Background – The current position in the US

Since November 2008 when the Securities and Exchange Commission ("SEC") issued a proposed roadmap for the mandatory adoption of International Financial Reporting Standards ("IFRS") for public companies, there has been a significant level of speculation regarding the future of the US accounting framework. Detractors have continued to critique and criticize the IFRS framework for its lack of rigour compared with US GAAP and highlighted its failure to enhance comparability. Supporters, however, have continued to deliver a robust challenge to such views, while bigger questions around timescales and the conversion-convergence debate remain unresolved.

In its response to the SEC's roadmap proposal, the National Association of Real Estate Investment Trusts (NAREIT) has indicated that it 'believes that there are far too many open questions/issues regarding the adoption of IFRS' and 'strongly recommends the continued convergence of US GAAP and IFRS'. While NAREIT seems to be saying that US companies are not yet ready for IFRS, the idea is not being dismissed.

The comment period for the roadmap has closed and the outcome is eagerly anticipated. Mary Schapiro, the SEC Chairman, has confirmed that while she supports the notion of a single accounting framework for use worldwide, she will be deliberate in moving forward with IFRS but not feel bound by the current roadmap proposal.

Whilst the G-20 group of global leaders continues the push for standard setters to achieve a single set of global accounting standards, it is clear that a move to IFRS for US public registrants is high on the agendas of some key stakeholders – possibly sooner rather than later. And, with wide use of IFRS (in over 100 countries), any global framework is likely to be closely aligned with current IFRS.

Following adoption in Japan, all major economies will be using IFRS with the exception of the US. Sir David Tweedie, Chairman of the International Accounting Standards Board (IASB), has commented that global, economic and political pressures may force the US to adopt by 2011.

In 2005, Europe, Australia and South Africa adopted IFRS as the primary reporting framework with many others since following suit or setting a date for conversion. One of the most recent countries to initiate their conversion process is Canada, where IFRS reporting becomes mandatory in 2011.

Reception in Europe has been positive with many stakeholders believing that, on balance, IFRS has led to improved quality of financial reporting with many believing that the commercial reality of transactions is better reflected in IFRS than in other accounting frameworks.

Market context

All of this is happening in the context of an economic downturn which is adding further challenge to plans for near term transition to an IFRS framework. In particular, rightly or wrongly, the appetite of many to move to a principles based accounting standards framework that requires a greater use of fair value than US GAAP appears to have diminished. This presents dangers to both the ongoing march towards global financial reporting uniformity and to the more immediate practical concerns of those US Real Estate companies which are trying to prepare for their anticipated conversion. The potential costs of conversion and the distraction that IFRS may cause – at a time when focus on financial reporting rigour and quality of reporting to stakeholders are key – are top concerns.

With this in mind, it is vital that the maximum value is extracted from every aspect of the effort put into planning and executing the conversion process.

The European experience

Experience in Europe has evolved from one of "getting through conversion" to a colourful tale of four-to-five years spent bedding down a reporting framework into everyday life across a range of Real Estate companies – investors, developers, contractors and funds. We can look back on the process of getting through the initial adoption and learning from that process. But, having been running with IFRS as "business as usual" for some years, we also have a mature perspective on what is required to take a smart route through the transition period, what pitfalls were laid for us and how to conduct an efficient and effective transition and secure long term financial reporting process efficiency.

Our optimistic prediction for the US Real Estate sector is that it has the potential to follow a different conversion path from the European experience. Whilst we had to learn IFRS for Real Estate companies as we went along, the European experience can be leveraged effectively by US Real Estate companies. Engaging with those who have previous experience, whether of strategic input or detailed support, will lead to a more cost effective and time efficient conversion. That is why Deloitte in the US is involving our UK Real Estate team in discussions with clients and contacts – to bring to the table our practical experience of IFRS to help minimise the potential cost burden of the conversion process.

Following on from Deloitte's recent IFRS summit, we have taken the opportunity to share ten key lessons from our European experience of IFRS conversion for Real Estate investors and developers.

1. Conversion can be conquered

Pre-match nerves

Conversion is complex, time consuming and requires real commitment. There is no doubt that a substantial amount of planning is required to make it a success. But our overriding sense from the busy conversion window in Europe was that the process was not as painful as some feared it to be at the early implementation stages if the company had the right resources and advisors in place. Our experience was that company CFOs and finance teams suffered a degree of trepidation and indecisiveness as to where to begin for fear of starting in the wrong place. However, once they were immersed in the conversion process, they began to understand that it was not as daunting it was held out to be.

