1. EXECUTIVE SUMMARY

The Interim Management Statement (IMS) is now four years old. The UK Listing Authority introduced the IMS in 2007 for listed companies to meet the requirements of the EU Transparency Obligations Directive. Deloitte has been reviewing these reports since the very beginning. Indeed, this is the Firm's sixth survey because in the first year the IMSs were surveyed regularly to seek to establish general practice. In 2008 and 2009, the IMSs issued in the first half of the year were surveyed. Deloitte's 2010 survey addressed the IMSs issued in the second half of the year.

This survey examines the current crop of first half's IMSs and has produced some interesting results:

- only a low percentage, 22%, of corporates clearly met all of the IMS content requirements. Many fail to describe adequately their financial position. This is an improvement from the practice in the first two years;

- investment trusts which are considered separately in this survey continue to be the stars in content compliance terms. 77% of trusts (second half IMSs: 77%) clearly met the content requirements;

- the average length of IMSs is two pages;

- 53% of corporates specifically mentioned economic difficulties in their first half IMS;

- 24% of corporates gave liquidity information on their access to external funding; and

- timing of reporting does not seem to be much of an issue for either corporates or investment trusts: 93% (second half IMSs: 97%) corporates and 90% (second half IMSs: 83%) investment trusts filed their IMS within the Disclosure and Transparency Rules' deadline.

No sooner are UK listed companies getting accustomed to the new regime when a review is announced. The European Commission consulted in May 2010 on the modernisation of the Transparency Directive. The responses to that indicated support for the flexibility in the IMS rules and there were few calls for more prescription. An interesting response to the consultation was to question whether the requirements should be removed for small listed companies. The majority of respondents rejected this. While this may be a disappointment to some smaller companies, the silver lining is that respondents found the information they get useful. So, IMSs are here to stay in their present form, at least until the next review.

2. THE SURVEY

Following the introduction in 2007 of the DTR requirements for listed companies to publish bi-annual IMSs, past Deloitte surveys have highlighted that some companies seemed to have difficulties in meeting the requirements. The IMS is no longer a new requirement. Companies have had over three full years' experience. So it was timely to carry out this survey to look at current practice and to consider whether it has changed or improved over the years.

Deloitte has reviewed reporting in five previous surveys on IMSs. In the 2010 survey And there's more, the focus was on the IMSs published in the second half of the year. This year's survey focuses on the first half's IMSs and compares these primarily with the 2010 results.

The main objectives of this survey were to consider:

- how companies met the DTR requirements in the IMSs published in the first half of the fourth year since its introduction;

- what information companies provided in their IMSs and how it was presented; and

- how the fourth year's first IMSs published compared to earlier IMSs.

There were, as at 30 June 2011, 994 fully listed UK companies which formed the population for this survey. 39% of these companies were classified by the London Stock Exchange as being in the sectors of non-equity or equity investment instruments. Due to the specialised nature of investment trusts, and the particular needs of their investors, they were treated as a separate population, consistent with other Deloitte surveys on financial reporting, and a sample of 30 of these companies was used. Their findings are covered in Section 5 of this report.

To achieve meaningful comparisons with previous findings, the sample of 100 companies was as consistent as possible with the randomly-selected sample used in recent surveys and with that used in the upcoming Deloitte survey of annual reports. One company had de-listed before the IMS deadline. A replacement company was picked at random from the same size category. The sample of 100 corporates contained 34, 33 and 33 companies from the top 350, middle group and smallest 350 companies by market capitalisation respectively. The sample of 30 investment trusts included ten trusts from each category. For companies with 31 December 2010 year ends, their fourth IMS was required to be published by 19 May 2011.

The next two sections, "The IMS basics" and "Content of IMSs", refer to the main sample of 100 companies excluding the investment trusts which are separately discussed in the section "Investment Trusts' IMSs" from page 13. The rules allow companies to file a quarterly report instead of an IMS. Whilst no companies in the survey chose to provide a quarterly report, some comments on quarterly reports are included under "Quarterly reports".

3. THE IMS BASICS

|

This section considers the fundamental elements of IMS reporting such as the timing of publication, the overall structure and the length of IMSs. Comparisons with the findings of the previous Deloitte survey And there's more are included where relevant and relate to the IMSs published during the second half of the second year of reporting under the DTR.

|

DTR 4.3.2 |

In the context of DTR 4.3.2. "making public" means the publication of the IMS in unedited full text via a RIS as required by DTR 6.3.5. In the sample of 100 companies surveyed:

- 85 companies (second half IMSs: 93 companies) published information clearly labelled as an IMS. Nine of these companies referred to this as a "AGM and IMS";

- 14 companies (second half IMSs: five companies) issued "AGM statements", "trading updates" or "Q1 results" statements which did not include "IMS" in the title; and

- one company (second half IMSs: two companies) did not issue any information that could be considered to be an IMS. This company was in the smallest 350 companies by market capitalisation.

