The National Living Wage comes into force in April 2016. This morning, the government announced it is doubling the penalties for minimum wage violators. In this blog, we take a closer look at how the National Living Wage (NLW) will work in practice.

What is it?

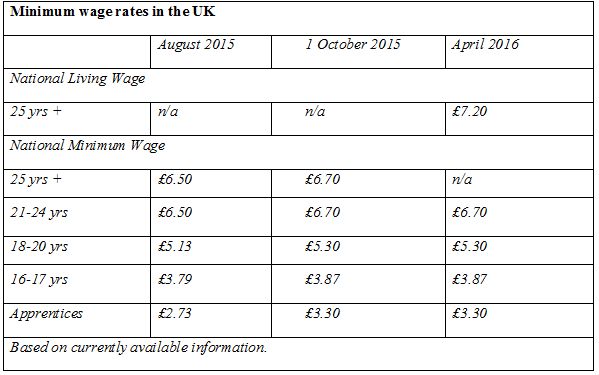

From April 2016, all workers aged 25 and over will be entitled to be paid £7.20 per hour (rising to £9 by 2020).

How will it work in practice?

Essentially it will create a new tier of National Minimum Wage (NMW) for those aged 25 and over. The NMW is currently £6.50 per hour for those aged 21 and over. The Low Pay Commission will decide how the NLW will reach £9 by 2020.

What is going to change in April 2016?

Isn't it age-discriminatory to pay workers different amounts based on their age?

Yes, normally it would be. However, the Equality Act 2010 contains an exception that allows an employer to pay a young worker less than an older worker by reference to NMW pay bands. Logically, this exception will need to be expanded to include the new National Living Wage.

Can an employer dismiss employees aged 25 and over to avoid the National Living Wage?

Almost certainly not. The legislation is awaited, but it will likely follow the same model as the NMW. Employees cannot be dismissed, and workers cannot be subjected to a detriment, because they "will or might qualify, for the NMW, or a particular rate of the NMW". That rules out dismissing employees or changing shift patterns to reduce the impact. In any event, targeting those aged 25 and over would likely be age discriminatory.

What is the impact for employers?

The Office for Budget Responsibility predicts that around six million people will be affected. The extent of the impact is a matter of much debate. Corporation tax is being cut from 20 per cent to 18 per cent by 2020, and the Chancellor announced a 50 per cent increase to the national insurance employment allowance from £2,000 to £3,000, to help offset the increased cost of the NLW. Employees in low-wage, labour-intensive sectors will be most affected, and the voluntary sector is also expressing concern.

What are the penalties for non-compliance?

Non-compliance with the NLW will be a criminal offence. The government announced this morning the doubling of penalties for non-payment. Currently, the penalty for non-payment is 100 per cent of arrears. This is now doubling so that those who do not comply will face a penalty of 200 per cent (with a minimum penalty of £100). This will be halved if employers pay within 14 days. The overall maximum penalty of £20,000 per worker (for pay reference periods starting on or after 26 May 2015) remains unchanged. Further, the government has announced that anyone found guilty will be considered for disqualification from being a company director for up to 15 years.

What happens next?

The government will publish the detail of its proposals in legislation. For more information on the National Living Wage, listen to our podcast by clicking here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.