Footnote

1. Andean Pact Commission, Multilateral Act No. 578 of 2004.

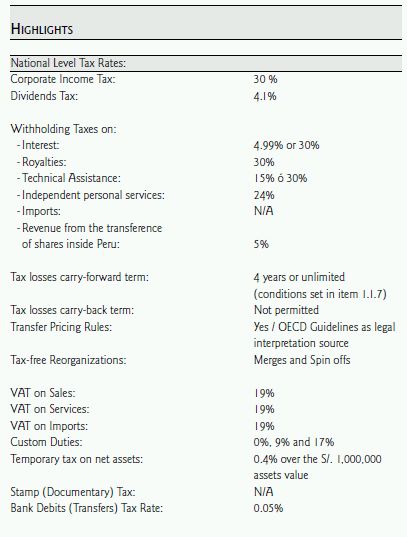

Overview

1. Income Tax

1.1. General Aspects

1.1.1. Income Tax Rate.

30% applicable to domiciled companies including Peruvian branches of foreign companies. Dividends and profit distribution are subject to a 4.1% withholding (not applicable to non domiciled companies).

1.1.2. Taxable Base. Income derived from capital, work or both factors, are deemed as taxable income. This includes income from habitual sale of goods, capital gains, and results of transactions with third parties. All revenues are subject to income tax unless otherwise excluded by law.

1.1.3. Deductions.

As a general rule all costs and expenses are deductible provided that they are necessary to produce taxable income, or maintain its source. Any costs or expenses related to exempted income are not deductible. Some costs and expenses are limited (e.g. Vehicles related expenses, donations, directors fees, travel and recreation expenses); or forbidden (e.g. as fines, not invoice supported expenses and some expenses derived from transaction with companies that are resident in tax havens).

1.1.4. Depreciation.

Tangible fixed assets depreciation is deductible, provided that it does not exceed the maximum rates and is registered in the accounting books. Depreciation term varies depending on the nature of the asset. The maximum annual depreciation rates are 20% for vehicles, 25% for cattle and fishery nets, 25% for hardware, 20% for machinery and equipment used in the mining, oil, construction industries, 10% for other machinery and equipment acquired since 1991, and 10% for other fixed assets. Buildings are subject to a fixed 5% depreciation rate. Intangibles amortization is also deductible only if the intangible asset is deemed as limited useful life intangible, such as software, patents and author copyrights. The amortization rate is 100% in the first year or 10% during 10 years.

1.1.5. Transfer Pricing.

Transfer pricing rules are applicable to transactions between related parties1, not only to international transactions but also to local ones. In addition, they are applicable to all transactions with companies located in tax havens. Also, Transfer Pricing rules will apply when one of the related parties is subject to a preferential income taxation regime, or when the related party has obtained losses during the last six years or has celebrated a Stabilization Contract with the Peruvian Government. Peruvian transfer pricing rules are based on the OECD Arm´s length principle.

The Peruvian tax authority is allowed to adjust the prices of transactions between controlled parties when they are not consistent to the transfer pricing rules and its results. Related Parties are obliged to have a Transfer Pricing Study, In such a case, SUNAT may do assessments to the Income Tax and Add Value Tax related to such adjustments.

There are three formal requirements that related parties subject to transfer pricing rules must follow: to have a Technical Transfer Pricing Study, keep all the information and documentation that supports the Technical Transfer Pricing Study, and to file an annual tax transfer pricing return.

Contributors are obliged to have a Technical Study if the earned income overcomes the amount of S/. 6,000,000, and the amount of the operations with the related parties overcomes the amount of S/. 1,000,000; and / or they had realized at least a transaction from, towards or across countries or territories with low or non imposition. Contributors are obliged to file an annual tax transfer pricing return if the amount of the operations with related parties overcomes the amount of S/. 200,000; and / or they had performed at least a transaction from, towards or across countries or territories with low or non imposition.

If the company do not keep the supporting information and documentation, or if the company do not show the supporting information and documentation, or if company do not file an annual tax transfer pricing return, it will be subject to a fine equivalent to 0.6 % of the net income of the company.

1.1.6. Inflation Adjustments.

Not applicable since 2005.

1.1.7. Tax Losses Carry-forward / Carry-back.

Peruvian tax system does not permit loss carry backs, but only loss carry forwards. There are two options to carry forward the losses: (a) carry forward for four consecutive years, beginning with the first following year from the one the loss has arose; or (b) indefinitely carry forward until finish it; but with an annual limit of such loss equivalent to the 50% of the taxable income in each tax year.

