- within Compliance topic(s)

1 New law for all Irish companies

The Companies Act 2014 is expected to come into force on 1 June 2015. The Act will apply to all Irish companies although the level of action required from the company will vary, depending on which type of company is concerned (public, private, limited, unlimited etc). The Act brings welcome consolidation and modernisation of existing Irish company law and Matheson can help companies transition to the new system in a simple and cost-effective way.

2 New company types – convert or not?

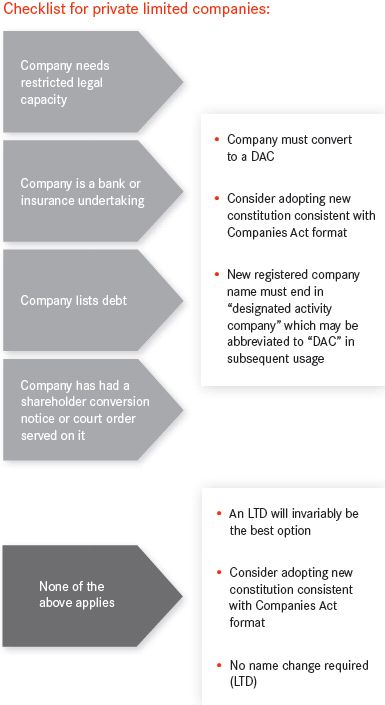

For all existing private companies, the primary decision will be whether to "opt in" to the new model company regime (LTD) which will effectively be the standard limited liability company for the future, or "opt out" by converting to a designated activity company (DAC) or another company type where required/preferred. Different considerations will apply in deciding which route to take and Matheson can help guide you down the right track. See our Companies Act 2014 Guide for more detail on the new legislation.

In addition, for a prescribed 18 month transition period to 30 November 2016 (or until conversion to one of the new company types, if earlier), all existing private limited liability companies will be subject to the law contained in the Act relating to DACs.

2.1 Company Limited by Shares (LTD)

This is the new model private limited liability company. It has new positive features such as a streamlined one-document constitution, no restrictions on what it can do, the ability to hold a written AGM and to have a sole director. It also has the advantage of not requiring any name change after conversion. We expect the majority of existing private limited liability companies to "opt in" and convert to the LTD form.

2.2 Designated Activity Company (DAC)

The DAC is the alternative to the LTD and is the closest corporate structure (in terms of format given its retention of the two-part constitution (memorandum and articles)) to the existing private limited liability company.

Many, but not all, of the reforms applicable to the LTD under the Act will also apply to the DAC. A DAC differs from an LTD in several important ways however. It must have an objects clause and hence is limited in what it can do. It must have two directors and (unless it is a single-member DAC) it must hold an AGM. It has a two-part constitution (memorandum and articles) and its registered name must end in "designated activity company" which may be abbreviated in subsequent usage to "DAC". The latter will mean changes to company stationery, registrations, websites etc.

The DAC may be appropriate for joint venture vehicles which must be restricted in what they can do (although a joint venture is not required to convert to a DAC). Banks and insurance undertakings or companies which list debt cannot convert to an LTD and therefore must convert to the DAC form to retain their private limited status.

2.3 Other company types – no conversion required

The Act will bring some changes to the law governing public limited companies, unlimited companies and guarantee companies but these types of existing companies do not need to convert. Unlimited companies and guarantee companies will, however, need to change the suffix to their names by the end of the 18 month transition period. In some cases, exemptions may apply.

3 Conversion: becoming an LTD

Migrating to the new system is easy and we can provide drafts of the required paperwork, which can then be tailored as needed in individual cases. There are three ways in which existing private limited liability companies can become an LTD:

-

Shareholder decision

The shareholders pass a special resolution (75% shareholder approval) adopting a new one-document constitution in a form approved by the shareholders. This is the recommended option. -

Directors' resolution

As an alternative, the directors prepare a one-document constitution but it must be based on the company's existing memorandum and articles of association. This is not an ideal option given that it may result in some overlap and/or conflict with the provisions in the Act. -

Automatic conversion

Where no action is taken by the shareholders or the directors within the 18 month transition period, private limited liability companies will automatically convert to LTDs. This is not recommended. The LTD may not necessarily be the best option for your company. Moreover, some provisions of the company's constitution may be overridden by mandatory provisions of the Act. This will not however be apparent from a reading of the constitution, leading to uncertainty as to the rules governing the company.

4 Conversion: becoming a DAC

It is also easy to "opt out" of the new LTD regime by converting to a DAC. An existing private company can convert to a DAC before 30 September 2016 by passing an ordinary shareholder resolution (50% shareholder approval). After that time, a special resolution (75%) is required. Companies converting to the DAC form must replace their existing memorandum and articles of association with a two-part constitution. After conversion, the DAC's shareholders can pass a special resolution to amend the constitution which can be tailored as required at that point.

A private company must re-register as a DAC if a re-registration notice has been served on it by members holding over 25% of voting rights or if members holding more than 15% of the issued share capital have obtained a conversion order from the court.

5 Which type of constitution is best?

In most cases, the best option for the company will be to adopt a Matheson form of constitution designed to take advantage of the reforms brought about by the Act while tailored in individual cases for client preferences or planning. We can also take care of all necessary Companies Registration Office filings as part of a smooth transition to the new regime.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.