The Central Bank of Ireland has a number of supervisory measures and enforcement tools available to it to enable it to address concerns it may have about regulated entities and their senior management.

The focus of this briefing note relates to one of these powers, namely the Administrative Sanctions Procedure ("ASP").

ENFORCEMENT DIRECTORATE STRUCTURE & FUTURE TRENDS

Over the coming years, use of the enforcement of its powers through ASP is likely to become more prevalent.

The Central Bank of Ireland ("the Central Bank") has been recruiting heavily for the past year to increase its enforcement staff to c.75 people. The Enforcement Directorate or department falls under the supervision of the Director of the Enforcement Directorate and is divided into two Enforcement Teams, the first of which ("Enforcement I"), is principally concerned with ASP.

In February the Central Bank published its Enforcement Priorities for 2012, and has stressed the importance of enforcement within its new risk-based regulatory framework, known as "PRISM" (Probability Risk and Impact SysteM). The aim of PRISM is to create a regulatory regime that is credible and effective. The Director of Enforcement has said:

"Enforcement action combined with the resultant publicity has a powerful impact, promoting compliance and deterring other industry participants from similar non-compliance whilst educating stakeholders on the standards and behaviours expected of them".

The Central Bank's information release of 13 February 2012 further notes that: "Where serious breaches of these regulatory requirements occur, regulated entities and their management can expect vigorous investigation and follow-up by the Central Bank."

To this end, the Central Bank has announced that it intends to build on the Enforcement work carried out in 2011, during which time it entered into "enforcement settlements" under the ASP with ten regulated financial service providers. This resulted in a range of sanctions including the disqualification of two directors and fines totalling €5,050,000, including the largest fine to date of €3,350,000 (details of these are set out in Appendix 1). From the publicly available information it does not appear that any of the ASP actions to date have been determined by an Inquiry (addressed further below) and it appears that settlement will remain a highly important enforcement tool for the Central Bank.

The Central Bank is currently conducting a review of the ASP following the publication of the Central Bank (Supervision and Enforcement) Bill 2011. The period by which comments could be made in respect of the draft Inquiry Guidelines (Consultations Paper 57) ("Inquiry Guidelines") closed in January 2012. Ultimately, it is proposed that the final form of those Guidelines would replace the existing ASP and that a Regulatory Decisions Unit ("RDU") within the Central Bank, which would be separate from the Enforcement Directorate, would have the responsibility for the proper conduct of an Inquiry.

The Inquiry Guidelines largely mirror the existing procedure, save that once the Central Bank determines, following Examination, that there is a reasonable suspicion that a prescribed contravention may have been or is being committed by a regulated financial service provider and persons concerned in the management of a regulated financial service provider, the matter is then referred to the RDU. The Inquiry Guidelines provide much more detail in terms of the practice and procedure to be adopted during an Inquiry and envisage a doubling of the monetary sanction that could be imposed.

We will address below the existing ASP and identify where the proposed Inquiry Guidelines would depart from the existing practice.

OVERVIEW

Statutory Basis

Pursuant to the Central Bank and Financial Services Authority of Ireland Act 2004, the Central Bank Act 1942 was amended to provide the Central Bank with the power to administer sanctions in respect of 'prescribed contraventions' by regulated financial service providers and persons concerned in the management of regulated financial service providers (collectively referred to hereafter as "RFSP").

The provisions governing the ASP are contained in Part IIIC of the Central Bank Act, 1942 as amended.

Prescribed Contraventions are defined in Section 33AN of the Central Bank Act, 1942 as amended. They are contraventions of:

- A provision of a designated enactment or designated statutory instrument (a non-exhaustive list of these is set out in Schedule 2 of the Central Bank Act 1942, as amended); or

- A code made, or direction given, under such a provision; or

- A condition or requirement imposed under a provision of a designated enactment, designated statutory instrument, code or direction; or

- Any obligation imposed on any person by Part IIIC of the Central Bank Act 1942, as amended, or imposed by the Central Bank pursuant to a power exercised under Part IIIC of the Central Bank Act 1942, as amended.

