PRESENTATION

Emlak Konut GYO A.Ş. has been a major corporate player in the Turkish Construction and Real Estate Industry for 61 uninterrupted years. Close examination of the housing industry in our country has turned into a management approach for Emlak Konut GYO A.Ş. as a result of the corporate culture and management approach acquired through the years. The brand value that has been created over the years allows our company to enjoy a management approach with the capability of continuously raising real estate industry standards. The company acts as leader and role model in the area of social awareness, especially in building systems, design, environmental consciousness and business methods. With aspiration for continuous fast growth, Emlak Konut completed two public offerings, the first one in 2010 and the second in 2013. Both public offerings attracted great interest from global and also local investors in Turkey, putting them among the most notable ones in the history of the Turkish Republic.

There have been significant advances in the construction and real estate industries, especially in the past 10 years, as a result of our accomplishments both for the country and for the industry. Emlak Konut GYO A.Ş. has done more than its share in this advancement by supporting the construction industry.

As part of its Corporate Governance Policy, the company places great importance to the notion of stakeholding in a broad sense. Accordingly, the company regards social responsibility in its areas of activity critical since it has a number of domestic and foreign stakeholders as well as institutions and people it does business with.

Our management considers "accurate information" as the most paramount value today. Therefore, we have commissioned a "Real Estate and Housing Report" and submitted to all stakeholders and the construction and housing industry with the goal of providing accurate, understandable and interpretable information.

The report published by us in the third quarter of 2014 sparked a lot of interest from stakeholders and the media, and it will be created quarterly to be disclosed to the public in keeping with the demands.

The published report was deemed worthy of the Finance Awards 2014 in Turkey's Best Management Consultancy category by the Wealth and Finance International.

The report provides macroeconomic results and general expectations as well as analysis of the construction and housing industries in particular. The report explains our projections, along with their justifications, for the coming period by taking into consideration that expectations and projections on the housing and construction industry is frequently stated in the public opinion. Transparent examination of sector data will not only improve the effectiveness of the related markets, but will also shed light on pricing discussions.

We respectfully submit our report to all parties in the industry and to the stakeholders.

INTRODUCTION

Emlak Konut GYO A.Ş. carries out operations while performing assessments of past and future periods. For this purpose, it keeps a close eye on economic variables specifically and also on developments related to the industry and business.

The company periodically performs macro- and microeconomic, financial and demographic analyses, and bases its executive decisions on these analyses. Performing special analyses has become a necessity for all stakeholders in the face of rising data and analyses needs in parallel with the fast growth of the construction and housing industry in the past decade. Pursuant to this responsibility, Emlak Konut GYO A.Ş. provides comprehensive analyses on the "Economy and Housing Industry," particularly in its annual reports but also in interim financial reports.

The following report primarily examines the Turkish Economy and Housing Industry as well as related main trends. The report consists of four parts.

The first part examines developments in the World Economy and in particular, in the concept of "the new normal" in post-2008 crises. It also deals with the significant changes that related economic developments have caused (or may cause) on the economy of the world and of emerging countries.

The second part examines developments in the Turkish Economy in the past decade and their effect on the industry as well as the important results of the "monetary and economic policies" implemented in our country.

The topics in part three addresses the Turkish construction industry, industry's impact on the country's growth, production, revenue variables, demographic aspects that affect the industry, and projections. Construction cost-interest-industry relationship is examined at the conclusion of the part.

Part four, the final section of the report, talks about the changes in global housing prices, asset and housing balloon concept, analysis of housing prices in Turkey and future price projections.

The study is based on objective and scientific sources on housing prices under the subject of "asset bubbles," a highly discussed issue at home and abroad after 2008. Our main philosophy was to provide information not only for analysts but for interested parties and the industry as well. Therefore, clear and understandable language was used so far as possible.

Emlak Konut, the largest Real Estate Investment Trust in Turkey, strives to shed light on the industry with this report and to fulfill its responsibility as an industry leader by making more accurate information available.

