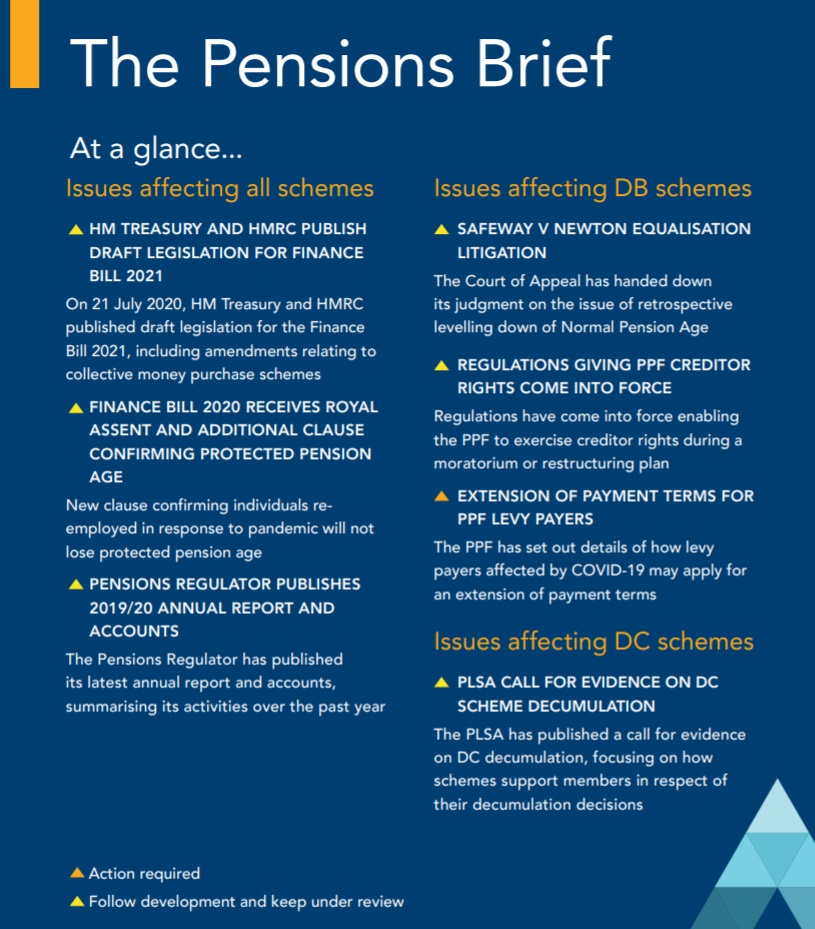

Issues affecting all schemes

Draft Finance Bill 2021

On 21 July 2020, HM Treasury and HMRC published draft legislation for the Finance Bill 2021.

The key pensions aspect of the draft legislation addresses collective money purchase schemes and, in particular, proposes amendments to the Finance Act 2004 to enable collective money purchase schemes to operate as registered pension schemes

The proposed changes to the Finance Act 2004 intend to reflect the unique status of collective money purchase benefits and arrangements, which are not currently reflected in the existing benefit categories under the Finance Act 2004.

The technical consultation on the draft legislation will run until 15 September 2020, with the intention that the Finance Bill 2021 will be introduced into Parliament in the following autumn Budget.

Action

For noting.

Finance Bill 2020 receives royal assent and additional clause confirming Protected Pension Age

On 22 July 2020, the Finance Bill 2020 received royal assent. Prior to that, a new clause was added to the Bill to prevent individuals that had been re-employed as a consequence of the COVID-19 pandemic from losing their protected pension age. This followed a previous announcement by HMRC of a temporary concession for members with protected pension ages where they were re-employed for reasons connected to the pandemic.

The new clause confirmed this temporary concession by amending paragraph 22 of Schedule 36 to the Finance Act 2004 by inserting a new re-employment condition. The new provision will have retrospective effect from 1 March 2020 and sets out that any individual who returns to work will not lose their protected pension age if:

- They were re-employed during the "coronavirus period" (defined as 1 March 2020 to 1 November 2020, although this period can be extended by regulations to any date prior to 6 April 2021); and

- The only or main reason for the re-employment was to respond to public health, social, economic or other effects of COVID-19

The Finance Bill 2020 received royal assent on 22 July 2020 and became the Finance Act 2020. Key changes made by the Finance Act 2020 include the following changes to the annual allowance provisions:

- A reduction in the minimum tapered allowance from £10,000 to £4,000 and the simplification of a formula used to calculate the reduced annual allowance; and

- An amendment to the definition of "highincome individual" so that the tapering of the annual allowance kicks in where adjusted income for the tax year is higher than £240,000 (the previous threshold had been £150,000) and whose threshold income for that year is £200,000 (previously £110,000).

Action

For noting.

Pensions Regulator publishes 2019/20 annual report and accounts

The Pensions Regulator has published its annual report and accounts for 2019/20.

The report highlights the Regulator's performance against 18 of its own key performance indicators, with 12 of the 18 metrics being met. Two of the key metrics were affected by COVID-19, which required the Regulator to pause certain regulatory initiatives and introduce additional workstreams.

Some notable activities highlighted in the report include the following:

- The authorisation and supervision of 38 master trusts;

- The completion of the roll-out of automaticenrolment duties, with focus now moving towards ensuring that the early adopters re-declare their ongoing compliance together with tougher compliance and enforcement activity;

- Extension of the Regulator's regulatory reach with the use of a wider range of proactive and targeted regulatory interventions, including a new supervisory approach for the most crucial schemes (covering around two-thirds of UK scheme membership);

- The use of targeted communications to inform trustees of DC schemes of the Regulator's expectations concerning default investment strategies reviews; and

- The Determinations Panel making 85 determinations and exercising 119 powers over the year (an increase from 71 determinations and 107 powers exercised in 2018/19). In the majority of cases the standard procedure was used, with only three cases being heard by the Panel under the special procedure.

Action

For noting.

To read the full article click here

Originally published 07 August, 2020

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.