- within Transport, Finance and Banking, Media, Telecoms, IT and Entertainment topic(s)

- with readers working within the Law Firm and Construction & Engineering industries

The Securities and Exchange Board of India (SEBI) released a Consultation Paper on Crowdfunding in India on 17th June, 2014 (Consultation Paper). SEBI invited comments and suggestions from the interested stakeholders regarding different possible structures for crowdfunding within the existing legal framework, and related issues. The Consultation Paper proposed a framework for the regulation of crowdfunding in India based on enabling access to capital markets, expanding coverage of early-stage funding to startups and small and medium-sized enterprises (SMEs), and introduction of measures for protection of investors. In addition, the Consultation Paper also provided a brief overview of various existing frameworks across the globe, the associated benefits and risks, and the extant legal structures governing fundraising for startups and SMEs in India.

This article aims to provide a comprehensive overview of issues raised, and concerns addressed, in the Consultation Paper. The article is divided into two parts. Part I provides an introduction to crowdfunding and the extant governing framework in India. Part II deals with salient features of the framework proposed in the Consultation Paper.

[Note - paragraph numbers (¶) referred to throughout this article refer to those in the Consultation Paper.]

PART 1 - INTRODUCTION

Q1. What is crowdfunding?

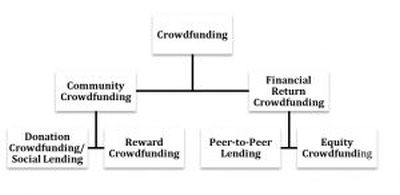

Crowdfunding is a means of raising funds through an online platform in the form of small financial contributions from multiple investors for a business venture, specific project or social cause.

(¶ 2.0)

Q2. Which are the different models of crowdfunding?

- Donation crowdfunding: It is the raising funds for philanthropic, social or other similar purposes, which must not be in exchange for anything having tangible value. (¶ 3.2)

- Reward crowdfunding: It refers to solicitation of funds from investors in exchange for existing or future tangible rewards. (¶ 3.3)

- Peer-to-peer (P2P) lending: Lenders are matched with borrowers on an online platform for provision of unsecured loans to the borrowers at an interest rate fixed by the platform. Certain platforms facilitate loan arrangements between individuals while others pool funds which are lent to SMEs. (¶ 3.4)

- Equity based crowdfunding: It refers to solicitation of funds by a business wherein equity interests in the business are offered as consideration. (¶ 3.5)

Q3. What are the benefits of crowdfunding?

SEBI lists the following as benefits of crowdfunding:

- Crowdfunding provides an alternate mode of financing for start-ups and the SME sector, and thereby allows an increased flow of credit to the SME sector and other users in the real economy.

- The ability of banks to lend to high-risk ventures was constrained as a result of the Basel III Capital Adequacy norms put in place after the financial crisis in 2008. Consequently, new sources of finance for such ventures are required, and crowdfunding fills this gap.

- Crowdfunding allows SMEs to raise funds at a lower cost and through a simpler procedure as compared to other modes of raising funds.

- Investors are provided with a new avenue for investment and thereby, an opportunity for diversification of avenue.

- It makes the funding space for start-ups and SMEs competitive.

- Additionally, crowdfunding platforms may undertake due diligence or vetting of projects hosted on their websites to maintain the reputation of the platform.

(¶ 4.0)

Q4. What are the risks involved with crowdfunding?

- Substitution of institutional risk by retail risk: In case of funding of start-ups and SMEs, the risk is usually borne by Venture Capital Funds (VCFs) and Private Equity Investors (PEIs). In the case of crowdfunding, the risk is shifted to retail investors who have a lower threshold for risk tolerance. Investments in start-ups and SMEs are prone to low liquidity and high risk and are generally, in the nature of long term investments. VCFs and PEIs are in a position to factor in the risks being undertaken and negotiate accordingly to protect their interests. Such flexibility to negotiate depending on the risk is not available in case of crowdfunding. (¶ 5.1)

- Risk of default: There is no or inadequate recourse available to the investors in case of defaults as funds are solicited through the platform and no offer documents are issued by the issuer. The platform is under no obligation to conduct due diligence to ensure the credibility of the issuer. If the platform is shut temporarily or permanently, there is no remedy that can be availed by the investors. Often, the funding is raised by ventures on future possibilities. Investments in ventures without a viable business model are beset with a higher risk of failure. In the case of P2P lending, no collateral is provided by the borrower, as in the case of corporate bonds, in order to provide protection to the investors. (¶ 5.2)

