A NEW LOOK FOR FINANCIAL REPORTING - THE SHAPE OF THINGS TO COME

Following a lengthy consultation process we finally have certainty as to the shape of future accounting in the UK and Republic of Ireland.

In November 2012 the Financial Reporting Council (FRC) issued two financial reporting standards. FRS 100 Application of Financial Reporting Requirements and FRS 101 Reduced Disclosure Framework. These were followed in March this year by FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland.

FRS 100 sets out which financial reporting standards apply to which entities when they intend to produce financial statements that give a true and fair view.

For those entities currently required to apply EU-adopted International Financial Reporting Standards (IFRS), for example fully listed groups or AIM listed groups, they will continue to do so. There is no extension of the existing rules on when the use of EU-adopted IFRS is mandatory. Qualifying entities as defined in FRS 101 (see the later article in this newsletter) may use the reduced disclosures of that standard. Small entities (defined by reference to the limits in the Companies Act 2006 but not restricted to companies and LLPs) may, as now, choose to use the Financial Reporting Standard for Smaller Entities (FRSSE) although, as discussed below, there have been some amendments to that standard.

All other entities will be required to apply FRS 102 unless they choose to adopt EU- adopted IFRS.

If the financial statements are prepared in accordance with FRS 102 or the FRSSE, Statements of Recommended Practice (SORPs) will apply where relevant. Many of the existing SORPs (for example those applying to LLPs and charities) are being updated to provide guidance on the application of FRS 102, however some SORPs will be withdrawn when the new regime becomes effective.

FRS 100 has a mandatory application date for accounting periods beginning on or after 1 January 2015, although early adoption is permitted.

The standard setters have found it necessary to make some consequential amendments to the FRSSE, including reducing the rebuttable presumption as to the maximum economic life of goodwill and intangible assets from 20 years to five years, clarification of the requirement to make an annual assessment for impairments where any indicators exist and exemption from disclosing related party transactions between group members where any subsidiaries are wholly owned.

|

Smith & Williamson commentary We are pleased that there is now certainty as to the accounting framework and entities will need to evaluate the options that may be available to them. For those entities that will need to apply FRS 102 there could be a lot to do if they are to be ready for the mandatory application date in 2015. For small entities the retention of the FRSSE will be a welcome option but they will also need to understand if the changes to that standard will have an effect on their financial statements. |

FRS 102 – THE NEW GAAP

FRS 102 is the single standard that will replace all current SSAPs, FRSs, and UITFs. It will also bring UK GAAP closer to EU- adopted IFRSs as it was originally based on the IFRS for SMEs.

Since the first exposure draft was issued in 2010, the standard has been amended quite substantially to take into account comments received on the original and revised proposals.

The standard we now have includes a number of accounting options permitted in existing UK GAAP but which do not form part of the IFRS for SMEs.

The standard is mandatory for periods commencing on or after 1 January 2015 and early adoption is permitted for periods ending on or after 31 December 2012. Where an entity is within the scope of a SORP, early adoption is permitted, providing it does not conflict with the requirements of the current SORP or legal requirements.

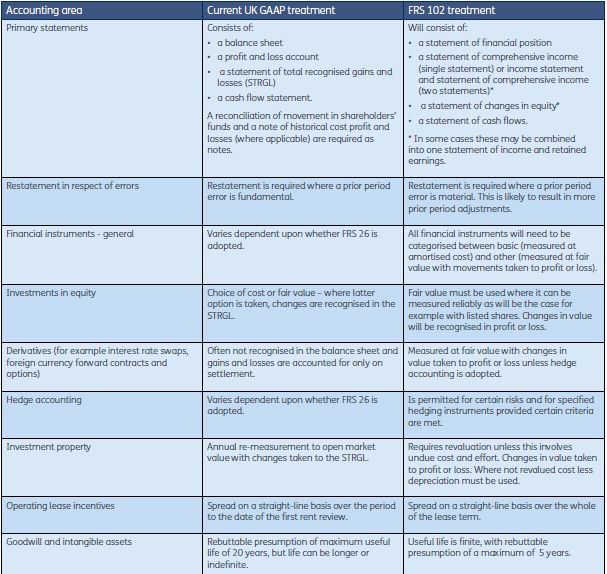

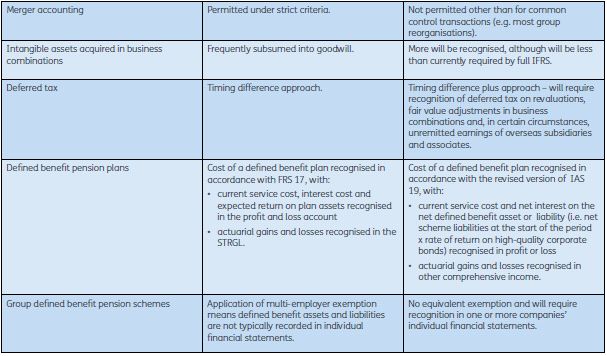

Key differences to existing UK GAAP

While there will be much that is familiar to UK GAAP preparers there are going to be some areas of significant change which will have an effect on the reported results and financial position of many entities. Some of the major differences are considered in the table below.

