Against a backdrop of wavering business confidence across the professions, we look at some of the complexities of keeping firms’ and partners’ finances in order.

PROFESSIONAL PRACTICES SURVEY 2007 - CHANGING TIMES

Tracing the trends and attitudes within the legal and property sectors, Simon Mabey analyses the results of our 13th annual survey of professional practices.

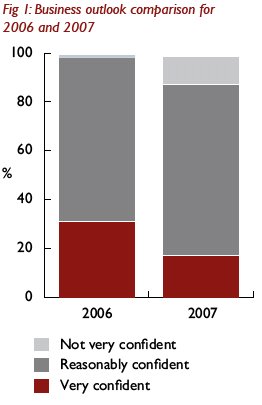

This year, our survey explored changing outlooks within professional practices. And, according to interviews with senior decision makers from 109 firms, business confidence is down for the first time in six years.

Our survey also suggests that firms face increased competition to recruit and retain quality staff. Perhaps as a result of this, there is significant interest in acquiring established teams from other firms.

Another trend appears to be a growing acceptance of the need for external capital – indeed the survey reveals that lawyers, as well as property firms, now see an Initial Public Offering as a means to raise such funds. With the introduction of the Legal Services Act, many in the legal sector are keen to see who will be the first to take advantage of the relaxation in the rules. Giles Murphy explores this further in the next article.

Fall in business confidence

While the vast majority (87%) of respondents are still ‘very or reasonably confident’ about the business outlook for the year ahead, this is a marked fall compared to last year when 98% said they were ‘very or reasonably confident’. As if to confirm this mood, participants report greater competition to win new work and difficulty developing new areas of business. Similarly, clients are putting more pressure on fees.

Vulnerable to the downturn

This year the survey took place as major concerns about the US sub-prime mortgage crisis and the consequent ‘credit crunch’ began to emerge in the UK; this backdrop undoubtedly influenced attitudes to the prevailing economic climate.

In considering which areas of business are most likely to be affected by an economic slump, it’s fair to say that, among law firms, those relying on mergers and acquisitions and transaction work appear most vulnerable. In comparison, where the focus is on litigation, private clients, arbitration or insolvency, law firms are less concerned about a downturn.

"Business confidence is down for the first time in six years"

The war for talent continues

The need to recruit and retain quality staff continues to be a major issue for both legal and property firms. The primary problem appears to be a lack of talented people, rather than lack of numbers, and this is contributing to rising overheads. Indeed, about half of all participants cited this as an area of concern, making it the most frequently mentioned difficulty facing individual firms over the next year.

Team acquisitions on the rise

As part of the drive to recruit the best talent and find new areas of profitable work, firms continually look to develop new practice areas or acquire teams from other businesses. In fact, almost two-thirds of firms (60%) reported that they had acquired a new team in the past two years. Of those firms that made such acquisitions, teams involved in real estate appeared most sought after, while those focusing on company commercial work or litigation polled joint second.

In general, newly acquired teams are soon profitable: 75% of those teams that changed hands were in profit within two years. It’s notable that most teams were fairly small. For instance, 48% of acquired teams included 2-5 people and 28% of teams included 6-10 people, whereas 15% counted from 11-20 individuals and only 6% contained over 20 new staff.

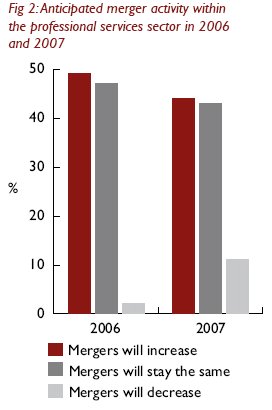

Confirming this trend towards team acquisitions, over three-quarters of firms (80%) admitted that they had either approached (or been approached by) another firm with a view to a potential merger or acquisition in the past two years. The equivalent figure last year was just 70%.

US in the UK

About half of the survey’s participants believe US firms will have an increasing role in the UK. Around a quarter of respondents believe that a US firm might try to raise funds through its UK entity, possibly by taking advantage of the new opportunities under the Legal Services Act. However, with many US firms now well established in London, participants no longer see them as a threat to their individual business.

PROFESSIONAL PRACTICES SURVEY 2007 - AN APPETITE FOR CAPITAL

Following the changes introduced in the Legal Services Act, Giles Murphy looks at what Smith & Williamson’s most recent survey tells us about law firms’ attitude towards external capital.

The opportunities to access external capital as an alternative source of funding for legal practices, as allowed by the Legal Services Act, seem to be gathering significant interest in the legal market, according to our professional practices survey.

