A. INTRODUCTION

Initial Coin Offering, known as "ICO", is a relatively new phenomenon in the crowdfunding industry being the main subject of discussion in the Blockchain and financial communities.

During the last year, ICOs have exploded and became an increasingly popular method of fundraising for start - ups and other companies with the intention to fund innovative projects based on the Blockchain technology.

Although, specific regulatory framework does not yet exist for ICOs, this does not mean that the market for ICOs is not regulated through other various laws in place.

Regulators are applying existing securities and financial market legislation to ICOs and issue guidelines as to the risks involved and the applicability of such laws on ICOs.

The Cyprus Jurisdiction

Companies Limited by Shares

The Cyprus Securities and Exchange Commission, (CySec) for the time being, follows the guidelines and warnings of the European Securities and Markets Authority (ESMA) and issues circulars to the public as to the dealings in virtual currencies.

There is no regulatory framework as to ICOs and thus no express prohibition of following such a step. The Cyprus regulator, CySec, remains silent on the matter without taking an official position so far.

In view of the absence of any sort of specific rules on the ICO regime, the road is open for such a step using a Cyprus Company exploiting all the Cyprus benefits of the surrounding financial and tax environment.

Funds

The current legislation does not impose any restrictions on the investment policy of Alternative Investment Funds (AIFs) with Limited Number of Investors, (AIFLNP).

In view of this legislative gap, the regulator, CySec, accepts applications for the establishment of AIFLNPs which will also be trading in cryptocurrencies or investing in ICOs. Various conditions must be met though.

In view of the above, it seems that a Fund dealing in cryptocurrencies could also be established in Cyprus through the Regulator process in addition to the ICOs through a limited liability company outside the control of the Regulator.

B. INITIAL COIN OFFERING - ICO

An ICO is the way by which companies, usually start-ups, raise funds from the public within a limited period of time by issuing digital Coins or Tokens (hereinafter referred to as Tokens) that are related to a specific innovative project. The Tokens are issued by means of Blockchain Technology and may be tradable on specific platforms.

The issuer company initiating the ICO, transfers to the investors Tokens being the subject of the issue, usually in exchange of cryptocurrencies, such as Bitcoin or Ether or Fiat currencies, such as US dollar or Euro.

The issuer can use the proceeds of the ICO to finance its business operations and future growth related to the project for which the ICO was set up. In the event that Tokens are exchanged for other cryptocurrencies, the issuing company can exchange them for fiat currencies like, US dollar or Euro, as required.

Tokens

The Tokens, subject to the particular issue, are in effect "contracts" granting certain rights to the investors. Subject to the issue, Tokens may represent rights to a specific or recurring service to be developed or a right to participate to a share in a project or a portion of the expected returns in the project.

In simple words, the Tokens issued, are usually connected with the project that will be developed by the issuer and for which financing is requested.

Although this is not exclusive, Tokens may have the form of Payment Tokens, which are similar to cryptocurrencies and do not have any connection with any project. They are accepted as means of payment.

Tokens may also have the form of Utility Tokens which give access to an application or service.

They may also have the form of an Asset Token representing an asset of the issuing company or of the project or right to dividends or to interest payments. These are analogous to equities, bonds or derivatives.

Payment Tokens will hardly be identified as securities but Utility Tokens and Asset Tokens under certain circumstances might be qualified as securities and the laws on Investment Services and Public Offer might be applicable with drastic negative effect on the ICO process.

Distinction from IPO

Contrary to a traditional Initial Public Offering ("IPO"), Tokens typically do not represent an ownership interest or dividend right in an entity. ICO investors seek to directly benefit from the issuing company's future business and particular project, while investors in IPOs tend to pursue a long-term interest in the value-creation of the IPO entity as a whole.

