The recent Swiss financial markets legislation, the Swiss Federal Financial Services Act (FinSA) and Swiss Federal Financial Institutional Act (FinIA), came into force on 1st January 2020, with a transition period of up to 2 years for certain key provisions.

Deadlines for the registration of individuals conducting the offer/marketing in Switzerland and the registration of financial service providers with an Ombudsman have recently become effective, following the authorisation of the relevant bodies by FINMA.

- Affiliation with Ombudsman in Switzerland – Effective 23rd December 2020

Foreign fund managers and distributors of foreign funds are required to be affiliated with a Swiss Ombudsman within six months of the authorisation of such an Ombudsman by FINMA.

A number of Ombudsman offices have now been approved by FINMA, with the result that all Swiss and foreign entities providing services in or into Switzerland must register with an Ombudsman office by 23rd December 2020.

- Register of Persons Carrying Out Marketing Activity/Client Advisers in Switzerland – Effective 19th January 2021

Prior to marketing funds to non-qualified/private investors, and following the authorisation of a fund by FINMA, the individual persons offering, promoting or marketing a fund or financial instrument in Switzerland will be required to register with an authorised client advisor registration office. In certain cases, such client advisers offering funds to qualified/professional investors will also be required to register. The registration office will among other things, verify the expertise and experience of the client advisors.

If the offer is strictly limited to professional and institutional investors and the fund manager/distributor is subject to prudential supervision in its home country, its client advisers will be exempt from the registration obligation.

The first entity authorised to maintain such a register was authorised by FINMA with an effective date of 20th July 2020. With the approval of BX Swiss AG as the sole authorised client advisor registration office to date, the six-month transition period provided for in the legislation is triggered, and accordingly, the application for entry in the register of advisors must be submitted by 19th January 2021 at the latest.

A list of authorised client adviser registers is expected to be available on the FINMA website.

A violation of these registration requirements carries severe

penal consequences.

Further provisions

In addition, as highlighted in a previous Dillon Eustace update, the legislation will also require compliance with the following additional requirements by 31st December 2021.

- Reclassification of Investors

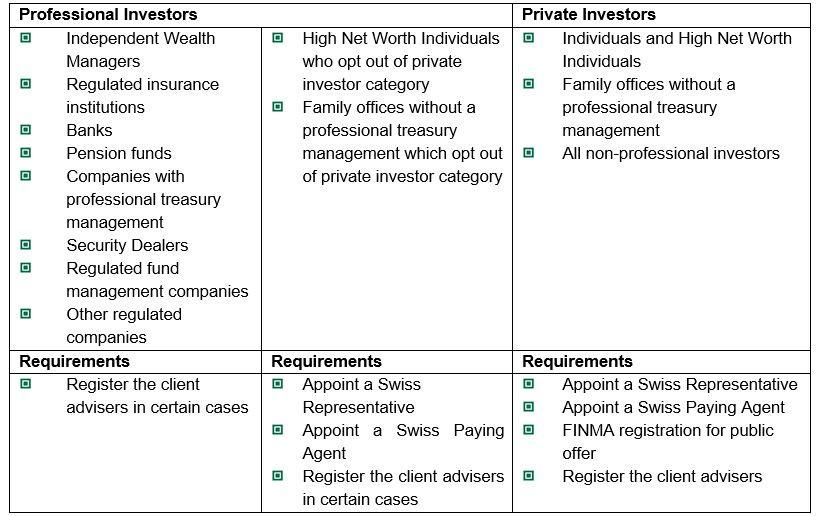

In order to more closely align Swiss investor classification with MiFID II, the existing investor categories "Regulated Qualified/Unregulated Qualified/Non-Qualified Investor" will be replaced as follows:

- Opting-In to a Classification of Professional/Private

Existing clients meeting the criteria to opt-in as professional investors must be advised of their opportunity to do so and of the associated risk of such an election.

Conversely, certain professional investors (such as pension funds) may elect to be treated as private clients (requiring FINMA registration, local agents, etc).

It is recommended that investors should be contacted at an early stage and well in advance of the December 2021 effective date to determine their classification. Any decisions to opt in or out of a professional/private classification should be made in writing.

- Basic Information Sheet

Any fund offered to a private client, and certain non-UCITS offered to certain qualified investors, will be required to prepare a basic information sheet including Swiss disclosures. The KIID or PRIIP KID supplemented with Swiss disclosures will suffice until this date.

- Distribution Agreements

The Swiss Representative will no longer be required to be a party to distribution agreements.

Action to be taken

You should consult with Swiss counsel or your local Swiss Representative to ensure compliance with these requirements and to facilitate the relevant registrations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.