Figure 1 below summarises how companies labelled their IMSs.

The company that did not publish any IMS information did not give any reason for its non-compliance and it has been issuing regular half-yearly financial statements and annual reports. There is no evidence that the company's shares were suspended from trading. Even if they had been suspended, this would not relieve the company from its continuing obligations under the DTR to publish an IMS. This was confirmed by the UKLA Technical Note: IMS Review (http://www.fsa.gov.uk/pubs/ukla/ims_review.pdf) which states that "these obligations do not fall away during a suspension and issuers must continue to comply". As a result, the discussion of findings below relates to the 99 companies that published a first half IMS.

Speed and period of reporting

|

DTR 4.3.3 |

The DTR effectively provides companies with two periods of approximately ten weeks to publish their IMSs.

Figure 2 below illustrates in which week, since the start of the six month period, companies published their first half IMSs. As expected and in line with the findings of the previous surveys, the top 350 group of companies typically reported slightly earlier than the middle group and the smallest 350 companies.

Of the companies surveyed 10 reported on the last day of the period specified by DTR 4.3.3 (second half IMSs: 12 companies), and six companies (second half IMSs: one company) reported outside the required timeframe. One of the companies reporting outside the timeframe was late by one working day which may have been due to some confusion over the actual deadline.

29% of companies issued their IMSs for the first six month period of the current year during the same week that they issued their IMSs during the second six month period. 36% of companies issued their first IMSs earlier than their second and 32% issued their first IMSs later than their second. This is illustrated in Figure 3.

|

DTR 4.3.4 |

Six companies (second half IMSs: four companies) did not indicate the period covered by the IMS. 65 companies (second half IMSs: 76 companies) explicitly stated the period being reported on, with 25 of these simply referring to the first quarter of the year. The remaining 28 companies (second half IMSs: 18 companies) used phrases such as "to date", "today" and "up to the date of publication".

50 companies (second half IMSs: 42 companies) fully complied with DTR 4.3.4 by covering the period up until the date of publication. This includes 15 companies (second half IMSs: 20 companies) that covered the period up to the last working day before the date of publication of the IMS, which was considered to have met the requirement under DTR 4.3.4.

As shown in Figure 4, the average delay between the reported date in the IMS and the date of publication was 10 days (second half IMSs: 11 days) with the maximum delay being 62 days (second half IMSs: 49 days). These figures are primarily attributable to those IMSs that cover the first quarter period and they show a slight deterioration from Deloitte's 2010 survey of the second half IMSs, albeit the result is consistent with the 2009 survey on first half IMSs.

Consistent with the findings of our previous surveys, the majority of companies with a delay between the period covered by the IMS and its publication were in the top 350 group of companies. This is perhaps partly because these companies are more likely to be complex multinational groups which makes collecting information together more time-consuming. It is also because, as mentioned above, many of the companies with delays discussed the results of a three month period or quarter rather than covering the period up to the date of publication of the statement as required by DTR 4.3.4.

Of the 50 companies covering the period up to the date of publication in their IMSs, 11 companies were from the top 350 group (second half IMSs: ten companies), 20 companies were from the middle group (second half IMSs: 17 companies) and 19 companies were from the smallest 350 companies (second half IMSs: 15 companies).

As discussed in the "Investment Trusts' IMSs" section (see page 13), industry guidance issued by the Association of Investment Companies (AIC) in April 2007 suggests that any 'gap' between the period covered by the IMS and its date of publication could be covered with a statement by the board of directors "to confirm that it is not aware of any significant events or transactions which have occurred between the 'as at' date of the financial information and the date of publication of the IMS which would have a material impact". This approach was taken by more than half of the investment trusts surveyed, suggesting that the provision of additional guidance in this area to corporates may result in better compliance. In its review of IMSs in May 2009 the UKLA did not include specific reference to this issue but it commented that, if there have been no material events in the relevant period, "there would appear to be no obligation to the issuer to make any comment". However, to avoid confusion it is advisable for companies to state clearly if the IMS covers the period up until the date of publication.

Director involvement

There is no explicit requirement for IMSs to be signed. 56 of the companies surveyed (second half IMSs: 52 companies) did not show any involvement by the board of directors in issuing the IMS. Of those that demonstrated some involvement:

- 27 companies (second half IMSs: 26 companies) included a quote or statement from the Chief Executive; and

- 16 companies (second half IMSs: seven companies) included a quote or statement from the Chairman.