Transition to FRS 102

The first set of FRS 102 compliant financial statements that an entity produces will need to include restated comparatives. The general principle is that all amounts and disclosures must be restated - however some exemptions do exist. An entity can choose which, if any, exemptions they wish to take advantage of.

In addition, extra disclosure will be required in the first set of FRS 102 compliant financial statements to assist users in understanding the impact that the standard has had on the entity's financial statements. These disclosures include:

- a reconciliation of equity shown under the previous financial

reporting framework to equity determined in accordance with FRS

102

- at the date of transition*

- at the end of the comparative period presented in the financial statements

- a reconciliation of the profit or loss determined in accordance with the previous financial reporting framework and the new framework for the comparative period.

* The date of transition is the beginning of the earliest accounting period for which comparative information is presented. For example, an entity with a December year end that does not adopt the standard early will have a transition date of 1 January 2014.

Reduced disclosure for parent and subsidiary Companies

Subsidiaries and parent companies applying FRS 102 will be able to take advantage of certain disclosure exemptions, provided that they are included in the consolidated financial statements of an entity whose financial statements give a true and fair view and are publically available. These exemptions, and the circumstances in which they may be taken, mirror the concessions offered to IFRS preparers in FRS 101 as discussed in the following article.

Public benefit entities

The ASB had originally suggested a separate, supplementary standard containing guidance specific to public benefit entities (PBEs), for example charities and registered providers. However, the final version of the standard includes this guidance as part of a separate section in the standard (Section 34 on 'Specialised Activities').

Further amendments to the standard

The UK FRC has indicated that they intend to amend the financial instrument sections of FRS 102 to bring it in line with the hedge accounting and impairment provisions in the new standard on financial instruments in full IFRS (IFRS 9 Financial Instruments) that is currently being developed by the IASB. This will result in FRS 102 being amended prior to its effective date although the exact timetable of any amendments is dependent upon when the IASB finalises these remaining parts of IFRS 9.

|

Smith & Williamson commentary This is a fundamental change in accounting that will affect a large range of entities of all sizes and across all business sectors. While there will be some areas of the new standard that will be familiar from current UK GAAP there are also a number of significant differences. Entities should not underestimate the effect these differences may have on their financial statements and their reported performance. Early preparation will be key not just in understanding what the standard requires but also in getting a detailed appreciation of how figures that are currently well understood may change. |

REDUCING THE DISCLOSURE BURDEN FOR IFRS PREPARERS - A REDUCED DISCLOSURE FRAMEWORK

The reduced disclosure framework of FRS provides certain disclosure exceptions to subsidiaries (including intermediate parents) and ultimate parents that are preparing their accounts in accordance with EU-adopted IFRS. The exemptions will be available in the single entity financial statements of the subsidiaries and parent only; they cannot be taken in any consolidated financial statements. To qualify for the exemptions, the financial statements of the parent or subsidiary must be included in publically available consolidated financial statements that give a true and fair view. These consolidated financial statements do not however need to have been prepared in accordance with EU-adopted IFRS.

Entities eligible to take the exemptions are referred to in FRS 101 as "qualifying entities". Charities cannot be qualifying entities.

Qualifying entities may take advantage of the disclosure exemptions only if:

- the entity's shareholders are notified in writing about the exemptions and those holding a specified percentage of shares do not object

- the entity's financial statements apply the recognition, measurement and disclosure requirements of EU-adopted IFRS but are otherwise prepared so that they comply with the Companies Act 2006

- the notes to the financial statements disclose details of the exemptions taken and the name of the parent in whose consolidated statements the entity is included.

The disclosure exemptions can be categorised into those that are equivalent to those allowed under UK GAAP, areas where disclosures are made on a group basis and certain other exemptions.

