Tax treaties generally provide that the business profits of a foreign enterprise are taxable in a State only to the extent that the enterprise has in that State a permanent establishment (PE) to which the profits are attributable. The definition of PE included in tax treaties is therefore crucial in determining whether a non-resident enterprise must pay income tax in another State.

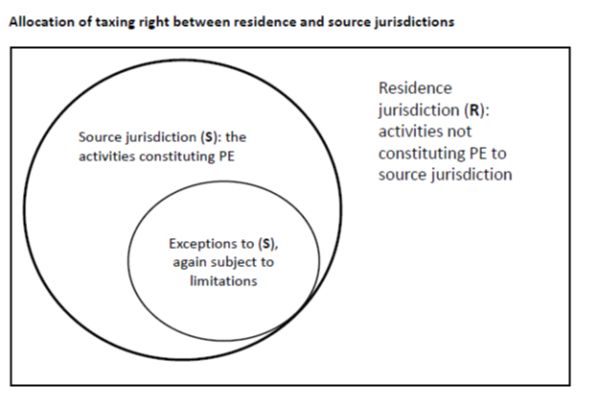

The PE concept is central to the allocation of taxing rights between the contracting states in tax treaties. A modification to the PE definition has direct impact on the scope of the exception to the source state. If a new rule narrows the scope of PE exceptions, then the tax base and thus the taxing right of the source country will be expanded, and vice versa.

The Action 7 of the BEPS 2015 Final Report (Permanent Establishment Status) includes the changes that will be made to the definition of PE in Article 5 of the OECD Model Tax Convention, which is widely used as the basis for negotiating tax treaties, as a result of the work on the OECD/G20 BEPS project.

Modification to the Model Tax Convention

Those changes to the Model Tax Convention mentioned in the preceding paragraph are:

- Artificial Avoidance of Permanent Establishment Status through Commissionnaire Arrangements and Similar Strategies [Article 12, the MLI];

- Artificial Avoidance of Permanent Establishment Status through the Specific Activity Exemptions [Article 13, the MLI];

- Splitting-up contracts between closely related enterprises [Article 14, the MLI];

- Defining a person closed related to an enterprise [Article 15, the MLI].

Corresponding PE status articles in the multilateral Instrument (MLI) under BEPS action 15

To implement EBPS Action 7, a party to the MLI may choose to apply Articles 12 to 15 of the MLI to the covered tax agreements that have been concluded before the entry into force date of the MLI.

|

Article 12 |

Article 13 |

Article 14 |

Article 15 |

|

Artificial Avoidance of Permanent Establishment Status through Commissionnaire Arrangements and Similar Strategies |

Artificial Avoidance of Permanent Establishment Status through the Specific Activity Exemptions |

Splitting-up of Contracts |

Definition of a Person Closely Related to an Enterprise |

Articles 12 to 15 of the MLI address the issue relating to the avoidance of the PE status that is provided under tax agreements. The PE status imposes limitation on the residence jurisdiction with respect to the right to taxes. However, a non-resident entity who has the access to advance information and communication technology may avoid the PE status in the source country. In order to protect the tax base of the source country, the scope of the PE Status exceptions is restricted or limited by the following: commissionaire arrangement (Article 12), specific activities (Article 13), and the disregard of split-up contracts (Article 14).

Article 12 – Artificial Avoidance of Permanent Establishment Status through Commissionnaire Arrangements and Similar Strategies

Article 12(1) and Article 12(2) of the MLI replicate the contexts of Article 5(5) and Article 5(6) of the 2017 update of the Model Tax Convention.

In many cases, commissionaire arrangements and similar strategies were put in place primarily in order to erode the taxable base of the contracting state where sales took place. Changes to the wording of Article 5(5) and 5(6) are therefore needed in order to address such strategies.