A "contravention" has a broad meaning and is described as a failure to comply and further includes:

- attempting to contravene;

- aiding and abetting and counselling and procuring a person to commit a contravention;

- inducing, or attempting to induce, a person (whether by threats or promises or otherwise) to commit a contravention;

- being (directly or indirectly) knowingly concerned in, or a party to, a contravention;

- conspiring with others to commit a contravention.

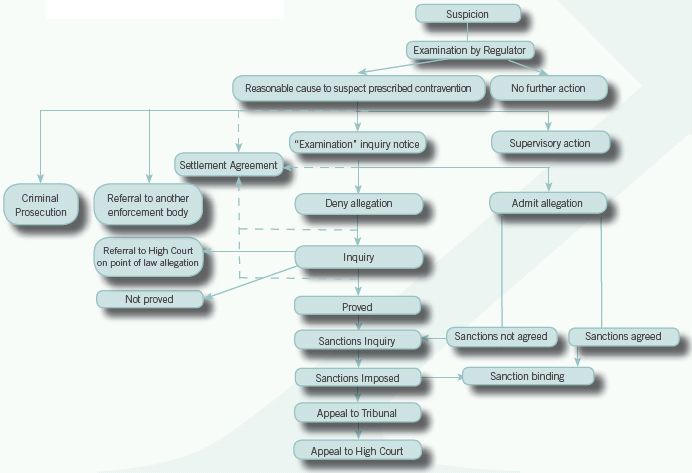

STEPS IN THE ASP

- EXAMINATION – fact finding

- INQUIRY – determines whether prescribed contravention occurred and imposes sanction

- SETTLEMENT – alternative means of resolution

- APPEAL

The steps are outlined in detail in the flow-chart below.

Examination

The ASP permits the Central Bank to commence an "Examination" where it has a concern that a prescribed contravention may have been or is being committed by a RFSP.

Whether or not the Central Bank seeks to examine a suspected prescribed contravention depends on the information before it and the seriousness of the suspected breach.

The Examination is an information gathering exercise on the part of the Central Bank to ascertain whether there are reasonable grounds for suspecting that the RFSP has or is committing a prescribed contravention.

The RFSP will usually first become aware that an Examination is underway when it receives an "Examination Letter" from the Central Bank setting out its concerns and requesting information, comments and explanations and putting the RFSP on notice that the matter may be referred to Inquiry. The responses received may lead to the Central Bank requiring further information, holding interviews and/or the taking of statements. Although Examinations of contraventions are confidential, third parties with information about the suspected contravention may also be contacted by the Central Bank as part of this process.

Prior to the conclusion of the Examination, the Central Bank issues a Report to the RFSP, appending all of the relevant information on which it will make its decision, identifying the prescribed contravention that is alleged.

As part of the Examination process and prior to the Central Bank making a decision on whether or not to hold an "Inquiry", the RFSP is afforded a reasonable opportunity to make written representations to the Central Bank about: (a) the suspected contravention; and (b) whether an Inquiry is necessary/ appropriate. Additional information can be provided to the Central Bank when making these representations.

The Examination concludes with a decision by the Central Bank as to whether or not to establish an Inquiry based on the information it has received, including any representations proffered by the RFSP. In considering whether it is reasonable to hold an Inquiry, the Central Bank will consider, inter alia:

- The seriousness of the breach (for suspected minor breaches, see Supervisory Action below);

- Whether remedial action was taken;

- When such remedial action was taken;

- The likelihood of reoccurrence.

- The compliance record of the RFSP (whether it has previously been sanctioned and/or received supervisory warnings/entered into settlements) and the age of such prior embellishments, if any.

Depending on the nature of the suspected prescribed contravention, the matter may also be referred to the Garda and/or the DPP for consideration of prosecution. In such circumstances the Central Bank may decide not to continue with its Inquiry.

Proposed Amendments in the Inquiry Guidelines

The Examination process remains largely unaffected by the proposed amendments. However, if at the conclusion of that process a decision is made to hold an Inquiry, the Central Bank would in future inform the RDU of that decision and provide it with copies of the documentation on which that decision was based.

Supervisory Action

Where it appears that a prescribed contravention has occurred but that the contravention was of limited regulatory significance or can be appropriately dealt with without the need for applying sanctions, the Central Bank may decide that the matter be dealt with by way of supervisory action.

