In a big relief to taxpayers, the government has extended the due date of filing GST annual return (GSTR-9) and reconciliation statement (GSTR-9C) to 31 March 2019. The government has also announced that the online utilities would be made available shortly. Extension of the due dates, along with the release of the online utilities, should help the businesses to better prepare for filing GSTR-9 and GSTR-9C by collating the relevant information from its financial statements, and the GST returns filed during the year. The additional time should enable the government to clarify certain issues in GSTR-9 and GSTR-9C, which have led to the confusion in the industry.

Top Trends

- Supply of goods and services between two public sector undertakings application have been exempted from the provisions of Tax Deducted at Source.

- E-commerce operators have been exempted from the collection of Tax Collected at Source (TCS) in respect of supplies of services made through their portal by persons having an aggregate turnover not exceeding INR 2 million in a financial year. Clarifications issued on the scope of principal-agent relationship in the context of a del-credere agent (DCA)

- Clarifications issued on the scope of principal-agent relationship in the context of a del-credere agent (DCA)

Scenario 1 - DCA is not an agent under Para 3 of Schedule I of the CGST Act, i.e., invoice for the supply of goods is issued by the supplier on the buyer

Short-term transaction based loan provided by DCA to the buyer would be an independent supply, separate from the supply of goods by the supplier to the buyer. Therefore, the interest charged by the DCA would not form a part of the value of supply of goods.

Scenario 2 - DCA is an agent under Para 3 of Schedule I of the CGST Act, i.e., invoice for supply of goods is issued by the DCA in his name on the buyer.

In this case, the short-term transaction based loan, being provided by the DCA to the buyer, no longer retains its character of an independent supply, and is subsumed in the supply of goods by the DCA to the buyer. Value of interest charged for such credit would be required to be included in the value of supply.

Status of GST refunds

The government has announced that it has cleared the GST refunds amounting to INR 0.91 trillion, which is almost 94% of the total refund claims.

| Issue | Ruling | SKP Comments |

| 1. Is GST applicable on the supply of food to employees of an

entity located in an SEZ?; or 2. Whether such a company can claim

that it is running a canteen in the SEZ area and hence no GST is

applicable?; or 3. Whether such company can claim that it is running a restaurant in an SEZ and hence GST is applicable at the rate of 5%? Merit Hospitality Services Pvt. Ltd. - Appellate Authority for Advance Rulings (AAAR), Maharashtra |

Question 1 and 2 The AAAR has held that the supply by the appellant to employees of the unit located in SEZ cannot be construed as zero-rated supply, as the employees can neither be treated as an SEZ developer nor an SEZ unit. Accordingly, GST will be applicable as per the classification of services. Question 3 A restaurant is not defined under the GST law. As per the Cambridge dictionary, a restaurant is a place where meals are prepared and served to the customer. In view of this, the AAAR observed that the applicant is registered as "outdoor caterers" and is engaged in providing corporate catering services. Reliance was also placed on submissions of the applicant, wherein it was submitted that the applicant prepares the food in its kitchen and then distributes it to various companies located at different locations. Thus, the services being provided by the applicant are not covered within the meaning of restaurant service. |

As per Section 2(93) (a) of the CGST Act, 2017, a recipient of

the supply of goods or services means – "where a

consideration is payable for the supply of goods or services or

both, the person who is liable to pay that

consideration." In the given case, the applicant had submitted that even though the contract for the supply of food was between the applicant and the entity located in SEZ, the consideration for supply was paid by employees of such entity. Consequently, the AAAR held that the recipient of services being employees of the SEZ unit, the supply cannot be treated as a zero-rated supply under the GST law. |

| Whether the amortized cost of the tool is to be added to arrive

at the value of the goods supplied for the purpose of GST? M/s. Nash Industries (I) Pvt. Ltd. - Authority for Advance Rulings (AAR), Karnataka |

The applicant is in the business of manufacturing sheet metal

pressed components. The components were manufactured based on

drawings of the customer. For this purpose, tools were designed and

manufactured by the applicant. Such manufactured tools were billed

to the customer, even though the tools are retained by the

applicant. The customers were of the view that the amortization

cost of these tools is not includible to arrive at the value of

supply for GST. Hence, the applicant preferred the advance ruling

to resolve this issue. The AAR observed that the cost of the tool is an essential element to be included in the cost of the component, finally supplied by the applicant, as the component cannot be manufactured without the tools. In this case, the cost of the tools is being borne by the recipient and therefore the facts, and the circumstances of the transaction attract the said Section and therefore, the amortized cost of tools shall be added to the value of supply for the purpose of computing GST. |

It is interesting to note that in the present case, even the applicant's view was that the amortized cost of the tool should be subjected to GST. However, since the customers of the applicant had refused to pay GST on the amortized cost of the tools, the applicant approached the AAR to obtain a ruling in this regard. |

| 1. Whether the 'commission' received by the applicant,

in convertible foreign exchange for rendering services as an

'intermediary' between an exporter abroad receiving such

services and an Indian importer of equipment, is an 'export of

services as per IGST Act, 2017 (the Act)?; and 2. If the answer to Q. (1) is in the negative, whether the impugned supply of service forming an integral part of the cross-border sale/purchase of goods, will be treated as an 'intra-state supply' under section 8 (1) of the Act? M/s. Micro Instruments - AAR, Maharashtra |