Of the firms we surveyed, 57% believe that professional firms will seek to increase their financial resources through the use of private equity. This is a surprisingly high figure given that the objectives of private equity do not necessarily coincide with those of legal practices. Traditionally, we have not seen significant long-term use of private equity in ‘people businesses’.

New opportunities

Asked how the market would react to the Legal Services Act, half of those surveyed expect law firms to take advantage of the provisions of the Act and list their equity on a UK stock exchange. We also asked firms about their own plans. Of those surveyed, 25% said they are looking to raise external capital in the next two to five years. Out of these firms, 52% said they would consider using private equity – perhaps as a stepping stone to a listing. A third of the firms looking to raise external capital in the next two to five years indicated that they would consider listing their equity on a stock exchange.

There is an assumption in the legal profession that the first wave of law firms listing on a UK stock exchange will be from the larger UK firms. However, the recent listing of Slater & Gordon in Australia (a small law firm that would not rank within the top 80 in the UK) suggests this may not necessarily be the case. Our survey appears to support this view, since the majority of firms (77%) are planning to raise less than £20m – a relatively modest sum.

An alternative interpretation of the relatively small sums that firms expect to raise is that listing is seen as a way of realising value in the firm and creating liquidity in the equity, rather than as a route to raising significant amounts of additional capital.

TAXIS GETTING VERY TAXING - An Up-date On HMRC’s Late Night Taxi Policy

By Pam Sayers

As we reported in our August newsletter, there have been worrying developments in HM Revenue & Customs’ (HMRC) stance on tax concessions on late night taxis. We summarise the changes to HMRC’s guidelines and what they mean for firms.

In brief, for the exemption to apply the following criteria must be met.

- The employee is occasionally required to work later than usual, until at least 9pm.

- Those occasions are neither frequent nor regular.

- At the time of travel, public transport has stopped or it would be unreasonable to expect the employee to use it.

Where the above conditions are satisfied, no tax charge will arise for the first 60 journeys.

New guidelines launched

In new draft guidelines, introduced in August 2007, HMRC states that if an employee works late every night on a project, then only the taxi on the first night will be tax exempt. Also, if it is not unusual for an employee to work late at that time of year, the exemption will not apply.

This guidance is at odds with HMRC’s Employee Travel Booklet, which covers people for whom late night working is common – those employed in restaurants, or on regular call-out duty for example. The new guidelines also state that it is not necessarily enough for employers to claim that it is unsafe for employees to take public transport after 9pm.

The general consensus among the professions is that the draft guidelines are impractical and should not be applied retrospectively to any open cases. Following various representations, HMRC has agreed to produce revised draft guidance for further comment at some stage. Although there is no timetable for likely publication, HMRC’s response is welcome news.

Any firms that are being challenged on the late night taxi exemption should take these developments on board. As long as you have been applying the tests outlined above and can clearly demonstrate that you meet the criteria, any challenge should be refuted.

NEW SIPP FOR PROFESSIONAL PRACTICES

By Mike Fosberry

Partners in professional firms often club together through their pension funds to buy commercial property which, in many cases, is leased back to the firm. This can be both administratively complex and costly. Smith & Williamson is launching an innovative solution via a Partnership SIPP – a self-invested personal pension. This new SIPP will have lower annual fees and administrative costs than many similar arrangements and provides some interesting options when it comes to drawing benefits.

FOR WHAT IT’S WORTH - Insights into goodwill in partnerships – an accountant’s perspective

Mark McMullen explores some of the key issues that partnerships encounter when considering goodwill.

Goodwill is a nebulous asset and a complex area. Defined as the difference between the value of a business and the value of its separable net assets, it can lead to a host of issues.

There are three main ways that goodwill can arise: inherent in an established business, acquired on the purchase of a business or created on incorporation. Whichever type of goodwill has been created, similar issues are usually encountered.

Actual value difficult to define

Goodwill is an important consideration in professional firms, both within the partnership and in transactions with other firms. But defining its actual ‘value’ is often a point of debate. It depends on various factors including the earnings of the business, the hypothetical or prospective purchaser’s desired return on investment, and any premium he/she is prepared to pay for acquiring the firm and its earnings.

In a partnership transaction, where the purchase consideration is a profit share in the enlarged business, it is usually beneficial to allocate the consideration between payment for the business and compensation for future services.

How to write it off

Goodwill is not usually carried on the balance sheet of partnerships. And those partnerships that do include it usually do so at cost rather than at a revalued amount. International Financial Reporting Standard 3 requires that any goodwill arising be reviewed for impairment every year, whereas Financial Reporting Standard (FRS) 10 states that it be amortised over its estimated useful economic life, normally a maximum of 20 years. If there is impairment, the goodwill is written off to estimated, recoverable value.