Disclosures not required by current UK GAAP

- No statement of cash flows required

- No disclosure of intragroup transactions (provided that any subsidiary involved is wholly owned) and no disclosure of the compensation of key management personnel

Items disclosed on a group basis

- No disclosure of share-based payments related to equity instruments of group entities or the ultimate parent's own equity instruments

- Various exemptions in respect of business combinations

- No disclosure of discontinued operations

- Exemption from all disclosure requirements in IFRS 7 'Financial Instruments – Disclosure'* and IFRS 13 'Fair Value Measurement'*

- Exemption from certain disclosures about assumptions in impairment assessments

* not available for financial institutions

The disclosure exemptions in this category are permitted provided that the equivalent disclosures are made in the consolidated financial statements in which the entity is included.

Other exemptions

- No disclosure of comparatives in the notes for property, plant and equipment, intangible assets, investment property and agriculture, no requirement for an opening statement of financial position for the comparative period where the entity makes a retrospective restatement or reclassification, and exemption from certain disclosures about the entity's capital management objectives, policies or processes

- No disclosure of standards not applied.

Reporting entities can choose which of the exemptions they want to take and there is no requirement to apply all of them.

Qualifying entities with financial liabilities held at fair value that are neither held for trading nor derivatives will be required to apply certain of the disclosure requirements of IFRS 7. In addition, a qualifying entity that is a financial institution as defined in the standard will not be able to take advantage of any of the exemptions from IFRS 7 and IFRS 13 nor that from IAS 1's requirements with regard to capital management.

Any entity currently applying EU-adopted IFRS that adopts FRS 101 will be preparing Companies Act individual accounts and not IAS individual accounts. The presentation of the financial statements will therefore need to be in accordance with the Companies Act, and FRS 101 includes a small number of amendments to the measurement and recognition criteria to maintain compliance.

FRS 101 applies for accounting periods beginning on or after 1 January 2015, although early adoption is permitted.

|

Smith & Williamson Commentary FRS 101 may make it easier for consistency to be achieved across groups as the lengthy disclosure requirements of IFRS have previously been a deterrent for many entities. The option does, however, still exist for subsidiary and parent financial statements to be prepared in accordance with FRS 102. Careful analysis of the choices will be needed and the interaction between accounting policies, tax and distributable profit may still be the deciding factor in determining which accounting framework to follow rather than the extent and nature of disclosure required. |

CONSOLIDATION EXEMPTION FOR INVESTMENT ENTITIES - AN AMENDMENT TO IFRS10

Subsequent to IFRS 10 Consolidated Financial Statements being issued in May 2011, the IASB has addressed the accounting implications of the new standard for investment entities. These are entities where, because of the nature of their investments, information about the fair value of an investment in a subsidiary may be more relevant than consolidation of its individual assets and liabilities. In particular the IASB has considered the circumstances where relief from consolidation might be appropriate. As a consequence an amendment to IFRS 10 was issued in October 2012. The amendment will exempt many investment funds and similar entities from the requirement to prepare consolidated accounts.

The amendment defines an investment entity as one that:

- obtains funds from one or more investors for the purpose of providing those investors with investment management services

- commits to its investors that its business purpose is to invest funds solely for returns from capital appreciation, investment income or both

- measures and evaluates the performance of substantially all of its investments on a fair value basis.

An entity meeting the definition must also have regard to certain characteristics as set out below. While failure to meet one or more of the characteristics does not preclude classification as an investment entity, the amendment does indicate that additional judgement may be required.

- Multiple investments

- Multiple investors

- Investors that are not related to the parent entity or the investment manager

- Ownership interests in the form of equity or partnership interests

Under the amendment an investment entity is required to account for its investments at fair value through profit or loss (FVTPL) and any investments in associates and joint ventures must also be accounted for at FVTPL if the entity is to qualify as an investment entity.

The amendment, which applies for periods beginning on or after 1 January 2014, can be applied early and is retrospective.

|

Smith & Williamson commentary The amendment addresses many of the concerns raised by investment entities in response to the original standard, but in some circumstances subsidiaries will still require consolidation. Non-investment entities are not eligible for relief from consolidation even where they have subsidiaries that are investment entities. Consequently, a non-investment parent will have to consolidate all subsidiaries including those controlled through a subsidiary meeting the definition of investment entity. |

LEASING – THE NEXT INSTALMENT - THE NEW EXPOSURE DRAFT

The efforts of the IASB to change lease accounting have stretched over a number of years. Their 2010 exposure draft received considerable criticism and since then a great deal of work has been done to refine the detail of how a new model might work, while keeping the overarching principle of having all leases included on the balance sheet. In May the IASB and the US Financial Accounting Standards Board (FASB) published an exposure draft of their revised proposals.