1.1.8. Tax-Free Reorganizations.

For income tax purposes, taxpayers can choose among three systems: (i) revaluate voluntarily the assets transferred under the reorganization with tax effects, but taxing the gain determined by the difference between the new value and the cost of acquisition; (ii) revaluate voluntarily the assets transferred under the reorganization without tax effects, and not taxing the gain determined by the by the difference between the new value and the cost of acquisition; and (iii) transfer the assets without revaluating them, with any tax effect in its value and not gain determined.

1.1.9. Leasing Tax Treatment.

As a general rule, the tax treatment is equivalent to the accounting one. Howerver, if some requirements are filled, the lessee can take an accelerated depreciation considering the term of the leasing contract as the term of the useful life of the asset that is subject to the leasing. The term of the contract must not be less than 2 years for leasing of machinery or equipment and not less than 5 years in the case of Real Estate property.

1.2. Payment and Filing.

1.2.1 Monthly Advance Payments on net income. 2% for the first year or if the Company has obtained losses in the last fiscal year. A coefficient (annual income tax over annual net income) is applicable for the other cases.

1.2.2. Yearly Basis return and payment.

During the first three month of the year.

1.3. Penalties.

Monthly lateness interest rate is of 1.2 %, and penalties may range from 5% up to 100% of the corresponding tax liability.

1.4. Dividends Tax.

(Not applicable to domiciled Companies).

1.5. Cross-border Transactions

1.5.1. Withholding Taxes.

Peruvian companies that pay or accrued Peruvian sourced income to nonresident individuals or entities must withhold the respective Income tax, which rate must depend on the type of income.

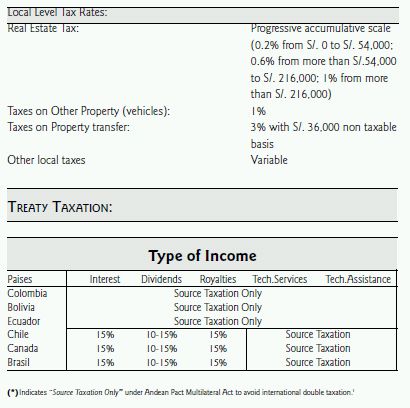

1.5.2. Tax Treaties

1.5.2.1. Treaties with the Andean Pact Countries (Ecuador, Bolivia, Colombia).

Under the tax treaty to avoid double taxation celebrated with the countries of the Andean Region Pact, the source taxation rule applies. Considering that, the income earned in those countries is excluded from Peruvian taxable income.

1.5.2.1. Treaties with Canada and Chile Based on the OECD Model Tax Convention on Capital and Income.

2. Value Added Tax (VAT)

2.1. General Aspects

2.1.1. Tax Rates.

VAT2's general rate is 19%. There are exempted and zero-rated goods and services. In general, sale of goods, public transportation vehicles, finance services, life insurances, transport and cultural shows are exempted of VAT. Exportation of goods as well as determined services are non taxable with VAT.

2.1.2. Taxable Transactions.

These are: sale of goods in the country, rendering and using of services in the country, building contracts, the first sale of real estate by the builder, and import of goods.

2.1.3. Taxable Base.

As a general rule, the taxable base is the sale price or paid for the goods or services, which may be adjusted by the Tax Administration considering their Fair Market Value (FMV).

2.1.4. Value Added Tax.

All VAT paid on its purchases of goods and services is considered credit against the VAT originated on sales. Exporters may apply for a reimbursement for any VAT paid on the purchase of goods and services related to the export activity.

2.2. VAT Advanced payments regimes

2.2.1 VAT Withholding regime.

Purchaser of goods or user of services charged with VAT shall withhold 6% of the sale price of the transaction, and pay it directly to SUNAT. This amount will be creditable by the supplier of goods and services to its output tax.

2.2.2 VAT Deposit regime (Sistema de Detracciones).

Certain goods and services are subject to this regime. The purchaser of such goods or services must make a deposit on a State Bank Account (Banco de la Nación) in the name of the Supplier, an amount of the sale price from 9% to 12%, depending on the services or goods. These deposits only can be used to pay taxes in charge of the Supplier (VAT, Income Tax, and others).

2.2.3. VAT advanced collection regime (Sistema de Percepciones).

By this system, the supplier of goods or services charged with VAT, designed by SUNAT as a "Collector agent", must add 1% to the sale price of the transaction, and pay it directly to SUNAT. This amount will be creditable by the purchaser of goods and services to its output tax for further transactions taxed with VAT.

2.3. Payment and Filing

The tax must be assed, filed and paid on a monthly basis.

2.4. VAT Anticipated devolution

Investments in any econocmic sector:

- Requirements: US$ 5 000 000 investmen, and a Proyect twiht a pre-operative phase of at least two years.

- Mining: Directed to Companies with approved minining permits Requirements: US$ 5 000 000 investmen.

- Electrict Generation: Directed to Companies with approved electric generation permits. Requirement: Having signed a definitive permit contract for the generation of electric energy.

