The scope and significance of a breakthrough in labour market regulation

The 2015 reform changed Italian labour law more significantly than that of May 1970, when the Statuto dei Lavoratori was enacted (a very important reform of the entire discipline of individual and collective labour relations, which introduced some very important protections against dismissal and discrimination in the workplace). In fact, at that time, albeit the enactment of that law marked a very important milestone indeed, it was a part of an ongoing process that had started some time previously, in the 1960s, with a number of statutory provisions granting labour protection: the ban on any interposition in 1960, a very restrictive regulation of fixed-term contracts in 1962, the protection of working women in connection with their marriage in 1963, the provision of compensation for unfair dismissal in 1966, long-term temporary lay-off insurance ("Cassa integrazione straordinaria") and special unemployment benefits in 1968, as well as the implementation of a very generous pension reform in 1969. A process of strengthening and improving the workers' protection system that continued throughout three decades of so-called "flexible guarantee approach", sometimes softening the protection granted in the "golden decade" 1960–1970, by adjustments and adaptations, but also reinforcing the protective system on some other occasions, like in 1990 in the field of individual dismissals, in 1991 in relation to collective redundancies, in 2000 relative to part-time, in 2001 regarding parental leave. In March 2015, conversely, when the first two legislative decrees (n. 22 and 23) started enforcing the delegation-law no. 183/2014, and in June 2015, when a third very important decree (n. 81) followed, Italian labour law changed its fundamental paradigm. Firstly, the property rule entailing an employee's right to reinstatement in case of unfair dismissal, which had previously been a keystone of the system, has been now replaced by a liability rule, i.e., a rule limiting the employer's contractual liability to the payment of an indemnification calculated according to the prevailing standards in Europe (decr. n. 23); secondly, much more flexibility into corporate personnel management was introduced, which allows the employer a broader discretion in the adaptation of the employee's duties to business needs (decr. n. 81). The unequivocal purposes of these changes are, on one hand, to provide the employer with a reliable forecast of termination costs, given that they have been already predetermined, and, consequently, to discourage any wager on the outcome of a lawsuit, which has pathologically increased litigation in Italy to date. On the other hand, the reform intends to pursue an increase in labour productivity through increased functional flexibility.

Let us focus on the first point: the dismissals reform. From a system of sanctions aimed, apparently, at preventing unilateral termination by an employer, since employees were assured that no forecast of the termination costs could be made by the employer, and that such costs were sure to be very high2, the Italian legal system has moved to a body of rules and sanctions inspired by a radically new design. The fundamental rationale underlying this new policy is to ensure possible predictability and, at the same time, to reduce termination costs, providing this is due to an adjustment of the workforce, a technological change, an organisational change, or the exercise of disciplinary power.

The new rules on dismissals

According to the new regulations, the monetary amount of damages that can be obtained by an employee following legal proceedings is set at two months of more recent wages per year of service in the company; with a minimum of four years and a maximum of twenty-four years. Moreover, the same decree no. 23 of 4 March 2015 – valuing the German experience – offers parties a standard settlement path, so as to avoid litigation in court and providing for immediate payment of an indemnification equal to one month's pay per year of service, that in no event should be any lower than two months' pay and no higher than eighteen months' pay: this solution is strongly supported by the total exemption of this compensation from income tax.

The only cases left in which an employer is sanctioned by an order of reinstatement of the employee in his/her job are those of null and void dismissal expressly provided by law: unlawful discrimination, anti-union retaliation and a working bride/mother in need of protection. Reinstatement is also ordered by the court whenever a disciplinary dismissal is subsequently proved in court to have been grounded on unsubstantiated facts; however, the same provision expressly excludes reinstatement in the event that the court should deem the dismissal disproportionate to the fault of the employee, provided that a fault has actually occurred (in this case the court will sentence the employer only to monetary compensation).

The new dismissals discipline, which, not surprisingly, had strong opponents who claimed it violated Italy's Constitution, can be explained within the new system framework created by the reform: in this new framework, reinstatement is no longer the main tool for protecting workers, since their economic and professional security will now be normally guaranteed in the market, rather than by freezing the employment relationship. Conversely, the reinstatement will be a penalty imposed on the employer only in cases in which individual dismissal power is used in an aberrant way (with aberrant use of dismissal power meaning something quite different to its merely debatable or unjustified use).

