Macroeconomic Performance

Even in a turbulent year due to increased socio political tension and the FED's revised monetary policy, the Turkish economy retained its momentum and achieved 4% growth. GDP reached US$820 billion in 2013 albeit the Turkish Lira devalued 20% against the US Dollar year-on-year to December 2013.

Turkey's growth and its continuing long term potential have led to sustained interest from investors, also in 2014, as evidenced by the BIST 100 index remaining above 75.000 points as of May 2014. Similarly, growth remained relatively robust in the first quarter of 2014 at 4.3% while a decrease of 30% was achieved in the current account deficit.

Turkey maintained its investment grade rating from leading credit rating agencies Moody's and Fitch Ratings.

Industry Commentary

As the Turkish economy grows, the Turkish retail sector has been one of the most appealing sectors for both investors and consumers. Per capita disposable income grew with a CAGR of c. 9% over the past 5 years and reached US$8,895 in 2013; it is expected to exceed US$13,000 in 2018. Despite the significant currency volatility and tightened credit card regulations in 2013, Turkish consumers remained keen on discretionary spending, which drove activity in the sector and continued to encourage a notable number of global brands to enter the market. In this context, the Consumer Confidence Index hit 76.00 as of May 2014.

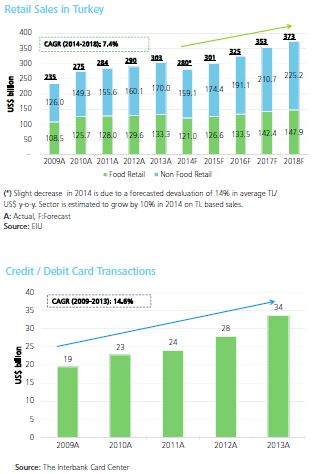

The total size of the retail sector in Turkey is estimated to have reached US$303 billion in 2013 and is expected to grow with a CAGR of c. 7% between 2014 and 2018.

Growth in the retail sector is highly influenced by shopping mall investments and the resulting increase in gross leasable area. In the past five years, the number of shopping malls and total gross leasable area both experienced rapid growth. Increased competition led investors to build larger shopping malls to create differentiation and attract a higher number of consumers.

In line with the increasing number and size of shopping malls, organized retailers' share of the total retail market has been steadily increasing and has reached 55% in 2013, ending the long-standing dominance of street shops and stalls in food distributorship.

Additionally, the use of credit cards continued to increase at an accelerated pace. In 2013, the total value of credit / debit card transactions grew by 21% year-over-year while CAGR for the last five years is now c.15%.

Category Commentary

Food and Beverage

Food and beverage, the largest segment of the total retail market (44%), are expected to grow with a CAGR of 5% in the next five years and reach almost US$150 billion in 2018. We expect to see continued expansion strategies at the discount retailers as well as a consolidation in the market.

Home Retailing

The home retailing market in Turkey, comprised of household furniture and textile products, reached US$51 billion in 2013. Sustained growth is expected in the market considering the many ongoing real estate development projects, nationwide urban transformation projects and increasing urbanization. The size of the home retailing market is forecast to reach US$60 billion in 2018, corresponding to approximately 6% CAGR in the 2014-2018 period.

Apparel and Footwear Retailing

One of the most promising segments, which received a high level of investor interest in recent years, apparel and footwear retailing is expected to grow with a CAGR of 8% in the next five years and reach US$37 billion in 2018.

Consumer Electronics and Technological Goods

Smartphone sales have become an important component of the market for consumer electronics and technological goods, which exceeded US$16 billion in 2013, with 5% year-over-year growth.

Internet Retailing

Boosted by rising internet penetration, an increasing number of Turkish companies are offering online shopping and implementing alternative payment methods. Therefore, the total volume of online spending* through virtual point of sales networks grew annually by 40% on average in the 2009-2013 period and reached US$18 billion. On the other hand, the total size of online retail excluding online legal betting and holiday spending, reached c. US$4 billion in 2013 and corresponded to c. 1.3% of the total retail sales.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.