This quarter's CFO Survey is the first to be conducted since the announcement that the UK's EU membership referendum will take place on 23rd June. It shows a marked rise in support for the EU among Chief Financial Officers. 75% of CFOs say they believe it is in the interests of UK business for the UK to remain in the EU, up from 62% in the fourth quarter of 2015. 8% of CFOs favour leaving the EU, up from 6%. The EU scores high marks with CFOs for its beneficial effects on UK exports, inward investment and financial services. At the opposite end of the scale only 15% of CFOs think UK business and the UK economy benefit from the EU's legal, regulatory and compliance framework.

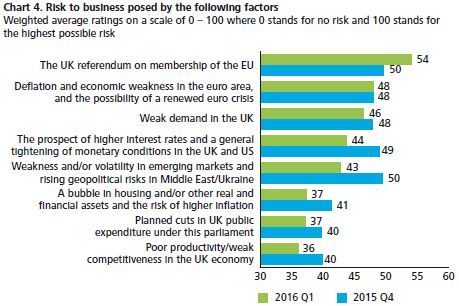

The dominant concern for CFOs is the forthcoming EU referendum. It tops the corporate worry list, eclipsing longstanding concerns about emerging markets and growth in the euro area. While CFOs see rising risks attached to the referendum, concerns around the other seven major macroeconomic categories of risk (see chart 4) have reduced or remained unchanged in the last three months.

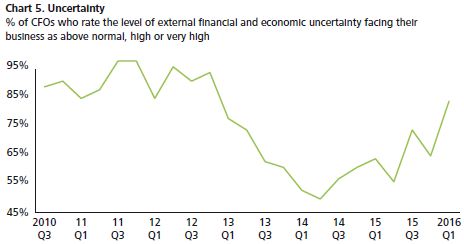

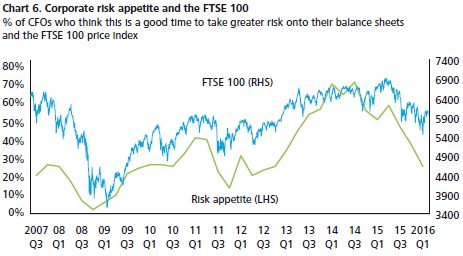

Growing concerns about Brexit seem to be behind a marked increase in CFO perceptions of financial and economic uncertainty. It now stands at levels last seen in early 2013, at the tail end of the euro crisis. Risk appetite has also suffered, with the proportion of CFOs saying that now is a good time to take risk dropping from 51% to 25% in the last year.

With the storm clouds gathering CFOs have maintained a focus on reducing costs and increasing cash flow. Enthusiasm for expansion has taken a knock too. Corporates are pulling in their horns, with expectations for hiring and capital spending at three-year lows.

Despite growing concerns about the forthcoming EU referendum, 53% of CFOs say they have not made, and are not in the process of making, contingency plans for a possible UK exit from the EU. 26% say they have made, or are making, such plans. It may be that the continued, albeit narrowing, lead for the 'remain' camp in the opinion polls, means that many corporates see a UK exit from the EU as being a fairly low probability event.

Focus on EU referendum

| A majority of CFOs

report that their businesses have not made, and are not in the

process of making, contingency plans for a possible British exit

from the EU. 26% say they either have such plans or are developing them. |

|

| A large majority of CFOs

think UK business and the UK economy have benefited from EU

membership in terms of improved export performance, facilitating

connections with other euro area nations and attracting foreign

direct investment. However, only 15% consider the EU's legal, regulatory and compliance framework as beneficial. |

|

Uncertainty rises

| CFOs rate the upcoming

referendum on EU membership as the greatest risk facing their

business. Deflation and economic weakness in the euro area, and

weak demand in the UK also remain prominent risks. Consistent with more 'doveish' messages coming from the Bank of England and the US Federal Reserve, the risk posed by interest rate rises has receded significantly. CFOs are significantly less worried about emerging market weakness and geopolitics in Ukraine and the Middle East. |

|

| Rising concerns over the

upcoming referendum on EU membership and euro area weakness have

fed through to CFO perceptions of uncertainty. 83% of CFOs now rate the level of external economic and financial uncertainty facing their business as above normal, high or very high, the highest reading in more than three years. |

|

| Corporate risk appetite,

which tends to move broadly in line with equity markets, has

dropped to a three-year low despite a rally in the FTSE 100 since

early February. Rising uncertainty seems to be weighing on risk appetite with just 25% of CFOs saying that now is a good time to take greater risk onto their balance sheets, down from 51% a year ago. |

|

To read this Report in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.