Overcoming the disparity between protected and unprotected employees

There were protests about this being a return to the 1950s, or even the nineteenth century. On the contrary, what should have been perceived as a return to weak regulations was the widespread use of long-term freelance agreements, or other contractual types, which were regularly used as of the end of the 1970s, with a view to circumventing labour law. A throwback to the nineteenth century were those three fourths or four fifths of fixed-term contracts compared to the general flow of new regular hiring, which have characterised the Italian labour market in the last two decades.

The breakthrough was made possible by the entry into force of the first two decrees of the delegation-law no. 183/2014. Firstly, it includes a revival of the open-ended contract as the normal form of employment, favoured by the law and encouraged by a strong tax break and welfare contribution reduction. Secondly, it shifts law-makers' focus to the protection of the workers in the market, rather than of his job inside the company at all costs, whenever they lose their jobs and have to look for another one, are in need of reliable income support and – in many cases – strong welfare benefits too.

Employees' protection in the market, not against the market

The protection, hence, is no longer against the labour market, but in the labour market: thanks to a universal and egalitarian income support system, aligned with top European standards, and thanks to a restructured system of employment services (the latter is foreseen by the new legislative decree no. 150/2015, but is still to be implemented).

The fundamental features of the new unemployment benefit scheme had already been introduced by law no. 92/2012 (the so-called Fornero Law). It has now been expanded in its duration and extended to include all unemployed individuals whose last position was a subordinate form of employment – including housekeeping and apprenticeship-related positions, which were previously excluded – or a relationship characterised by the economic dependence of the self-employed (although in this case a reduction of the unemployment benefit entity and duration is foreseen). Its coverage spans the first 24 months of unemployment: in the first three months the benefit is equal to 75 percent of the last salary. It then decreases by three percent every subsequent month, for a period of unemployment equal to half of the contribution period completed.

Further to this sort of "first pillar" of unemployment benefits, the intention of the lawmaker includes a second pillar, consisting of supplementary unemployment benefits negotiated by collective bargaining inside companies, or even in the scope of every industry sector. The 2016 Budget Law provides full tax exemption for this and other forms of "corporate welfare".

The so-called Repositioning Agreement as a tool to shorten unemployment spells

As regards the new system of employment services, the fundamental strategy conveyed by the delegation-law, enacted then by Legislative Decree no. 150/2015, is a strong integration between public job centres (PES) and private employment agencies (PEA), following the model successfully tested in the Netherlands. This complementary action is implemented by means of the new scheme of a so-called Repositioning Agreement, signed by the involved job seeker and the private employment agency chosen by the job seeker from a list of certified operators.

On the one hand, the Repositioning Agreement aims to provide the involved job seeker with effective support for his/her successful repositioning in the productive fabric. Provided that this goal is achieved, and only after its achievement, the public job centre or the private agency is paid a monetary award, inversely proportional to the employability of the involved job seeker. On the other hand, the involved job seekers are committed to keenly participate in all the activities proposed by their respective tutors as to promote faster and better reemployment. Any unjustified refusal by the person concerned to participate in those activities, or any refusal of an acceptable job offer, shall be reported to the public service. Consequently, if the refusal were found to be unjustified, the unemployment benefit would no longer be paid.

This scheme aims to shorten the time of unemployment, and also exposes the unemployment benefit scheme to a fair system of "cross-compliance": In fact, if an employment agency were known to be too strict, unemployed people would no longer choose it. If, conversely, its approach were too lax, it would not achieve the goal of reemploying the job seekers involved, and would receive no monetary compensation.

As much as this might seem very close to a market mechanism, it is really needed to kick-start the performance of public job centres in their function of assisting and promoting contact between the unemployed and the certified agencies who can supply the intensive assistance service.

At any rate, there is no need to mention that a sharp cultural and statutory change is vital to the proper functioning of this new tool: in the Italian labour market to date those who benefit from unemployment welfare have rested on the serene certainty of being able to decide calmly whether and when to seek a new job, because nobody has ever monitored their job-seeking activities or their actual availability in the labour market. The Repositioning Agreement cannot be a successful tool unless this page is turned, both from a cultural standpoint and from a labour law perspective, leaving behind the current regime, which has provided practically unconditional income support up until now (but only in favour of a privileged segment of the unemployed).

The fact is, however, that this part of the reform has not yet been implemented: The new national agency, ANPAL, is not expected to be operational until the end of 2016.

The new provisions governing change of duties and marking the distinction between subordinate employment and freelance collaborations covered by the Civil Code

Another of the eight decrees of the reform is dedicated to the so-called "contracts reorganisation" (legislative decree no. 81/2015), which is an important step on the way towards simplifying legislation.