Question 1 The applicant contended that the phrase 'intermediary services' as used in Section 13(8)(b) of the Act, which determines the place of supply of such services is not synonymous with the term 'intermediary'. The AAR rejected the contention of the applicant and ruled that the applicant is "very clearly covered under the definition of intermediary and the services being provided by them are clearly the services as given in the definition of 'Intermediary'" and hence its services cannot be treated as 'zero-rated'. Question 2 In regards to whether such taxable supply would be an intra-state supply or an inter-state supply, the AAR observed as under:

|

The ruling by the AAR in relation to taxability of intermediary

services is in line with the general understanding in the industry

that services of an 'intermediary' to a foreign client

cannot qualify as an 'export of services' under GST because

the place of supply of 'intermediary services' is the

location of the supplier of services, i.e., within India. However, whether the supply of intermediary services to a foreign client should be treated as an 'intra-state' supply or an 'inter-state' supply is a bone of contention in view of different possible interpretations of the provisions of place of supply. |

| Whether back office support services to foreign clients qualify

as zero-rated supply in terms of Section 16 of the IGST Act,

2017? Vserv Global Private Limited - AAR, Maharashtra |

The applicant provided, inter alia, following services to its

foreign clients:

The AAR held that the sum of activities mentioned above indicate that an applicant is a person who arranges or facilitates the supply of goods or services or both between the foreign client and customers of the foreign client. Therefore, the applicant is covered by the definition of an intermediary. Consequently, the place of provision of services, provided by the applicant, would be within India in accordance with Section 13(8) (b) of the IGST Act, 2017. Since the place of provision of service falls within India, the transaction would not qualify as export of service, and consequently cannot be treated as a zero-rated supply. |

India has developed as a hub of back-office support services

for companies around the globe. The understanding in the industry

was that such services would qualify as export of services under

GST and therefore would be zero-rated. The ruling by AAR may result

into the GST authorities sending notices to such service providers

for recovering GST on support services that are being provided to

the foreign clients. It would be advisable for companies operating a similar business model to revisit their tax positions and formulate robust agreements to minimize the possibility of any adverse action by the revenue authorities. |

| Whether the penal interest charged by an NBFC to its customers is to be treated as 'interest' for the purpose of exemption under Sl. No. 27 of Notification No. 12/2017-Central Tax (Rate) dated June 28, 2017? | The applicant contended as follows:

|

Given the trend of advance rulings generally favoring the

revenue, this decision may not be seen as an unexpected one.

However, under the GST law, interest or late fee or delayed payment

charges has to be specifically included in the value of supply. In

view of this, an argument can be made that such penal interest

should also take the color of interest and should be treated as an

exempt supply. Further, even under the erstwhile service tax law,

the taxability of penal interest has been a contentious issue, and

it is expected that it would continue to remain so under the GST

regime. The potential of ascribing a wide meaning to the term 'tolerance of an act' may result in authorities seeking to tax penal charges/interest, late fees etc. It is important for businesses, especially finance companies, to revisit any GST exposure on recovery of similar charges. |

It should be noted that an Advance Ruling is binding only on the applicant who had sought it and the concerned jurisdictional authority, i.e., an Advance Ruling is specific to an applicant and shall not be applicable to other taxpayers facing similar issues. However, the above-mentioned Advance Rulings provide clarity about the issues being faced and have a persuasive value in matters before the tax authorities.

Compliance Chart for Upcoming GST Due Dates

| Form | Applicable to | Period | Due Date |

| GSTR–1 | Registered taxpayers with annual aggregate turnover of more than INR 15 million | November 2018 | 11 December 2018 |

| GSTR–3B | All registered taxpayers | November 2018 | 20 December 2018 |

| GSTR–5 | Non-resident taxable persons | November 2018 | 20 December 2018 |

| GSTR–5A | Persons providing Online Information and Database Access or Retrieval (OIDAR) services | November 2018 | 20 December 2018 |

| GSTR–6 (monthly) | Input Service Distributors | November 2018 | 13 December 20 |

| GSTR–8 | TCS Collector | November 2018 | 10 December 2018 |

| GSTR–10 | Final return for persons whose registrations have been cancelled by the proper officer on or before 30 September 2018 | - | 31 December 2018 |

| GST ITC–04 | Taxpayers dispatching goods to a job-worker | July 2018 to September 2018 | 31 December 2018 |

Extended due dates for newly migrated taxpayers

| Form | Applicable to | Period | Due Date |

| GSTR–1 | Registered taxpayers with annual aggregate turnover of more than INR 15 million – Quarterly | July 2017 - November 2018 | 31 December 2018 |

| Registered taxpayers with annual aggregate turnover of more than INR 15 million – Monthly | |||

| GSTR–3B | All registered taxpayers | 31 December 2018 | July 2017 - November 2018 |

OTHER KEY ASPECTS

GST from a Macro Perspective

Revenue collections

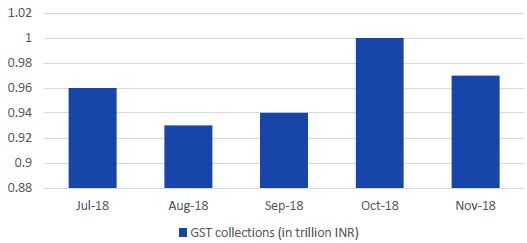

The government's GST collections in the month of November 2018 stood at INR 0.97 trillion. The collections had crossed the government's monthly target of INR 1 trillion in the month of October 2018, but have dropped once again in the month of November 2018.

GST in the news

- The 31st GST Council meeting has been scheduled for 22 December 2018 in New Delhi. The Council is expected to decide on rate cuts on certain electronic items currently falling under the 28% tax bracket is expected.

- The government's GST collections for the financial year 2018-19 are expected to fall short of its target by around INR 0.9 trillion.

- The simplified returns format approved by the GST Council are expected to be rolled out in April 2019.

- Faced with departmental notices for recovery of GST on 'free services' such as issuance of cheque books, additional credit cards, ATM usage etc., banks are considering passing on the cost of GST on such 'free services' to their customers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.