Key Facts:

- Number of Companies trading on AIM as at 31 December 2010 – 1,194

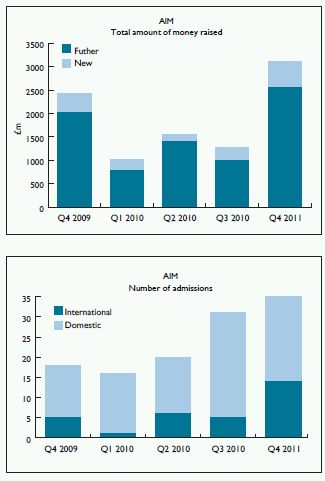

- Total funds raised on AIM in 3 months to 31 December 2010 – £3,101.7m

- Number of Companies trading on Main Market as at 31 December 2010 – 1,004

- Total funds raised on Main Market in 3 months to 31 December 2010 – £7,075.3m

Market Commentary

AIM

- Number of listed companies continues to decline since January 2008.

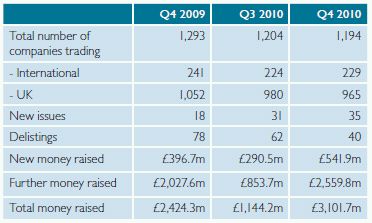

- The number of new issues in Q4 2010 has increased to 35 from 18 in Q4 2009.

- Number of Companies on AIM now at same level as May 2005.

- Average market of an AIM company increased to £67.0m in December 2010 from £55.1m at the end of September 2010. This has increased from £44.5m as at December 2009.

Market movements

- FTSE AIM All – Share rose 19.4% in Q4 2010 to 782.2 (18.1% increase in Q3 2010).

Summary statistics

Main Market

- There has been an increase in money raised for new issues in Q4 2010 from £662.9m in Q4 2009 to £2,667.6m.

- The number of companies has fallen from 1,026 at 31 December 2009 to 1,004 at 31 December 2010.

- The amount of further money raised has decreased from £18,574.5m in Q4 2009 to £4,407.7m in Q4 2010.

- The proportion of money raised for new issues has increased from 3% in Q4 2009 to 38% in Q4 2010.

Market movements

- FTSE All-Share rose 6.8% in Q4 2010 (12.8% rise in Q3 2010).

Summary statistics

Conclusion

Q4 2010 saw an improvement in the number of admissions and new money raised on AIM, compared to the prior quarter. Despite this, the total number of companies on AIM continued to decline.

On the Main Market, the number of admissions and total money raised in Q4 2010 increased, compared with the prior quarter.

In general, anecdotal evidence suggests that the new issues pipeline continues to improve.

Figures are obtained from the monthly market statistics produced by the London Stock Exchange.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.