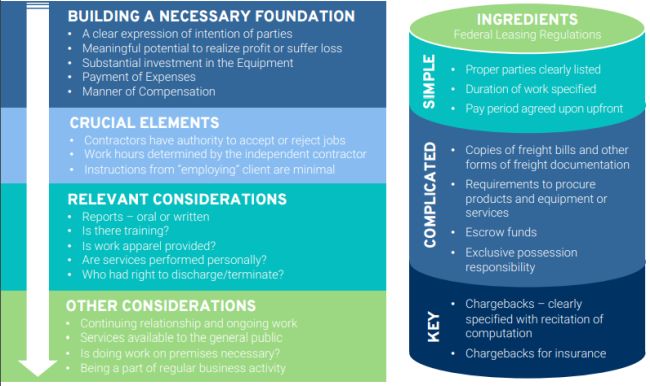

Distinguishing An Independent Contractor

Best Practices for Working With Independent Contractors

- Understand IC's make their own business decisions

- IC's have absolute ability to accept or reject jobs

- Ensure any company signage is easily removable

- Provide opportunities for negotiation

- Avoid long term loans or business coaching

- Respect IC's ability to work for others

- Recognize potential for profit or loss

- Provide incentives in exchange for branding vehicles/clothing with company logo

- Require IC's to obtain permits

- Provide for portability in equipment leases

How Does This Impact the M&A Process?

If the acquisition is a sale of stock...

Then the buyer will take on the liability for the misclassification even though it occurred before the acquisition. However, the purchase agreement will provide for the seller to indemnify the buyer for such liabilities, so they have a shared interest in avoiding such claims.

If the acquisition is a sale of assets...

Then the buyer may still be deemed to be a "successor corporation" for wage claims such as these. Again, the seller's indemnity provisions will align the buyer and seller in trying to avoid these claims

What You Can Do About It

Recommendations for Buyers

Conduct knowledgeable diligence of transportation and employment issues (including Federal Leasing Regulations compliance) to determine whether there are any existing or potential wage and hour claims, including misclassification, in order to identify the potential liability and assure that there is sufficient escrow holdback to cover any such claims is incredibly important. This process will also help to incorporate any necessary re-classification, changes to operating structure, or improvements of contracts and processes, that are essential post-closing into the integration planning process.

Recommendations for Sellers

Self-audit for these issues before taking the company to market in order to identify the scope of any potential liability for which they might have an indemnification obligation and, if possible, to correct the processes, paperwork, and classifications in order to prevent this from being an issue during deal negotiations or due diligence.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.