- Risk of fraud: There is a possibility of genuine platforms being used by persons claiming to be promoters of projects in order to defraud investors. Fraudulent platforms may also be established in order to solicit credit card or any other sensitive information from investors. Therefore, these platforms may be misused and pose identity theft and cyber-security concerns. (¶ 5.3)

- Central role of the Internet: Crowdfunding takes place through an online platform and therefore, has the potential to affect investors widely as compared to traditional modes of fundraising. Funding can be raised from investors residing in several countries without compliance to the laws prevailing in those jurisdictions. (¶ 5.4)

- Systemic risk:

- Individuals investing through crowdfunding platforms may not diversify their portfolio to mitigate the risks undertaken.

- A secondary market may not be available for investors to sell their investments and therefore, there is a risk of low liquidity.

- Such platforms can also be used for money laundering.

- Other financial sectors may be exposed to the risk of default by these platforms as had happened in the financial crisis of 2008. These risks could become systemic if P2P lending continues to grow at a rapid rate.

- The disparities in the laws of different jurisdictions from where the funds are raised may give rise to cross-border implications. (¶ 5.5)

- Information asymmetry:

- Due to excess reliance on information available on social networking platforms and other online platforms, a situation of information asymmetry may be created as certain investors may have access to information which is not available to other investors.

- The accounts where the funds raised through the platforms are deposited are not monitored.

- The issuers are not subject to stringent obligations on reporting and transparency including with respect to end-use of the funds.

- The issuer may make misrepresentations which may result in the investors over-estimating the returns from the investment.

- Substitution of existing regulatory framework: The due diligence and disclosures involved in crowdfunding are not comparable to the regulatory framework for a public issue of equity shares or private placement. (¶ 5.7)

Q5. Which agency regulates crowdfunding in India?

No single department of the government acts as a regulator. As equity crowdfunding raises money in lieu of ownership in the company it is under the scanner of SEBI. Similarly, P2P lending is related to issuing loans and may come under the scanner of Reserve Bank of India (RBI). There is no specific regulator for either donation crowdfunding or reward based crowdfunding (¶ 9.0.5). However, it is important to note that general statutes such as the Income Tax Act, 1961, the Foreign Contribution (Regulation) Act, 2010 (FCRA) and the Foreign Exchange Management Act, 1999 (FEMA) would apply to all types of crowdfunding.

Q6. Will SEBI have jurisdiction to regulate crowdfunding in India?

Jurisdiction of SEBI is limited to regulation of securities in India. Therefore, donation based crowdfunding, reward based crowdfunding and P2P lending do not fall within the jurisdiction of SEBI as issuance of securities is not involved. However, security-based crowdfunding such as equity crowdfunding will be under the regulatory purview of SEBI.

(¶ 9.0.5)

Q7. What are the possible routes of security-based crowdfunding being explored in India?

There are three different routes being explored for security-based crowdfunding.These are:

- Equity-based crowdfunding

- Debt-based crowdfunding

- Fund-based crowdfunding

(¶ 9.0.7)

Equity and debt based crowdfunding are based on private placement route as explained in Section 42 of the Companies Act, 2013. On the other hand fund based crowdfunding is based on the SEBI (Alternative Investment Funds) Regulations, 2012.

(¶ 9.0.8)

Q8. What concerns should be addressed when regulating crowdfunding?

Crowdfunding has emerged as an important mode of finance for start-ups and SMEs as it allows solicitation of funds at considerable ease. However, it is imperative that retail investors are protected from fraudulent activities of unscrupulous players. Therefore, it is essential that a balance is struck between investor protection and the need to promote equity markets through the regulations.

(¶ 8.4)

Q9. What are the international perspectives considered by the SEBI in formulating the proposed framework in the Consultation Paper?

The table available here is indicative of the international perspectives considered by the SEBI in formulating the proposed framework.

PART 2 - THE PROPOSED FRAMEWORK

Q1. Who can invest in crowdfunding?

With an aim of balancing the need of companies and investor interests, SEBI has suggested that only accredited investors (AI) and experienced retail investors must be permitted to invest through crowdfunding.