Length of IMSs

Based on the information as published on the RIS, the first half IMSs are, on average, 2 pages which is an increase from 1.7 pages for first half IMSs in 2009 (second half IMSs: 2.2 pages). The IMSs ranged from half a page to 13 pages. Figure 5 shows the average, maximum and minimum number of pages of an IMS by size of company. As expected and consistent with previous surveys, the top 350 group of companies produced the longest statements.

The 9% decrease in the length of the first half IMSs when compared to the second half IMSs is due to companies including more detail in their second IMS as it is published before the announcement of the full year results or that they feel that more detail is appropriate given the length of time that has passed since their last annual report or a combination of both. In contrast, the first half IMS is issued usually shortly after the publication of the lengthy annual report and at the time of the AGM. So there is likely to be less new information to include in the first half IMS.

4. CONTENT OF IMS

|

|

DTR 4.3.5

|

From 2007, the UKLA gave some guidance, on applying the new rules on IMSs, in its regular publication List! These publications were withdrawn in 2010 but the relevant guidance on IMSs was retained and is now found in two Technical Notes called Disclosure and Transparency Rules (DTR) and IMS Review.

In its Technical Note: DTR (http://www.fsa.gov.uk/pubs/ukla/disclosure_transparency.pdf), the UKLA explained that the broad requirements were provided on the basis that companies should be free "to choose a form of reporting appropriate to their stakeholders".

The UKLA further stated that "we continue to believe that the content of IMS will depend on the circumstances of each issuer and the markets in which it operates" and that it supported a "market-led solution where the detail of IMS are developed by market practitioners and discussed between preparers and users of the information".

Following its May 2009 review of IMSs, the UKLA commented (in Technical Note: IMS Review) that its "view remains that individual issuers are best placed to consider the approach that they take in their IMS announcements". It concluded that "it would be counter-productive to take a more prescriptive 'one size fits all` approach".

The rules do not specifically require an IMS to contain any numerical data. The Technical Note: DTR also clarified this point, stating that: "We believe that IMS may not require financial data in certain circumstances. The issuer's nature, scale and complexity may mean it can provide a meaningful narrative description of the major events/transactions that have occurred during the relevant period and the issuer's financial position. If this happens numerical data may not be required." In its Technical Note: IMS Review, the UKLA stated further that it "envisaged that the use of financial data was likely to be the main approach". However, despite this flexible attitude, the UKLA's own findings highlighted that many companies failed "to provide adequate coverage in either narrative or data".

This section considers how companies complied with these broad DTR requirements and the additional UKLA Guidance in its Technical Notes and whether there are any emerging trends. This assessment was performed across the following areas:

- financial performance;

- financial position;

- material events and transactions;

- going concern, risks and uncertainties, and liquidity; and

- other information provided.

Financial performance

There were many approaches to providing a general description of financial performance. The following trends were identified:

- 84% of companies surveyed (second half IMSs: 92% of companies) commented on financial performance to some extent. 16% of companies (second half IMSs: 8% of companies) failed to comment on financial performance in any way.

- 68% of companies (second half IMSs: 57% of companies) gave a brief description of revenue levels, often combined with other measures associated with financial performance such as order book, new contracts or transaction volumes. Sometimes the information provided by the companies was easily understandable only to those familiar with the company, but not to other market participants without reasonable prior knowledge of that company.

- 38% of companies (second half IMSs: 8% of companies) commented

on gross or operating profit in varying degrees. This is an

example:

"Overall, operating profit, cashflow and the balance sheet are strong, and in line with our expectations. The pubs acquired over the last year are trading very well and investment in our existing brands and formats is delivering healthy returns."

Greene King PLC – Interim Management Statement September 2010

When making this type of statement, care must be taken to make the information meaningful to all readers, not just informed readers with prior knowledge of the company. The UKLA raised this as an issue in its Technical Note: IMS Review, noting that information provided on financial statements should be meaningful. It commented that in comparing to expectations, companies "should be careful to refer to verifiable (that is, publically stated) expectations". It also concluded that "unless the company clarifies what these expectations relate to, such as management expectations from previous reports, analyst or market expectations etc, it risks that information not being meaningful to the reader".

- 59% of companies (second half IMSs: 53% of companies) provided numerical information expressed as a percentage or an absolute number or both.