There are two problems arising from "pre-match nerves". First, companies may place undue weight on planning for those areas that appear complex. In practice, this apparent complexity may not be the reality and an ineffective plan may result.

Second, building up the tension around an IFRS conversion may create an over-engineered solution to some of the issues at hand. In the worst cases this is resource heavy and costly, and leads to an overly complex answer being embedded into the "business as usual" reporting state in subsequent years.

An area that was, more often than not, over-engineered in the conversion of Real Estate companies in Europe was tackling the classification of leases under IAS 17. Ultimately, a common sense approach to the principles of the standard, supported by some rational analytics, was the key to delivering an appropriately worked-through and accurate solution. Many companies lost time performing highly detailed calculations to support interest rates implicit in leases and analyses of land and buildings into their component parts, ignoring both materiality and a common sense perspective of where the accounting would end up.

Other areas which can be over complicated in Real Estate companies relate to pensions and other employee benefits as Real Estate companies usually have a low employee headcount and therefore material issues are fewer.

Ultimately, searching for common sense answers to the truly challenging accounting issues proved the right way to approach the IFRS conversion plan, and the right way to allocate resources to make it happen.

2. The European Real Estate experience versus other industry sectors

Highlighting difference

A significant amount of the press coverage about implementation of IFRS in Europe and the expected impact in the US has been focused on the impact "on companies" in general. However, Real Estate companies bring specific challenges whilst avoiding some of the other complex accounting issues that other companies suffer. Some of the areas where IFRS is most complex to apply relate to transactions that are rare amongst Real Estate companies.

Real Estate investors, for example, often are not as concerned with the complexities of accounting for multiple and diverse revenue streams, but these are routine issues in other sectors. Similarly, due to the centralised nature of many Real Estate operations, which have a low employee headcount, significant pension and benefit issues have been fewer in Real Estate than in other sectors. However, Real Estate has its own complexities that do (or should) give focus to the conversion process.

3. Getting the strategic plan right is fundamental

Building from solid foundations

The European experience of IFRS conversion really brought home the importance of a good strategic plan. Some of the key recommendations arising from the successful conversion processes we saw included the following:

Establish a steering committee

Setting up an internal steering committee will allow you to run the process effectively. The importance of having the right person leading this committee cannot be overemphasized. Selecting a strong leader with a vision, rather than someone with a tendency to get lost in the detail, will drive your process forward. In our experience, this does need to be an accountant – they may struggle with understanding some of the financial reporting implications, but equally importantly, they need to have the right personal qualities – to be a decisive decision maker and not be someone who gets bogged down in technical details.

By setting up this committee at the outset and conducting regular meetings you will be able to monitor your progress and deal with any issues in a timely manner. This committee should have regular interaction with the Board and Audit Committee to enable senior members of the organization to remain involved and engaged in the process. The committee should also engage with your external auditors.

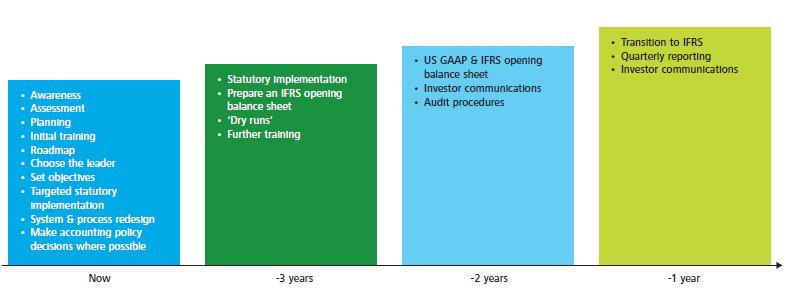

Set a realistic and informed timetable

Having formulated your planned approach and set up a committee to oversee your transition process, you will need to establish a clear and realistic timetable for progress and deliverables that all stakeholders believe in. We set out a suggested timetable on page 6.

Make the right accounting policy choices

In our experience, identifying areas of accounting policy choice and selecting the right choice for the company, before beginning data collection and analysis, commonly led to a more efficient process. The right choice needs to reflect consistency with other accounting policy choices, practicality of implementation in the long term and investor and peer group views.