The ‘write off ’ of goodwill, whether immediate or over time, can impact inequitably on partners where there are changes in profit-sharing ratios.

Dealing with ownership

It is best practice for the partnership agreement to specify ownership of goodwill. In most cases, members of a partnership own it internally. But in some instances, partners outside the partnership can own it personally.

Within a partnership, partners usually own goodwill in their (capital) profit-sharing ratios. Incoming partners usually acquire a share of this on admission and can be asked to pay for the privilege. Partners typically realise their goodwill on retirement or on sale of the business.

Level of protection

Most partnerships will take steps to protect their goodwill, particularly in international situations. At a basic level, this will involve protecting the name through registration as a trade or service mark and preventing local partners from exploiting the goodwill for non-firm benefits. At a deeper level, this includes the setting and monitoring of common quality control standards.

Tax considerations

On incorporation, the capital gain represented by the increase in the value of goodwill can usually, with care, be deferred and not give rise to an immediate charge.

Disposals of goodwill from changes in profit-sharing ratios are exempt from capital gains tax (CGT) under the Revenue’s statement of practice D12 – unless the goodwill has been revalued in the partnership accounts. In such circumstances, each change is subject to CGT. The combination of administrative complications and a tax burden make it relatively unusual to see revalued goodwill.

Retiring partners who receive a payment for their share of goodwill are subject to CGT on the disposal, currently at rates of between 10% and 40% depending on availability of business asset taper relief. This will change to a flat rate of 18% with effect from 6 April 2008, if the current proposals are enacted.

For long-established firms, the base cost of goodwill is dependent on its valuation as at 31 March 1982. It is important to maintain records to justify such a valuation.

Stamp duty, stamp duty land tax and VAT are not normally problematic for goodwill.

Where there’s a will…

Goodwill is a complicated area and the above points are just some of the many factors to consider in partnerships. Clearly, the treatment of goodwill will vary depending on the nature of the business, how long it has been established and the individuals involved. However, in most situations, expert professional advice is essential to arriving at an amicable, and profitable, treatment.

ALL CHANGE - COMPANIES ACT 2006

Jeff Selden looks at the Companies Act 2006 and its impact on LLPs.

The Companies Act 2006 received Royal Assent in November, and its provisions are already being implemented. Earlier this year the Government, by way of the Department for Business Enterprise & Regulatory Reform (BERR), consulted on how best to apply the Act to limited liability partnerships (LLPs).

BERR has now issued a further consultation paper setting out specific proposals. The paper proposes that the provisions of the 2006 Act should be applied as far as possible to replace the provisions of the Companies Act 1985 currently applied to LLPs. Two examples of changes in the 2006 Act, which are proposed to apply to LLPs, are shortening the deadline for filing accounts at Companies House from ten to nine months, and removing the exemption from preparing consolidated accounts for medium-size groups.

With respect to auditors, the paper proposes that the ‘senior statutory auditor’ sign the audit report in his/her own name on behalf of the audit firm. It also introduces a new criminal offence of ‘reckless auditing’, which is punishable with an unlimited fine. The provisions on limiting auditors’ liability will not apply to LLPs.

Due to the fundamental differences between LLPs and companies, the duties of directors as set out in the 2006 Act will not apply to members of an LLP.

The consultation paper states that the majority of changes proposed for LLPs will be implemented in October 2009, with the following three exceptions.

- Part 15 (Accounts and Reports) will begin in October 2008, apart from the rules on filing deadlines and penalties, which will be implemented for accounting periods beginning after 6 April 2008.

- Part 16 (Audit) will start in October 2008.

- Provisions relating to e-communications will begin in October 2008.

We expect BERR to issue further proposals on timetable and content in early 2008.

PENSION PLANNING - MAKING THE MOST OF YOUR ANNUAL ALLOWANCE

Paul Garwood explains how partners and other high earners may be able to use their annual pension allowance twice in one year.

Although individuals can get tax relief on pension contributions of up to 100% of their earnings in any tax year, if they exceed their annual allowance they will be liable to 40% tax.

As a result, high earners are effectively capped by this allowance – £225,000 gross in 2007/08, rising by £10,000 per year to £255,000 gross in 2010/11. Future increases will be at the discretion of the Treasury. This all looks quite straightforward, but closer scrutiny reveals that it is possible to double up on the annual allowance with careful planning. This is because the annual allowance test is undertaken with reference to ‘pension input periods’ (PIPs) ending at any point in the tax year. By contrast, tax relief is granted with reference to earnings and the contributions an individual actually pays in the tax year.

