1. Introduction

The act for the Reform of the Renewable Energy Act (the "Reform Act") was approved by the German Bundestag on the 27 June 2014 and on 11 July by the German Upper House. It is now set to come into force on 1 August 2014.

Sigmar Gabriel, German minister of Economy and Energy, stressed that the reform would provide a reliable but ambitious expansion path for renewable energy. Whereas previous German governments emphasized the increase of renewable energy generation capacity, the Reform Act has four main objectives:

- Continuing and controlling the expansion of renewable energy

- Lowering the cost of funding

- Spreading the financial burden more fairly

- Improving the market integration of renewable energy

The main objective of the Reform Act is to reconcile cost effectiveness, environmental compatibility and security of supply, three concerns that have often been referred to as the "energy trilemma".

In spite of the emphasis on cost control, the German government is keen to point out that the long-term objective of generating 80% of electricity through renewable resources has not changed. The expansion of renewable energy in Germany is set to continue, albeit at a slower pace.

2. Continuing and controlling the expansion of renewable energy

The Reform Act stipulates specific targets as to the portion that energy generated from renewable sources should make up in the future:

- until 2025, this portion should total 40 - 45 per cent; and

- until 2035, this portion should total 55 - 60 per cent.

Additionally, the Reform Act sets targets for annual expansion of specific technologies:

- Installed capacity for solar power should increase by 2,500 MW annually.

- Installed capacity for on-shore wind farm should be 2,500 MW

In order to regulate the expansion of onshore wind capacity, the EEG now contains an expansion target of net 2,400- 2,600 MW/year for onshore wind power plants for the first time.

- The annual increase for biomass has been set at no more than 100MW

- Off-shore wind capacity has a target of 6,500 MW by 2020 and of 15,000 MW by 2030.

3. Lowering the costs

The objective of the Reform Act is to reduce the financial burden of the support programme for renewable energy generation. In order to achieve this objective, the Reform Act will reduce the support levels – with the introduction of technology specific tariffs which will apply to all new plant commissioned after 1 August 2014, further details and technology specific differences are set out below.

Onshore wind

The Reform Act introduces a number of changes for onshore wind; one of the consequences that has been predicted is a "race to commissioning" in 2014 to receive assistance from the old support regime which is likely to be followed by a somewhat slower year in 2015.

From 1 August, the tariff for newly commissioned onshore wind will decrease every quarter by 0.4 per cent (compared to the immediately preceding quarter) subject to the overall expansion of installed onshore wind capacity remaining within the target corridor of 2,400 – 2,600MW/year. Should this target corridor be exceeded, the rate of decrease will be accelerated accordingly. On the other hand, should the lower end of the target corridor (the "Onshore Target Floor") not be reached, the tariff will be adjusted accordingly.

If the target is exceeded by

- up to 200MW, the reduction will be 0.5 per cent;

- more than 200 MW, the reduction will be 0.6 per cent;

- more than 400 MW the reduction will be 0.8 per cent;

- more than 600 MW the reduction will be 1.0 per cent; and

- more than 800 MW the reduction will be 1.2 per cent

If the Target Floor is not reached in the relevant period the monthly reduction of the applicable value is decreased. For a shortfall of the Target Floor by up to 200 MW, the reduction is decreased by 0.3 per cent; for a shortfall of the Target Floor by more than 200 MW, the reduction is decreased by 0.2 per cent; and if the Target Floor is not reached by more than 400 MW, the tariff will not be reduced.

The central problem in this approach however is that the actual tariff for each quarter will only be known, at the earliest, five months prior to its entry into force and is calculated on the basis of the reaching or otherwise of the Onshore Target Floor in the period from the last calendar day of the 18th month prior and the first calendar day of the fifth month prior to the relevant quarter. This introduces a level of uncertainty into any project's financial plans which in turn are not within the control of the project itself but determined by the speed with which its competing projects are commissioned. This scenario could lead to some interesting market dynamics in the future but will likely increase the difficulty of financing onshore wind projects.

In another significant change to the previous onshore wind regime, the Reform Act introduces changes to the reference yield model ("Referenzertragsmodell" in German). In this model, the tariff for onshore wind sets out a higher tariff for an initial period of time and a lower rate for the remainder of the 20 years (plus year of commissioning) in which the support tariff applies.

Offshore wind

The Reform Act also introduces a number of changes to the offshore regime.

The Reform Act introduces, by means of an amendment to the German Energy Industry Act (Energiewirtschaftsgesetz), a new mechanism for the allocation of grid connection capacity for new capacity of up to 6,500MW up to 31 December 2020. From 1 January 2021 onwards, the grid connection available for allocation capacity will increase by 800 MW/year.

In the case of demand beyond these capacity targets, the relevant additional grid connection capacity will be allocated in an auction. Should a wind project fail to use its allocated grid capacity, the competent authority, the German Federal Maritime and Hydrographic Office may, subject to certain conditions, revoke allocated grid connection capacity.

It is possible that this new mechanism will make the already difficult process of offshore grid connection more complicated for projects. Further, it remains to be seen whether this process will help to alleviate the pressure on the two offshore TSOs to provide timely grid connections.

