FOREWORD - ALL CHANGE

When the editorial committee of Professional Practices News meets to discuss the content of each newsletter, there are times when topical articles are hard to come by. However, in this period of huge uncertainty and massive, rapid change, this is most certainly not the case. Since we first met to discuss this edition, Europe has gone from one turmoil to another, Dewey & LeBoeuf has achieved the dubious accolade of being the largest-ever law firm failure and Eddie Stobart has launched a legal service (www.stobartbarristers.co.uk)! Somehow, despite all of this uncertainty and innovation, those responsible for managing professional services firms are required to demonstrate leadership, develop strategies, make crucial long-term decisions and manage the performance of their firm, partners and staff.

In this issue, we aim to provide some guidance to those individuals. Whether you are looking to take in external investment and want to know more about the Russell Jones & Walker transaction with Slater & Gordon or you are the one chosen to be the 'COFA' within a law firm, we hope that there is something for you in this issue.

We would obviously be delighted to discuss with you in more detail any areas of particular interest.

Giles Murphy

A WHOLE NEW WORLD - THE PIONEERING SPIRIT OF RUSSELL JONES & WALKER AND SLATER & GORDON

By Andrew Pedrette, Pamela Sayers and Giles Murphy

Having advised Russell Jones & Walker on its recent merger with Slater & Gordon, Andy Pedrette, Pamela Sayers and Giles Murphy reflect on a ground-breaking deal.

The Legal Services Act has long heralded the start of widely anticipated changes to the UK legal landscape and the Solicitors Regulation Authority (SRA) finally began to issue alternative business structure (ABS) licences in late March 2012. Now, for the first time, licensed UK law firms can accept external equity investment from non-lawyers as part of the financing for their future growth.

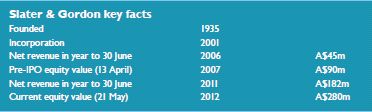

One of the first firms out of the blocks has been Russell Jones & Walker (RJW), which has become part of Australian law firm Slater & Gordon, the world's first publicly listed law firm, in a £54m deal. All of RJW's equity partners remain with the business and have become shareholders in Slater & Gordon. RJW now trades as 'Russell Jones & Walker, part of Slater & Gordon Lawyers'.

A natural fit

When Slater & Gordon listed on the Australian Stock Exchange (ASX) in 2007, it set out its aim to become one of the leading consumer law firms in Australia, with ambitions to expand overseas in due course.

Slater & Gordon's shares are traded daily on the ASX and its shareholders include institutions and individual retail investors. Slater & Gordon raised external equity in an initial public offering and then raised a significant further amount to finance a major acquisition in Australia in 2010. New Slater & Gordon shares have also been issued regularly since 2007 to finance smaller Australian acquisitions and to provide shares to staff under the firm's Employee Ownership Plan.

Outside Australia, few jurisdictions allow external investment in law firms, but the advent of the UK Legal Services Act and jurisdictional similarities between the two countries meant the UK was a natural place for Slater & Gordon to explore its international expansion plans. For its part, RJW had been anticipating a changing legal environment in terms of regulation and service delivery, and was looking for the 'right' source of funding to take its business to the next level. The opportunity finally presented itself in early 2011, when RJW and Slater & Gordon first made contact.

Being a listed firm means Slater & Gordon has the ability to raise additional capital on the ASX to fund future acquisition or investment opportunities in the UK. It is also a longer-term funding solution than private equity, where investors may typically seek an exit event in three to five years. There is no such pressure for a single exit event on a publicly quoted company like Slater & Gordon, as investors can increase or decrease their shareholding through daily trading on the public market.

Critical preparation

Any business seeking to attract external equity needs to identify its objectives and to assess the suitability of the various types of funding available. The first obvious question is what will the money invested be spent on?

Investors will expect a firm to prepare financial projections, probably over three years, showing the requirements for capital investment. This may include 'money out' to the current stakeholders, as well as development capital to be injected into the business to accelerate its growth. Investors accept that in reality no business will develop exactly as its business plan predicts. But the financial plan must enable them to understand the main performance drivers of the business and so assess the impact of increased funding.