PART ONE

1. Global Economic Developments

The most critical milestone for the global economy was the Global Crisis of 2008. After effects are still being from the crisis from which every country was affected in one way or another. Today, countries' economies interact with each other with an increasingly rising trend. Thus, making an impact on global economic conditions while changing them.

It has become a necessity to keep up with all crucial developments as a result of globalization and increasing ties between countries' economies.

Even though it has been nearly six years since the second large global economic crisis, it is still difficult to maintain that socioeconomic sizes have gone back to pre-crises levels. This is especially felt in the economies of emerging countries. Over a period of time, each country may take a separate course regarding its economic program, resulting in implementation of opposing economic policies. In return, this becomes a factor that increases global uncertainty.

Central banks are the most decisive implementers of economic policies. Decisions made by the largest and most influential global central banks have acted as the main guidance for "international fund movements," and emerging countries' assets have been affected the most by the negative or positive changes in them.

Three biggest central banks (the US Federal Reserve (the Fed), the European Central Bank (ECB) and the Bank of Japan (BOJ) affect and shape global economies. Thus, policies by these banks give rise to implications that need to be followed up closely by the other economies.

Right after the crisis, the Fed began implementing expansionary fiscal policies quite swiftly. Accordingly, a number of methods were applied like interest rate cuts, bond purchases, funding the financial system through asset purchases, and utilizing the loan mechanisms. The goal of such a monetary policy was to come out of depression (crisis) by achieving the ultimate objective of growth through financial stability and stimulation of investment and consumption.

The policies implemented by the Fed to come out of crisis were not only unconventional, they were also essential to be adopted by the other central banks with diverse ways of implementation methods. Although belated, the ECB made an effort to follow in the footsteps of the Fed, which reacted to the crisis swiftly with more dynamic decision-making mechanisms. In East Asia, the BOJ implemented similar policies so as to curtail deflation and recession (a general decline in prices followed by stagnation), a chronic issue for its economy.

In parallel with the relative recovery in the US economy, the Fed initiated "bond buyback tapering" on December 2013 in order to step back from its expansionary monetary policy. An earlier-than-expected start of the process caused a decline in the local denominations of emerging countries (i.e. Brazil, Argentina, Indonesia and India), including Turkey, at first; then, a partial outflow of funds (i.e. Portfolio Movements, Hot Money), which come from financial markets for short-term investments, was observed.

The Fed's "cash inflow into the market through bond purchases" ceased in October 2014. However, the transition to an interest rate hike, which will put an end to monetary expansion, is anticipated towards the end of 2015. US officials set a target of an interest rate increase of 2 percent over the annual inflation and an unemployment rate below 6.5 percent. In the first months of 2014, they revised this objective to cut unemployment as much as possible and to increase buoyancy. This announcement from the Fed, coupled with the fact that data from the US economy do not indicate a fast recovery, was interpreted as a factor that increases risk appetite in terms of international fund movements.

Rising risk appetite diverted portfolio movements to emerging countries. At first, stock markets of countries such as Brazil, Turkey, Indonesia and India displayed upward trends and an increase in the value of their currencies as of the second half of March. However, important developments in the global conjuncture caused financial assets of emerging countries to fluctuate more.

On the other hand, the BOJ and the ECB, two major central banks that influence the global economy with their decisions, continue with "monetary expansion" policies in an effort to maintain economic boom. The BOJ went one step further and set an inflation goal to raise the general level of prices. Extremely loose monetary policies were implemented in November, following the Japanese economy's plunge into recession after unexpectedly shrinking in October.

In the second half of April, the ECB President Draghi announced a new expansion package in the works to pump life into the economy. The ECB began implementing a new expansionary monetary policy in October with the goal of overcoming the increasingly deep recession in the European Union. ECB President Draghi explained the new austerity package's objective as expanding the banks' loan mechanism, and by extension, boosting investment and consumption trends. However, he added that price increase and economic recovery would take longer to achieve.1 Despite of these developments, short-term recovery is not in sight for the European economy and the Euro, its monetary currency.

Table 1. Policy Interaction of the Three Big Central Banks

Even though the measures taken by the three major central banks are similar, there were significant timing differences. As a result, while the Fed put a stop to its monetary expansion policies, the ECB and the BOJ were re-instating these policies.

