Global economic growth: rebounding?

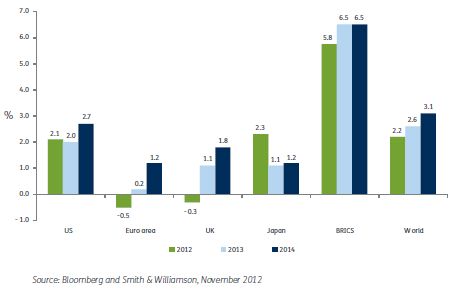

After its initial recovery from the recession induced by the global credit crisis in 2008, global economic growth has faltered so far this year, with the US and Chinese economies slowing and many European countries slipping into a second recession. Consensus economic forecasts collected by Bloomberg suggest that the world economy will revive over the next two years, but at a much slower rate than was the norm in the years leading up to the crisis. The fastest rates of growth will again be observed in the BRICS countries (Brazil, Russia, India, China and South Africa). If the forecasts are correct, slower growth will continue to act as a headwind for future investment returns.

Investors remain in cautious mode

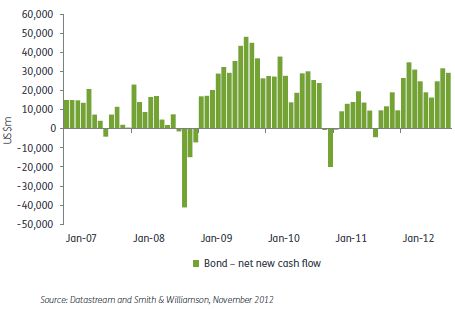

The years since the financial crisis have been marked by high levels of investor aversion to risk. This has been evident both in surveys of investor sentiment and in the flow of funds into different asset classes and fund sectors. Net flows of investor money into bond funds – the balance between new investment and fund redemptions – has been strongly positive for most of the last three years, as shown in the chart. Flows into equity funds by contrast have been more often negative than positive since 2007, reflecting investors' reluctance to risk new commitments of capital to equities, despite the higher potential returns which equities have historically provided.

Mid-cap outperformance

Since the beginning of the year mid-cap stocks (here represented by the FTSE 250 index) have outperformed the large cap stocks in the FTSE 100 index by a significant margin. The FTSE 250 index is now close to an all-time high relative to the FTSE 100. One reason is that the FTSE 100 index has a disproportionate number of mining and energy stocks which have been among the worst performers in 2012, being most affected by the slowdown in global economic growth. By contrast mid-cap stocks are mostly domestic UK businesses which have benefited from a modest relative improvement in the UK economy's performance. Historically mid-cap stocks have tended to do better proportionately in rising markets and worse in falling markets and are also more volatile.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.