- 25% (second half IMSs: 40% of companies) gave their general description of the financial performance of the company using only narrative. In the Deloitte 2009 survey of first half IMSs, 42% used only narrative information. So there has been a significant shift from 2009/10 to now. More numbers are being used in IMSs. The use of numerical information by size of company is summarised in Figure 6 below.

Financial position

While most IMSs included some information on the financial performance of the company, 38% of companies (second half IMSs: 29% of companies) met clearly the requirement to provide a general description of the financial position of the company. The low level of compliance in this area has been seen in all of the previous Deloitte IMS surveys. Another 29% of companies provided some very limited information on aspects of their financial position.

Of the 67% of companies that provided any description of the financial position:

- 63% of those companies (second half IMSs: 43% of those

companies) provided a description of the financial position

together with some financial data, such as:

"During the period we invested approximately £10 million to support the further growth of two companies in our portfolio.

At 30 June 2010 our undrawn debt facilities stood at £780 million. Together with our third party funds we have an investment capacity of over Euro 2 billion.

This highly liquid position is a key competitive advantage in the current market and as a result our investment pipeline continues to build across our global office network.

We remain on track to deploy £150-£200 million in the financial year, however continue to exercise caution given the fragility of the economic recovery."

Intermediate Capital Group PLC – Interim Management Statement July 2010 - 37% of those companies (second half IMSs: 57% of those

companies) made a statement about the financial position of the

company without providing any financial data, for example:

"Except for the completion of the acquisition of a stake in Meininger on 16 December 2010, there has been no significant change in the Group's financial position since the full year results statement in November 2010. The normal working capital cycle of the Group's businesses is unchanged."

Holidaybreak PLC – Interim Management Statement February 2011

"Our balance sheet remains strong, with the net cash position being further enhanced since the year end."

Latchways PLC – Interim Management Statement August 2010 - nearly all companies that provided any information on their

financial position did this by providing limited information on

individual balance sheet items, commonly net debt or cash, for

example:

"Cash generation has continued to be healthy and net debt is expected to be around £9.0m (31 May 2010: £14.3m)."

Porvair PLC – Trading Update June 2011

The remaining 33% of companies (second half IMSs: 42% of companies) did not give any information about the financial position of the company and therefore failed to comply with the relevant requirement.

Figure 7 summarises the type of information provided by companies on their financial position, if any, by size.

The above findings are consistent with the findings of the UKLA, set out in its Technical Note: IMS Review which summarised the 2009 review of IMSs. The note states that "this is the weakest area of compliance within the IMS obligations" as "the majority of IMS did not adequately deal with the financial position requirement, with many containing no information on, or even mentioning, the issuer's financial position".

Material events and transactions

79% of companies (second half IMSs: 63% of companies) discussed transactions or events that occurred during the period. Consistent with prior years, it has been assumed that any event or transaction mentioned in the IMS was material.

77% of those 79 companies disclosing material events and transactions went on to give some explanation of the impact of the events or transactions (second half IMSs: 82% of companies). The explanation of the impact of material events or transactions, required by DTR 4.3.5, typically included details of the financial impact in absolute terms or, to a lesser extent, as a percentage movement. Common types of material events and transactions discussed included:

- new business or contract wins;

- new products and locations;

- acquisitions and disposals of businesses; and

- restructuring.

Examples included:

"Since the announcement of our preliminary results for the year ended 31 March 2010 on 17 May 2010, we have successfully retained and expanded a number of existing contracts and secured new work across our business:

- We have been appointed preferred bidder for a facilities and energy management agreement to support Rolls-Royce across its estate in the UK and mainland Europe.

- We will commence a £15m mechanical and electrical project for the London offices of a large investment bank, upgrading the building management system over a 19-month period.

- We renewed a three-year, FM contract for RWE NPower with an annual value of £9.2m.

- We have been awarded a contract for the cleaning and waste management of the Scottish government for four years with an annual value of £1.8m.

- We have been awarded a technical FM contract for the

national portfolio of retail outlets for Lloyd's Pharmacy with

an annual value of £5.6m for a three-year period".

MITIE Group PLC – Interim Management Statement July 2010

"Since 30 September 2010, we have announced £25

million of infill acquisitions. These include the acquisition of

foodservice of Life's A Party in Australia, a 90% interest in

Chiyoda Food in Japan, Menke Menue in Germany and Sabora in Spain.

The acquisition of Reilimpa marked our entry in the support

services market in Portugal."

Compass Group PLC – Interim Management

Statement February 2011

"The Group incurred £16.9m exceptional operating

items in the three month period (2010: £14.2m). These related

to the previously announced UK and North America restructuring and

integration of Oeger Tours in Germany."

