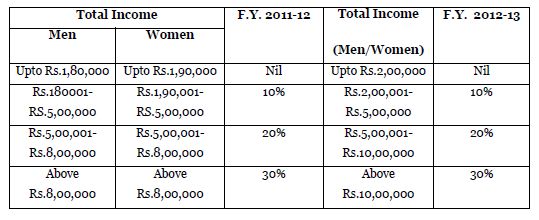

Rates for Individuals including Women (below age of 60 years at any time during the year), HUF, AOP, BOI:

Rates for Senior citizen (Age 60 and above at any time during the year):

Basic exemption continues to be Rs.2,50,000/-

Accordingly, tax on a Senior Citizen earning Rs.10,00,000 p.a. will be Rs.1,25,000/- + Cess

Rates for Very Senior citizen (Aged 80 and above at any time during the year):

Basic exemption continues to be Rs.5,00,000/-

Accordingly, tax on Rs 10,00,000/- will be Rs.1,00,000 + Cess of Rs.3,000/- = Rs.1,03,000 /-

Securities Transaction Tax (STT)

STT W.e.f.1st July, 2012 shall be reduced from 0.125% to 0.1% on delivery-based transactions such as purchase and sale of equity shares listed on a recognized stock exchange in India.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.