Investors must see a clear presentation of historical trading to understand what has already been achieved in the business and how this compares to forecast growth. Exceptional items that may have distorted historical results need to be identified, so that investors can appreciate the 'maintainable' performance of the business.

Key to negotiating any investment is to understand how a particular type of investor will look at your business and their likely requirements for financial returns. It's essential to prepare by analysing your underlying financials in the same way that a potential investor will.

Value and structure

In applying 'normal' valuation metrics to a partnership for the purposes of assessing an investment, investors will generally focus on the profitability of the business after payment of market rates to the firm's current partners.

An investor used to corporate transactions involving owner-managed businesses will tend to treat a law firm partner's profit share as comprising two components: a market-rate salary and an additional profit which equates to a corporate dividend. The capital value of the partnership is likely to be discussed as a multiple of the dividend profit (after deducting the base salary from the partnership profits).

However, agreeing the value of a business is a matter of negotiation. The financial projections are crucial, but so too is an understanding of the strategic rationale behind the investment and an understanding of the investor's requirements. In RJW's case, we were delighted to be able to work with both firms to establish that RJW was a substantially more valuable business than Slater & Gordon had initially estimated.

The structuring of any investment is as important as the headline price. In RJW's case, the merger was structured to include cash and deferred cash payments, as well as shares in Slater & Gordon. The balance struck gave the reassurances required to Slater & Gordon's investor community that RJW partners would remain committed to the UK business, while enabling those partners to realise some cash immediately, some over time, and still share in the equity of the business. In addition, a combined business plan was developed with funding available to underpin the enlarged entity's UK growth plans.

There were numerous complex tax issues for both parties and a crucial part of the structuring ensured that RJW partners were taxed on their share of the consideration at 10%, benefiting from entrepreneurs' relief.

Managing the investment process

The RJW transaction took almost 18 months to complete, primarily because of delays in the SRA accepting ABS applications. The proposed transaction was publicly announced in late January, subject to ABS licensing, and completion was not effective until 30 April 2012.

Advice in managing such a lengthy process is critically important, especially as the business seeking investment needs to deliver its projected financial performance in the short term despite any distractions due to the deal process. For RJW, between initial discussions and completion of the deal, the business had to deliver actual results for the last few months of its year to 31 March 2011 and then the whole of its 2011/2012 financial year. So management needed support while also focusing on keeping current trading on track through a prolonged period of scrutiny from Slater & Gordon.

Internal negotiations and communication

In addition to working on external fundraising, firms also need an internal process to plan and implement how current partners' interests will be organised in an ABS structure suited to external equity investment. For existing partners, if a proposed transaction includes a mixture of money-out and equity interest to be rolled forward into a new entity, then the proportions of equity to be sold and ongoing equity interest to be retained by each individual partner will also need to be negotiated.

For the Slater & Gordon transaction, a senior management team was established at RJW that reported on deal progress to the broader equity partner group. It was important for RJW to establish and maintain unanimous and strong support for the transaction within its partner group. Smith & Williamson assisted throughout this internal communications process, reporting on negotiations and as particular issues arose.

Share ownership and incentives

Any capital structure designed to enable external investment to fund additional growth must also cater for a firm's personnel who are key to delivering that future growth. Slater & Gordon is committed to incentivising its legal and non-legal staff. A large part of its incentivisation strategy is the staff ownership plan, whereby staff are issued with shares based on their performance. This strategy has already been implemented in Australia.

Slater & Gordon was originally a tightly held partnership, which became a company in 2001 and then had its shares listed in 2007. A strand of its development has been to widen staff ownership of the firm. At its IPO in 2007, seven former partners were major shareholders and 32 employees were participants in its staff share ownership plan. In its last annual report, 69 employees held over 5 million shares under that plan. Because the firm has publicly quoted shares, staff can see their value every day. Staff with shares also receive dividend income. Slater & Gordon believes that this tangible opportunity for more staff to share in the equity in the firm demonstrates the firm's loyalty to its people and, in turn, encourages staff commitment.