Thomas Cook Group plc – Interim Management

Statement February 2011

The remaining 21% companies (second half IMSs: 37% of companies) did not discuss material events and/or transactions in their IMSs. In its Technical Note: IMS Review the UKLA states that "there would appear to be no obligation on the issuer to make any comment" if there have been no material events or transactions in the relevant period. Therefore it appears that these 21 companies met the requirements of DTR 4.3.5(a).

Going concern, risks and uncertainties, and liquidity

The FRC's guidance on Going Concern and Liquidity Risk: Guidance for Directors of UK Companies 2009 was issued in October 2009. The FRC Guidance says that it need not be applied to IMSs. But, in light of the current economic climate and the DTR requirement to discuss financial position, it may be expected that companies comment, at least briefly, on going concern in their IMSs. A lthough only one company from this survey explicitly referred to going concern, 53% included information about the principal risks and uncertainties facing the company, although often not referred to as such, in their first half IMSs.

Disclosed risks and uncertainties included:

- general economic uncertainty;

- weak consumer confidence and reduced spending;

- reduced demand arising from government cuts;

- mortgage crisis;

- volatile stock markets;

- political unrest in Egypt and Tunisia; and

- disasters in Japan.

Furthermore, information was provided in some IMSs on liquidity and cash flow, with 24% of companies (second half IMSs: 7% of companies) specifically commentating on liquidity, including companies referring to their access to external funding such as borrowing facilities. These comments included:

"On 14 April 2011, Mondi signed a new Euro 750 million

5 year syndicated revolving credit facility with 10 banks to

refinance its existing Euro 1.55 billion revolving facility that

was due to mature in June 2012. Following this refinancing the

average maturity of the Group's committed debt facilities is

extended to 4.2 years from 2.6 years as at December 2010, with

unutilised committed borrowing facilities of Euro 760

million."

Mondi PLC – Interim Management Statement May

2011

Information provided on key performance indicators, specifically labelled as such, was not provided by any company (second half IMSs: 2% of companies).

Other information provided

Some companies chose to provide additional information in their IMSs such as non-financial data, forward-looking statements and related disclaimers.

Non-financial data

73% of companies (second half IMSs: 66% of companies) presented non-financial data in their IMSs to supplement the financial data presented. The nature of items included was matters such as:

- order books;

- new customer contracts;

- new products;

- store numbers; and

- prices for raw materials.

Forward-looking statements

Although the publication of forward-looking information is not an IMS requirement, 73% of companies (second half IMSs: 84% of companies) included comments about the future. The forward-looking information was incorporated into the text of the IMS in most companies, with 20% of companies (second half IMSs: 29% of companies) including a separate "Outlook" section. Figure 8 illustrates the nature of the information provided.

34% of companies (second half IMSs: 36% of companies) included some cautionary statements regarding the future outlook of operations.

"We have made a good start to the financial year, but

following the recent Budget and the actions proposed to reduce the

national deficit, including the increase in VAT, we are cautious

about the outlook for consumer confidence and spending and continue

to manage the business accordingly."

Marks & Spencer Group PLC – Interim

Management Statement July 2010

6% of companies (second half IMSs: 28% of companies) made some generic comments, neither positive nor cautionary, about the future.

"As a result of the first quarter growth in

like-for-like revenue, demonstrating the quality and resilience of

the continuing Group, and the momentum in new business wins,

trading continues in line with management's and market

expectations."

Creston PLC – Interim Management Statement

July 2010

33% of companies (second half IMSs: 20% of companies) included only positive statements about the future.

"RM's financial position remains strong and the

Board believes the Company remains well-placed to manage its

business risks for the foreseeable future."

RM PLC – Interim Management Statement

February 2011

26% of companies (second half IMSs: 16% of companies) did not include any forward-looking information.

Disclaimers

In line with the findings reported in previous surveys, 29 companies (second half IMSs: 29 companies) included some form of disclaimer statement in their IMSs, clarifying that the forward-looking statements were made in good faith and should be treated with caution due to the inherent uncertainties which underlie such forward-looking information.

"This release includes statements that are forward

looking in nature. Forward looking statements involve known and

unknown risks, assumptions, uncertainties and other factors which

may cause the actual results, performance or achievements of the

Group to be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements. Except as required by the Listing Rules and

applicable law, the Company undertakes no obligation to update,

revise or change any forward looking statements to reflect events

or developments occurring after the date of this

release."

Speedy Hire PLC – Interim Management

Statement July 2010

Companies may wish to discuss with their legal advisors whether such a statement is advisable.