(¶ 9.1.3)

AI shall include:

- Qualified Institutional Buyers (QIB) as defined in SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009;

- companies incorporated under the Companies Act with a net worth of Rs. 20 crores (Company);

- High Net Worth Individuals (HNI) with a net worth of more than Rs 2 crore (excluding the value of their primary residence or any loan secured on property); and

- Eligible Retail Investors (ERI).

(¶ 9.1.4)

Q2. What are the qualifications for an ERI?

The conditions to be fulfilled by the investor are as follows:

- It shall have a minimum gross income of Rs. 10 Lakhs.

- It should have filed tax returns for the last 3 years.

- It shall not invest more than Rs 60,000 in an issue.

- It shall not invest more than 10% of its net worth through crowdfunding.

Further an ERI shall fulfil one of the following conditions:

- received advice from an investment advisor; or

- availed the services of a portfolio manager; or

- passed an appropriateness test conducted by either an institution accredited by National Institution of Securities Markets (NISM) or the crowdfunding platforms.

(¶ 9.1.4)

Q3. What limitations may be placed on investments?

- In consonance with the Companies (Prospectus and Allotment of Securities) Rules, 2014, SEBI has suggested that private placement offers through equity-based crowdfunding and debt-based crowdfunding can be made to any number of QIBs but to a maximum of 200 HNIs and ERIs combined. ( ¶Para 9.1.5.1)

- In order to validate the credibility of the issuer, in private

placement offers through equity-based crowdfunding and debt-based

crowdfunding, certain investors are required to own a fixed

percentage of the securities issued. The Companies (Prospectus and

Allotment of Securities) Rules, 2014 prescribe that the minimum

offer value per person must be at least Rs. 20,000 of the face

value of the securities. In view of the prescribed minimum offer

value per person, the obligations with respect to investors are as

follows:

- A QIB is required to purchase at least 5 times of the minimum offer value per person with all QIBs collectively holding a minimum of 5% of the securities issued.

- A company is required to purchase at least 4 times of the minimum offer value per person.

- An HNI is required to purchase at least 3 times the minimum offer value per person.

- An ERI is required to purchase at least the minimum offer value per person with the maximum investment in an issue not exceeding Rs. 60,000. An ERI shall not invest an amount exceeding 10% of its net worth in crowdfunding in a year.

(¶ 9.1.5.3)

Q4. What conditions may be imposed on the investments?

- A risk acknowledgement is required to be signed by ERIs and HNIs. This shall provide that they understand the risks associated with crowdfunding.

- AIs are required to hold a demat account as the issue has to be in demat form.

- Payments shall be made through normal banking channels, further, payment through cash and credit cards not being permissible.

- ERIs must be Indian citizens and must fulfil the criteria laid down.

- Investment by foreign investors will be subject to guidelines framed by RBI and the government from time to time.

(¶ 9.1.6)

Q5. What restrictions may be placed on the eligibility of a company to raise money through security-based crowdfunding?

The Consultation Paper proposed exhaustive criterias to ensure that only early stage startups or SMEs can raise money through crowdfunding. The company should fulfil all of the following criteria:

- It should not raise capital exceeding Rs. 10 crores in a period of 12 months.

- It should not be promoted, sponsored or related to an industrial group with a turnover of more than Rs. 25 crores.

- The company should not be listed on any stock exchange.

- It should not be more than 48 months old.

- A company engaged in non-financing activities shall not use the money raised through a crowdfunding platform to provide loans or to invest in other entities.

- The company should not be engaged in any real estate activity which are not permitted by industrial policy as provided by the Government of India.

(¶ 9.2.4)

Additional requirements are proposed to ensure that only genuine entities raise funds through crowdfunding, which are as follows:

- The issuing company, its directors, promoters or associates have not been prohibited from accessing or operating in the capital market.

- The issuing company, its directors, promoters or associates have not been mentioned as a defaulter or a wilful defaulter by RBI or Credit Information Bureau (India) Limited (CIBIL).

- The directors or promoters are not disqualified to be directors of the company under the Companies Act, 2013.

- The directors, promoters and associated of the company are "fit and proper" persons as specified under Schedule II of SEBI (Intermediaries Regulations), 2008.

(¶ 9.2.5)

Further, the following compliances are suggested, as well:

- In a given period of 12 months, the company raising funds shall not use multiple crowdfunding platforms to raise funds.