FIXED SHARE PARTNERS - EMPLOYMENT STATUS CLARIFIED

By Pamela Sayers

Pamela Sayers looks at a recent case concerning whether a partner had employment or partner status for tax purposes.

A recent case heard in the Employment Appeal Tribunal (EAT), which upheld the decision of the Employment Tribunal, has provided welcome relief for LLPs with fixed share equity partners.

In Tiffin v Lester Aldridge LLP, Tiffin who, although a fixed share equity partner, considered himself to be an employee rather than self-employed and wanted to seek compensation for unfair dismissal. The EAT dismissed the case, satisfying LLPs that individuals who enter into members' agreements cannot seek claims in employment tribunals.

However, partnership agreements should be reviewed as the EAT considered Tiffin to be a partner because he:

- made a capital contribution to the LLP

- was entitled to a profit share

- had a say in the management of the firm

- would share in the LLP's surplus assets of the firm on a winding up.

The degree of these did not seem to matter (for example, Tiffin received a very small profit share) and no emphasis was placed on any one of these criteria. However, in the case of Williamson & Soden Solicitors v Briars, the EAT held that the fact that someone receives a share of the profits will not, in itself, point to partnership status. But it should be noted that in the case of Williamson, not much had changed for the individual when he moved from being an employee to a member of the LLP.

BUDGET NEWS

The Budget brought welcome news that the top rate of income tax will fall to 45% from 6 April 2013. Planning will now be required to see if any income can be deferred to 2013/14.

A change of accounting date could move profits into the 2013/14 tax year, but care would need to be taken as overlap profits could be created which may not be relievable until a partner either ceases to be a member or a further change of accounting date occurs.

More importantly, consideration should be given to bringing revenue expenditure forward into accounting periods that will be taxable in the 2012/13 tax year.

The use of corporate members in the larger professional practice LLPs has not been widely taken up following the introduction of the 50% rate of income tax in 2010/11. With this reducing to 45% there will be less of an incentive for anyone, other than those partners retiring imminently, to introduce a corporate member.

Service companies remain an attractive structure following the announcement in the Budget that corporation tax would reduce to 24% from 1 April 2012, with further reductions due over the next couple of years.

This figure compares very favourably with the highest rate of income tax and national insurance contributions combined, even when they reduce from 52% to 47%, and shows that significant savings can be made.

ECONOMIC OUTLOOK

By Michael Quach

Michael Quach considers the state of the UK economy and questions the future of the Chancellor's austerity drive.

The UK economy slipped back into a technical recession in the latter part of 2011. Real gross domestic product contracted by a further 0.3% in the first quarter of this year following a 0.2% decline in the fourth quarter of 2011. This left the level of output some 4% below its 2008 recession peak.

The main drags on the domestic economy continue to be the ongoing severe squeeze on real household incomes, deleveraging in the private sector and exposures to events in the euro area. The impact on the UK of problems on the continent are from reduced trade, increased bank funding costs as the crisis has intensified and a fall in private sector confidence. It will take time for the financial sector and credit conditions to normalise.

Support for the economy comes from the ultra-loose monetary policy employed by the central bank and a large depreciation of sterling in recent years. The prospect of a further period of soft economic activities points to a growing need for additional policy measures by the authorities.

Lending to private non-financial companies continues to be sluggish, with credit conditions for small and midsized enterprises remaining tight. Last year's failure of the much-talked about Project Merlin has been another drag on potential growth. Although the Monetary Policy Committee's preferred measure of M4 money supply actually rose 6.4% in the first quarter, broad money growth remains well below its early 2010 peak and continues to decline.