- Oil: Directed to Companies having a contact with PETROPERU.

3. Other Taxes

3.1. Temporal Net Assets value Tax

0.4% from the net assets value considered in the balance up to 31 December of the previous year, with some exceptions, provided it exceeds approximately S/.1,000,000 soles. Peruvian branches and corporations are subject to this tax.

3.2. Property Taxes

3.2.1 Real State:

Between 0.2% and 1% of the property value.

3.2.2 Vehicular:

1% of the commercial value of the vehicle

3.3. Transfer of Real Estate property tax

3% applicable to all real state transfers for the excess of 10 UITS (S/.36,000 approximately) of the price of the sale.

3.4. Bank Debits (Transfers) Tax

0.05% applicable to all deposits and withdrawals of money from Peruvian bank accounts. This tax is withheld by Peruvian banks (and other savings institutions). There are very limited exemptions to this tax.

4. Custo ms Regime –General Aspects

4.1. Custom Duties

- Ad Valorem Custom Duties, with 0%, 9% and 17% tax rate.

- Band of prices: variable additional specific amount. Zero-rated custom duties regimes are available for some activities or importers.

These must be checked further on case-by-case basis.

4.2. Taxable Base

Customs value of the goods. Importation VAT is calculated considering the customs value of the goods plus the corresponding customs duties.

4.3. Custom Valuation /Transfer Pricing

For tax purposes the value of the goods must be determined based on the valuation methods established in the WTO Customs Valuation Agreement, and in the regulations approved by the Customs Administration for such purpose.

4.4. Filing and Payment

The importation procedure can be conducted before the arrival of the goods with the return of the Customs Declaration. Custom duties and import VAT must be paid the day after the goods have been unloaded in Peruvian territory, or the day after the import return has been presented to the Customs Authority. All commercial importations procedures must be performed through an authorized customs agent.

4.5. Special Importation Regimes

Importation of goods can be performed through a variety of customs regimes different to the importation for consume regime. Each of these special custom regimes has a different customs duties and import VAT treatment. These regimes are: temporary admission for re-exportation in the same condition, temporary admission for active transformation regime and warehouse regime.

4.6. Special Regimes

There are duly delimited geographically zones in Perú that qualified as CETICOS that are Export, Transformation, Industrial, Marketing and Service Centers. Most of these centers were created on the basis of existing areas, like the Free Zones of Ilo and Matarani, and the Special Treatment Zone of Tacna. CETICOS are considered Primary Customs Zones. If foreign goods enter the countries through them, the entry will not be deemed as import and will not be subject to any customs duties or taxes.

The users of CETICOS are the beneficiaries of the exemption benefit, which expires on December 31 , 2012 . The benefit includes: exemption from Income Tax, VAT, Municipal Promotion Tax, Selective Consumption Tax, Tax, and every tax, rate or contribution.

4.7. Other Customs Taxes

Import VAT at a general rate of 19%. Excise Taxation is applied with variable tax rates only to luxurious goods and fuel and oil byproducts. Advanced VAT (Percepciones): 3.5%, 5% and 10% of the value of goods plus VAT.

5. Payroll Taxes / Welfare Contributions

5.1. Retirement Contributions

The employee might choose between the private pension fund (AFP) or the Public Pensions Funds (SNP). In the first case, the employees must contribute between 11% and 12.8% depending on the respective AFP (private entities that manage pension funds under this system). In the SNP, employees must contribute a 13% of their salaries. The employer is responsible for withholding the employee's corresponding contribution and for the accreditation of the 100% of the monthly contribution in the pension fund.

5.2. Health Contributions

9% of the total payroll shall be paid by the employer to the National Health System (ESSALUD). In addition, employers might acquire further coverage with private health care companies (Entidades Prestadoras de Salud-EPS). In this case, employers can use part of the fees paid to the private system as a credit against the contribution, but not in excess of the 25% of it.

5.3. Labor Risks Insurance System

The employer must provide an insurance coverage to its employees that carry out activities involved in a significant level of risk.

5.4. Unemployment Fund Contribution

During the employment relation, the employer must contribute an amount equal to one monthly wage per year to an unemployment fund elected by the employee (Compensación por Tiempo de Servicios-CTS), that can de deposited in a bank account. The contribution must be pay in two installments of 50% during the months of may and November.

Footnotes

1 For our tax laws, two companies may be deemed as related parties in the following cases:

a. When one of them has directly or indirectly more than 30% percent of the stock of other company.

b. When they have common directors, managers, or other main directives in the company.

c. When they have consolidated financial statement

d. When one of them provides to the other more than 50% percent of its sales

e. When they participate in the same joint venture f. When there is a permanent establishment of a nonresident company.

2 IGV: Impuesto General a las Ventas.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.