This should be driven from the central finance team of larger organisations. It's a great opportunity to streamline your accounting policies across your entire group, especially if you have overseas operations where IFRS is already being applied.

Engage the right people

The broader implications of IFRS are often underestimated. In lesson 6 below, we set out some of the key people within your organisation that may need to be brought into the project from the outset.

Peer group views have also been important in the conversion to IFRS and evolution of practice thereafter. In Europe, members of various companies' steering groups would meet regularly to share their experiences and discuss the accounting policy options available to them – either through informal meetings or via industry bodies such as the British Property Foundation ("BPF") and the EPRA.

Learn from the experience of others

The greatest resource you can find is someone who has been through the process before. To enlist those from both within your organisation (for example, those who already apply IFRS in accounting for overseas operations) as well as from outside will help you build a team that will be able to bring the benefit of their experiences to your conversion.

Create documentation that will stand the test of time

Updating existing documentation and processes to make sure you capture the right information in a way that is efficient for your business will allow you to focus on more important operational matters and embed the IFRS differences quickly.

Focus on disclosure in addition to recognition and measurement issues

The presentation and disclosure changes may be significant. You will have several key deliverables to produce as part of your conversion and ongoing reporting, including restated financial statements. As the comparative balances are already there and ripe for amendment, don't hold off putting pen to paper and making changes as early as possible. In Europe, financial statements grew by 50-100% on conversion to IFRS. The additional required disclosures create further information needs and puts pressure on the timetable.

A timetable stakeholders believe in

A structured and well planned transition will likely be more time and cost efficient. A realistic timetable will form the basis of an effective transition.

4. Define the big issues early

Drawing the map

One of the first priorities for any steering committee is to define the big issues early – in our experience this is important enough to draw out as a separate recommendation.

Define the big issues early

The steering committee should ensure key issues are identified and set a strategy to address these:

- Valuations.

- Industry performance measures and educating stakeholders.

- Tax.

- Financial Instruments.

- Presentation and disclosure.

The benefits we saw to companies adopting this measured approach included:

- A more cost- and time-efficient approach overall, enabling project costs to be spread and use of outside resources to be limited.

- A better thought-out process – the objective should be "no surprises".

- A practical process with less need for separate project team. Individuals running the detail of the conversion would also implement and take responsibility for the changes going forward.

- A well-communicated transition plan for investors and analysts.

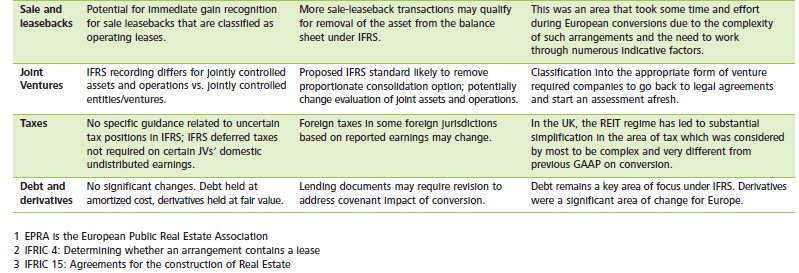

When Europe went through IFRS conversion, there were a large number of changes between IFRS and local GAAP. Derivatives on balance sheet, hedge accounting, properties at fair value, full provision for deferred tax on property revaluation gains and a host of other fundamental differences had to be assessed in the conversion process for Real Estate companies.

Focusing on the really significant GAAP differences at the planning stage was central to success, as was an avoidance of over-engineering the process or a particular area. We believe this analysis was best approached on a standard-bystandard basis, as this tended to lead to a more complete analysis compared with an account balance-by-account balance approach.

We found that key areas of technical complexity were around corporate structures, sale and leasebacks and, for us, derivatives. In contrast, easy wins included a pragmatic approach to business combinations and goodwill, few componentization issues and widespread adoption of a transparent fair value framework.

A key area commonly missed, however, was presentation and disclosure matters which, contrary to expectations, took a very significant portion of the IFRS conversion effort to get right.

5. An opportunity for consistency across the industry – and to deal with the valuation issue once and for all

Showing your worth

One of the most critical differences for Real Estate companies between IFRS and US GAAP is the policy choice between the fair value and cost models for investment property. In the UK, investment property (and, in many instances, development property) were already held at fair value and the change to IFRS had little impact on balance sheets. Elsewhere in Europe, where cost bases were the norm, the move represented a significant opportunity to change to, what many consider, a more meaningful representation of property on the balance sheet. A significant proportion of companies in those jurisdictions moved to a fair value model.