With a backdrop of growing anti-austerity pressures in Europe, further questions are likely to be asked over the Chancellor's austerity drive if the public sector net borrowing position deteriorates further and growth continues to contract. We still believe that more creative growth policies from the coalition Government might be needed if the economy is to gain greater traction in its recovery from the financial crisis. Another round of quantitative easing isn't out of the question and remains a policy tool at the Government's disposal, especially with broad money growth remaining at such low levels and the economy still clearly in need of a lifeline.

FEELING THE PRESSURE - FIRMS LOOKING TO DE-EQUITISE PARTNERS

By Giles Murphy

Giles Murphy looks at how many firms are getting tougher on partner performance and moving individuals from equity to salaried status.

The harsh economic environment of recent times has put professional firms under increasing financial pressure, resulting in big changes to practice management at many of the larger firms. One of these changes has been to look more closely at performance management and, in particular, partner performance.

In response to weaker trading, de-equitisation of partners has become commonplace, especially among larger practices. This was confirmed by Smith & Williamson's Annual Survey of Law Firms 2011, in which half of the UK's top 30 law firms said they are looking to de-equitise partners.

Who is de-equitising?

Closer examination revealed that 9 of the 15 firms from the UK's top 30 that took part in the survey were already in the throes of de-equitising partners or had recently done so, while the remaining 6 were considering it. These results are part of a broader survey of 126 law firms of which half came from the UK's top 100. The level of de-equitisation among the top 30 practices appeared to be substantially higher than among the total sample group. Among larger firms more than 4 in 10 firms had already de-equitised partners, compared to 1 in 10 smaller firms (less than 25 partners).

Usually, no-one beyond the partners in a practice knows if individuals are moved from equity to salaried status. So these statistics are very revealing and indicate that de-equitisation is now a commonly used tool among larger firms. They are grasping the financial reality that some partners have either been over-promoted or 'gone off the boil'. These individuals may still hold value and the firm may wish to keep them on, but at a level of remuneration that more accurately reflects their contribution.

Culture shift

The survey also showed that the proportion of profits shared on a discretionary basis by most firms is relatively low, but it is widely anticipated that a greater element of profit share will shift from a lockstep system to a discretionary basis in the next few years. Presumably, this is also in response to varying partner performance.

This trend demonstrates a general move towards tighter practice management and a more corporate attitude. The larger firms face competition from each other and frequently also from well-positioned niche practices, and they have no option but to manage their top and bottom lines very carefully.

Where management teams have introduced tighter working practices and disciplines they should be in a better financial position to take advantage of the challenges ahead. However, managing a firm in a period of huge economic uncertainty, which coincides with a period of major change in the legal sector, will keenly focus the minds of individuals and management teams leading these firms. Poorly managed and poorly performing firms may well struggle to continue, but many believe that 'survival of the fittest' will result in a more healthy, successful professional services sector, as and when the economy recovers.

PARTNERS' PENSIONS - PLANNING FOR A COMFORTABLE RETIREMENT

By Dani Glover

Many professional firms make provisions for their partners' retirement, but it's important for individuals to consider whether this will provide them with a sufficient income, says Dani Glover.

Rarely a day goes by when pensions are not in the news. Yet many people pay little attention to their own financial affairs, especially with regard to saving for retirement. When asked why, they often say that pensions have become too complicated or that pension performance has been poor, so why bother? Even when they do plan for the future, left to their own devices, too few people set aside enough funds for their retirement.

Whose responsibility?

Interestingly, Smith & Williamson's Annual Survey of Law Firms 2011 shows that more and more professional firms are making provisions for their partners' retirement. For example, a firm might withhold a percentage of a partner's profit share to invest in a pension of the partner's choice. This enables partners to plan for a comfortable retirement, but can also help firms deal with issues such as succession planning, with partners no longer needing to stay on past retirement age. However, individuals will need to consider whether the amount invested will be sufficient for their retirement and if further action will need to be taken.

There are significant tax incentives to saving into a pension plan. This is especially the case for those whose earnings are between £100,000 and £116,210 as their effective tax rate can be up to 60%.

The average pension, in payment, for an individual who has been a member of a final salary scheme is significantly higher than for someone who has made voluntary payments. Therefore, it is essential to start a pension into which regular payments are made if one is to have any sort of reasonable pension income in retirement.