However, the structure of the current tariff regime remains largely unchanged and the availability of the popular acceleration model pursuant to which an increased tariff applies for the first eight years has been extended to plants commissioned prior to 1 January 2020.

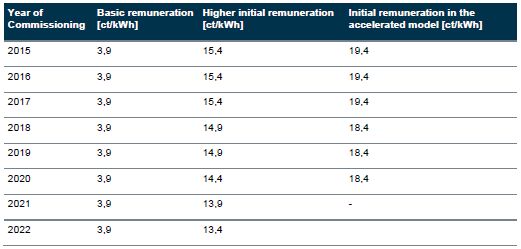

There are two different approaches of remuneration for offshore wind farms which commence operation before 1 January 2020. Wind farm operators can choose between:

- claiming the 'initial remuneration' of 15.4 ct/kWh over a period of 12 years; or

- claiming an 'initial remuneration' of 19.4 ct/kWh for a total of 8 years (the so-called optional acceleration model).

After 12 or 8 years, as applicable, the remuneration returns to a fixed level of 3.9 ct/kWh.

Under certain circumstances, the initial remuneration of 15.4 ct/kWh can be extended beyond the period of 12 years, depending on the distance between the wind farm and the coast and the water depth at the location. The period in which the increased initial remuneration of 15.4 ct/kWh is paid is extended by 0.5 months for every full nautical mile of distance between the system and the coast over twelve nautical miles and by 1.7 months for each full metre of water depth exceeding a depth of 20 metres.

The possibility of extension also applies to wind farms for which the operator has selected the higher rate of remuneration of 19.4 ct/kWh for a period of 8 years in accordance with the acceleration model.

Regardless of whether or not the operator has chosen the acceleration model, if the remuneration period is extended, 15.4ct/kWh will be paid out during the extension period.

Overview of applicable FiTs for offshore wind farms pursuant to the Reform Act

Solar (photovoltaic)

The Reform Act does not introduce structural changes to the support regime for solar (photovoltaic) installations; it specifies an expansion corridor of newly built capacity of 2,400-2,600 MW/year (the "Solar Target Corridor"). The slightly changed tariff structure for solar plants will be applicable to plants commissioned from 1 September 2014 onwards.

The applicable value depends on the installed capacity of the plant.

For up to and including 10 MW it is 9.23 Cent/kWh provided that –

- the plant is affixed to, in or on a building and the building is predominantly used for purposes other than the generation of electricity from solar power

- certain zoning law provisions are complied with.

If the plant is affixed to, in or on exclusively on a building or a noise protection wall, the applicable value is for an installed capacity of –

– up to and including 10kW 13.15 Cent/kWh

– up to and including 40 kW 12.80 Cent/kWh

– up to and including 1 MW 11.49 Cent/kWh

– up to and including 10 MW 9.23 Cent/kWh

Reduction of financial support

From 1 September 2014 the applicable value is reduced monthly by 0.5 per cent relative to the applicable value in the previous month.

The monthly reduction is reviewed and increased or decreased every quarter, depending on whether or not the Solar Target Corridor has been met or exceeded. If the Solar Target Corridor has been exceeded in the relevant period (the period between the last day of the 14th month and the first day of the last month preceding the review) the monthly reduction of the applicable value is increased.

For an excess of -

– up to 900 MW to 1.00 per cent

– more than 900 MW to 1.40 per cent

– more than 1,900 MW to 1.80 per cent

– more than 2,900 MW to 2.20 per cent

– of more than 3,900 MW to 2.50 per cent

– more than 4,900 MW to 2.80 per cent

If the Solar Target Corridor has not been met in the relevant period, the monthly reduction of the applicable value is decreased.

For a shortfall of -

– up to 900 MW to 0.25 per cent

– more than 900 MW to nil

– more than 1,400 MW to nil; the applicable value is increased by 1.50 per cent once on the first day of the applicable quarter

4. Spreading the burden more fairly

In Germany, the cost of the support regime for renewable energy is socialised and largely borne by industrial and domestic consumers through the mechanism of a charge (the "Reallocation Charge") which is added to electricity bills. In the past, large industrial consumers enjoyed an exemption from this reallocation charge. This exemption regime was subject to criticism from the European Commission. One of the objectives of the Reform Act is to spread the burden of the Reallocation Charge more fairly and to revoke or limit any exemptions.

Self-supply

Under the Reform Act, self-supplying entities with an installed capacity of more than 10kW will be subject to the Reallocation Charge.

For self-supply from renewable energy plants commissioned after 1 August 2014 a reduced rate of the Reallocation Charge will be payable. The reduced rate is 30 per cent until the end of 2015, 35 per cent in 2016 and from 2017 onwards 40 per cent of the full amount.

Energy-intensive corporations

Under the applicable regime prior to the Reform Act, energy-intensive corporations were exempt from the Reallocation Charge. Under the Reform Act, exemptions will be limited to corporations and specified sectors characterised by high energy costs, intensity of trade and subject to international competition that depend on the exemption to remain competitive. Eligible sectors are categorised into two lists ("List 1" and "List 2", respectively) which are annexed to the Reform Act.

