Within the current economy, the role of Information Technology (IT) has taken centre stage in many business functions. In addition, a large number of firms have undertaken the development of their own IT systems (software/hardware) either as part of mainstream product development or as part of their effort to improve internal processes and operations. Consequently, activities such as software development are not just confined to software houses; indeed firms in the non-IT sectors such as finance, leisure and retail also develop their own software.

Is R&D for the "staff in lab coats"?

There is a common misconception that the term Research and Development (R&D) for tax relief purposes only relates to progressive 'blue sky' research activities. The latest Department of Trade and Industry (DTI) guidelines, published in March 2004, state that R&D for tax relief purposes takes place when a project seeks to achieve an advance in science or technology. This widens the scope of activities that could potentially be categorised as being R&D, i.e. as long as the project(s) can demonstrate an advance that is a departure from conventional knowledge.

Are you losing out?

IT development, whether as part of a mainstream product development or the support function, requires substantial investment of time and money. In addition, such activities often carry major risks and technical challenges. It is therefore not surprising that such development activities require the resolution of technological uncertainties, in addition to the management of risk.

Within the non-IT sector, software development often focuses on improving current processes and/or improving legacy systems in line with current working practices and legislation. This can create challenges which the IT development teams must overcome by formulating an advanced solution to the problem.

It is therefore very likely that regardless of the business sector, IT development activity within a company could be categorised as R&D and qualify for tax relief, enabling further investment in the development activities.

Examples of potentially eligible IT activities

The following is a list of activities that could potentially involve R&D:

- integration of telephony and voice technologies

- smartcard interfacing with other devices

- integration of mobile technologies such as pen-pad or mobile phones and

- improvement of processes/operations.

The primary criterion used to determine if an activity or a project qualifies as R&D is the presence of scientific or technological uncertainty and risk.

What constitutes technological uncertainty?

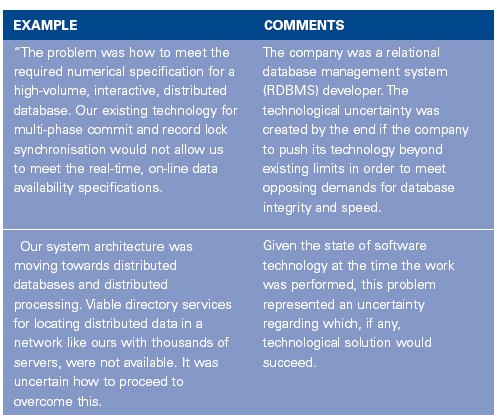

The examples below illustrate how technological uncertainties can manifest themselves within typical IT development projects:

Qualifying activities

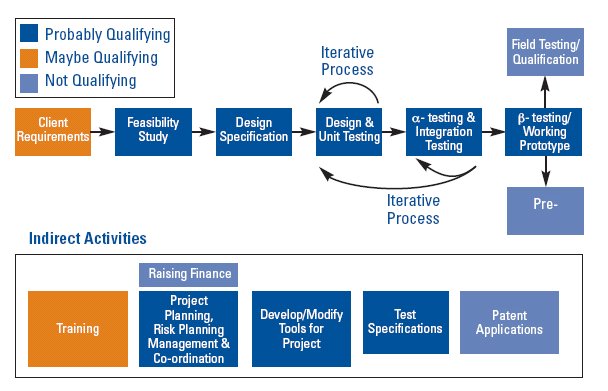

The project life-cycle diagram (below) highlights activities that could attract tax relief by potentially qualifying as R&D. The development program may be based on a Gated Development process whilst the software development could be based on a Waterfall or an Iterative approach.

KPMG's R&D Tax Relief group in the UK

KPMG's multidisciplinary approach and considerable practical experience can put you in an appropriate position to determine the qualification of potential R&D expenditure, to possibly improve tax benefits and potentially save you money. By using a team consisting of Software Architects, Hardware engineers, tax and accounting professionals, KPMG can expeditiously review your company's R&D activities to help determine eligibility and help optimise the tax benefit.

The R&D Tax Relief Group in action

Recently a producer of a financial software believed that the work they conducted did not qualify for R&D tax relief. However a feasibility study by KPMG identified in excess of £1m in qualifying expenditure. In addition we were able to increase the claim for R&D capital allowances. These tax benefits made funds available for additional R&D projects, which can potentially benefit the long term future of the company.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.