How it works

To find out whether the annual allowance has been exceeded in a tax year, contributions to money purchase schemes and the deemed value of defined benefit accrual are combined to calculate an individual’s pension input amount for all PIPs ending in that tax year. If the total ‘pension input amount’ for PIPs ending in the tax year exceeds the annual allowance, the 40% annual allowance charge applies. Strictly, the PIP for a new plan commences when the first contribution is made after 5 April 2006 and ends on the anniversary of that date, unless the member notifies the scheme administrator of an earlier end date.

If, for example, the first contribution after 5 April 2006 is made on 1 December 2007, the first PIP will end on 30 November 2008. As this falls in the 2008/09 tax year, the pension input amount will be tested against an annual allowance of £235,000 gross, not £225,000 gross. While this gives an additional £10,000 capacity compared to a PIP ending in 2007/08, it also means that the 2007/08 allowance is unused. This could be problematic if the individual is close to retirement and wishes to maximise his/her contributions.

Planning opportunities

The ability to nominate the first PIP end date presents an opportunity for high earners to double their contributions in one tax year, providing they have sufficient earnings. This is achieved by contributing £225,000 gross into a new plan and nominating the PIP end date as, say, 31 December 2007. As this is in the 2007/08 tax year, the contribution is tested against the annual allowance of £225,000 gross.

A further contribution of £235,000 gross can then be made to the same scheme between 1 January 2008 and 5 April 2008. This PIP will end on 31 December 2008 and the contribution will be tested against the 2008/09 annual allowance of £235,000 gross.

As tax relief is granted with reference to the tax year of payment, not the PIP, the individual will receive relief on contributions of £460,000 gross in 2007/08, providing he/she has sufficient earnings in the tax year. Individuals will receive an automatic 22% basic-rate relief and can claim an additional 18% higherrate relief of £82,800 from HMRC. There will be no annual allowance charge as the individual will not have exceeded the annual allowance for either 2007/08 or 2008/09.

In an extreme example, it would be possible to pay pension contributions of £705,000 gross over four days, beginning on 3 April 2008, and obtain full tax relief without triggering any clawback. But this requires careful planning. It is vital, however, to ensure that any contributions paid into the same plan in the 2008/09 tax year are delayed until after 31 December 2008, and the PIP for 2009/10 has begun.

CALLING ALL OFFSHORE ACCOUNT HOLDERS

Trouble looms for offshore account holders following tax amnesty, says Alan Long.

Under the tax amnesty announced in April, offshore account holders were given until 26 November 2007 to come forward and make a disclosure, together with payment of outstanding tax.

HMRC launched the amnesty after it obtained information from the major banks about some 400,000 offshore bank account holders. A substantial amount of data was also gathered via the EU Savings Directive. Under the amnesty, individuals are only required to pay a penalty of 10%, in addition to the tax and interest due. Taxpayers are effectively able to wipe the slate clean.

So far, some 300,000 taxpayers have made the appropriate declarations and have nothing to fear. Of the balance, some 62,000 people have registered an intention to disclose, which means that at least 38,000 account holders have not. So what does the future hold for them?

HMRC expects to accept the majority of formal disclosures it received by 26 November. Those people will be notified of acceptance by 30 April 2008. But for those who chose not to register, the future does not look bright. HMRC will investigate as many as 2,000 cases per week. HMRC has also stated that some people will be specifically targeted for criminal prosecution, with the first cases reaching court by 2008.

Those investigated under civil fraud procedures could face substantial penalty fines; HMRC has said that it will make life uncomfortable. Individuals who are prosecuted may face imprisonment. Either scenario requires immediate specialist professional advice.

Recent reports suggest that HMRC may obtain further information about offshore account holders from other institutions in the new year and a further amnesty arrangement may follow. As yet, however, there has been no official announcement.

FRED 41 RINGS THE CHANGES

What will the introduction of FRED 41 mean when completing accounts? Jeff Selden reports.

In July 2007, the Accounting Standards Board (ASB) issued Financial Reporting Exposure Draft (FRED) 41 on accounting for related party transactions. This will result in a new standard replacing FRS 8. In turn, it will mean a number of changes to disclosures required in accounts.

FRED 41 primarily concerns companies and directors, but it will have an equal impact on LLPs and members as it will alter accepted accounting practices in the UK. The ASB introduced FRED 41 in order to meet the requirements of European Directive 2006/46/EC on Company Reporting, which seeks to increase confidence in financial statements. The aim is to ensure sufficient disclosure to help readers understand arrangements the business has entered into. We discuss the most significant changes below.

