TURNING THE CORNER?

More than half of the UK's top 230 law firms took part in our 16th annual survey of the legal sector. Although the economy remains the greatest concern for most firms, it appears that business confidence has risen since last year. Merger activity remains high on the agenda for many firms. Once they are able to next year, it appears that many law firms are anticipating joining forces with other professions and raising external capital.

In this issue of Professional Practices News we look at how regulatory and recent tax changes might affect firms' business structures in the future. In particular, we examine opportunities to minimise the tax burden through the use of a service company and the merits of setting up an overseas office and taking advantage of lower taxes in other jurisdictions.

Despite the difficulties in the job market, many firms are seeing staff on the move and some will be taking their teams with them. We provide some guidelines on the processes you need to have in place to protect client and other sensitive information.

We hope that there is plenty of food for thought for you here.

FIRMS FEELING CONFIDENT - 2010 legal sector survey results

By Giles Murphy

We examine the results of our 16th annual survey of the legal sector.

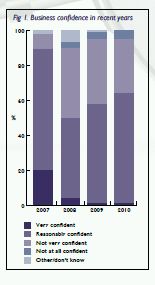

Results from our survey of 126 of the UK's top law firms show that business confidence has risen slightly since last year. Although experience is mixed and competition for work remains high, 64% of respondents report that they are confident about the next 12 months.

Six in ten firms cited the economy as the issue of greatest concern. This is closely followed by pressure on fees, which is a worry for half the participants. These statistics are similar to last year.

On a brighter note, fewer respondents are worried by a fall in demand for their services (down from 30% last year to 15% this year). Although cashflow issues are still causing difficulties for a quarter of the firms surveyed, this is down from 40% last year.

Tax and finance

Living with higher tax rates has undoubtedly encouraged many firms to look at tax planning opportunities. For example, more than six in ten firms are either introducing a service company or considering it (as shown in Figure 2).

General cost cutting measures have also been widely applied. Seven in ten firms have cut staff costs while almost a fifth have closed or are closing offices. Last year, just one in ten firms had closed an office. Given that four in ten practices have reorganised their management structure, the effects will have been felt right the way through from junior staff to the top.

While personnel represents the highest single cost for all law firms, only a relatively small proportion have used outsourcing as a way of minimising costs. A slightly larger number say they are considering this option. However, more than four in ten firms have centralised functions and about two in ten are looking into this.

M&A interest holds strong

Merger activity within the legal sector remains a hot topic and around threequarters of respondents anticipate an increase. A number of participants commented that the sector is ripe for consolidation, particularly at the 'silver' level and they suggest that the merger activity expected last year may yet occur. Certainly, informal conversations at a senior level between potential merger partners appear to be common.

Given the perceived difficulties associated with such mergers, interest in acquiring 'bolt-on' teams is huge. Indeed, more than eight in ten respondents said they would consider acquiring a practice area from another firm. Four in ten of those we questioned had acquired a 'bolt-on' team in the last year, with a handful of businesses acquiring more than two new teams.

There has been a slight fall in the number of 'failed' negotiations: last year 19% of attempted M&A negotiations didn't come to fruition, while this year 14% hit the buffers. 'Cultural differences' were cited as the principal reason for not meeting the expected level of M&As shown in the last few years' surveys.

Legal Services Act

Next year, under the Legal Services Act, law firms will be able to merge with other professions and raise external capital.

About three-quarters of respondents expect firms from different professions to join forces and there is now widespread acceptance that some law firms will seek to increase financial resources through private equity funding and potentially an IPO.

Indeed, about one in six (16% of our 126 respondents) consider it 'very likely' or 'likely' that they will look to raise external finance in the next five years. The private equity route appeals to more firms than an IPO, perhaps reflecting that practices are typically looking to raise £20m or less.

Smith & Williamson's 16th annual survey of the legal sector explored issues and trends affecting law firms and the legal market. Of the UK's top 230 law firms, 126 took part - including 63 of the top 100, and 4 of the top 10. Practices were represented by their managing partners, finance directors or similar.

PROTECTING YOUR PEOPLE TALENT – GET YOUR STAFFING POLICIES IN ORDER

By Rachel Stone

Rachel Stone explains what you need to have in place in the event of a star performer leaving your firm.

Even in these straightened times, we are still seeing teams on the move. So it's worth taking a minute to consider whether your firm is in the best shape to deal with the loss of some of your key players. Make sure you have the following three steps covered.

1. Contractual protection

- Make sure that you have valid and robust restrictive clauses that will stand up to legal challenge.

- Check that your employment contracts have clauses allowing you to use garden leave to keep an employee off site after resignation.

- Your gross misconduct definitions in your disciplinary policy should include clear references to poaching clients, staff and information.

2. Communication and engagement

- All key staff need to feel involved and engaged in your business.

- Talk to them about the future, their part in it and how they will share in the success of the business.

3. Protecting client information and relationships

- Your IT policies and systems should make it difficult for staff to copy records or to take client information off site.

