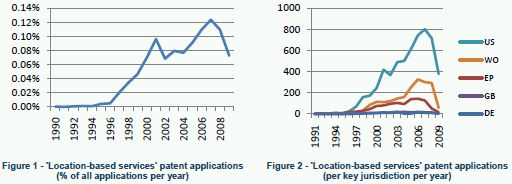

In the early 2000's, the market for LBS was in its infancy, restricted mainly to mapping, GPS in PND's and high-end consumer mobile devices. Since the advent of smartphones for the wider commercial market, this has all changed and the widespread provision of mobile LBS is now seen as an inevitable future. The relative number of applications for patents related to 'location-based services' has been on an upward trend since the mid 90s, as can be seen in Figure 1, along with the source of these applications in Figure 2 (note patent applications are typically published 18 months after a first filing so recent figures will be lower than actual) .

Of the assignees that hold LBS patents, it is possible to identify those which hold key LBS related portfolios. In Figure 3, a selection of key assignees are plotted according to patent citations, where we can see that companies such as Go2, Openwave and Trafficmaster all have smaller but very highly cited portfolios. Other, much larger companies such as Microsoft, Qualcomm and Nokia hold much more LBS related IP including some important patents. These are mainly all patents from reasonably well established LBS markets such as navigation, advertising and enabling infrastructure, and when additional markets develop it is likely that this picture may change significantly.

Each result was then checked for terms matching significant categories and assigned to one, more or none of these depending on the keywords it contained. Within the field of LBS IP, currently two of the most populated categories are navigation and advertising, as can be seen both in Figure 4 and from investigating the key assignees shown in Figure 3, as these categories form important aspects of their businesses. Commerce also factors significantly into those companies and while only a small proportion of LBS patents are related directly to that category, it is thought that these form only a small part of the larger end to end provision for mobile payments. Patents related to privacy and security of these systems also form and are likely to continue to form a significant proportion of the IP landscape.

Social networking, gaming, and often a blurred border between the two have seen significant growth from nearly nothing a decade ago, both in number of applications (Figure 5) and in importance to the LBS landscape. As the technology providing the backbone to LBS matures, companies are increasingly taking advantage of this to supplement their services with additional features, and the continued growth in patent applications for these categories reflects this. In particular, applications for LBS gaming related patents have shown consistent growth (Figure 6). With the gaming industry in 2009/10 being worth $50bn+1 globally and the growth outpacing other entertainment forms such as music and movies, the proliferation of LBS gaming and social mechanics throughout the industry looks set to cement itself as an important part of the LBS IP landscape.

All of this tells us about the state of the IP today and where it has come from, but what about the future and where it is going? Examination of recent filings shows a trend towards automated and predictive systems; LBS that anticipates where you are going to be rather than acting on where you are. Along with this there is also a trend for the integration of LBS into more specialised areas, for example schedule management and healthcare provision; if it moves, chances are someone is developing a location based technology around it. It looks as if LBS innovation so far has just been laying the foundations for future applications that reach into all aspects of technology.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.