In such circumstances the Central Bank may:

- Impose an enhanced supervisory regime (ensuring future adherence to the required standards);

- Issue a supervisory warning (which forms part of the compliance record of the RFSP).

In determining whether supervisory action is appropriate the Central Bank will consider, inter alia:

- The degree of co-operation it received from the RFSP;

- Whether the prescribed contravention was remedied effectively and immediately;

- The compliance record of the RFSP (whether it has previously been sanctioned and/or received supervisory warnings).

Inquiry

Where it has been determined following Examination that there are reasonable grounds for suspecting that a prescribed contravention has taken or is taking place, an "Inquiry" shall be held.

The purpose of the Inquiry is to determine:

- whether a prescribed contravention has or is occurring; and, if so,

- to determine the appropriate sanction(s).

Note that an Inquiry may not be necessary or will not conclude in circumstances where a Settlement Agreement is reached with the Central Bank (as discussed below).

Notice of Inquiry

In advance of an Inquiry being held, written Notice is sent to the RFSP which sets out1:

- the suspected contravention(s);

- grounds for suspecting that a contravention has taken place;

- the date, time and place the Inquiry will be held;

- an invitation to the RFSP to attend and/or to make written submissions;

- the procedures envisaged for the conduct of the Inquiry;

- details of any information relevant to the issue to be determined, including documents, statements etc;

- a report prepared by/for the Central Bank setting out the relevant prescribed contravention(s) and the facts and matter relied on in support of its suspicion.

Importantly the Notice will also ask the RFSP to:

- admit or deny whether the prescribed contravention occurred;

- identify agreed facts;

- submit representation on the alleged prescribed contraventions;

- submit representations on the procedure to be adopted by the Inquiry.

The RFSP is permitted to make written representations to an Inquiry in advance of that Inquiry taking place2.

Form of the Inquiry

There is no prescribed form for an Inquiry. Section 33AY(1) of the Central Bank Act 1942, as amended, provides that it should be conducted with as little formality and technicality, and as much expedition, as a proper consideration of the matters will allow. A RFSP does not necessarily have the right to make oral submissions to the Inquiry and it may proceed based on the written information already before it if it considers it appropriate. Therefore the opportunity to submit representations on the procedure to be adopted when replying to the Notice queries should be considered carefully.

Determining how to conduct the Inquiry is a matter for the person presiding over the Inquiry to determine in advance of the Inquiry taking place. The factors that will be considered when adopting a procedure will include:

- the complexity of the case;

- the benefit that oral evidence would add to written representations.

The Inquiry may even take place in the absence of the RFSP provided that it has been afforded an opportunity to attend or make written submissions3.

Such Inquiries are held in public save where it is agreed that they should be held in private or where the Inquiry will consider confidential information/unfairly prejudice a party/relate to an offence against a law of the State4. This is determined on a case by case basis in the public interest.

Admission or Denial of Occurrence of Prescribed Contravention

In responding to the Notice, the RFSP must advise the Inquiry of whether it admits or denies that the prescribed contravention took place. If it is admitted, the Inquiry shall write to the RFSP seeking consent to dispense with the Inquiry and offering sanctions so that the need to hold a sanctions inquiry is avoided. If no response/ consent is forthcoming then an inquiry to determine the appropriate sanction will take place5.

In the event that the contravention is denied or the RFSP fails to respond to the Inquiry, the Inquiry shall be held to determine whether the case is proved and, if so, to determine appropriate sanction(s).

Inquiry Composition

The Inquiry panel consists of one or more officers or employees of the Central Bank. The Inquiry panel cannot include any person(s) responsible for the authorisation or on-going supervision/monitoring of the RFSP.

The person nominated to preside over the Inquiry is also responsible for determining the procedure of the Inquiry prior to and during the Inquiry.

Burden of Proof

The burden is on the Central Bank to determine on the balance of probabilities whether a prescribed contravention took place.

Although the Inquiry is not bound by the rules of evidence it must, nonetheless at all times adhere to the requirements of natural and constitutional justice.

Decisions of the Inquiry

The decision of the Inquiry panel is determined by majority votes of those members of the panel present. Each member is afforded one vote.

If the Inquiry panel determines that there was a prescribed contravention, the RFSP is notified of this finding of fact in writing and is provided with the grounds upon which they are based together with details of the sanctions to be imposed, if any.