Consequently, expectations rose in the global economy that the "familiar" abundance of cash would continue in different channels. It appears insufficient that the US economy is the only one growing among other developed economies. The global economy is under threat from the syndrome of stagnation as highlighted by the ECB, which added a new dimension in monetary expansion, by the BOJ and even by the Central Bank of China.

This global issue creates pressure against the Fed's decision to increase interest rates (so as not to increase interest rates in the US) and keeps "risk perception" of the financial markets alive. It appears that ending the stimulus monetary policies, which the Fed initiated swiftly and effectively, got caught in the issue of global growth with the ECB, the BOJ and the Bank of China. This situation raised expectations of continuing positive outlook for fund inflows to countries such as Turkey, South Africa, Brazil, India and Indonesia.

As of 2014, recover in the global economic activity remains slow with varying dynamics among countries. While the US economy is recovering, economic growth in the Eurozone and Japan looks quite fragile and weak. The growth rate in emerging countries is losing steam. Recent downtrend in commodity prices is expected to adversely affect the growth dynamics of commodity exporting emerging countries2.

Sustainability of economic growth is another concept that is becoming increasingly important for the new central banking approach. Meanwhile, achieving and maintaining economic growth is among the most closely-watched risk elements. As such, it is a variable that needs to be closely watched in terms of the global economy.

1.1. Growth in the World Economy and Related Macroeconomic Developments

Growth was the macroeconomic variable that took the brunt of the global crisis of 2008 the fastest. Post-crisis "shrinkage" in developed countries peaked, causing the most severe stagnation since 1929. Developed countries were faced with ever-increasing risks of negative economic growth, deflation and unemployment, whereas emerging countries had a rather satisfactory period between 2009-2011. A good example of this is the high rate of growth and economic boom particularly in the countries known as the BRICs (Brazil, Russia, India and China). Consequently, these countries' role in the positive growth of the world economy has increased.3

After 2012, issues (current account deficit, inflationary pressure, upsurge in asset prices) began to arise due to fast growth in emerging countries, prompting them to make sacrifices and take measures to curtail their growth rates. A group of countries, including Turkey, Brazil and Indonesia, took the lead in these measures.

Throughout 2014, recovery in global economic activities remained slow and differences in countries' growth trends drew attention. A low trend of inflation is tied to weak outlook in economic activities and drop in oil prices. Even though monetary policies of developed countries still support growth, monetary policies of the Fed and the ECB differ from each other. Nevertheless, loose monetary policies that are implemented to boost recovery also cause certain financial risks for developed countries. In these countries, banking industry fails to give enough support to economic recovery, and risks concentrate especially on the non-bank financial industry. Global risk appetite and capital inflow to emerging countries fluctuate due to expectations regarding the Fed's likely decision to increase interest rates and geopolitical risks4

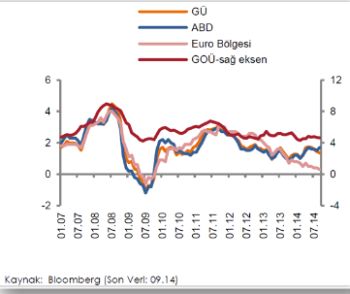

Graphic 1. Global and Developed-Emerging Countries' Growth Trends (Annual %)

Due to the reasons explained above, global growth projections and risk forecasts are revised often. There have been downward revisions in global and country-based growth projections in 2014 and 2015.

Table 2. Growth Projections

The International Monetary Fund (IMF) projected a global growth rate of 3.6 percent in April and later revised it down to 3.3 percent in October5. Whereas the World Bank (WB) announced its global growth rate projection in 2014 as 2.8 percent at the beginning of the year, only to raise it to 3.4 percent in November. There has not been a major revision in the global growth rate projections of 2015. Nevertheless, significant downward revisions have been made in growth projections and related assessments in oil and natural gas exporting countries like Russia, Venezuela and Brazil.

On the other hand, upward changes are seen in the growth projections of countries, including Turkey, that obtain most of their oil and natural gas from abroad, and as a result, experience fragilities in foreign currency.