The 2017 update on Model Tax Convention has incorporated the recommendation of the 2015 Final Report under Action 7 of the BEPS package, which expands the scope of the activities of the a person acting in a contracting state for an enterprise to cover the activity that plays a principal role leading to the conclusion of contracts and the supply of services and intangible properties. Such commissionaire arrangements trigger a taxable presence in the state with respect to the activities which that person performs for the enterprise. Consequently that enterprise shall be deemed to have a PE in that state in respect of the activities which that person undertakes on its behalf, unless those activities fall under the scope of specific activity exception mentioned in paragraph 4 of Article 5 which, if done through a fixed place of business, would not make this fixed place of business a PE under the provision of that paragraph.

A comparison between the 2014 Model Tax Convention and the 2017 update of the Model Tax Convention is given below:

|

2014 OECD Model Tax Convention – Article 5(5) |

2017 update on OECD Model Tax Convention – Article 5(5) |

|

5. Notwithstanding the provisions of paragraphs 1 and 2, where a person - other than an agent of an independent status to whom paragraph 6 applies - is acting on behalf of an enterprise and has, and habitually exercises, in a Contracting State an authority to conclude contracts in the name of the enterprise, that enterprise shall be deemed to have a permanent establishment in that State in respect of any activities which that person undertakes for the enterprise, unless the activities of such person are limited to those mentioned in paragraph 4 which, if exercised through a fixed place of business, would not make this fixed place of business a permanent establishment under the provisions of that paragraph. |

5. Notwithstanding the provisions of paragraphs 1 and 2 but subject to the provisions of paragraph 6, where a person is acting in a Contracting State on behalf of an enterprise and, in doing so, habitually concludes contracts, or habitually plays the principal role leading to the conclusion of contracts that are routinely concluded without material modification by the enterprise, and these contracts are a) in the name of the enterprise, or b) for the transfer of the ownership of, or for the granting of the right to use, property owned by that enterprise or that the enterprise has the right to use, or c) for the provision of services by that enterprise, that enterprise shall be deemed to have a permanent establishment in that State in respect of any activities which that person undertakes for the enterprise, unless the activities of such person are limited to those mentioned in paragraph 4 which, if exercised through a fixed place of business (other than a fixed place of business to which paragraph 4.1 would apply), would not make this fixed place of business a permanent establishment under the provisions of that paragraph. |

Similarly, the 2017 update of the Model Tax Convention redefines that the activities performed by an independent agent do not include those performed by a closely connected person.

|

2014 OECD Model Tax Convention – Article 5(6) |

2017 update on OECD Model Tax Convention – Article 5(6) |

|

6. An enterprise shall not be deemed to have a permanent establishment in a Contracting State merely because it carries on business in that State through a broker, general commission agent or any other agent of an independent status, provided that such persons are acting in the ordinary course of their business. |

6. Paragraph 5 shall not apply where the person acting in a Contracting State on behalf of an enterprise of the other Contracting State carries on business in the first-mentioned State as an independent agent and acts for the enterprise in the ordinary course of that business. Where, however, a person acts exclusively or almost exclusively on behalf of one or more enterprises to which it is closely related, that person shall not be considered to be an independent agent within the meaning of this paragraph with respect to any such enterprise. |

Article 13 - Artificial Avoidance of Permanent Establishment Status through the Specific Activity Exemptions

Article 13(1) of the MLI provides three options that a contracting jurisdiction may choose to apply Option A under Article 13(2), or Option B under Article 13(3), or neither Option. Article 13(4) of the MLI replicates Article 5(4) and Article 5(4.1) of the Model Tax Convention, which specifically closes gaps that existed with respect to the avoidance of PE status.