This decree includes, among others, a provision that grants more powers to employers to change their individual employees' duties, as an alternative to laying them off: The new rule (which applies not only to new employment relationships, but also to those established before the reform) allows, in the case of restructuring, the assignment of lower-level tasks.

The same decree also includes a rule that redefines the border between the area covered by labour law and freelance work, with only the latter governed by the Civil Code. Under this provision, labour law applies only in cases where the employer has the power to stipulate the location and times at which work is performed. In other words, warehouse operators or secretary assistants can no longer be qualified as freelance collaborators. Conversely, journalists can still be classified as freelance collaborators providing they are free to work where and whenever they deem appropriate.

Key issues of compliance with the Constitution

a) regarding the difference between the discipline of ongoing contracts and the discipline of new ones

The silver bullet of left-hand opponents to this reform is the claim that it does not comply with the Constitution, since it implies uneven entitlements by employees as regards the regulation of dismissals, those under the old employment contracts and those under the new ones. This objection ignores that the existing situation was even less compliant, and this is why the present reform is willing to put an end to it. In fact, the ancien regime practically gave five sixths of new recruits little chance of being hired under open-ended employment contracts.

Actually, in its review of other amendments of law provisions governing long-lasting contractual relationships, the Constitutional Court accepted both legal changes: those that had applied the new rules only to the contractual relationships established after the reform, and those that had also applied the new rules to pre-existing relationships, just limiting their application in the latter case, reasonably, so as to prevent mandatory regulations from dramatically impacting the pre-existing contractual balance.

On the other hand, in the case of this labour reform, it is clearly reasonable to exclude those relationships that had been already established at the time of its enactment from the application of the new dismissals discipline. Let us consider what might happen if the protection granted by the rigid 1970 discipline were to be suddenly removed for all employment relationships, both ongoing and new ones. This would risk triggering the prompt dismissal of all those individuals whose employment balance was at a loss to the employer, whether significantly or not, which held on to their jobs to date thanks to the old discipline. Should this massive layoff phenomenon take place, the economic system could by no means financially cope with it, since funds would not be sufficient to provide the necessary unemployment benefits to everyone. Such a situation could not be addressed by any actions, not even by the new employment services provided by the reform, such as the Repositioning Agreement, which requires cooperation between public services and specialised private agencies providing assistance to those job seekers who have just lost their jobs (see § 5). These new tools need a testing time, which is possible only if the demand for new services only gradually increases over the first two or three years.

Furthermore, a sudden and dramatic increase in layoffs would provoke widespread social alarm, and, as a result, exert foreseeable pressure on the Government and the Parliament for suspending the application of the new rules. This would give pause to both employers and investors who, faced with an unpredictable scenario in terms of the stability of the legislative framework, would most probably neutralise the positive effect of the reform and its incentive to hire.

Continued: b) regarding the replacement of the property rule that has protected regular workers to date with a liability rule, and the reduction of court-ordered indemnification; c) regarding the use of the predetermined severance cost as an objective sorting tool for business decisions in this respect

The crucial political and juridical point of this reform is the transition from a regime in which a dismissal is considered a "death penalty", or in any case a fact in itself pathological, only acceptable as a last resort in extreme situations, to a regime in which it is considered instead as an integral part of the normal physiology of corporate life and of any career, which is useful to some extent to improve the allocation of human resources in the productive fabric, and, therefore, to improve labour efficiency, as well as for employees to increase their compensation.

The argument raised by opponents to this approach can be summarised as follows: If a judge finds that the employer's action was unlawful, why not to allow the same judge to sanction the unlawful action by fully eliminating its effects (reinstatement), or, at least, by ordering payment of a compensation amount that is strictly proportioned to the damage actually suffered by the other party?

This is how that argument may be countered: firstly, it is worth noting that it is virtually impossible to quantify the actual damage caused to a dismissed employee in individual cases, since there is no way to check on the actual availability of the same person for a new job and, most importantly, monitor his/her proactive search for a new job. Conversely, if the compensation is pre-determined by law, also based on the damage mitigation owed to the newly-provided unemployment benefits, there is no danger that the prospect of a higher level of compensation obtainable through judicial litigation discourages the dismissed employee from promptly and effectively seeking a new job.

Moreover, the most appropriate counterargument to the reform's opponents is that no exact evaluation can be made in court, since the depths of the expected loss that led the employer to decide upon the dismissal cannot be completely researched in a judiciary proceeding.