Factors for determining what Sanction should apply

The Central Bank has listed a series of factors which it takes into consideration when determining sanctions in its 'Outline of Administrative Sanctions Procedure' document of October 2005. They are set out below:

- Nature and seriousness:

-

- Whether the contravention was deliberate, dishonest or reckless;

- The duration and frequency of the contravention;

- The amount of any benefit gained or loss avoided due to the contravention;

- Whether the contravention reveals serious or systemic weaknesses of the management systems or internal controls relating to all or part of the business of the RFSP;

- The extent to which the contravention departs from the required standard;

- The impact of the contravention on the orderliness of the financial markets, including whether public confidence in those markets has been damaged;

- The loss or risk of loss caused to consumers or other market users;

- The nature and extent of any financial crime facilitated, occasioned or otherwise attributable to the contravention;

- Whether there are a number of smaller issues, which individually may not justify administrative sanction, but which do so when taken collectively;

- Any potential or pending criminal proceedings in respect of the contravention which will be prejudiced or barred if a monetary penalty is imposed pursuant to the ASP.

- The conduct of the RFSP after the contravention:

-

- How quickly, effectively and completely the RFSP brought the contravention to the attention of the Central Bank or any other relevant regulatory authority;

- The degree of co-operation with the Central Bank or other agency provided during the Examination of the contravention;

- Any remedial steps taken since the contravention was identified, including: identifying whether consumers have suffered loss and compensating them; taking disciplinary action against staff involved (where appropriate); addressing any systemic failures; and taking action designed to ensure that similar problems do not arise in the future;

- The likelihood that the same type of contravention will reoccur if no administrative sanction is imposed;

- Whether the contravention was admitted or denied.

- The previous record of the RFSP:

-

- Whether the Central Bank has taken any previous action resulting n a settlement, sanctions or if there are relevant previous criminal convictions;

- Whether the RFSP has previously been requested to take remedial action;

- General compliance history. In its determination of whether a prescribed contravention is or has occurred and the appropriate sanction to impose, the Central Bank is not permitted to take account of whether the RFSP has previously received supervisory warning(s). In determining appropriate sanctions however, the Central Bank can have regard to any previous Settlement Agreements entered into.

- General considerations:

-

- Prevalence of the contravention;

- Action taken by the Central Bank in previous similar cases; and/or

- Any other relevant consideration.

Sanctions which may be Imposed

The Central Bank may impose the following sanctions:

- A caution or reprimand;

- Direction to refund or withhold all or part of an amount of money charged or paid, or to be charged or paid, for the provision of a financial service;

- Monetary penalty (not exceeding €5,000,000 in the case of a corporate and unincorporated body, not exceeding €500,000 in the case of a person);

- Direction disqualifying a person from being concerned in the management of a regulated financial service provider;

- Direction to cease the contravention if it is found the contravention is continuing;

- Direction to pay all or part of the costs of the investigation and Inquiry.

Examples of some of the sanctions actually imposed in 2011 are set out at Appendix 1.

Publication of Adverse Decision and Imposition of Sanction

As with Settlement Agreements, the Central Bank publically reports on adverse decisions following an Inquiry and on the sanctions imposed or agreed, and issues a press release and details of the decision of the Inquiry on its website.

Such disclosures will include the names of the parties, the quantum of any fine imposed or nature of the sanction, together with details of the breach and often comments on the seriousness of the breach and how this is considered by the Central Bank.

Publication will only be withheld if it can be demonstrated that publication is not in the public interest, the information is confidential, relates to a criminal offence or would unfairly prejudice a person's reputation6. Publication of the existence of a sanction without releasing its terms, or publication of the terms without disclosing the name of the sanctioned entity are possible, but the burden of establishing grounds for such non-disclosure is high.

Proposed Amendments in the Inquiry Guidelines

As stated above, the Inquiry Guidelines provide a much more detailed breakdown of the Inquiry process. The most significant of which are outlined below:

- The Inquiry Guidelines specify that the Notice will be issued by registered post at least 28 days in advance of the Inquiry being held.