In April, the IMF projected a 2.3 percent annual growth rate for Turkey as of the end of 2014, but it later revised it to 3 percent November. Similarly, the WB revised Turkey's growth projection to 3.5 percent, up from 2.4 percent6.

1.2. Developments in Global Employment

Employment issues created other unfavorable conditions for developed countries after 2008. Rising unemployment due to growth and stagnation is unsettling the Western economies and is an issue to be addressed through serious measures. The Fed as well as the ECB and the Bank of England (BOE) frequently state that they are taking measures to increase employment. After 2008, England and the US have been working towards accomplishing an "acceptable" rate of unemployment with a more successful employment chart compared to that of the Eurozone.

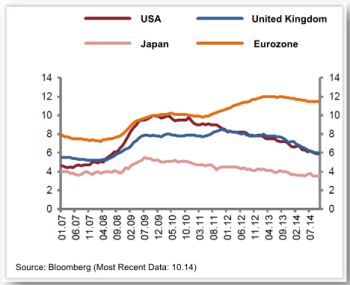

Graphic 2. Unemployment in the Economies of Select Developed Countries

While the US labor market maintains a strong positive outlook, the Eurozone suffers from high unemployment. Nevertheless, downward trend in the labor force participation rate continues to play a major role in falling unemployment rates. Furthermore, part-time employment remains above pre-crisis levels, indicating that labor market is yet to fully recover in the US7.

1.3. Developments in Commodity Price and Changes in General Price Levels

The Fed and the BOE, the central banks of countries with relatively more economic success, have swelled their balance sheets as a result of monetary expansion, asset purchasing and strengthening credit lines, and they now face the challenge of having to create "new money and central bank policies" to normalize the situation. Likely problems arising as a result of over expansion should be ruled out Risks in financial markets of developed countries appear to be intensifying, especially in the non-banking industries. While the banking industry loses leverage, hedge funds and stock market mutual funds that are involved in shadow banking activities enjoy a higher leverage and also deal with maturity mismatch risk. This is an indication that the non-bank industry may be affected the most from repricing8.

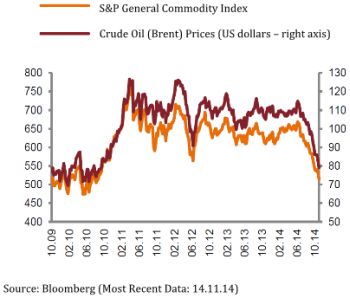

Graphic 3. S&P Commodity Index and Brent Oil Price Index

Weak outlook in global economic activity and downward trend in commodity prices cause global inflation rates to remain low. High output deficit continues in developed countries. Oil prices are in a downward trend brought on by weak economic activity. Also, prices do not pose an upward pressure in terms of inflation, especially in the US. Inflation in developed economies remain below targets due to these developments. Decline in commodity prices above projections has not only revealed the global problem of growth once again, it has also put off track the inflation (rise in general level of desired affordable prices) targets set by the economies of developed countries in an effort to get rid of deflation (decline in general price levels).

Graphic 4. Inflation Rates in Developed and Emerging Countries

It still pays to keep an eye on the following in terms of the macroeconomic state of the world economy: Recovery is slower in developed economies since this was where the crisis emerged. Emerging countries (which have more flexible internal dynamics, population, consumption, demand and supply structure) are able to recover and take action much quicker following a crisis. Nevertheless, these countries depend on developed economies for exports, funding, and importation of some intermediate goods. If recovery lags in developed economies, funds that come from portfolio activities may decrease, especially due to a change in the risk perception that could cause even more difficulties in exporting9.