In the UK, where it was already common for valuations to be performed at each reporting date (i.e. semi-annually), this practice has simply continued. This has cost implications but also brings substantial advantages around embedding a regular and consistent valuation approach into the reporting cycle and the benefits this can deliver to management reporting and improved transparency of property performance and decision making.

Current practice in the US is mixed, with public Real Estate Investment Trusts commonly taking a cost approach, while Real Estate funds already use a valuation model based on either external valuations or internally generated valuations.

Clearly this area will be no small step for US public companies, whatever accounting policy choices are made, so engaging early with this element of the process will be key.

6. Engage the right people

Who do you need on your side?

Within European companies, the demand of IFRS conversions on functions outside the accounting team was often underestimated. IFRS is not just about accounting – it affects a wide range of functions.

Human Resources

For the core Human Resources function, three of the key impacts in Europe involved benefits, training & use of specialists.

Benefits

IFRS accounting for benefits, such as stock option plans, was new and complex for European converters. In Europe we saw some companies engaging their HR function to re-design stock based compensation plans to avoid cash-settled accounting for example. Whilst US GAAP is close to IFRS in stock based compensation accounting, IFRS has a wealth of rules and guidance across a range of employee benefits and ensuring the HR function is abreast of the impact and the data requirements on them is key.

Training

In terms of training, giving staff timely training on IFRS and communicating the transition process was a time-consuming but worthwhile investment. We found it was important to make sure this training was adequately focused on both the short term process but also on longer term principles and processes so that staff learned how to run the business-as-usual. This frequently meant broader training was required for a wider range of individuals at the start of the process but it often led to a more holistic and considered approach.

Use of internal and external specialists

Secondments within and into companies were common during conversion and enabled companies to benefit from experience they could not otherwise access. Where you are considering using external specialists or employees from overseas operations to assist on a short-term basis, planning how you retain the knowledge and expertise within your organisation will be critical when advisors and consultants depart. We found that the "accounting manual" became an even more important tool to help document and retain the deep knowledge gained through the conversion process.

Tax

We found that many of the measurement and presentation changes brought about by IFRS around, for example, lease accounting, property accounting, derivatives and revenue recognition, had important tax consequences. Fully engaging the company's tax professionals in the IFRS conversion plan was not just about having a full and balanced conversion team but was essential to protect against unexpected tax consequences.

Treasury

In the treasury area, the impact of measurement changes in the financial statements on debt covenants required thought, communication and, in some cases, amendment to lending documents. The additional disclosures required for financial instruments also created significant work for treasury teams. In Europe, we also had to deal with hedge accounting for the first time, which will be less of a step-change in the US. Nonetheless, we found treasury teams to be one of the most stretched teams during conversion.

Legal

We found that converters needed to focus more than expected on corporate structures and transactions as the requirements of the consolidation related standards in IFRS had a number of impacts on the accounting. In this area and in others, we found a significant requirement to go back and revisit contracts and agreements in detail to re-confirm the accounting adopted. Putting the legal team on notice was important.

IT

Collating the necessary information and representing your financial information in your accounting systems may require your IT function to become involved in the transition process. There is also an outstanding opportunity here as conversion provides a chance to get old systems up-to-speed and designed to meet longer term needs, although this does create additional pressure if attempted in parallel with conversion.

7. The importance of communication

It pays to talk

Europe reacted swiftly and, in many regards, as one to adopt stakeholder reporting practices that were understandable and consistent. Notably, companies took a straight-forward approach to dealing with increased volatility and additional "difficult to grasp" items hitting the income statement – by adjusting them out of their non-GAAP performance measures.

Such a rapid and consistently-applied response was achieved in part through regular, often quarterly, focus group meetings between CFOs of the major Real Estate companies. This collaborative approach ensured that communication with investors, analysts and other interested parties was more consistent and significantly reduced the possibility of an individual company adopting a measure or presentation approach that fundamentally differed from its peers.

Real estate professional bodies were also proactive in establishing guidelines for the appropriate presentation of such measures. EPRA, which works closely with NAREIT, led the way through the European conversion period and worked towards the introduction of recommended bases for the calculation of key metrics such as adjusted earnings per share. This had the effect of committing the industry to consistent and comparable key performance indictors.