- The issuing company shall not advertise their offering to public in general or solicit investments from the public.

- The issuing company shall not compulsorily route all its crowdfunding activities through SEBI approved platforms.

- The issuing company shall not incentivize or compensate a person to promote its offering.

- The issuing company shall provide provisions for over subscription, which should not exceed 25% of the actual issue size.

(¶ 9.2.6)

Q6. What could be the disclosure requirement for companies raising money through security-based crowdfunding?

SEBI lays down that disclosures should be required to be made at the time an issuer approaches a crowdfunding platform as well as on an ongoing basis.

At the time of seeking an investment the company shall submit a private placement offer letter which shall include:

- the name of the company & the registered office address;

- a description of the current/new venture that the company is undertaking;

- issue Size and specified target offering amount and usage intended usage of funds;

- description on the valuation of securities offered;

- past history of funding of the firm;

- history of any prior fundraising on any crowdfunding platform by the company;

- a description of the financial condition of the company which shall include the audited financial statements of the past one year;

- price of securities offered and the rights and liabilities attaching to the securities

- ownership details and capital structure;

- details regarding board, management and group entities, persons with a shareholding of 20% or more;

- principal's risks to the issuing companies business;

- grievance and redressal and dispute resolution;

- any other information as specified by SEBI; and

- future growth projections based on trusted third party research and realistic assumptions.

(¶ 9.3.3)

Additionally, an issuing company shall make bi-annual disclosures to the crowdfunding platform, which may, inter alia, contain:

- the audited financial statements;

- the utilization of funds raised in accordance to the object of the issue;

- a detailed view of the current state of business and the progress made since last disclosure;

- any other funding raised since the last disclosure; and

- any penalty, pending litigation or regulatory action against the company or promoters or directors.

(¶ 9.3.6)

Q7. Which companies may set up a crowdfunding platform in India?

SEBI has established three different lists of entities that can have a crowdfunding platform. The same are listed below.

Class I entities, which shall include:

- recognized stock exchanges with nationwide terminal presence; and

- SEBI registered depositories.

(¶ 9.4.4.2)

It has also been proposed that in order to ensure a healthy competition in the market an additional class of entities with relevant experience and domain knowledge be allowed to launch crowdfunding platforms.

(¶ 9.4.4.3)

Class II entities, which shall include Technology Business Incubators:

- which are promoted by central government or a state government through bodies such as NSTEDB (National Science & Technology Entrepreneurship Development Board) under the Department of Science and Technology;

- which are as functioning as a society registered under Societies Act 1860 or is a non-profit making section 8 company;

- which have had at least 5 years of experience;

- with a minimum net worth of 10 crores;

- which are self sufficient; and

- which shall only display companies on their platform which have a common focus are with the incubator.

(¶ 9.4.4.4)

A joint venture of Class I and Class II entities shall also be allowed to act as a platform.

(¶ 9.4.4.5)

Class III entities which shall include:

This entity has been created for fund-based crowdfunding, SEBI has proposed to create a crowdfunding Alternative Investment Fund which may be displayed at a recognized stock exchange or depositaries.

(¶ 9.4.4.6)

This class shall also include associations and networks of PE or angel investors

- with a track record of a minimum of 3 years;

- with an active 10-member strength; and

- which are registered as Section 8 companies with a capital of Rs. 2 crores.

(¶ 9.4.4.7)

Q8. What would be the obligations of the crowdfunding platform?

SEBI puts an obligation on the crowdfunding platform to ensure a balance between the investor and the company requiring funds. The obligations proposed are:

- to conduct basic screening and due diligence. The due diligence shall include a track record of the promoters, directors, key managerial personnel, business carried out by the company, proposed business plans, opportunities, strategies pending litigations etcetera;

- to conduct background and regulatory checks on shareholders with more than 20% shareholding in the issuing company;

- to review the information presented on the platform by the issuing company to confirm if it adequately sets out general features, structure of security, issuer specific risk, parties involved, and identified conflict of interest and the intended use of funds;

- to conduct due diligence of investors such as net worth requirement and KYC requirement, if any;

- deny access to issuing platform if the platform considers the issuing company to be fraudulent;

- to maintain a record of all the issues brought by the companies and their disclosures; and

- to provide information to SEBI as required.