Compliance

Overall, 22% of companies clearly met all of the content requirements of an IMS as specified by DTR 4.3.5. All of these companies reported within the ten week window provided by the DTR. The 22% is an improvement from the 15% recorded in the 2009 survey of first half IMSs.

5. INVESTMENT TRUSTS' IMSs

|

Nearly 400 of the companies listed on the Main Market are investment trusts. For the purpose of this survey, investment trusts are defined as those companies classified by the London Stock Exchange as being in the equity and non-equity investment instruments sectors, but excluding real estate investment trusts and investment type companies in other sectors. A random sample of 30 investment trusts was selected, being ten companies from each of the top 350 companies, the middle group and the smallest 350 companies by market capitalisation. This section examines the survey findings on the IMSs published during the first half of the trusts' fourth year of reporting under the DTR. Comparisons with the findings of the previous Deloitte survey And there's more are included where relevant and relate to the IMSs published during the second half of the trusts' second year of reporting under the DTR.

29 of the investment trusts selected published IMS information (second half IMSs: all 30 investment trusts).

In April 2007 the AIC published technical guidance (http://www.theaic.co.uk/Files/Technical/IMSguidancefinalApril07.pdf) on issues and considerations specific to investment companies in preparing their IMSs. This guidance is available in the AIC website and relevant key points are included below, where appropriate.

Signature and indicators of director involvement

There is no explicit requirement for the IMS to be signed and 14 of the IMSs surveyed did not contain any signature or quotes (second half IMSs: 18 IMSs). Of the remaining 15 trusts, twelve IMSs contained signatures from the company secretary and three contained a statement from the Chairman.

Speed and period of reporting

|

DTR 4.3.3 |

90% of trusts published their IMSs within the ten week window specified by the DTR (second half IMSs: 83%). The two IMSs that were published after the DTR deadline passed were from the smallest 350 companies and were published up to one week after the deadline.

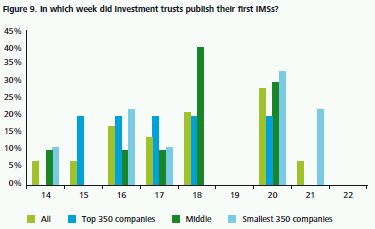

The first IMSs were published, on average, 18 weeks into the first half of the financial year (second half IMSs: 18 weeks). In line with the findings for the corporates, investment trusts from the top 350 group tended to publish their IMSs earlier, on average during week 17. This compares to the middle group publishing their IMSs during week 18 on average and the smallest 350 trusts publishing their IMSs also during week 18 on average. This is shown in Figure 9.

The time taken to report is in line with the second half of the year, with 54% of trusts making their first half IMSs public in the same week as they did with their second IMSs, 28% of trusts published their first IMSs earlier than their second, and 18% published their first IMSs later than their second.

Figure 10 below illustrates how the week of publishing the second IMSs compares to the week that the first IMSs of the year were published.

|

DTR 4.3.4 |

18 of the IMSs (60%) explicitly described in their IMSs the period covered as the period up until the date of publication of the IMS.

14 of these IMSs reported on the three month period with additional statements to confirm that the IMS covered the period up until the date of publication, for example:

"This interim management statement relates to the

period from 1 January 2011 to 31 March 2011, and contains

information that covers this period and up to the date of

publication of this interim management statement, unless otherwise

specified."

Murray Income Trust PLC – Interim Management

Statement April 2011

Four IMSs covered the period up to the date of publication without reporting on a specific quarter, for example:

"This interim management statement relates to the

period from 1 January 2011 to the date of publication of this

statement and has been prepared solely to provide additional

information in order to meet the relevant requirement of the UK

Listing Authority's Disclosure and Transparency Rules

..."

Dexion Equity Alternative Limited – Interim

Management Statement May 2011

The remaining 11 trusts reported on a specific period, for example the three months to 30 September 2010, and did not include in their IMSs any reference to information covering the period end to the date of publication of the IMS. This 'gap' was on average 30 days (second half IMSs: 28 days), with a range of four days to 53 days. The AIC guidance suggests that any 'gap' between the end of such a specified period and the date of publication of the IMS may be covered by a statement by the Board "to confirm that it is not aware of any significant events or transactions which have occurred between the 'as at' date of the financial information and the date of publication of the IMS which would have a material impact".

Length of IMSs

The IMSs of investment trusts were on average 2.3 pages long, down from 2.9 pages from IMSs issued during the second half of the year but identical to the length noted for first half IMSs in the 2009 survey, and ranged from one page to four pages. The average length from the top 350 trusts was 2.3 pages, the middle group had an average of 2.6 pages and the smallest 350 had 1.6 pages.