In order to apply for an exemption a corporation from an eligible sector will need to provide evidence of the following:

- a certain minimum of energy consumption in the preceding financial year; and

- that its energy costs make up at least 16 per cent (17 per cent from 2015) of their gross value (for List 1 sectors) or at least 20 per cent of gross value (for List 2 sectors).

Companies benefitting from an exemption are likely to have to pay at least a certain amount of the Reallocation Charge, ie they will have to pay the full Reallocation Charge for the first GWh consumed, and thereafter, for every kWh 15 per cent of the full Reallocation Charge. The amount payable is subject to a cap (or super-cap) of 4 per cent of gross value of the corporation (the "cap") and 0.5 per cent of the gross value of the corporation (the "super cap"). The super cap applies to companies with energy costs of more than 20 per cent of their gross value. Regardless of any applicable cap, the minimum amount payable will be 0.1 cent/kWh or 0.05 cent/kWh for corporations operating in the nonferrous metals sector.

5. Improving the market integration of renewable energy

Compulsory 'direct marketing'

Direct marketing refers to the selling of renewably generated electricity directly to another market participant at market prices rather than to the TSO under the applicable feed-in-tariff.

Under the regime prior to the introduction of the Reform Act, direct selling was used by some large plant operators in peak times to achieve an electricity price above the feed-in-tariff. The Reform Act introduces an element of compulsory direct marketing:

- for plants with an installed capacity in excess of 500 kW from 1 August 2014; and

- for smaller plants with an installed capacity of more than 100 kW from 1 January 2016.

Plants with a lower installed capacity remain entitled to a feed-in tariff as well as plants with an installed capacity of up to 250 kW commissioned between 31 December 2015 and 1 January 2017.

For operators subject to the direct marketing regime, the feed-in-tariffs will effectively only be available as an emergency back-up in that such operators will only receive a reduced tariff in case of a switch back to the FIT.

Introduction of tendering

Under the regime prior to the Reform Act, TSOs were subject to a compulsory purchase obligation and as such had to take off, transmit and distribute any renewably generated electricity and pay the producer on the basis of statutory feed-in-tariffs.

The Reform Act introduces, for the first time, the concept of tenders for solar plants on open land by way of a pilot project. If this is successful, the government plans to introduce tendering for all renewable energy sources. The Reform Act does not specify the details of the intended tendering regime – this will be addressed in subsequent secondary legislation.

6. Impact on current and future renewable energy projects

What happens to existing plant?

Offshore wind

The pre-Reform Act tariffs will continue to apply to:

- plants commissioned before 1 August 2014; and

- plants with a commissioning date between 1 August 2014 and 31 December 2014 if the developer obtained the licence under the Federal Emission Control Act (Bundesimmissionsschutzgesetz) on or before 22 January 2014.

For all other projects, the support regime of the Reform Act will apply.

Existing biogas plants

In general, the financial support provisions at the time of commissioning are applicable. However, support for subsequent capacity additions is capped at the output achieved in 2013 or 95 per cent of the installed capacity on 31 July 2014, whichever is the higher.

Operators of existing plants are entitled to €130 per kW flexibly provided additional installed capacity per year subject to the additional electricity being made available to the market through direct marketing.

Hydropower plants launched after 1 January 2009

If an existing hydropower plant with an installed capacity of more than 5MW is extended after 1 August 2014, the operator is entitled to financial support under the new rules for 20 years from the date of extension (not including the year of extension).

Where plants with an installed capacity of below 5MW are extended after 1 August 2014 the entitlements remain the same as under the previous rules.

State Aid

The Reform Act, which enters into force on 1 August 2014, will have a yearly budget of ca.€20 billion. The EU Commission has confirmed that the measures set out in the Reform Act are compatible with the EU state aid regime, as the Reform Act supports EU environmental and energy objectives without unduly distorting competition in the European single market.

7. Outlook

It is likely that the Reform Act will spark a '"race towards" commissioning in the offshore wind sector by the end of 2014 in order to benefit from the support regime applicable prior to the Reform Act.

The efforts of the Reform Act to introduce more market based instruments such as compulsory direct marketing and tendering procedures for new facilities which are compatible with European State Aid guidelines reflect a larger trend across the EU.

Weaning companies off from what is perceived as high levels of support with little risk has long been an ambition of many European governments as well as the European Commission as many governments have struggled to maintain the expensive support regimes put in place to achieve a higher share of renewably generated energy.

The fact that the Reform Act has, in contrast to reforms in other EU member states, not cut any tariff retro-actively and, in case of offshore wind, extended the popular acceleration tariff ought to instil confidence in investors.

However, it would seem that the proposed tendering mechanism is the source of some uncertainty which will not be eliminated until the secondary legislation for the tendering procedure is in place and has been tested in practice. Commentators have also criticised the somewhat complicated benchmarking of tariffs on a quarterly basis against technology specific target corridors as these will make it more difficult to reliably predict tariff based income – which may add some difficulty for the financing of some facilities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.