Disclose management personnel

FRED 41 will require compensation payable to key management personnel to be disclosed. Key management personnel are defined as "those persons having authority and responsibility for planning, directing and controlling the activities of the entity, directly or indirectly, including any director (whether executive or otherwise) of that entity".

This definition makes it clear that directors (or members) will be classed as key management personnel, but it is not exclusive to these individuals. LLPs will have to consider what constitutes the management team. In cases where the executive team includes non-LLP members, such as a non-executive chairman or finance director, it is likely that their remuneration will have to be disclosed.

Remuneration shown will be an aggregate for all key personnel, so details of each individual’s compensation will not be revealed. As well as a total figure, the compensation will need to be split into four categories.

- Short-term employee benefits – includes salaries, profit shares, bonuses and nonmonetary benefits (such as medical care, housing and cars).

- Retirement benefits – includes pensions or other retirement benefits, postemployment life insurance and postemployment medical care.

- Other long-term employee benefits – includes long-service leave, long-term disability benefits, profit shares, bonuses and deferred compensation not payable within 12 months of the period end.

- Termination benefits and share-based payments.

Other transactions with related parties

FRED 41 will require transactions with related parties in cases where "such transactions are material and have not been concluded under normal market conditions" to be disclosed separately. The disclosure must include the amount of the transactions, the nature of the relationship between the parties and "other information about the transaction necessary for an understanding of the financial position of the entity".

This will clearly lead to non-commercial transactions being given more prominence in the accounts. The disclosures will also include details about the transactions to which a reader would not currently be privy. r example, if members of an LLP own the business property in a separate entity and the rent charged is not at market rate, this, including the financial effect it is having on the reported results, would have to be explained.

Group companies

Currently, companies do not have to disclose transactions with other members of a group if subsidiaries are 90% owned. Going forward, subsidiaries will need to be 100% owned for the exemption to apply.

No need to disclose names of related parties

Under the proposed rules, requirements concerning the naming of a related party will be relaxed. Currently, the individual or company’s name must be disclosed. But under FRED 41, only the nature of the relationship must be disclosed.

BERR expects the standard to be effective from 2009.

FIVE TAX TIPS FOR PARTNERS

Sharon Templeman offers pre-year-end tax planning advice.

- Maximise your pension relief

- Give to charity

- Use a tax-free savings account

- ‘Shelter’ yourself

- Plan carefully for CGT

Make sure you’re using the annual exempt amount of £9,200 for 2007/08. But be careful – watch out for the new rules set out in the CGT Targeted Anti Avoidance Rule (TAAR) and 2007 Pre-Budget Report.

The CGT TAAR can restrict the availability of losses arising on disposals made on or after 6 December 2006, specifically in relation to ‘bed and spousing’ and ‘bed and ISAing’.

With effect from 6 April 2008, taper relief and indexation allowance will no longer be available for individuals, trustees and personal representatives. Instead, a flat rate of 18% CGT will apply. Therefore consider whether it is tax beneficial for assets to be disposed of before or after 5 April 2008.

Make sure you get full use of the current year pension relief. It’s equal to 100% of your earnings up to £225,000 in the 2007/08 tax year. Note that you can no longer carry back pension contributions to the previous tax year (although there may be ways in which the relief can be increased – see Paul Garwood’s article in this newsletter).

Make Gift Aid payments to charities before 6 April 2008. Also, check whether payments made in the following tax year could be related back.

Invest in tax-free investments, such as Individual Savings Accounts (ISAs) and National Savings. To make the best use of personal allowances and lower tax bands, you could transfer income-generating investments to your spouse or into joint accounts.

Consider using Enterprise Investment Schemes and Venture Capital Trusts. They provide tax shelter and deferral benefits for CGT and income tax. The new CGT rules mentioned below provide the opportunity to defer a gain arising in the last three years which has been taxed at 40% into an EIS. The gains should crystallise at the new rate of 18% thus providing 22% CGT relief.

USE YOUR CAPITAL ALLOWANCES BEFORE IT’S TOO LATE

Firms may be able take advantage of the new Annual Investment Amount before the end of the current tax year. – Pam Sayers

The 2007 Budget announced changes to the capital allowances regime, with the introduction of an Annual Investment Amount (AIA).

The current regime of First Year Allowances (FYA) for small to mediumsized enterprises will be replaced with the AIA. This will provide 100% FYA for up to £50,000 expenditure incurred on plant and machinery, with anything over £50,000 dealt with through the standard regime for capital allowances.

Reclaim your capital

Each unincorporated business (individuals in partnership or sole traders) will be able to claim an AIA, even where one individual owns several businesses.

The effective date for the changes to the capital allowances regime is 1 April 2008 for corporation tax and 6 April 2008 for businesses subject to income tax.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.