The fundamental principle of bringing what are currently classified as operating leases onto the balance sheet remains. The key changes in the new exposure draft are as follows:

- a lessee will not be required to recognise assets and liabilities for leases with a maximum lease term of no more than 12 months

- leases will be split into 'Type A' and 'Type

B'. A Type A lease is one where the lessee consumes "more

than an insignificant portion" of the asset over the lease

term, i.e. most equipment and vehicle leases. A Type B lease is one

where the lessee only consumes an insignificant portion of the

asset over the lease term, i.e. most property leases.

- Lessees under Type A leases would present amortisation and interest separately in the income statement, and principal paid and interest paid separately in the cash flow statement. Under Type B leases, a single straight- line lease expense and a single cash outflow would be presented.

- Lessors of Type A leases would derecognise the underlying asset and instead recognise a lease receivable and a retained interest in the underlying asset in the balance sheet. Interest income on both the lease receivable and the residual asset would be recognised over the lease term. For Type B leases, a lessor would continue to report the asset being leased in the balance sheet and recognise rental income in the income statement.

- the guidance on how to apply the definition of a lease has been changed with the intention that fewer contracts (such as certain types of service contracts) will be classified as leases

- variable lease payments (unless fixed in substance or linked to an index or rate) and payments in optional renewal periods (unless the lessee has a significant economic incentive to renew) will now be excluded from the measurement of lease assets and liabilities.

The comment deadline is 13 September 2013, after which the boards "expect to have received sufficient information to proceed with and finalise the standard". The effective date of the new standard has yet to be decided.

|

Smith & Williamson commentary The proposals set out in the new exposure draft represent a significant improvement, addressing many of the issues raised in the feedback on the original version. The removal of much of the complexity in measurement contained in the earlier proposals is particularly welcome. Nearly all entities have leases and many are currently classified as operating. In spite of the proposed improvements and simplifications, this will still be a significant change in accounting for a large proportion of IFRS preparers. |

FINANCIAL REPORTING ROUND-UP - AN OVERVIEW OF THE REPORTING LANDSCAPE

Exposure draft on revenue recognition

The revised exposure draft on revenue recognition issued in 2011 was discussed in the Spring 2012 edition of Financial Reporting. The IASB has indicated that it expects to issue the final standard in the third quarter of 2013. In the revised exposure draft it was anticipated that the standard would be issued in the second half of 2012 with an effective date no earlier than 1 January 2015, to allow companies providing two years of comparative data adequate time to prepare. If a similar timetable is now followed, it would indicate a standard with an effective date of 1 January 2016 at the earliest, although this could be even later.

IFRS annual improvements

The IASB uses the annual improvements process to make necessary, but non-urgent, amendments to IFRSs. The latest improvements:

- permit repeated application of IFRS 1 First-time Adoption of International Financial Reporting Standards

- amend the treatment of borrowing costs relating to qualifying assets where the commencement date for capitalisation is before the date of transition to IFRS

- clarify the requirements for comparative information

- set out the classification of servicing equipment under IAS 16 Property, Plant and Equipment

- clarify that the tax effect of distributions to holders of equity instruments should be accounted for under IAS 12 Income Taxes

- clarify the interim reporting of segment information for total assets and liabilities.

The amendments are effective for annual periods beginning on or after 1 January 2013, although entities are permitted to apply them earlier.

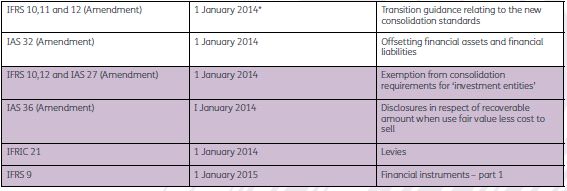

ON THE HORIZON - EFFECTIVE DATES FOR NEW AND REVISED IFRS AND IFRS INTERPRETATIONS

The table below summarises the effective dates for new and revised IFRS and IFRS interpretations. Those that are shaded have not yet been endorsed by the EU and the effective date will be contingent on successful endorsement.

* These transition dates apply for entities reporting under IFRS as adopted in the EU. Earlier dates apply for entities reporting under IFRS as issued by the IASB. Early adoption is permitted.

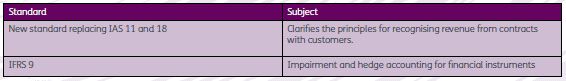

In addition, the following standards may be published by the IASB before the end of 2013. Standard title, effective date and EU endorsement will be confirmed following publication.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.