- The Inquiry Guidelines propose that a 'Case Management Questionnaire' be issued to the RFSP together with the Notice. The purpose of the questionnaire is to establish the form and procedure of the Inquiry to include:

-

- Inquiry arrangements (confirm hearing date; length of leaving; legal representation);

- confirm agreement to a public hearing;

- confirm whether legal submissions will be delivered;

- matters of evidence;

- estimate of costs;

- other relevant matters.

- Depending on the responses received to the questionnaire, a case management meeting may be required in a small number of cases to hear submissions on such matters and issue directions with the aim of narrowing the issues in dispute between the parties and to assist with a timely and efficient dispute of the case.

- The proposed Inquiry Guidelines also include that an agreed Book of Documents, to include, inter alia, the Notice, all documents provided to the RDU following the Examination, any witness statements and expert reports, and that the Book of Documents be made available by the RDU at least 5 working days in advance of the Inquiry to the parties.

- Legal submissions and case law to be relied upon to be submitted per the timetable directed following review of the Case Management Questionnaire.

- The RFSP may choose to have legal representation (as may the Central Bank).

- Inquires without oral evidence will proceed on the basis of the Agreed Book of documents / legal submissions.

- Transcripts of all Inquires shall be made available to the parties.

Included at Appendices 2 and 3 respectively are sample running orders of Inquiries with and without the hearing of oral evidence.

Oral Evidence

Although proceedings are purportedly informal, when oral evidence is envisaged, the proceedings are likely to be similar to High Court proceedings as they mirror many of the same procedural formalities. The Panel has the same powers with respect to the examination of witnesses that a High Court judge has. In the same vein, a person appearing before the Panel is afforded the same rights and privileges as a witness in High Court civil proceedings:

- The Panel can summon a person to appear and give evidence before it and / or produce documents;

- The Chairperson can require a person to give evidence under oath;

- The Chairperson can require a person to answer a question put to them (although the answer cannot be relied on against that person subsequently in criminal proceedings, other than proceedings for perjury);

- The Chairperson may permit evidence to be given by written statement, verified on oath.

A person may be held to have committed an offence where it has failed to comply with a request of the Panel, obstructed the Panel, knowingly resisted the Panel, or refused to attend before the Panel and / or give evidence on oath.

Panel Composition

Under the proposed amended Inquiry procedure, the panel will consist of three persons including the Chairperson.

In Public

The Inquiry Guidelines note that the time, date and location of a public Inquiry will appear on the Central Bank website and the venue will have space for public / media attendees.

Settlement

Applications can be made to adjourn the Inquiry to pursue a settlement with the Central Bank. The panel members are not permitted to discuss issues relating to the Inquiry with the Central Bank without the RFSP being present.

Decision of the Panel

If the Panel concludes that the suspected prescribed contravention took place, it will hear representations from the parties regarding sanctions, to include the issue of costs, at a separate sanctions and costs hearing.

Sanctions

Two new sanctions are proposed to be introduced, namely:-

- the suspension of the RFSP's authorisation in respect of any one of its activities for up to 12 months; and

- revocation of the RFSP's authorisation. (see generally 5.49(a) Central Bank (Supervision and Enforcement) Bill 2011).

The proposed maximum fines are also set to double to:

- €10,000,000 for a body corporate or unincorporated or 10% of its turnover for the last complete financial year (whichever is the greater); and

- €1,000,000 for a natural person.

In determining what sanctions to impose, the Panel will consider the following additional factors:

- the appropriate deterrent impact of any sanction on the RFSP and on other RFSPs;

- the level of turnover of the RFSP in its last complete financial year prior to concision of the contravention; and

- the likelihood of detection of such a contravention.

Settlement Agreement

At any time prior to the conclusion of an Inquiry, a settlement agreement may be entered into resolving the matter7 ("a Settlement Agreement").

Any such Settlement Agreement:

- must be in writing;

- is binding on both the Central Bank and the RFSP;

- will form part of the RFSP compliance record.

Settlement Agreements appear to be a highly important tool for the Central Bank. To date it appears from published sanctions that no party who has been engaged in ASP has allowed the ASP to proceed to an Inquiry. However, given the recent recruitment drive by the Enforcement Directorate, it remains to be seen whether a fully resourced Central Bank will be as amenable to settlement in future. There were ten Settlement Agreements in 2011, details of which are enclosed at Appendix 1, which notes that fines ranging from €10,000 to €3.5 million have been imposed via Settlement Agreements. Each of these Settlement Agreements resulted in a reprimand and therefore an admission on the part of the RFSP.

