The extent to which branches may recover VAT has always been unclear. Most of the uncertainty stemmed from the fact that it was not entirely clear whether the turnover of a head office should be included in the computation of the input VAT deduction right of a branch, in particular where the two are established in different EU member states.

Background

As a general principle, VAT incurred on costs directly linked to activities that give right to input tax recovery is fully recoverable, whereas VAT on costs incurred for activities that do not give right to recovery is not. The remaining costs, those that cannot be allocated to a specific activity (so-called "general expenses" or overheads), are subject to a partial deduction based on the overall activity of the company.

The most commonly used apportionment method is the general pro rata one, whereby a ratio is computed by dividing the turnover that gives right to input tax recovery by the total turnover within the scope of VAT.

In a head office / branch situation, the question arises as to what extent the turnover of the head office and / or the branch may be taken into account when calculating the pro rata.

Where both the head office and the branch are located in the same country, given that both are considered the same legal entity from a VAT perspective, it seems natural to take into account their combined turnover. Where both are located in different EU jurisdictions, things may be more complex as input tax recovery rights are not always harmonised.

In 2013, the Court of Justice of the European Union (CJEU) held in the Crédit Lyonnais case that a head office could not include the turnover of foreign branches when calculating its general pro rata1. Guidance was provided at the time regarding the method for head offices to determine their VAT recovery position but we have had to wait until now to obtain clarification with respect to how branches should do it.

Findings of the Morgan Stanley case2

If we apply the same reasoning as in the Crédit Lyonnais

case, the turnover of the head office should not be relevant for

calculating the general pro rata of a branch located in a different

jurisdiction.

In the Morgan Stanley case, the reasoning of the court was slightly

different, as the general expenses incurred by the branch were used

(in part or fully) by the head office to carry out its economic

activity.

Where the overheads of the branch are exclusively and directly linked to the activity of the head office, the CJEU held that the deductible proportion is the total turnover of the head office that gives the right to recover VAT and that would also give the right to recover VAT in the country where the branch is located, divided by the total turnover of that head office within the scope of VAT.

Illustration with a Luxembourg established branch:

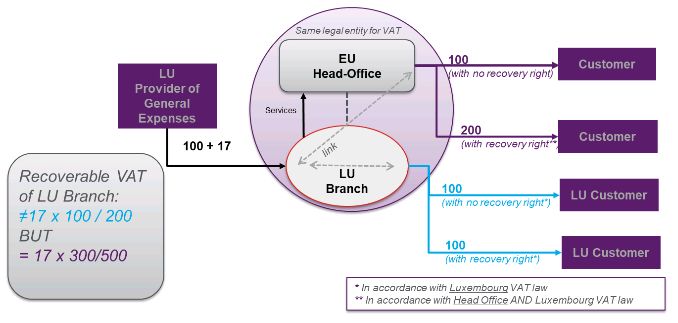

On the other hand, the Court provides for a different method where the general expenses are used for both the activity of the branch and the head office. In such a case, the deductible proportion is the total turnover of the branch plus the total turnover of the head office that give the right to recover VAT and that would also give the right to recover VAT in the country where the branch is located, divided by the total turnover of the head office and of the branch within the scope of VAT.

Illustration with a Luxembourg established branch:

The "double layer" test

It appears from the judgment of the CJEU that there is a double condition for a branch to include the turnover of its head office in the numerator of the pro rata used for calculating the amount of input tax that it can recover on costs linked (at least partly) to the activity of the head office.

This dual requirement is that not only the turnover gives the right to input tax recovery in the country where the head office is established but also that it would give the right to input tax recovery had it been subject to VAT in the country were the branch is located.

This has a limited positive impact for branches that incur costs used by the head office if part of the head office's turnover would not give the right to recover VAT had it been realised in the country of the branch.

Practical impact

The Morgan Stanley case brings long-awaited guidance when it comes to calculating the input tax recovery of branches. However, the judgment is not as positive as one could have expected and questions remain.

The remaining issues derive mainly from the fact that input VAT deduction on costs incurred for the supply of services or charged by a branch to its head office is denied since no supply is deemed to take place within the same legal entity, even though the costs are ultimately used for activities that may give a right to recover VAT. If the services provided by the branch to the head office were taxable, the issue would not arise and VAT on the costs should normally be fully recoverable at the level of the branch. Any limitation of the right to recover VAT on the costs in questions would ultimately be calculated at the level of the head office, hence the necessity to regard the branch as "transparent" where it comes to costs it incurred that are in fact used for the activity of the head office. The "double layer" test limits this reasoning and is therefore debatable, in particular given that the wording of the Court may be subject to different interpretations.

This may lead to VAT leakage in the case of a branch where VAT may be applied (therefore giving right to input tax recovery) in the country of the head office, whereas such an option is not provided for under the VAT law of the member state where the branch is located.

The application of the findings of the Skandia3 case may partly solve this issue by subjecting to VAT services between head offices and branches if either or both formed part of a VAT group in their local jurisdiction. In the above case, this shifts the VAT burden to the head office, which can therefore recover it according to its local rules.

The Court is also silent as to whether the turnover of the head office is relevant where the latter is established outside the EU.

Finally, the fact that branches may take the turnover of their foreign head office to determine how much VAT they can recover on costs ultimately used by that head office raises the question as to whether the opposite may also be true.

Footnotes

1 1 Le Crédit Lyonnais v Ministre du Budget, des Comptes publics et de la Réforme de l'État, C-388/11, 12 September 2013

2 Morgan Stanley & Co International plc v Ministre de l'Économie et des Finances, C-165/17, 24 January 2019

3 Skandia America Corp. (USA), filial Sverige vs Skatteverket, C-7/13, 17 September 2014

Dentons is the world's first polycentric global law firm. A top 20 firm on the Acritas 2015 Global Elite Brand Index, the Firm is committed to challenging the status quo in delivering consistent and uncompromising quality and value in new and inventive ways. Driven to provide clients a competitive edge, and connected to the communities where its clients want to do business, Dentons knows that understanding local cultures is crucial to successfully completing a deal, resolving a dispute or solving a business challenge. Now the world's largest law firm, Dentons' global team builds agile, tailored solutions to meet the local, national and global needs of private and public clients of any size in more than 125 locations serving 50-plus countries. www.dentons.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.