- within Law Department Performance, Litigation, Mediation & Arbitration and Antitrust/Competition Law topic(s)

On 18 November 2015, the Central Bank issued a report setting out its observations and expectations in relation to Anti-Money Laundering ("AML"), Countering the Financing of Terrorism ("CFT") and Financial Sanctions ("FS") compliance by Irish funds and fund service providers (each, a "firm"). The report is based on a series of inspections both on and off site that were carried out over the course of 2014. The inspections included: (i) a review of relevant AML policies and procedures, risk assessments and management information; (ii) interviews with key senior staff, including Money Laundering Reporting Officers ("MLROs"); (iii) sample testing of customer due diligence ("CDD") documentation, suspicious transaction reports, third party and outsourcing arrangements, transaction monitoring records and training records; and (iv) testing of IT systems and controls, including measures relating to screening of investors for compliance with FS regulations.

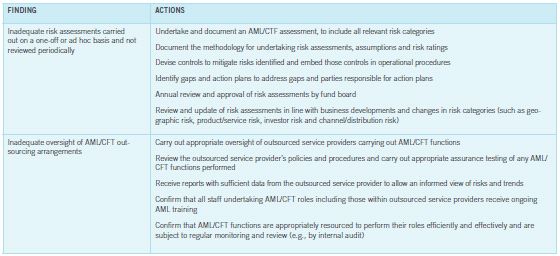

In its conclusions, the Central Bank stated that it expects a fund and its service provider(s) to work closely with each other to ensure that appropriate measures are in place to mitigate the risk of money laundering/terrorist financing. While the Central Bank acknowledged that satisfactory processes and controls were found in some areas, the number and nature of issues identified suggest that more work is required to effectively manage money laundering/ terrorist financing risk. Fund boards should take into account the findings of the report in assessing their current AML/CFT policies and procedures and their arrangements with their MLROs, funds service providers and third parties upon whom they rely to carry out CDD.

To read this article in full, please click here

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.