The third quarter of 2011 was one of the most challenging in the recent history of financial markets due to underlying volatility and a substantial decline in market value.

AIM

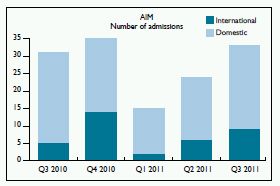

A total of 33 new companies were admitted to AIM in the third quarter of 2011. This was an improvement on the 24 new issues in the previous quarter and a slight increase on the 31 new companies that listed in the same period last year.

New money raised on AIM in the third quarter of this year totalled £271m, with £414m of further money raised. These figures are lower than in both the previous quarter and the equivalent period last year, reflecting stalling investor confidence.

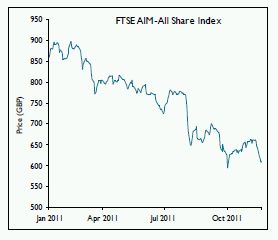

Despite this turbulence, the number of companies listed on AIM rose for the first time since the fourth quarter of 2007 to 1,156. However, there was a decrease in the aggregate market capitalisation of these companies, with the average market capitalisation falling to £55.1m at the end of September from £65.6m at the end of June. This decline in average value is also reflected in the AIM All-Share Index, which fell 18% in the third quarter of 2011, with an 11% drop in August.

The Main Market

It has also been a difficult quarter for the Main Market, where the number of new admissions fell from 25 in the relatively successful preceding quarter to 11. This was slightly down on the 12 new admissions in the third quarter of 2010. The level of funds raised from new issues was £474m, a substantial decline on both the previous quarter and the same period last year, when new money raised totalled £9.6bn and £2.0bn respectively. All of the £474m was raised in July, with no money raised through new issues on the Main Market in August and September.

In the third quarter, £585m of funds were raised through further issues on the Main Market, compared with £1.1bn in the previous quarter and £2.8bn in the equivalent period last year. Unlike AIM, the total number of companies listed on the Main Market fell to 1,402, down 11 on the previous quarter and 27 on the third quarter of 2010.

The FTSE All-Share Index fell 14% in the third quarter of 2011, with a 10% drop in August.

Similarly the FTSE 100 Index decreased 14% in the third quarter of 2011, with a 9% fall in August.

What's next?

Overall, optimism in the IPO market has been low since the end of the second quarter. This is reflected in the lower levels of money raised and the number of new listings on both AIM and the Main Market in the third quarter.

The post-IPO share price performance of newly listed companies has been poor on balance. This, combined with macroeconomic issues, has meant investors are reluctant to invest in new opportunities until more stable market conditions return.

Anecdotal evidence and current data suggest that the final quarter of 2011 will show little improvement; October was the third consecutive month this year when the Main Market didn't raise any money from new issues, with AIM raising just £0.8m.

Despite recent agreements in the eurozone, there is still substantial progress to be made before a detailed solution emerges and investor confidence is restored. Yet even with this challenging outlook, a significant level of investor cash has been built up. It would be reasonable to expect this money to start flowing into the financial markets once the eurozone is stable and confidence in the global economic outlook returns.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.