1.4. Review of Emerging Countries' Economies

Between 2008 and 2012, emerging countries' economies were among the group that came out of the crisis the quickest. Rising growth rates during this period breathed life into the global economy. Post-crisis performances of countries like China, India and Turkey were especially impressive. Despite their relatively higher dynamism compared to developed countries, emerging countries still experience structural economic problems. (i.e., current account deficit, lack of savings, problems with demand, technological deficiencies, fluctuations in general price levels and exchange rates)

Graphic 5. GDP Developments in Countries and Regions (2013)

A different case that could be named the "new normal" arises when we look at the situation in terms of global financial markets and fund movements. Under the circumstances, "monetary and fiscal expansion" will continue in developed countries' economies as their economies falter, and as a result, funds with diminished risk perception will continue to flow towards emerging countries. Even though this particular situation creates a boosting effect in "asset prices," with occasional shifts in the risk perception, fluctuation arises both in asset prices and in local currencies. Measures to boost the supply and use of money are the most important methods used in the world to come out of crisis. Rather than encouraging consumption and production in developed countries, these measures bring in capital gains through financial markets in emerging countries.

It should be noted that a large part of the funds that come to emerging countries are short-term cash inflows, called "portfolio movements." Monetary policy preferences of developed countries are sure to affect emerging countries such as Turkey, Brazil, Hungary, India, Indonesia and Russia in the coming days.

Excessive borrowing may be triggered in the event of delayed normalization in develop countries' monetary policies due to slowing speed of global growth. In that case, it will be crucial to initiate measures so as to encourage strengthening the financial system and prudent borrowing10.

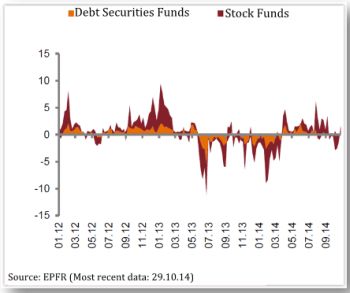

Graphic 6. Weekly Fund Inflow into Emerging Countries ($Billion)

Emerging countries employed central bank policies to overcome fast growth issues and increasingly more prevalent problems arising from developments in global conjuncture in 2013. Central banks of countries such as Chile, Peru, Poland, Thailand, Russia, Turkey and Mexico implemented repeated changes in interest rate policies so as to mitigate the after shocks created by fluctuations in funds.

1.5. Structural Problems and Employment in Emerging Countries

Most critical issues emerging countries experience are usually structural problems, which can be alleviated through decisive measures in the medium term. While structural problems vary from country to country, major ones are lack of savings, issues related to general level of prices, changing import and export items, and achieving balance of foreign currency.

Graphic 7. Policy Interest Rate Changes in Emerging

Countries

(January 2012 - October 8, 2014, Basis point)

As a result of lack of savings, an issue experienced in many developed countries, funds have been sought so that investment and consumption functions can be carried out. Our country's need for public borrowing has been reduced thanks to the measures taken during the 2001 crisis. Although this has built economic resilience, it has also increased the industry's need for external resources. After an examination of the household, public sector and real economy in terms of banking in the same country groups, countries appear to be performing relatively well in some fields. Even though the discipline accomplished in Turkish economy following the 2001 crisis brought with it successful results in topics like public debt, banking rates and budget balance, there is still work to be done regarding inflation, current account deficit and value-added exports.

Table 3. Selected Key Indicators of Emerging Countries

Increasing employment one of the most significant problems faced both by developed and emerging countries especially in the past decade. With the onset of global crisis, this has turned into a social problem that needs to be resolved immediately. Turkey has accomplished considerable success in reducing unemployment when compared to developed and emerging countries.

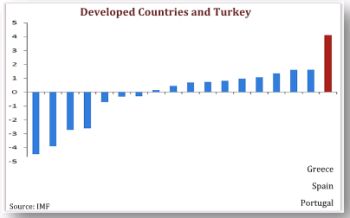

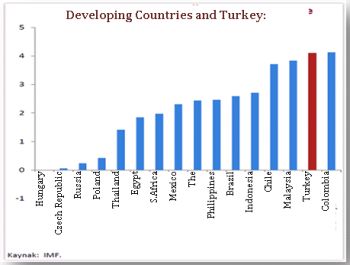

Graphic 8. Average Annual Employment Increase Rates (%, 2007-2013 Period)

The ability to overhaul and recover the economy is faster in emerging countries in comparison to developed economies. The issue these types of economies experience is the failure to preserve stability and the gains made. Among this group of countries, Turkish economy appears stable in terms of increases in employment.

