The new Corporate Governance Communique No. II-17.1 (the "Communique"), repealing the former communiques (i.e., Serial IV No 56 and Serial IV No 41) has been published by the Capital Markets Board ("CMB") in the Official Gazette on 3 January 2014.

The Communique determines the corporate governance principles applicable to publicly traded companies and rules and procedures for related party transactions. Joint stock corporations, publicly held but not traded, are not subject to the corporate governance principles.

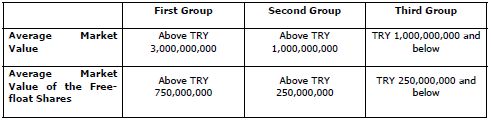

Publicly traded companies are subject to different mandatory corporate governance principles. The Communique classifies the publicly traded companies in three groups considering their systemic importance and based on their market value and share market value. Accordingly, application of mandatory corporate governance principles varies depending on which group a company falls into.

Joint stock corporations which apply to the CMB for initial public offering and/or trading on Istanbul Stock Exchange ("ISE") for the first time will be considered under the third group and must comply with the corporate governance principles by the next general assembly meeting after being traded on ISE.

Certain mandatory corporate governance principles introduced by the Communique are essentially as follows1:

A. General Assembly

- Announcement of the general assembly meeting in the public disclosure platform and the official web-site of the company,

- Discussion of the agenda items objectively and in detail, including responding to shareholders' questions which are not qualified as trade secret verbally during the general assembly meeting or in writing after the general assembly meeting, and

- Including the material transactions of the controlling shareholders, board members, executive directors and their spouses and up to second degree relatives with the company or its affiliates which may cause a conflict of interest with the company as an agenda item in the general assembly meeting to inform the shareholders.

B. Board of Directors

- Sale or purchase of asset and service transactions exceeding ten percent of the company/asset/revenue value require the affirmative votes of the majority of the independent board members,

- Public disclosure in the public disclosure platform in the event the chairman of the board is also the chief executive officer ("CEO") of the company,

- Total number of the board members in the company cannot be less than five,

- Majority of the board members must be non-executive board members,

- Number of the independent board members cannot be less than one third of the total number of board members in the company and in any event there cannot be less than two independent board members,

- Independent board members serve for a term of three years and can be re-elected,

- Companies must establish the following committees consisting of

at least two members, majority of which must be non-executive board

members (CEO cannot be a member of such committees),

- Audit Committee (excluding banks),

- Early Risk Determination Committee (excluding banks),

- Corporate Governance Committee,

- Nomination Committee, and

- Remuneration Committee (excluding banks).

- Remuneration principles of the board members and the executive directors must be determined in writing and included as an agenda item in the general assembly meeting to inform the shareholders and the remuneration policy must be also announced in the official web-site of the company, and

- Remuneration of the independent board members cannot be structured on payment plans including dividend, equity options or performance based payments which would endanger their independence.

Publicly traded companies must specify the corporate governance principles that they are complying with and explain the reasons why they are not complying with the others in their annual reports. The companies must also prepare a corporate governance compliance report.

The CMB is entitled, ex officio, to adopt resolutions and take necessary actions (e.g., filing for preliminary injunctions, filing lawsuits and appointing independent board members) to compel the relevant companies to comply with the mandatory corporate governance principles.

Companies are also obliged to establish Investor Relations Departments reporting directly to CEOs/vice presidents/other executives with management responsibilities. Obligations of the companies with respect to provision of collateral, pledge, mortgage and suretyship and requirements of these are specifically covered under the Communique.

Footnote

1 Application of the mandatory corporate governance principles are subject to certain exceptions as set forth under the Communique. There are various carve outs depending on the action in question.

© Kolcuoğlu Demirkan Attorneys at Law, 2014

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.