Negotiations

A precursor to any settlement is that the RFSP has remedied the breach where possible.

Discussions about settlement may take place on an informal basis and take place on a without prejudice basis. The contents of those discussions are not made known to the Inquiry panel when determining whether a contravention took place. They may subsequently be disclosed when considering what sanction is appropriate.

When considering whether to enter into a Settlement Agreement, the Central Bank will also look at the compliance record of the RFSP (whether it has previously been sanctioned and/or received supervisory warnings), whether settlement is appropriate given the facts of the case and if settlement is consistent with the Central Bank's promotion of compliance within the industry.

It has been part of the practice of the Central Bank to date to issue a without prejudice settlement letter shortly after issuing the Inquiry Notice, in an attempt to resolve prescribed contraventions in a timely / resource friendly manner, thus opening the door to negotiations at an early stage.

It is important that the person attending settlement discussions on behalf of the RFSP has authority to agree the sanctions on that day, and to sign the Settlement Agreement which is likely to form the basis of what is subsequently disclosed by the Central Bank by way of publication.

Publication

A settlement is voluntary but generally not confidential. The Central Bank publically reports on entering into Settlement Agreements and issues a press release and a copy of the terms of the Settlement Agreement on its website. Examples of these are found at Appendix 1. Note that those reports disclose the names of the parties to the agreement, the quantum of any fine imposed or nature of the sanction, together with details of the breach and often comment on the seriousness of the breach and how this is considered by the Central Bank.

Publication will only be withheld if it can be demonstrated that publication is not in the public interest. Publication of the existence of a sanction without releasing its terms, or publication of the terms without disclosing the name of the sanctioned entity are possible, but, as noted above, the burden of establishing grounds for non-disclosure is high.

Appeals

Decisions of an Inquiry may be appealed to the Financial Services Appeals Tribunal and the High Court.

Decisions of the Inquiry do not come into force pending the conclusion of the appeal.

Proposed Amendments in the Inquiry Guidelines

- Such an appeal to the Financial Services Appeals Tribunal must be made within 28 days of being notified of that decision, or within such time as agreed with the Registrar and Chairperson of the Financial Services Appeals Tribunal.

- Similarly, appeals from the Financial Services Appeals Tribunal to the High Court to be made within 28 days of being notified of that decision or as permitted by the High Court.

- Decisions of the Inquiry take effect on the expiration of any period within which the RFSP has to appeal the decision of the Inquiry, provided that decision is not appealed.

- If appealed to the FSAT, the decision is stayed pending the confirmation of that body and the expiry of the period to appeal that confirmation to the High Court.

- If appealed to the High Court, the decision is stayed pending the confirmation of the High Court of that decision.

APPENDIX 1 – PUBLICATION

The Central Bank has published details of ten Settlement Agreements concluded in 2011 and publicity notices in respect of each of those settlements, and a total of 45 since June 2006. The names of the party it settled with were declared in all instances, together the amount of fine imposed.

2011 Settlement Agreements

Combined Insurance Company of Europe Limited The Central Bank reprimanded the firm and required it to pay a monetary penalty of €3,350,000.

The Central Bank has entered into a Settlement Agreement with effect from 16 December 2011 with Combined Insurance Company of Europe Limited, a RFSP, in relation to breaches of regulatory requirements contained in the 2006 Consumer Protection Code, the European Communities (Insurance Mediation) Regulations (SI 13/2005) and the 2006 Minimum Competency Requirements.

The Central Bank also issued a general comment from its Director of Enforcement, who said:

"This is the largest fine issued by the Central Bank and reflects the seriousness with which we view fundamental regulatory failures including inadequate systems and controls which cause large scale non-compliance with our regulatory requirements. This enforcement action relates to consumer protection failures and the penalty imposed demonstrates that we will not tolerate breaches of this nature.

The types of failures arising in this matter not only cause detriment to a firm's customers but also erode the special trust customers place in regulated firms, leading to significant reputational and regulatory cost, in the form of penalties and the expense of remedial action for firms."

Susquehanna International Securities Limited

The Central Bank reprimanded the firm and required it to pay a monetary penalty of €60,000.

