Parent companies (resident in Italy) are now required to prepare and file Country-by-Country reporting each year.

The obligation for parent companies (resident in Italy) of international groups to prepare and file every year, Country-by-Country (CbC) reporting, was introduced in the 2016 Stability Law (Law no. 208, pars. 145, 146, of 28 December 2015).

Revenues and gross profit, paid and accrued taxes, as well as any other element indicating a real financial activity, should be indicated in the reporting. Ministerial Decree of 23 February 2017 set out the operating methods to transmit to the reporting to the Revenue Agency.

Who does it affect?

In general terms, the obligation to file CbC reporting applies to parent companies, resident in Italy, of international groups:

- That are subject to the obligation to prepare consolidated financial statements

- That have a consolidated turnover of at least €750 million, generated by the international group of companies in the tax year preceding the year of reporting

- That in turn are not controlled by other companies or entities.

However, the obligation applies to subsidiary companies resident in Italy, if one of the following conditions occurs:

- The holding company of the international group is not obliged to file CbC reporting in its jurisdiction, as it is resident in a state that has not introduced this obligation

- The parent holding company is resident in a state that has not entered into an agreement with Italy providing for an automatic exchange of information relative to the reporting.

Therefore, effective from the tax year starting 1 January 2016 or on a subsequent date, with the entry into force of the decree in question, the reporting shall be filed also in regard to tax year 2016, even though, if it coincides with the solar year, this has already ended.

Action

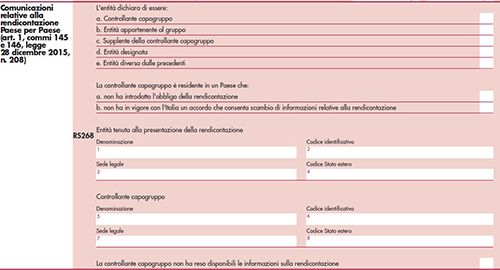

The decree clarifies that a (parent or subsidiary) company subject to the reporting obligation, within the deadline to file the tax return relative to the tax year forming the scope of the reporting, shall notify the Revenue Agency of its reporting obligation. In this regard, it should be noted that a line has been added for this purpose in Section RS (RS268), Modello SC 2017 (Local Entities Form 2017).

Line RS 268 also provides for the possibility that an entity belonging to a group, resident in the territory of the State, is subject to the obligation to file the reporting but, even though it has requested of the parent holding company the necessary information, it has not received it; in this case, the company shall fill out a proper box in line RS268 to certify that the parent holding company has not provided the necessary information requested by the entity filing the tax return.

Reporting content

With regard to an international group, CbC reporting shall contain for each state in which it is active:

- Quantitative data: aggregated data of all companies belonging to the group relating to revenues, profit (loss) before income taxes, paid and accrued income taxes, declared capital, undistributed profit, number of employees and tangible fixed assets (other than available cash or cash equivalents).

- Qualitative data: identification data of each entity resident in the jurisdiction in relation to which the reporting is filed, the tax jurisdiction where establishment or organisation has occurred (if different from the tax residency jurisdiction), the nature of the core business or main activities.

Deadline

Reporting shall be filed within 12 months of the last day of the reporting tax year of the international group. Therefore, the data relating to year 2016 should be transmitted by 31 December 2017. The operating methods for filing the reporting shall be defined in a subsequent provision of the Director of the Revenue Agency.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.