The 21% decrease in the length of the first IMS when compared to the second was also seen with the corporates and is usually due to companies wishing to include more detail in their second IMSs as it is published before the announcement of the full year results or that they feel that more detail is appropriate given the length of time that has passed since their last annual report and accounts or a combination of both.

Content of IMSs

The content of the IMSs issued by the investment trusts were reviewed to assess compliance with the DTR requirements.

|

DTR 4.3.5

|

Financial performance

The AIC guidance states that "the most likely measures which will be used are share price total return and NAV total return". The guidance further suggests that "performance of the benchmark" is likely to be given and that "information on share price and discount movement is highly valued by investors". How the IMSs provided information on the financial performance during the period covered is summarised in Figure 11.

100% of IMSs (second half IMSs: 100%) included information that clearly represented a general description of the financial performance. All these IMSs contained some information about NAV, net asset value per share.

Benchmark information was given by 55% of the investment trusts, often as percentage change relative to the benchmarked index.

76% of trusts included information on their share price, of which 77% of trusts gave both the share price as at a date and the percentage change over a certain period. 18% of trusts included only the share price information as at a date and the remaining 5% of trusts included information only on the percentage change over a certain period.

Information on the discount or premium of the share price compared to the trusts' NAV at the period end was given by 12 of the 29 trusts.

Other performance indicators were considerably less widespread. These included information on yields, net revenue return after tax and volatility.

Financial position

In its guidance on IMSs, the AIC recognised that, in addition to being a measure of performance, the most recent NAV was also useful information in the context of the financial position of an investment trust.

The guidance does not state explicitly whether or not NAV information alone would be sufficient to meet the DTR requirement to provide a general description of the financial position. However, the AIC recommended that investment trusts may "wish to publish a figure for total net assets" and expected that most trusts would include information on gearing, suggesting that information about NAV alone may not be enough to meet the DTR requirement.

All IMSs contained some information regarding the trusts' financial position in the form of NAV. 76% of the trusts (second half IMSs: 77%) went on to provide a general description of the financial position of the trust. This type of information ranged from a single figure for total net assets to many balance sheet line items being disclosed in addition to information on gearing. Figure 12 below shows some of the frequently disclosed measures of financial position.

Of the seven trusts that gave information on the financial position but did not appear to meet the DTR requirement to provide a general description of the financial position of the trust, six gave only NAV and the remaining one gave NAV and a description of new investments during the period.

An analysis of investments was given by 76% of trusts. A table of the top investments was given by 22 trusts. Further information on investments was given by nine trusts that analysed investments by geography and eight trusts that analysed investments by sector.

Material events and transactions

19 of the IMSs surveyed included information about material events or transactions. The information varied in its level of detail, especially in respect of the impact that material events or transactions had on the financial position of the trust.

Of the ten companies that did not disclose a material event or transaction, nine explicitly stated that there were no material events or transactions.

Common examples of material events or transactions included:

- the issue of shares or share buy backs during the period;

- new investments made;

- investments sold;

- changes in borrowing facilities;

- changes to the Board; and

- impairment of investments.

Use of numerical data and measures

Given the nature of investment trusts, it was not surprising to find that all 29 IMSs contained monetary amounts or percentages, and usually both. This also reflects the AIC's expectation "that most companies will provide statistical information".

Compliance

Overall, 23 of the 30 IMSs surveyed clearly met all of the DTR 4.3.5 content requirements consistent with the last survey which also showed 77% compliance. However, full compliance based on all of the DTR requirements including the timing requirements for the IMS reporting (i.e. the reporting timeframe and the period to be covered) was met by 14 of the 30 trusts (47%), being five from the top 350, five from the middle group and four from the smallest 350. This compares with a 37% full compliance rate for the second half of the year.

6. QUARTERLY REPORTS

|

DTR 4.3.6 |

Quarterly reports which include, as minimum, a management commentary, primary statements and related notes, contain considerably more detail than the DTR requires for an IMS.

In this year's sample of 100 corporates and 30 investment trusts there were no formal quarterly reports published in place of IMSs. Three companies referred to their IMSs as a quarterly report in the headings of their IMSs but their reports did not appear to contain that material expected in a quarterly report.

It is not surprising that few, if any, companies prepare a quarterly report as during the development of the Transparency Obligations Directive the European Commission indicated that the IMS requirements were deliberately designed to be less onerous than quarterly reporting. Those companies that produce something approaching a quarterly report often do so because of obligations arising from additional listings on non- European exchanges.