- All key clients should have a good working relationship with more than one person in your business.

If the worst happens, there are a number of actions you should take straight away. Firstly, remind any resigning employees about their restrictive covenants and put this in writing. If you suspect that an employee or ex-employee is breaching these, take legal advice immediately. Remove access to your computer systems and ask for the immediate return of any client records that they may have and remove memory sticks, laptops and company phones that may contain lists of client or other sensitive information. Finally, make a handover plan so that clients meet their new contact as soon as possible.

BRANCHING OUT - Overseas planning for UK partnerships and LLPs

By Rajesh Sharma

Operating overseas? Rajesh Sharma looks at the issues.

There are numerous issues to consider when structuring overseas activities via offshore companies. The overriding reason for establishing an overseas entity should be driven by commercial reasons rather than tax mitigation. There are also legal, regulatory and language issues to consider of course.

However, members of UK partnerships and LLPs will suffer rates of tax of up to 52% (including national insurance contributions) on their share of profits from April 2011. As a result, such firms might consider taking advantage of lower taxed regimes in other jurisdictions if substantial work is done outside the UK.

What's the strategy?

With proper planning, a firm could be established in a non-UK jurisdiction to conduct overseas activities. The company would be subject to local tax on its profits. Provided that the central management and control of the company is located in that local jurisdiction, the profits of that company should not be subject to UK tax.

The likelihood is that some support operations for the offshore company will be provided from the UK. A sensible transfer pricing policy would have to be introduced to ensure that such UK costs are recharged to the non-UK company at arm's length rates.

The partnership deed or members agreement should be reviewed to ensure there are no conflicts with an overseas entity carrying out business activities. Similarly, partnership profit-sharing arrangements might be affected by such planning, both in terms of the overseas profits foregone by the UK partnership, and the ownership of the offshore company.

Where in the world?

There are a number of competitive jurisdictions with relatively low tax regimes. The strength of the double tax treaty network and the imposition of withholding taxes on dividends and fees for technical services would need to be considered, so local tax advice is recommended.

Post-tax profits allocation

The allocation of post-tax profits of the overseas company among principals is a key issue for consideration. The simple allocation of shares to members of the partnership would present difficulties in the future when new partners are admitted or existing partners retire or leave the firm. Care should also be taken to ensure that no employment income tax issues arise under the employment related securities legislation where, for example, members become officers or employees of the company.

Profits generated by the overseas company could be enjoyed by the shareholders in a variety of ways. Dividends paid to, and sales of shares by, UK resident taxpayers would give rise to a further layer of tax. However, there might be some tax advantages for non-UK domiciliaries to set up an offshore structure to shelter future offshore gains.

Anti-avoidance

There is a substantial body of UK antiavoidance legislation in place to examine any structures that are not sufficiently robust. These issues will vary from business to business, so would have to be discussed at the initial planning stage.

Costs

The establishment and running of an overseas company will mean substantial costs. Fiscal advantages can only be secured if the company has sufficient substance in the overseas territory. Any services provided from the UK would need to be charged on an arm's length basis.

THE FUTURE FOR TAX RELIEF ON PENSION CONTRIBUTIONS

By Paul Garwood

Four years on from 'pension simplification' and the rules have changed, explains Paul Garwood.

For three years following its launch pension simplification ran smoothly. But then the Government realised it could not continue to give tax relief on sizeable pension contributions while tax receipts were falling.

In the spring of 2009 it was announced that there would be some radical changes to tax relief on pension contributions from 2011/12. However, it was not until the March Budget of 2010 that the mechanics of these changes were announced and we realised that simplification was over.

For 2009/10 and 2010/11 we were given transitional rules which limit pension contributions for those earning £150,000 or more (including pension contributions) to the same level of regular (at least quarterly) contributions that they were paying as at April 2009; or £20,000; or £30,000 if their average pension contributions in the previous three tax years had been at least this amount.

These rules are complex and were tinkered with in December 2009 when the income limit was reduced from £170,000 to £150,000 (including pension contributions of at least £20,000). However, the rules proposed for 2011/12 looked totally unworkable for pension advisers.

New rules under discussion

Unsurprisingly, it was announced in the June Emergency Budget that the new rules planned for 2011/12 would be "simplified". This was closely followed by the publication of a discussion document on 27 July.

This document makes it clear that if the Government decides that its alternative approach meets its objective of reducing the tax relief given on pension contributions, it will replace the complex legislation that was enacted at the end of the last Parliament.

The document focuses on reducing the annual allowance (currently £255,000), the valuation of pension accrual within defined benefit schemes, limiting tax relief to a maximum of 40% and reducing the lifetime allowance, currently £1.8m.

It advocates a flat rate annual allowance for all of between £30,000 and £45,000 and a simple non-age adjusted flat factor of between 15 and 20 to convert defined benefit pension accrual into a contribution which can be measured against the annual allowance. Steps will also be taken to stop employers from granting extra deferred benefits which fall outside of this equation.