Graphic 9. Average Annual Employment Increase Rates (%, 2007-2013 Period)

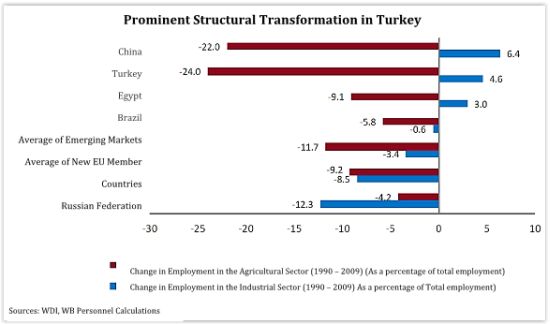

Considerable transformation has taken place in employment, not only in terms of ratio and labor force, but also structurally. Industry and services industry replaced the agriculture industry, which accounts for a major portion of employment. Transformation in the industry is especially striking.

Graphic 10. Prominent Structural Transformation in Turkey

1.6. Emerging Economies in Summary

In summary, even though the effects of the 2008 crises have weakened, it is difficult to say that economic variables have gone back to normal. It must be remembered that the crisis affects different economic blocks differently. The US economy is in relatively better shape than the EU and Japanese economies, partly due to its political decision-making mechanism's ability to react easily. As for the EU economy, problems related to the Southern countries persist, with the issues regarding their decision-making mechanisms delaying a solution to the crisis. The macroeconomic variables of the UK, a member of the EU but not the Eurozone, are turning out better. Meanwhile, the Japanese economy was in a cycle of recession and deflation prior to the 2008 depression, and it is struggling to fix its economy with more intense efforts to lessen the effects.

It is clearly understood that the developed economies played a vital role in terms of growth and employment in the post-2008 world. Countries such as China, India, Brazil, Russia and Turkey performed exceptionally well, solidifying their position among the world's prominent economic players. Nevertheless, structural problems (lack of savings, borrowing requirements, fluctuations in foreign currencies, issues regarding the general level of prices, and political and geographical risks) experienced in emerging countries present themselves as factors that create potential vulnerabilities.

As of 2014, these countries started to encounter different problems within themselves. The best example of this was the adverse impact and issues experienced in oil-exporting countries' economies (i.e. Russia, Venezuela) caused by the sharp drop in oil and natural gas prices. There have however been improvements in balance of payments for countries (i.e. Turkey), which import oil and natural gas and use them as input, and by extension, which have a high foreign trade deficit.

The need to improve "sustainable growth and the potential for growth" is the hot issue in the global economy. Keynesian policy decisions made during the time of crisis have helped reduce the effects of recession and deflation; however, they will not suffice to achieve a permanent solution. On the other hand, having come to prominence prematurely in the global economy is leading central banks to have to deal with problems such as taking on very different jobs and tasks.

To read this Review in full, please click here.

Footnotes

1. Draghi,M,http://www.bloomberght.com/haberler/haber/1673077-draghi-tesvigin-etkileri-icin-zaman-gerekli

2. Report on Financial Stability, CBT, Ankara, November 2014, issue.19, p.50

3. Emlak Konut GMYO A.Ş. 3rd Quarter Report http://www.emlakkonut.com.tr/_Assets/Upload/Images/file/Faaliyet-Raporu-2014-9-ayl%C4%B1k.pdf, Istanbul, October, 2014, .50

4. Report on Financial Stability, CBT, p.5

5. IMF, WEO,'http://www.imf.org/external/ns/cs.aspx?id=29',October 2014

6. IMF,'a.g.e' ve WB,'http://www.worldbank.org/tr/news/press-release/2014/10/08/cloudy-outlook-for-growth-in-emerging-europe-and-central-asia, October 2014

7. Report on Financial Stability, CBT, p.6

8. Bank for International Settlements (BIS). "84th Annual Report" Basel, June 29, 2014.p.85-96

9. Review of the Real Estate and Housing Industry, "Emlak Konut GYO A.Ş.," September 2014, p:14

10. Report on Financial Stability, CBT, p.8

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.