On December 28, 2015, the U.S. Department of Commerce, Bureau of Industry and Security ("BIS") published a proposed rule that would revise its guidelines on administrative enforcement actions under the Export Administration Regulations ("EAR"). According to BIS, the proposed rule seeks to make civil penalty determinations for violations of the EAR more predictable, transparent, and better aligned with procedures used by the U.S. Department of the Treasury, Office of Foreign Assets Control ("OFAC"). Perhaps most importantly, unlike the current BIS enforcement guidelines, which list only factors to be taken into account in determining appropriate enforcement for violations of the EAR, the proposed rule provides a systematic calculation method for determining the base penalty amount. A brief summary of the proposed method is provided below.

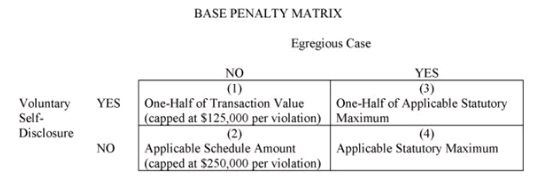

Under the proposed guidelines, BIS would first categorize an enforcement case as egregious or non-egregious and apply a different base penalty amount depending on whether the violations were voluntarily disclosed. BIS would base its determination of egregiousness on a number of factors but would give particular weight to considerations of willfulness or recklessness, awareness of the conduct giving rise to an apparent violation, and the harm done to regulatory program objectives. BIS would next determine how many violations of the EAR occurred and would then determine the base penalty amount based on three different values—the "maximum statutory amount" ($250,000), the "transaction value," or the "applicable schedule amount." An illustration of this approach is provided in the matrix below.

- Under the proposed rule, "transaction value" generally is defined as "the U.S. dollar value of a subject transaction, as demonstrated by commercial invoices, bills of lading, signed Customs declarations, or similar documents." The proposed rule provides that where the transaction value is not otherwise ascertainable, BIS may consider the market value of the items that were the subject of the transaction and/or the economic benefit derived from the transaction.

- Similar to OFAC's guidelines, under the proposed rule, the "applicable schedule amount" would be determined by referring to a table that lists several different amounts and provides a range of transaction values corresponding to each of the amounts. For example, the applicable schedule amount is $10,000 if the transaction value is at least $1,000, but less than $10,000.

Once the base penalty amount has been calculated, aggravating (e.g., willfulness or recklessness), mitigating (e.g., remedial measures taken), and other relevant factors would be applied to determine whether the base penalty should be adjusted downward or, subject to the statutory maximum, upward.

U.S. companies that export from the United States and non-U.S. companies that receive and/or re-export items subject to the EAR should expect higher penalties for violations of the EAR if the proposed guidelines are implemented. Public comments on the proposed changes are due on February 26, 2016. We are available to help companies understand how these proposed changes can affect their business and to assist in the preparation of comments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.