Smith & Williamson's survey found that 91% of respondents believe that it is the individual partner's responsibility to get advice on retirement planning and to pay for it themselves. While firms seem to delegate this responsibility entirely to their partners, this does allow the partner to choose how much to invest and how much to contribute.

An adviser will be able to help partners calculate the level of contribution required to reach a certain level of income. The adviser will also take into account the partners' other assets, bearing in mind that a pension plan is only one way of saving for income in retirement – albeit probably the simplest.

SIPPs

Many people tend to want to spread their investment risk and so end up with a range of providers or have simply collected various personal pension plans along the way. Self-invested personal pensions (SIPPs) offer a very simple and transparent contract to amalgamate the plans, as well as having added flexibility in the way that an income can be taken.

One of the key advantages of SIPPs is the ability to appoint your own fund manager who not only invests in line with the aims and objectives of the individual investor, but who constantly monitors the SIPP in line with prevailing market conditions. Investments are made on the basis of informed decisions rather than potentially out-of-date hearsay.

The overall cost of a SIPP will not necessarily be higher than some pension contracts offering a wide range of funds with various investment houses. In addition, costs are transparent allowing the investor to see the cost of each element of the pension process.

SRA: WHERE ARE WE NOW? - UPDATE ON SOLICITORS REGULATION

By Deborah Anderson

Deborah Anderson provides updates from the Solicitors Regulation Authority.

Partner moves

The Solicitors Regulation Authority (SRA) recently published new guidance on the notification requirements for partner appointments. These requirements were more onerous than was previously the case and all law firms would need to have been aware of the changes when appointing new partners. However, less than a month after issuing the guidance, the requirements changed.

Prior to the changes, the SRA must have pre-approved every partner appointment made after 1 April 2012. The approval process for a solicitor partner was anticipated to take around 30 days, but could be substantially longer (between 12 to 16 weeks) for a Registered Foreign Lawyer partner. However, it appears that common sense has prevailed as firms are now allowed to notify SRA of partner appointments after they have occurred, although the requirements still apply for a Registered Foreign Lawyer.

Appointing COLPs and COFAs

In April 2012, the SRA announced that the nomination process for compliance officers for legal practice (COLP) and finance and administration (COFA) will open on 31 May 2012. Firms will have until 31 July 2012 to make their nominations, and initially most were expected to be approved between 1 August and 31 October 2012. This has now been revised to 1 August to 31 December 2012. COLPs and COFAs must start fulfilling their duties no later than 1 January 2013.

The launch of the form has been delayed due to the late start of the practising certificate renewals and recognition exercise. But the SRA has stated that this should allow more time to consider the nomination and approval process and, hopefully, ensure that firms do not experience difficulties.

Firms will be asked to complete a web-based nomination form in which they and the nominee compliance officer will need to confirm that:

- they understand their obligations

- they have suitable arrangements in place

- the nominee is qualified, suitable and consents to undertake the role.

In a recent speech, Samantha Barrass, SRA executive director, stated: "...signatures in actual blood aren't obligatory, but I think our intention to focus minds is clear and we will take it very seriously if subsequently it becomes clear that declarations were signed unthinkingly."

She went on to stress that while the COLP and COFA will act as the formal focus points for compliance, they are not the sacrificial lambs enabling others within the firm, particularly senior managers, to absolve themselves from their responsibilities. If this were the case then the regime would fail its most important test: creation of a firmwide culture of compliance.

BUILDING A PARTNER PERFORMANCE MODEL

By Rachel Stone

As part of our series on taking a balanced approach to measuring partner performance, Rachel Stone looks at the vital area of existing client relationships.

Partners pride themselves on the size, prestige and value of their client portfolios. Being valued as a trusted adviser by their clients is part of the core motivation for most individuals who reach partner level. It is a key differentiator between those who develop a loyal and long-standing client base, and those who find it difficult to build and maintain long-term client relationships.