(¶ 9.4.5)

Q9. Are there any additional requirements for crowdfunding platforms?

The platforms have to ensure the following:

- The platform should be well equipped to manage the daily affairs and emergency situations. Further, the platform should own the domain name/website URL.

- The platform should have adequate human, technology and risk management capabilities.

- the platforms are required to have a fair, orderly and transparent process.

- There are procedures in place to address and kind of issues arising between the investors and issuing companies.

- The platform, its subsidiaries, associates or any company related to the platform shall not raise funds through the platform.

- There are elaborate contingency/termination plans to ensure minimum impact of investors on closure of platform.

- The platform shall not offer any investment advice or make any recommendation to the investor.

- The platform shall not manage funds or securities.

- Only AI registered with the platform shall be able to invest in the companies listed on the platform.

- Only Indian SMEs and start-ups would be allowed to raise funds through a crowdfunding platform.

- The platform shall conduct due diligence which will involve a scrutiny of the track record of the promoters, directors, key managerial personnel, business carried in by the company, proposed business plans, opportunities, strategies, litigations etc.

(¶ 9.4.6)

Q.10 Will there be any other filtering process for companies to be listed on a platform?

SEBI suggested constituting a Screening Committee to filter out the quality of ideas and business plans.

(¶ 9.4.6)

Q.11 Who would be the members of Screening Committee?

The Screening Committee shall have the following composition:

- 40% of the committee should be composed of professionals with expertise in mentoring startups and early stage ventures.

- 30% of the committee should be composed of professionals with experience in banking or capital markets.

- Not more than 30% of the committee should be persons of high calibre and qualifications which are nominated by the crowdfunding platform. However, they should not be on the payroll of the portal.

(¶ 9.4.6.1)

Q.12 Are there any further conditions proposed that a company has to meet before raising funds through equity crowdfunding?

It is proposed that the company would have to further ensure the following:

- No single investor in the company should own more than 25% stake in the company; and

- The promoter should maintain a minimum of 5% equity stake in the company for a period of 3 years.

(¶ 9.5.3)

Q.13 How many investors may invest through security crowdfunding?

On the basis of the Companies (Prospectus and Allotment of Securities) Rules, 2014, it has been suggested that a company can raise funds through any number of QIBs and a combined total of 200 of HNI's and ERI's.

(¶ 9.1.5.1)

Q.14 Is there any minimum investment amount proposed for the investors?

Taking the minimum offer value as Rs. 20,000 as provided in The Companies (Prospectus and Allotment of Securities) Rules, it has been suggested:

- A QIB shall purchase at least 5 times of the minimum offer value. Further, the total share of QIB shall be limited to 5% of the securities issued

- A company shall purchase at least 4 times of the minimum offer value

- A HNI shall purchase at least 4 times the minimum offer value

- An ERI will purchase at least at the minimum offer value. However, ERI shall not invest more than Rs. 60,000. Further, it has also been clarified that total crowdfunding investment by an ERI shall not be more than 10% of their net worth.

(¶ 9.1.5.3)

Q.15 What would be the rights given to investors investing in equity crowdfunding?

The investors shall have the rights similar to equity shareholders as given under the Companies Act, 2013.

(¶ 9.1.5.5)

Q.16 Are there any further conditions that a company has to meet before raising funds through debt-based crowdfunding?

The company has to further ensure that:

- the debt securities issued complies with requirements as per Companies Act and rules applicable to debentures or bonds;

- the issuer appoints a debentures trustee to hold assets on behalf of the investors;

- the issuing company creates a debenture redemption reserve of 25% of the value of debentures; and

- the issuing company further provides a summarized term sheet as specified in SEBI (Issue and Listing of Debt Securities) Regulations, 2008.

(¶ 9.6.3, ¶ 9.6.4)

Q.17 What are the rights proposed for investors investing in debt crowdfunding?

Such investors shall have the same rights as debenture holders under the Companies Act, 2013.

(¶ 9.6.5)

[This post is authored by Reshabh Bajaj and Anish Krishnan, fifth year undergraduate students of Jindal Global Law School, with contributions from Sushma S. Babu, a fourth year undergraduate student of HNLU, Raipur, during their internships with TRA. Pushan Dwivedi, Associate, and Nehaa Chaudhari, Public Policy Lead, gave inputs.]

Originally published 18 April, 2018

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.