The Central Bank has entered into a Settlement Agreement with effect from 13 December 2011 with Susquehanna International Securities Limited, a RFSP, in relation to breaches of Regulations 112 and 33(1)(a) of the European Communities (Markets in Financial Instruments) Regulations 2007 (the "MiFID Regulations").

J & E Davy t/a Davy

The Central Bank reprimanded the firm and required it to pay a monetary penalty of €50,000.

The Central Bank has entered into a Settlement Agreement with effect from 8 December 2011 with J & E Davy t/a Davy, a RFSP, in relation to breaches of Regulations 112 and 33(1) (a) of the MiFID Regulations.

McSharry & Foley (Sligo) Limited

The Central Bank reprimanded the firm and required it to pay a monetary penalty of €10,000. The Central Bank has entered into a Settlement Agreement with effect from 24 October 2011 with McSharry & Foley (Sligo) Limited, a RFSP, in relation to breaches of regulatory requirements contained in the Consumer Protection Code and the Handbook for Authorised Advisors.

Goldman Sachs Bank (Europe) plc

The Central Bank reprimanded the firm and required it to pay a monetary penalty of €160,000. The Central Bank has entered into a Settlement Agreement with effect from 8 September 2011 with Goldman Sachs Bank (Europe) plc, a RFSP in relation to breaches of regulation 16(3) of the European Communities (Licensing and Supervision of Credit Institutions) Regulations 1992.

Pan Index Limited

The Central Bank reprimanded the Firm and required it to pay a monetary penalty of €40,000. The Central Bank has entered into a Settlement Agreement with effect from 25 August 2011 with Pan Index Limited, a RFSP, in relation to breaches of Regulations 76 and 94 of the MiFID Regulations.

Aviva Investors Ireland Limited

The Central Bank reprimanded the firm and required it to pay a monetary penalty of €30,000. The Central Bank has entered into a Settlement Agreement with effect from 20 July 2011 with Aviva Investors Ireland Limited, a RFSP, in relation to breaches of regulatory requirements contained in the Client Asset Requirements.

MBNA Europe Bank Limited

The Central Bank reprimanded the firm and required it to pay a monetary penalty of €750,000. The Central Bank entered into a Settlement Agreement on 21 June 2011 with MBNA Europe Bank Limited, a RFSP, in relation to breaches of regulatory requirements contained in the Consumer Protection Code.

Scotiabank (Ireland) Limited

The Central Bank reprimanded the firm and required it to pay a monetary penalty of €600,000. The Central Bank has entered into a Settlement Agreement with effect from the 2nd June 2011 with Scotiabank (Ireland) Limited, a RFSP in relation to breaches of regulation 16 of the European Communities (Licensing and Supervision of Credit Institutions) Regulations 1992 and section 10 of the Central Bank Act 1971.

1) Patricia Clinton t/a Innovative Mortgage Service and 2) Mr Frank Clinton (as a person concerned in the management of Innovative Mortgage Service)

The Central Bank imposed a disqualification period on each of Mr Frank Clinton and Mrs Patricia Clinton from being a person concerned in the management of a regulated financial service provider for 3.5 years with immediate effect. The firm's authorisation as a mortgage intermediary was also revoked by the Central Bank on 14 August 2009, at the request of the firm and prior to the commencement of the ASP Examination.

The Central Bank entered into a Settlement Agreement on 11 March 2011 with Patricia Clinton trading as Innovative Mortgage Service formerly a RFSP and Mr Frank Clinton, a person concerned in the management of the firm, in relation to breaches of regulatory requirements contained in the Consumer Protection Code and the Consumer Credit Act, 1995.

Further details relating to each of the press releases and settlement agreements are published on the Central Bank's website.

Footnotes

1 Section 33AP of the Central Bank Act, 1942 as amended.

2 Section 33AP(3) of the Central Bank Act 1942, as amended.

3 Section 33AP(5) of the Central Bank Act 1942, (as amended).

4 Section 33AZ of the Central Bank Act, 1942.

5 Section 33AR(1) & (2) of the Central Bank Act 1942, (as amended).

6 Section 33BC of the Central Bank Act, 1942 (as amended).

7 Section 33AV of the Central Bank Act, 1942 (as amended).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.