If the annual allowance is breached it is proposed that there would be a 'stepped' tax charge to recoup tax relief. This would depend on the quantum of the excess contributions over the annual allowance. Following a reduction in the annual allowance, it is suggested that the lifetime allowance also be reduced to £1.5m. This would be accompanied by the right to make an election, to protect those with funds exceeding the lifetime allowance when the change is introduced, although only up to the level of the value of the fund when the changes are made.

Finally, the proposal that higher rate tax relief on contributions be limited to 40% rather than 50% is also under review.

Less relief to high earners

The proposals are radical and will most definitely reduce the amount of higher rate tax relief given to high earners. They would also bring a large number of people with final salary schemes into charge to tax and it remains to be seen whether those affected will want to renegotiate their salary packages.

A lower lifetime allowance with another round of pension protection elections might be welcomed by advisers but will not benefit pension investors. Whatever comes out of the consultation, it is certain that high earners with final salary pensions will be lobbying hard against the proposals as they stand.

ALTERNATIVE BUSINESS STRUCTURES - Next phase of the Legal Services Act looms large

By Nick Learoyd

Nick Learoyd considers the forthcoming ABS regime, which is set to change the entire legal marketplace.

When the Legal Services Act came into force in late 2007, the expected timescale for the alternative business structures (ABS) changes afforded by the Act seemed a long way off and most firms added it to the agenda for future consideration.

Most firms, understandably, have been distracted from longer-term strategic planning over the last two years, having had to face the more immediate challenges of the recession. However, interest in the opportunities afforded by the Act is now increasing. With less than a year to go, the timescale for considering these issues is becoming intense.

Whether or not firms seek to take direct advantage of any of the opportunities will depend on their specific circumstances. What firms cannot afford to do is simply ignore the issue, as the implications of the Act will not only affect individual firms, but are likely to change the entire legal marketplace in which all firms operate.

A real alternative to funding

The relevance of the ABS changes to individual firms will vary enormously depending on their business strategies. For businesses seeking to expand, the reforms represent a real alternative to funding investment, where traditionally this could only be achieved internally or through bank debt.

Firms seeking external investment will need to consider that investors will only be looking to invest in well-managed businesses with a clear and credible strategy for growth. For many firms this will require substantial internal changes including reforming remuneration arrangements, introducing corporate governance structures and using professional management.

The natural conservatism of many firms will lead them to conclude that this sort of structural change is not for them, and clearly an expansionist strategy is not appropriate for every firm. However, this does not mean that the provisions of the Legal Services Act will be irrelevant. Converting a practice into an ABS may form part of a defensive strategy to ensure that a firm can retain its key fee earners in a changing marketplace and to provide incentives to attract new talent.

'Tesco Law' – the next stage

The introduction of the ABS regime in mid 2011, will allow non-lawyers, including commercial organisations such as banks and supermarkets, to own firms that provide legal services. The reforms will also allow lawyers to form multidisciplinary practices offering legal services in conjunction with non-legal services, such as lawyers working alongside other professionals to provide a one-stop shop for business advice.

An issue to consider

Although an ABS could be achieved either as a partnership, an LLP or a corporate, external investors are likely to favour the better-understood corporate model. This raises the contentious issue of how ownership of the business should be determined, not only at incorporation, but also on an ongoing basis in order to ensure that a firm can continue to attract and incentivise key staff.

TAX RISE PUTS BUSINESS STRUCTURES UNDER SPOTLIGHT

By Pamela Sayers

Pam Sayers explains how firms are exploring opportunities to minimise their tax burden.

This year's 10% increase in the top rate of income tax – the first increase in 23 years – has inspired many professional practices to review their current business structure.

In our latest annual survey of the legal sector (see inside for details), 45% of firms said they have considered or are considering ways to mitigate the effect of higher tax rates by introducing a corporate partner or member. Over 65% are considering or have already set up a service company for this purpose.

Challenge to service company route

Using a service company, tax mitigation is achieved through the UK transfer pricing rules. With the significant discrepancy between the top rate of income tax and the current main rate of corporation tax, the use of a service company and the application of the UK transfer pricing rules has created much interest at HM Revenue & Customs.

Clearly, there are many factors that need to be taken into account and each firm's situation in relation to the use of a service company must be considered on its own merits. However, from a tax point of view there are essentially two main criteria to determine whether a service company is appropriate.

- Is the service company providing discrete professional services?

- What is the level of risk assumed by the service company?

Great care must be exercised in light of the new tax penalty regime and the powers of the authorities, which have undergone a profound change and some of which we have seen in operation for the first time over the last year. While it would be wrong to draw too many conclusions about the new regime from its first year of operation, there are some emerging trends worth noting.

The experience of the new powers is still fairly limited partly due to the changes being introduced in a gradual, measured way with no 'horror stories' emerging. There seems to be a mixed response to how penalties are being set with some anecdotal evidence of reasonable spreads, but with some bunching towards the middle and indeed some concern over how suspended penalties are offered.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.