In truth, the reason for any dismissal has always been, ultimately, an expected loss in case of continuation of the relationship, whether in terms of financial costs or of opportunity cost. This also applies whenever the dismissal follows to an employer's complaint regarding some fault on the part of the employee. Thus, we are talking about a forecast of something occurring in the future, which cannot be proved in court, either by documental evidence or by witnesses: It can just be subject to an evaluation with wide margins of discretion. However, a court can hardly make such an assessment with reliable results, since a specific technical expertise and the knowledge of all context data would be required, none of which the court may sufficiently possess.

The new rules governing this matter therefore outweigh the impossibility of the employer to provide the court with exhaustive evidence of the economic reason or business cause for the dismissal, which is usually the case, except when a serious corporate crisis is manifest. On account of this, the new provisions offer a tool for sorting business choices in this field, based on a "standard termination cost" to be incurred by the employer whenever no agreement is reached with the employee on the termination of the work relationship. The sole exception to the above is the case in which the reason for dismissal is so evident that it can be easily proved in court.

In this view, most observers will find the rationale of the new Italian dismissals discipline consistent with the grounds of the draft reform of this matter that was presented to the French Government by the economists Olivier Blanchard and Jean Tirole in 2003 (Blanchard and Tirole 2003).

Impact of the reform on employment flows and quality in the first year

Law-makers have helped the reform to take off by offering a significant tax break and welfare contribution reduction for open-ended employment contracts signed in 2015. More precisely,

- The Income Tax on Productive Activities (IRAP) was reduced for costs associated with new open-ended hires;

- The state takes over all cost of social security contributions related to new permanent hires, provided that they had not been employed under open-ended contracts in the previous six months. The same incentive was provided in case of fixed-term contracts converted into open-ended ones; conversely, it cannot be applied in cases of apprenticeships converted into regular open-ended work agreements. In 2016, this economic incentive was reduced to 40 percent of the amount of social security contributions due.

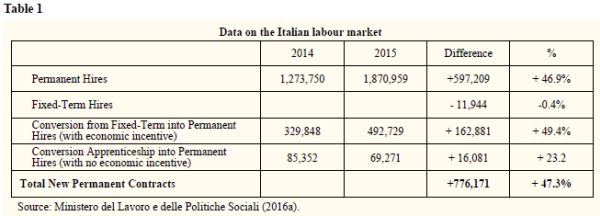

Figure 1 shows the data on the impact of this economic shock combined with the regulatory shock (the new regulations on dismissals) provoked by the reform throughout 2015. Additionally, Table 1 presents detailed data on the Italian labour market flow in 2015 compared to 2014.

In the Economic and Financial Document submitted to the Parliament on 9 April the Italian Government indicates 846,498 as the difference between the new stable employment contracts (new open-ended hires plus transformations of fixed-term in open-ended contracts) and terminations during 2015. During January and February 2016 a net decrease was seen in new open-ended contracts: This is the predictable consequence of the peak in permanent hires that occurred in December 2015, caused by the 31 December deadline of the economic full incentive. However, comparing the set of stable jobs in the quarter December 2014–February 2015 (396,309) with the sum of those recorded in the quarter December 2015–February 2016 (543,119) reveals that 2015 saw an increase of 37 percent in open-ended hirings. Moreover, if we consider that in the months of January and February 2015, the full economic incentive was already in force, we can gain an indication of the causal link between the majority of the said increase and the regulatory shock. Finally, the following data on the last quarter of 2015 show the impact of the reform on the labour market in terms of the decrease in precarious jobs (fixed-term contracts and freelance work agreements) filling permanent job needs: People hired on open-ended employment contracts in Q4 2015: 739,880 (+100.9 percent relative to Q4 2014). People hired on long-term freelance work agreements in Q4 2015: 104,676 (-40.4 percent relative to Q4 2014).3

Hypothesis on the impact of the economic shock versus the regulatory shock

These figures raise the question of whether it was the regulatory shock (the new regulations on dismissals) or the economic shock (the significant tax break and welfare contribution reduction concerning open-ended contracts entered into in 2015 and continued in a milder form in 2016) that triggered the sharp increase in new permanent employment contracts, i.e., 776,171 more in 2015 compared to 2014 (taking into account new hiring + former fixed-term contracts made open-ended, as shown by table 1).

