- in Australia

- within Compliance, Finance and Banking and Antitrust/Competition Law topic(s)

In the Official Gazette dated 18 February 2017, the Capital Markets Board of Turkey ("CMB") introduced certain amendments to the Communiqué on Debt Securities ("Communiqué"), and these amendments have entered into effect as of the publication date. In this article, we will briefly explain the content and discuss the implications of the most significant amendments made to the Communiqué, as follows:

- "Financing bill" replaces "bill": The terminology of the Communiqué has been modified by amending the term "bill" ( "bono " in Turkish) as "financing bill" {"fmansman bonosu" in Turkish). It appears that this change aims to diversify the bills, including precious metals bills.

- Repayment in installments: The CMB has regulated that financing bills and bonds ("tahvil" in Turkish) may be repaid to investors in installments until the maturity date, whereas they could previously be repaid in a lump sum on the due date.

- Minimum nominal value requirement: For private placements arising from domestic sales without a public offering, a minimum nominal value of TL 100,000/per unit has been introduced. Previously, there was no nominal value requirement. This is an extra condition that must be fulfilled, in addition to the limit of 150 maximum investors for private placements.

- CMB powers strengthened: The CMB has been granted the authority to make certain additional requests from the issuer, such as imposing restrictions on the qualifications of the investors and/or sale conditions, or shortening the term of the issuance document.

- With regard to the cancellation (in whole or in part) of debt securities whose sale has failed to reach the previous issuance ceiling, the CMB has been authorized to assess the cancellation upon the issuer's request.

- For the issuance of convertible and exchangeable bonds in Turkey without a public offering and for such an issuance abroad, the CMB has been granted the power to apply different rules upon the request of the issuer.

- Authorized corporate body: It has been regulated that, in the authorized corporate body resolutions (i.e., general assembly resolutions or board of directors' resolutions) regarding the issuance of debt securities, the specific type of the debt securities should be explicitly indicated. Otherwise, the phrase "debt securities" is deemed and interpreted as "financing bond and bill." Therefore, if a company wishes to issue lease certificates or asset-backed securities, it is recommended that the company mentions this explicitly in the relevant resolution.

- Information requirement for foreign debt securities: Issuers will no longer be required to register their issuances of foreign debt securities with the Central Registry Agency ("Merkezi Kayıt Kuruluşu" in Turkish) ("CRA"). For debt securities to be issued abroad, the issuer is required to inform the Central Registry Agency and provide detailed information as to the debt instrument (e.g., issuance amount, issuance date, ISIN code, due date, interest rate) in any case.

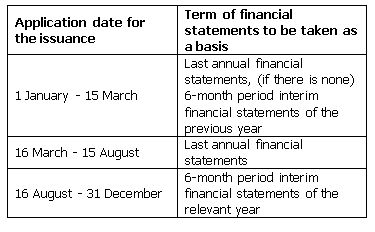

- Financial statements are to be taken into account: In order to calculate the issuance limit of debt securities, the following financial statements, which will be prepared in accordance with the relevant regulations and communiqués of the CMB, should be taken as a basis.

The foregoing terms can be duly adapted for companies that are subject to the "special accounting period."

Buyback of debt securities: Issuers may purchase their own bonds. Once purchased, the issuer may choose to resell, keep, or cancel these bonds. If an issuer wishes to purchase its own bonds outside the Borsa Istanbul, such transactions must be disclosed on the Public Disclosure Platform.

This article was first published in Legal Insights Quarterly by ELIG, Attorneys-at-Law in September 2017. A link to the full Legal Insight Quarterly may be found here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.