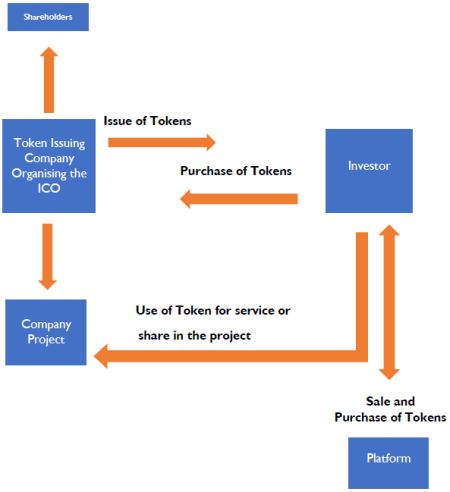

The ICO Structure in a diagram

The roadmap to an ICO

1. The project

The issuer must come up with an innovative idea, preferably not already in the market, that will work and will inspire the public as to its success and usefulness for possible investment.

2. The team

A good team of various known professionals is a prerequisite for a successful ICO. The team must be carefully created to cover all aspects of the issue, including, IT experts, software specialists, marketing specialists, designers, lawyers, tax consultants, ICO consultants and public relations officers. The team to be created must convince the investors that they are trustworthy and knowledgeable of the subject.

3. The company or companies

The company that will undertake the issue of the Tokens must be established in a particular jurisdiction.

The company must be well structured in a solid jurisdiction with fit and proper persons to reflect the trustworthiness and competency image. They must pass the message that these particular people can do what they offer. Their expertise and qualifications must be such to justify without ambiguity that they can accomplish what they offer.

The Investors will search in detail as to the financial and other characteristics of the jurisdiction and as to who and for what is used in the structure.

An escrow company for more transparency and reliability might be registered which company may accept the funds and will release them to the issuer only upon certain conditions related to the project.

In addition, a separate company for the business/project in place, from the Token issuing company may be used.

4. The Whitepaper

This is the most important document in the ICO journey. It is similar to the prospectus in an IPO. The Whitepaper describes in detail the project, the terms of the issue / purchase of the Tokens, the risks involved and the rights given to the investors.

The ICO documentation may also include a Token purchase agreement stipulating the terms and conditions pursuant to which investors can purchase the Tokens.

5. Effective promotion – marketing

The ICO journey to the outside world starts with the promotion / marketing of the project. An effective marketing and promotion must be achieved as this will build confidence and trust in the offering.

6. Tokens to be issued

Regulators in assessing ICOs will focus on the economic function and purpose of the Tokens issued by the ICO organiser. Each Token offering is different, attaching different rights. Depending on its rights granted, its nature, the purpose of issue and whether they are tradable or not, will classify them as Financial Instruments within the provisions of local legislation or not.

If the rights granted to the Tokens are such that they will be classified as Financial Instruments then such classification immediately complicates the ICO process as the laws on the Investment Services and Public Offer come into play and different procedures should be followed.

In this respect, careful planning should be made as to the issue of the Tokens and the rights conferred to them. Special advice should always be obtained from qualified practitioners on the matter.

7. Launching the ICO

This is the last step of the process. Once this face arrives the issuer will need to pay full attention to the requests received and monitor the ICO campaign.

ICO Roadmap process

C. LEGAL IMPLICATIONS OF AN ICO

The fact that there is no specific legislation as to ICOs, does not render the process as not regulated. "Unregulated" does not mean "Not-Regulated".

The issuing of Tokens, depending on the features of each Token, involve significant risks for the issuer due to the possible violation of various legal framework in place.

For the investor the risks might relate to the complete loss of its investment.

Indicatively, and not conclusively, the following legal complications and considerations might be present in any ICO which must be carefully addressed by the ICO organizers:

- Are the Tokens issued considered Securities or Financial Instruments?

- If, are classified as Securities or Financial Instruments what are the consequences?

- Is the Prospectus Directive applicable?

- Is the MiFIDII or the Alternative Investments Funds Managers Directive (AIFMD) applicable?

- Does the issuance of Tokens amount to a deposit taking business, for which other licensing requirements might be in place?

- Could the issuance of Tokens be considered an investment advice or takes the form of acceptance and reception of orders which is a regulated activity under MiFIDII?

- What information should be disclosed in the ICO documentations so that to avoid possible claims for damages on civil law regime based on misrepresentation or fraud or otherwise?

- May an ICO qualify as an Alternative Investment Fund (AIF)?

- Are Tokens issued classified as currencies? If yes, what are the consequences?