This question can only be clearly and plausibly answered with econometric research. However, we already have some clues to that point, at least tentatively, to one explanation. The first clue is the balance between the increase in permanent employees hired in January– February 2015 compared to the same two months of 2014 (30.9 percent) – which was affected by the economic shock only, since the regulatory shock had yet to come – and the increase recorded in March 2015 compared to March 2014 (49.5 percent), which was affected by both. This difference suggests that almost two fifths of the increase was due to the new provisions on layoffs.

Another clue emerges from comparing the percentage rate of the overall increase in new open-ended contracts or in temporary employees made permanent throughout 2015 compared to 2014 – 46.3 percent – and the percentage rate of the increase in apprentices made permanent under an open-ended work contract, i.e., 23.2 percent. In fact, the latter was impacted by the regulatory shock only, not by the economic one. Based on these figures a tentative assumption may again link approximately one half of the increase in permanent work relationships to each factor.

Moreover, we have seen (§ 9) that among the permanent employment data for the quarter December 2014– February 2015 and data for the quarter December 2015– February 2016 there was an increase of 37 percent, mostly due to the regulatory shock (since the full economic incentive was already in force in January 2015).

Finally, the figures provided by Istat (2016) and reported in the Economic and Financial Document submitted by the Government to the Parliament on 9 April should be mentioned, whereby 35.1 percent of manufacturing companies and 49.5 percent of those in the service sector declared that they grew their staff base in 2015 and were partly motivated to do so by the new discipline of the permanent contract.

The increase in new, open-ended contracts will probably slow down in 2016, as a direct result of the economic incentive reduction. Nevertheless, the positive influence of what we called regulatory shock can be expected to increase. In the first year after the reform came into force, in fact, the impact of the regulatory shock has been surely mitigated by the justifiable scepticism of a number of entrepreneurs wondering whether the new regulations on dismissals could be counted on in case of litigation. They were still smarting from the disappointing experience of seeing the new provisions by the socalled Fornero Law, no. 92 of June 2012, on disciplinary dismissals practically nullified by the courts' decisions in the three years that followed. Now, instead, all players in this field – including judges – confirm that, in the first year after the new regulations took effect, almost every case of early termination of employment under the regimen of the Legislative Decree no. 23/2015 was resolved by means of standard transactions. This in turn means that the 2015 reforms have produced the desired result of reducing drastically litigation concerning layoffs. This might convince even the most reluctant entrepreneurs to change the old practice of using a series of fixed-term hirings. This is why the impact of the reform should be stronger in the time to come.

Will such employment growth continue?

Providing there is no negative impact from exogenous shocks, there is good reason to hope that employment will continue to grow. The reason for this is that Italian consumers should be more confident of economic growth, and international investors more willing to invest in our country, as a result of the progressive alignment of the Italian system with standards in other Western countries with regard to labour regulations, the performance of public offices and bodies – starting with the courts – and the reduction of energy power cost. However, emphasis should be put on the term "providing", which calls for the utmost caution.

This article was released in June 2016.

References

Blanchard, O. and J. Tirole (2003), Protection de l'Emploi et Procedures de Licenciement, Conseil d'Analyse Économique.

Istat (2016), Rapporto sulla Competitività dei Settori Produttivi, http://www.istat.it/it/archivio/180542 (accessed 19 July 2016). Lavoce.info (2016), www.lavoce.info (accessed 19 July 2016).

Ministero del Lavoro e Delle Politiche Sociali (2016a), Comunicazioni Obbligatorie, February 2016.

Ministero del Lavoro e Delle Politiche Sociali (2016b), Comunicazioni Obbligatorie, March 2016.

Sestito, P. and E. Viviano (2016), "Hiring Incentives and/or Firing Cost Reduction? Evaluating the Impact of the 2015 Policies on the Italian Labour Market", Banca d'Italia Occasional Papers no. 325.

Footnotes

1. University of Milan.

2. In past decades, the cost to be borne by a company in case an employee won the lawsuit relative to his/her dismissal, pursuant to Article 18 of the Statuto dei Lavoratori, could raise up to a monetary amount equivalent to the compensation of the dismissed employee and welfare contributions for many years.

3. Ministero del Lavoro e Delle Politiche Sociali (2016b). The data refer to Q4 2015 only, because – as we have seen in § 6 – the new boundaries of the area subject to labour law were laid down by a provision which became effective in July 2015 only (its consequences, hence, could be seen only in the last quarter of the year).

Originally published by CESifo DICE Report 3/2016 (September).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.