APPENDIX 1 – ILLUSTRATIVE INTERIM MANAGEMENT STATEMENT

This illustrative IMS has been developed to provide an example of what a first half IMS may include. This illustrative IMS is based on a hypothetical large group and hence may go beyond the level of detail that is required by the DTR.

Interim management statement

To the members of Group plc

|

Cautionary statement This interim management statement has been prepared solely to provide additional information to shareholders as a body to meet the relevant requirements of the UK Listing Authority's Disclosure and Transparency Rules. The interim management statement should not be relied upon by any other party or for any other purpose. The interim management statement contains certain forward-looking statements. These statements are made by the directors in good faith, based on the information available to them up to the time of the publication of this interim management statement but such forward-looking statements should be treated with caution due to the inherent uncertainties, including both economic and business risk factors, underlying any such forward-looking statements. |

This interim management statement has been prepared for the Group as a whole and therefore gives greater emphasis to those matters which are significant to Group plc and its subsidiary undertakings when viewed as a whole.

DTR 4.3.4

This interim management statement relates to the three

months ended 31 March 2011 and contains information that covers the

first quarter and the period since the quarter end to the date of

publication of this interim management statement.

DTR 4.3.5 – Our operations

Group plc manufacturers innovative, high quality products

for the [ ] and [ ] industries. These products are used by our

customers in a variety of systems which perform functions such as [

] and [ ]. Our product portfolio includes lines such as the [ ]

range and the [ ] range and our key brands include [ ], [ ] and [

].

While the current economic conditions remain challenging, our sales performance has been reasonably resilient due to the breadth of our operations and continuing strong end-user markets, particularly in the [ ] and [ ] industries. Although sales in the period are [ ] % down on those in the equivalent 2010 period, our performance is in line with the Board's expectations as communicated to shareholders in our recent annual report. The difficulties in financial markets are still not necessarily resolved and we remain cautious about business levels for the remainder of the year. Due to our continued focus on cost efficiencies and effective working capital management we were able to maintain gross margins, one of the Group's key performance indicators, at a level which puts us on track to meet our profit target for the full year.

Progress during the period

Revenue and operating profit

Total group revenue for the three month period was down by

_% on the corresponding period in the previous financial year to

£_million, with growth of _% in Asia Pacific being offset by

a decline in Europe (_%) and the Americas (_%). Excluding the net

impact of foreign currency effects (£_million), acquisitions

(£_million) and disposals (£_million), revenue on a

like-for-like basis was lower by _% at £_million. Group

operating profit for the three month period was £_million, _%

below the comparative period in the previous financial year

(£_million).

During the period, we have invested £_million (2010: £_million) in our core products and have launched a new product, [Product X1]. This new product contributed revenue of £_million during the first quarter with a promising order book in place for the next three to four months. Further new products are nearing completion and are due to be launched over the next 12 to 18 months.

In our last annual report, we reported on the delay of the replacement of [Product X] with its updated version due to further testing requirements on the new version being imposed by the regulator. This has resulted in lower than anticipated sales from [Product X] with sales being _% below those in the first quarter in the prior year. The required tests have now been completed and the Board expects to receive regulator approval in due course. The launch of the new version is now expected to occur at the beginning of the third quarter of this financial year.

Significant events, transactions and financial

position

During the period, we acquired [name of company] for

£_million to grow our market position in the Americas and we

are currently restructuring this part of the business following the

acquisition to consolidate our positions in this market. The

consideration for the acquisition of [name of company] was funded

partly by cash reserves available to the Group, and partly by

utilising available funds under the Group's loan facility at

competitive rates.

Total Group net assets as at 31 March 2011 remain relatively stable at £_million (31 December 2010: £_million). Net debt increased to £_million (31 December 2010: £_million) due to additional loans of £_million that were drawn down under the Group's existing loan facility at the time of the acquisition of [name of company]. The covenants under the loan facility are monitored closely and the directors expect that the headroom currently available can be maintained for the foreseeable future.

There have been no other significant events or transactions that could have a material impact on the financial position of the Group over the period since the beginning of the first half of the financial year.

DTR 6.3.5 – (3)(c)

|

[Address of registered office] |

By order of the Board, [Signature] [Director] |

|

29 April 2011 |

[Name of signatory to be stated] |

A copy of this statement can be found on the company's website www.groupplc.com/investorrelations

APPENDIX 2 – INTERIM MANAGEMENT STATEMENT DISCLOSURE CHECKLIST This IMS checklist is based on the Disclosure and Transparency Rules (DTR). In the

checklist below are shaded boxes containing useful guidance from the UKLA Technical Note: DTR and Technical Note: IMS Review.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.