The attractive tax regime for investment into UK commercial real estate by foreign investors is changing. Foreign investors and their advisers should now consider if traditional structures remain effective, in light of new UK Government proposals being introduced in both April 2019 and 2020.

Tax on Rental Profit

- Overseas investors who are not tax

resident and do not carry on a trade in the UK are only liable to

pay basic rate income tax (currently 20%) on rental profits during

their period of ownership of a UK commercial investment

property.

To achieve the favourable tax treatment outlined above, it is important to use an offshore company to acquire the UK property and that the company is managed and controlled in a manner that ensures it remains resident outside of the UK for tax purposes.

- Where an investment is made in the

name of a non-resident individual, applicable tax rates are

equivalent to the UK income tax rates (up to 45%).

The UK Government has announced that it will bring non-UK resident companies with UK property income within the scope of corporation tax from April 2020. This will mean that UK rental profit will be subject to UK corporation tax at a rate of 17% (the anticipated corporate tax rate in April 2020).

Implications of Falling Within the UK Corporate Tax Regime

While the lowering of the tax rate is positive, falling under the UK corporation tax regime will mean that, from 2020, the UK's corporate interest and loss restriction rules will be relevant:

- The corporate interest restriction

rules restrict a group's deductions for interest expense and

other financing costs to an amount commensurate with its taxable

activities in the UK. The rules will apply to groups with a

net interest expense of more than £2million per annum and

could significantly restrict the deductibility of financing costs,

leading to a significant increase in tax liabilities.

- The corporate loss restriction rules restrict a group's deductions for carried-forward losses to £5million. Above the £5million allowance, only 50% of profit can be covered by carried-forward losses. While this rule may not have such a significant impact as the interest restriction rule, the impact should be considered.

Capital Gains

Currently where a non-UK resident investor acquires a UK commercial property for investment purposes, any capital gain arising on a subsequent disposal of the property will not be subject to UK tax.

From April 2019, non-UK residents holding UK commercial real estate will be subject to UK tax on their gains. This means that from that date almost all non-resident owners of UK land will be within the scope of UK tax on gains, including "widely held" investment funds. This brings the UK into line with most other tax jurisdictions and the concept that land should be taxed where it is situated.

The precise rules are not yet known, but if the rules introduced for the taxation of residential property are followed there is likely to be a rebasing of the cost of the property at April 2019, meaning that only gains from that point onward will be charged to tax.

The new rules will also apply to sales of interests in "property rich" vehicles – that is, entities that derive at least 75% of their gross asset value from UK land. Gains on the disposal of any interest in such a vehicle amounting to 25% or more will become liable to UK tax.

Property Developers and Traders

In 2016, anti-avoidance rules were introduced to counteract any claim that a development or dealing trade relating to UK property was actually being carried on outside the UK, and therefore not subject to UK tax.

Profits from a development project are therefore within the scope of income tax or corporation tax, depending upon who is carrying it out. These rules also apply where there are arrangements to sell the development company, rather than the land itself. They apply where shares (for example) are sold and they derive at least 50% of their value from UK land.

Stamp Duty Land Tax (SDLT)

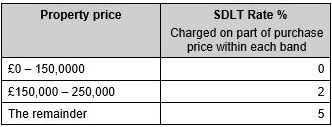

Acquiring a UK commercial property directly incurs a charge to SDLT (a purchase tax) as follows:

No such tax generally arises when acquiring a company that itself holds UK property. As a result, there is benefit in acquiring and disposing of UK commercial property via a company vehicle, particularly where that company is based offshore in a jurisdiction that does not charge transfer tax on share dealings.

Value Added Tax (VAT)

The sale of a freehold or long leasehold title to a commercial property will, by default, be exempt from VAT. However, property owners have the option to 'opt to tax' their property, which may make the sale of that property subject to VAT (but, as a consequence, also entitles the property owner to claim credit for VAT charged to them on their overheads).

This is a complex area and, when acquiring UK commercial property, due diligence will therefore be required to establish whether the property is subject to VAT or not, and what impact this may have for the purchaser.

On Death - Inheritance Tax (IHT)

From 6 April 2017, all UK residential property, whether held directly or indirectly, became liable to UK IHT (with the exception of property owned by diversely held vehicles). UK commercial property held directly by an individual is similarly liable to a UK IHT charge; however, commercial property held via an offshore company is not.

There is, at this time, no indication that commercial property held indirectly through a company or similar vehicle will give rise to an exposure to UK IHT; however, in light of recent changes this might be a logical next step.

How Dixcart Can Help?

Dixcart can assist with reviewing existing UK commercial property ownership structures to determine any impact the changes might have and whether action is required to restructure such investments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.