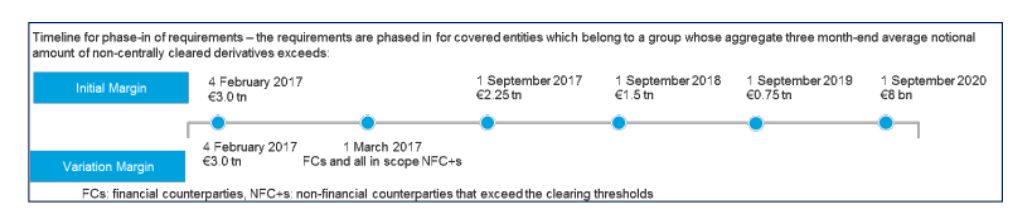

The implementation of the mandatory exchange of initial and variation margin for non-cleared OTC derivative trades in the EU commenced on 4 February for financial counterparties with the largest derivatives portfolios. The introduction of these rules – which was part of the G20's mandate to reduce the systemic risk posed by the OTC derivatives trading – is expected to lead to an increase in the cost of trading for non-cleared trades.

The rules will be phased in for the remaining market participants and those non-financial counterparties subject to the rules in accordance with the timeline below.

First wave firms have already had to deal with a number of implementation challenges, which means that there are a number of lessons learnt which are relevant to those firms subject to the requirements at a later date. This blog discusses some of these operational challenges and the actions that firms subject to the rules at a later date should consider taking to become compliant, if their implementation programmes have not yet achieved this.

Revisit documentation

Market participants will need to revisit their documentation ('repapering') in light of the introduction of the rules. In particular, firms will have to put in place new documentation for the exchange of initial margin and variation margin, increasing the complexity of documentation management.

Firms can negotiate the documentation bilaterally with every counterparty or implement standardised documentation with multiple counterparties reducing the operational burden of the 'repapering' exercise. The International Swaps and Derivatives Association (ISDA) has developed standard industry documentation in the form of regulatory-compliant credit support annexes (CSAs).

Whichever route they choose, firms will encounter difficulties in dealing with multiple legal documents, each of which has specific information (e.g. reporting currency or initial margin threshold) which needs to be taken into account when calculating sensitivities and exposure for counterparty credit risk. Ideally, legal agreements should be integrated into the firm's IT infrastructure. There are some early industry initiatives which aim to introduce utilities that could negotiate and capture CSA terms.

Initial margin model

Market participants will have to decide whether to follow the standard schedule – set out in the regulations – for calculating initial margin or develop their bespoke initial margin models, which require relevant technical expertise and regulatory approval (in the US, but also likely to be required as part of the EMIR review). ISDA has developed its Standard Initial Margin Model (SIMM) which would allow firms to calculate initial margin based on a single industry agreed model. Most firms are intending to use the SIMM to carry out their calculations as the savings are significant compared to the standard schedules, but without the costs or burden of seeking regulatory approval of a firm's bespoke model. Using an industry-wide standard model will also minimise disputes over the calculation of initial margin as bespoke models would often result in different amounts of initial margin to be exchanged between two counterparties.

IT infrastructure

The new requirements will add to the complexity of collateral management. Firms should consider updating their IT infrastructure, incorporating vendor solutions alongside existing systems. IT enhancements will be required to: segregate collateral; monitor re-hypothecated positions; calculate margin calls; track open positions so as to be able to model future collateral needs; and keep track of which instruments can be traded with which counterparties.

Policies and processes

Firms will need to consider updating their risk and collateral management policies to reflect the new requirements, specifically around the eligibility of collateral and the parameters of appropriate segregation requirements and preferred methodology (e.g. individual versus omnibus segregated account). They should also reflect the changes relevant to the appropriate use of pledge or title transfer agreements and the permissibility of collateral re-hypothecation and lending. These policies should also consider collateral eligibility parameters on a country-by-country basis.

Firms will need to define and implement new processes around how they classify an initial margin dispute (i.e. the threshold above which an initial margin difference will be considered as dispute), which internal functions are involved in remediation and how to align with external counterparties.

The increased importance of the operations function

The operations functions could now play a more active role as new regulations will require more expertise, for instance understanding the initial margin calculation, the collateral agreements, the eligibility criteria of collateral and collateral allocation amongst other things. The operations unit will also have to develop close links to the risk management function and the funding and capital valuation adjustments (XVA) desk. Firms could train their staff to develop the relevant expertise or bring on board relevant experts to supplement their teams.

Firms should also review their vendor partnerships and the mix of in-house versus third party solutions, as vendors could offer firms expertise in particular areas (e.g. valuation of collateral, dispute processes and reporting) or reduce operational burdens.

Conclusion

As the implementation date for initial and variation margin requirements approaches, it is imperative that affected firms, in particular those that belong to the second wave, gear up for compliance. Failure to do so will impede trading with other counterparties, disrupting derivatives activity significantly.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.