- Does the amended Payment Services Directive (PSD2) apply?

- What are the Anti Money Laundering (AML) requirements?

- What are the Tax implications for the parties involved for such a step?

- In which jurisdiction the ICO will be launched and under what type of company?

Why does it matter if an ICO infringes any one of the laws in place in the jurisdiction of issue?

Under the law on Public Offer in place, any offer and sale of securities, to the public, under certain conditions must be registered and follow particular procedures unless it falls within the exceptions provided there in.

An ICO that does not meet the requirements of an exemption from registration or if it clearly falls within the provisions of any of the existing Directives and Laws in force regulating public offerings would likely be an illegal offering and the issuer or individual responsible for promoting it could face serious civil or criminal liability.

The purchasers of the securities in such a case, also have the right to claim damages and force the seller to rescind the transaction and repurchase the securities at their original purchase price, plus interest.

If securities are offered, the activities of exchanges and other intermediaries would also be scrutinised.

Documentation requirements even the Tokens are not classified as securities

The ICO documentation must be accurate and not misleading, not fraudulent, comprehensive, transparent and include potential risk factors as well as a description of the characteristics of the Tokens and the business of the issuer.

Full, genuine, correct and detailed information as to the project and its future prospects analysing the possible potential risks must be given.

The ICO transaction documentation must include all necessary information to permit an average investor to make a reasonable investment decision.

The above information requirements may apply to the issuer and any other party involved in the sale and marketing of Tokens.

Any non – compliance with the above obligatory disclosure of accurate information, leaves room for actions for damages and under certain circumstances to criminal prosecution.

D. WHY TO USE CYPRUS COMPANIES FOR AN ICO

Cyprus being an EU jurisdiction with a well-organized and regulated regime gives comfort to prospective investors to rely on ICOs through organizers based in Cyprus.

Further Cyprus having a favorable tax system along with an extensive network of the double tax treaties make Cyprus an ideal jurisdiction from a financial aspect as well for both the issuing company and the investor.

The flexible and well organized infrastructure of Cyprus as well as the low costs for setting an office in Cyprus for creating substance for the ICO project, are additional advantages to be considered favorably for such a choice of jurisdiction.

E. CONCLUSION

ICOs are an innovative and quick method for companies to raise capital.

Cyprus offers a way to such a step compared to other jurisdictions due to the various benefits in place.

Irrespectively of the fact that currently there is no specific ICO regulation in place, Cyprus still remains a strong player in this field.

The absence of specific regulation does not mean that the ICO organisers may not comply with the existing applicable regulatory framework. A detailed analysis of the applicable laws is necessary to identify and ensure legal compliance prior to launching the ICO.

Additional legal issues though might arise and need to be considered if an ICO targets investors globally.

Regardless of the Token structure and its classification, the issuing company needs to provide investors with full, genuine, correct and detailed information and disclose such information comprehensively and transparently to permit an average investor to make a reasonable investment decision.

Non-compliance with any of the above may impose a range of severe legal consequences for an ICO issuer.

It is highly advisable to all ICO intended issuers to seek legal advice and guidance at all stages of an ICO.

With the proper guidance and professional advice an ICO may become a solid valuable method of financing companies and give a boost to innovative technology and infrastructure.

F. HOW KINANIS LLC CAN ASSIST

Our consultants, lawyers and accountants may assist potential ICO organizers on the following, subject to the project evaluation, based on Cyprus Law:

- Legal support for ICO procedure;

- Preparation of legal opinion on the Tokens issue;

- Assisting in development of ICO documentation, legal structuring;

- Formation of companies;

- Legal analysis of the Cyprus regulatory framework;

- KYC, AML and Compliance;

- Overview of the Whitepaper to ensure compliance with applicable Cyprus laws;

- Advise on Data Protection law issues;

- Tax advisory;

- Accounting issues;

- Support on banking issues and opening of bank accounts;

- Legal drafting and preparation of documents;

- Drafting of shareholders' agreement between the beneficiaries (if necessary);

- Drafting and establishing Trusts for beneficiaries;

- Ongoing legal advising on the matter and related issues.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.