Specific Activity Exceptions

The 2015 Final Report under Action 7 included changes to prevent the exploitation of the specific exceptions to the PE definition provided for by Article 5(4) of the OECD Model Tax Convention (2014), an issue which is particularly relevant in the case of digitalised businesses. These changes were incorporated into Article 5(4) as part of the 2017 Update of the OECD Model Tax Convention, which is set out below:

|

2014 OECD Model Tax Convention – Article 5(4) |

2017 update on OECD Model Tax Convention – Article 5(4) |

|

4. Notwithstanding the preceding provisions of this Article, the term "permanent establishment" shall be deemed not to include: (a) the use of facilities solely for the purpose of storage, display or delivery of goods or merchandise belonging to the enterprise; (b) the maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of storage, display or delivery; (c) the maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of processing by another enterprise; (d) the maintenance of a fixed place of business solely for the purpose of purchasing goods or merchandise, or of collecting information, for the enterprise; (e) the maintenance of a fixed place of business solely for the purpose of carrying on, for the enterprise, any other activity of a preparatory or auxiliary character; (f) the maintenance of a fixed place of business solely for any combination of activities mentioned in sub-paragraphs (a) to (e), provided that the overall activity of the fixed place of business resulting from this combination is of a preparatory or auxiliary character. |

4. Notwithstanding the preceding provisions of this Article, the term "permanent establishment" shall be deemed not to include: a) the use of facilities solely for the purpose of storage, display or delivery of goods or merchandise belonging to the enterprise; b) the maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of storage, display or delivery; c) the maintenance of a stock of goods or merchandise belonging to the enterprise solely for the purpose of processing by another enterprise; d) the maintenance of a fixed place of business solely for the purpose of purchasing goods or merchandise or of collecting information, for the enterprise; e) the maintenance of a fixed place of business solely for the purpose of carrying on, for the enterprise, any other activity; f) the maintenance of a fixed place of business solely for any combination of activities mentioned in subparagraphs a) to e), provided that such activity or, in the case of subparagraph f), the overall activity of the fixed place of business, is of a preparatory or auxiliary character. |

|

4.1 Paragraph 4 shall not apply to a fixed place of business that is used or maintained by an enterprise if the same enterprise or a closely related enterprise carries on business activities at the same place or at another place in the same Contracting State and a) that place or other place constitutes a permanent establishment for the enterprise or the closely related enterprise under the provisions of this Article, or b) the overall activity resulting from the combination of the activities carried on by the two enterprises at the same place, or by the same enterprise or closely related enterprises at the two places, is not of a preparatory or auxiliary character, provided that the business activities carried on by the two enterprises at the same place, or by the same enterprise or closely related enterprises at the two places, constitute complementary functions that are part of a cohesive business operation. |

The provisions of Paragraph 4 of Article 5 was redrafted by removing the phrase "of a preparatory or auxiliary character" from sub-paragraph (e). This is to ensure that all the sub-paragraphs of Article 5(4) are subject to a "preparatory or auxiliary character" condition.

Paragraph 4.1 of Article 5 of the 2017 version of the Model Tax Convention has incorporated a new anti-fragmentation rule, which, as provided under page 39 of the Final Report, is aimed to restrict the scope of Article 5(4) to activities having a "preparatory and auxiliary" character because, in the absence of that rule, it would be relatively easy to use closely connected enterprises in order to segregate activities which, when taken together, go beyond that threshold.

Paragraph 4.1 of Article 5 applies to two types of cases. First, it applies where the non-resident has a PE in the source country, whether the non-resident directly sets up the PE or it uses closely related entities to set up the PE in the source country. The tax authority in the source country needs to determine whether the activities of the non-resident enterprises give rise to one or more PE's in the country under Article 5(4.1). The profits attributed to the PEs and subject to source taxation are the profits derived from the combined activities constituting complementary functions that are part of a cohesive business operation, considering the profits each of them would have derived under the arm's length principle.

The second type of case to which Article 5(4.1) applies is one where there is no pre-existing PE but the combined activities in the source country by the non-resident and closely related non-resident enterprises result in a cohesive business operation that is not merely preparatory or auxiliary in nature. In such a case, a determination will need to be made as to whether the activities of the enterprises give rise to one or more PEs in the source country under Article 5(4.1). The profits attributable to each PE so arising are those that would have been derived from the profits made by each activity of the cohesive business operation as carried on by the PE under the arm's length principle.

(to be continued in Part 2)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.