8. Keep up-to-date with open matters and developments

Be at the front of the pack

In the aftermath of conversion, staying informed has been the biggest lesson. The IASB continues to improve and amend existing standards. Improvements issued in 2008 and applicable in 2009 have already fundamentally changed the approach to accounting for properties acquired for future use as investment properties by aligning the accounting approach with completed investment properties. The IASB is also working closely with the Financial Accounting Standards Board ("FASB") on convergence projects including key topics such as revenue recognition and leasing. Proposed changes could have sweeping implications for accounting, tax and commercial aspects of Real Estate companies.

For these reasons, keeping up-to-date with the changing face of IFRS has proved to be vital in the pre- and post-conversion period for European Real Estate companies. There are many resources available to assist you, we have listed some on the back of this document.

A consultative process was generally the most effective – both within the industry group framework and with contacts and advisors.

9. Look out for common pitfalls

Know your enemy

In Europe, we encontered a number of potential hazards. These included:

Lack of direction from the top

The 'tone from the top' is of primary importance. When the Board and senior management drove this process we found staff were more engaged and embraced the process as an organization-wide mission.

Lack of connection with the bottom

We also found lack of connection with the supporting teams at lower levels. At transition, IFRS conversion in Europe was commonly approached top-down, with a large number of companies retaining previous GAAP accounting in subsidiary financial statements. Lack of engagement with subsidiary accounting functions, particularly where they operated semi-autonomously or overseas, was a common cause for delay and frustration. On an ongoing basis, where IFRS adjustments are handled top-side, a disconnect between the head office and subsidiary operations can make the production of IFRS financial statements inefficient. Ensuring all of your local teams understand the requirements of IFRS will enhance the information they provide to you; not only at conversion, but on an ongoing basis and promote a smooth and efficient reporting process.

Starting late

Starting the conversion process late was a common issue frequently resulting in a more costly and time-consuming transition. This was compounded by a lack of lead-time for European conversions and a greater level of contemporary evolution of standards. The more up-front planning you can do, the better you will embed a longer-term process.

Failing to achieve completeness

This was something we encountered quite often. Overall, we found that approaching an analysis of IFRS differences on a standard-by-standard basis rather than an account balance-by-account balance basis was more successful at promoting completeness.

Focusing on presentation and measurement – but not disclosure

Disclosure is a significant aspect of IFRS. Many European Real Estate companies fell into the trap of becoming highly focused on detailed computations, especially leasing, but not giving enough consideration to disclosure matters. This put pressure on the process in the later stages when the financial statements had to be prepared rapidly.

Business-as-usual was not a core objective

Not achieving a business-as-usual state in year one of conversion led to ongoing cost and resource issues in subsequent years. The constrained implementation time available for conversion in Europe, due to late resolution to mandate conversion, resulted in short-term fixes and resource-heavy solutions. IFRS reporting processes, information systems and documentation had to be substantially improved in subsequent years in order to fully embed IFRS into the day-to-day activity of the business.

10. Make use of resources

Don't be afraid to ask

European corporate advisors have a distinct advantage – we have already learned IFRS through training and rigorous implementation; we don't need to re-learn it when we assist overseas companies with their conversion processes. Europe's professional advisors played a vital role in ensuring a smooth transition to IFRS.

In the US, the key to taking forward the conversion process is consultation and sharing. That is why Deloitte LLP (UK) is engaging directly with the Deloitte US firms and clients of the Deloitte US firms and the Deloitte Touche Tohmatsu network to offer advice and support. Your Deloitte contacts are ready to help you.

Deloitte offers companies assistance with:

- Evaluating the potential impacts of IFRS.

- Assessing readiness for IFRS conversions.

- Implementing IFRS conversions, providing support with technical research, project management, and training.

- Addressing the implications of IFRS in areas such as tax, finance operations, technology, and valuation.

Deloitte's Online Resources

For a wealth of online resources related to IFRS, visit www.deloitte.com/us/ifrs . Available materials include newsletters, whitepapers, pocket guides, timelines, webcasts, podcasts, and more.

www.iasplus.com is the international Deloitte resource for IFRS preparers and contains 700 web pages and 4,000 downloadable files. With free access, it is one of the most visited IFRS resource sites globally, and is used by our clients and Deloitte personnel on a regular basis.

International Accounting Resources

The IASB develops international financial reporting standards for general purpose financial statements. Visit the IFRS section of www.iasb.org for additional details and copies of the standards.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.