Client standards for every partner

There is always a danger of taking existing clients for granted, particularly when relationships have worked well for years. Measures for the quality of client relationships need to include the provision of current services and the opportunity to introduce clients to other services your firm may offer, which could support their business.

In terms of looking at a partner's existing client relationships, it may be worth considering some of the following issues.

- Does the partner have a structured client contact and support programme in place?

- What proportion of the partner's clients stay with the firm each year?

- How many clients choose to move to other firms and for what reasons?

- How much cross-selling activity has been carried out to the existing client group and with what success?

- How much new work has the partner's existing clients referred into the firm?

- How successful has the partner been in creating a broader and deeper advisory relationship with key clients?

Measuring client satisfaction

Not every firm chooses to invest time in gathering formal feedback from its clients, but well-designed client feedback tools can provide timely and valuable data. For example, surveys or structured review meetings can inform the review of partner performance and the overall client support approach of the firm.

Useful information can be gathered by asking clients about their level of satisfaction. Questions might include some of the following.

- How well is our firm meeting your needs?

- How would you rate the quality of our advice?

- How would you rate the overall value of our offering to your business?

- Would you be prepared to act as a referee or be included in a testimonial for our firm?

How a client responds can feed directly into a balanced review of partner performance.

In the next issue of Professional Practices News, we will look at partner performance in terms of internal management measures.

THE CHANGING FACE OF REVENUE RECOGNITION

By Nick Randall

Revised IASB proposals could affect the way income is recognised, writes Nick Randall.

The International Accounting Standards Board (IASB) has issued a revised exposure draft (ED) in response to feedback on its original proposals. If finalised, it could affect how professional practices recognise their income and, therefore, pay tax. The IASB received more than 1,000 comment letters on the original ED. Many felt it was unclear how to apply the proposed core principles in practice, to both service and construction contracts.

Revised ED proposals

The core principle set out in the revised ED is consistent with the original draft. It says: "an entity shall recognise revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled to in exchange for those goods and services."

The revised ED outlines five steps an entity needs to consider to recognise revenue.

- Identify the contract with a customer.

- Identify the separate performance obligations in the contract.

- Determine the transaction price.

- Allocate the transaction price to the performance obligations.

- Recognise revenue when a performance obligation is satisfied.

For many firms, step five will be the most important in determining revenue to be recognised in each accounting period. For contracts such as straightforward advisory transactions, this will have little, if any, effect on the timing and amount of revenue recognised. However, the proposed new standard could mean significant changes for long-term contracts, those containing multiple deliverables or contracts for services.

Step five says that revenue should be recognised when an entity satisfies its performance obligations by transferring control to the customer. If clearly transferred at a specific time then revenue should be recognised from then. If transferred over a period of time, then it should be recognised over the period.

The original ED proposals would have prohibited the recognition of revenue over time for many service and construction contracts where the asset created by the seller's performance, i.e. the work in progress of professional practices, was not controlled by the customer until the end of the contract.

In the revised ED, revenue can be recognised even if the customer does not have control of the work in progress, provided that it does not have an alternative use to the seller and other criteria are met (including a right to payment for partial completion). It means that more transactions will be accounted for over time than under the original ED.

Presentation

A key change from the original ED and from current practice is the proposed treatment of credit losses. The revised ED requires the amount of any expected credit losses and any subsequent adjustments, i.e. any bad and doubtful debt expense, to be presented in a separate line item within the statement of comprehensive income (profit and loss account) next to the revenue line.

Disclosure

The revised ED proposes a fuller set of disclosures that require both qualitative and quantitative information about revenue and cashflows. Apart from some minor amendments they are unchanged from the original ED.

Effective date

The final standard is expected to be issued by the end of 2012. The IASB has indicated that the earliest date by which the new standard will be mandatorily effective is for periods beginning on or after 1 January 2015.

Although the new standard will not apply for a few years, the impact on some firms could be significant. Early efforts to consider how this could change the firm's accounting policies are recommended.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.