As mentioned in Study on Foreign-Invested Medical Institutions (I) (Click to Read), although China had at one time implemented a pilot program for establishing wholly foreign-owned hospitals, current policies prohibit full ownership. Currently, foreign ownership of medical institutions is limited to 70% as stipulated by the Interim Measures for the Administration of Sino-foreign Equity Joint and Cooperative Joint Medical Institutions (order of Ministry of Health and Ministry of Foreign Trade and Economic Cooperation, [2000] No. 11, hereinafter referred to as the "Interim Measures"), without reference to qualified Taiwan, Hong Kong and Macao investors.

We have noted, however, certain instances in which this foreign equity limitation was exceeded. How exactly did these foreign investors successfully break the 70% limitation? Is it due to previously applicable laws and policies, sophisticated ownership structures or some other coincidence? What lessons can potential foreign investors learn from these cases? In this article, we will attempt to answer these questions by analyzing three cases involving Phoenix Medical, Harmonicare, and Artemed in Shanghai pilot free trade zone.

Phoenix Medical

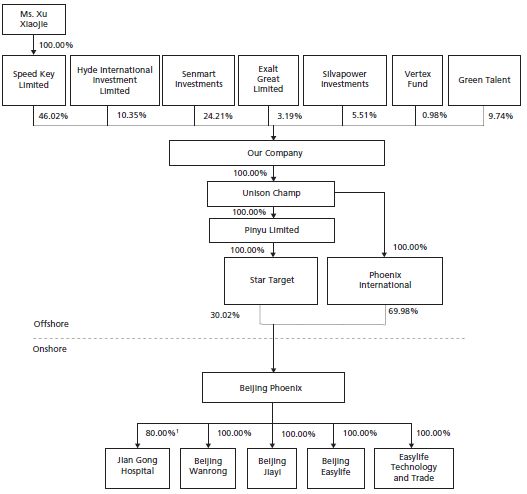

On November 29, 2013, Phoenix Medical (01515.HK) completed an IPO and was listed on the Hong Kong Stock Exchange Main Board as the first hospital concept stock. Phoenix Medical Group Co., Ltd. ("Phoenix Medical"), as the foreign listed company, was founded on February 28, 2013, and was the largest private hospital group in China. At the time of the IPO, all Phoenix Medical member medical institutions were located in Beijing, including some large general hospitals and community health care institutions. The ownership structure of Phoenix Medical immediately after the pre-IPO restructuring and before the IPO is shown below:

As shown in the chart above, prior to listing, Beijing Phoenix United Hospital Management Consulting Co., Ltd. ("Beijing Phoenix") was a wholly foreign-owned enterprise and directly held 80% of the equity of Beijing Jiangong Hospital ("Jiangong Hospital"). The remaining 20% of the equity was held by an independent third party, Beijing Construction Engineering Group Co., Ltd. The issue with this ownership structure is whether it violates the 70% foreign investment limit.

| Review of Regulations from Article (I): Policies |

|

The answer to this issue involves a restructuring of Jiangong Hospital which took place between April and August 2013, prior to which Beijing Phoenix was a wholly domestic-owned enterprise.

The main steps of the restructuring are as below:

Beijing Phoenix, after seeking the advice of its PRC counsel, chose to transfer its 10% equity interest in Jiangong Hospital to Beijing Wantong on April 19, 2013. However, it was expressly stipulated in the equity transfer agreement that Beijing Phoenix would retain voting rights, the right to appoint directors and the right to receive dividends in relation to the 10% transferred interest, and that Beijing

| 2013.04.19 | 2013.05.22 | 2013.06.17 | 2013.08.27 |

|

|

|

|

Phoenix would have the right to request Beijing Wantong to sell the transferred equity back to Beijing Phoenix at the original purchase price. After completion of the transfer, Beijing Phoenix officially held a 70% interest in Jiangong Hospital. We understand Beijing Phoenix took this seemingly redundant step because of concern that the Beijing Municipal Committee of Commerce ("BMCC") could decide that the Interim Measures also applied to medical institutions jointly established by a joint venture enterprise and wholly domestic-owned enterprise.

As stated in the prospectus, in spite of the above arrangements, in relation to the 30.02% Beijing Phoenix equity transfer, BMCC still believed it needed to consult with the Beijing Municipal Health Bureau ("BMHB") to confirm the interpretation of the Interim Measures. According to a reply from BMHB on May 13, 2013, BMHB believed that completion of the equity transfer would cause Beijing Phoenix to change from a wholly domestic-owned enterprise to a joint venture enterprise. This would in turn cause Jiangong Hospital's status to change from a wholly domestic enterprise to a "foreign-invested enterprise re-invested enterprise," rather than a foreign invested enterprise, which would not be subject to BMHB approval. BMCC approved the equity transfer based upon the BMHB reply.

Subsequently, the transfer of the remaining 69.98% equity interest in Beijing Phoenix was also approved based upon the same reasoning. After the second equity transfer, Beijing Phoenix became a wholly foreign-owned enterprise and subsequently repurchased the 10% equity interest in Jiangong Hospital from Beijing Wantong. Upon completion of the equity repurchase, Beijing Phoenix owned 80% equity in Jiangong Hospital. So, does this case mean that foreign investors may exceed the 70% equity limit without any concerns? If yes, this would undoubtedly be good news for foreign investors who intend to establish wholly foreign-owned hospitals in China.

However, we recommend investors hold a modestly positive attitude towards this result, mainly for the following reasons:

- The Interim Provisions on the Investment of Foreign-invested Companies in China(Order of Ministry of Foreign Trade and Economic Cooperation, the State Administration for Commerce and Industry [2000] No. 6)expressly stipulates that the Catalogue for the Guidance of Foreign Investment Industries shall apply by reference to domestic investments made by foreign-invested enterprises. In other words, in principle, domestic re-investments made by foreign-invested enterprises must also comply with foreign investment admission policies.

- As shown in the prospectus for Phoenix Medical, the BMHB reply is critical for BMCC to approve the restructuring. Without a definite reply from the local health department, the commerce department may not use the same interpretation.

- At the time of the Phoenix Medical restructuring, although the Circular on Carrying out the Pilot Program of the Establishment of Wholly Foreign-Owned Hospitals had not yet been promulgated, the Circular of the General Office of the State Council on Forwarding the Opinions of the National Development and Reform Commission and the Ministry of Health and Other Departments on Further Encouraging and Guiding Non-government Funding for Medical Institutions (Guo Ban Fa [2010] No. 58) and the Catalogue for the Guidance of Foreign Investment Industries (revised in 2011) indicated that the tone of macroeconomic policy at that time was to encourage foreign investors to set up wholly foreign-owned medical institutions in China. In this regard, BMHB was likely to interpret the Interim Measures more liberally. However, since April 2015, the policy has again become re-tightened, and no longer permits the establishment of wholly foreign-owned medical institutions. Based on this development, it is difficult to say whether BMHB will continue with its favorable attitude towards foreign investment.

Harmonicare

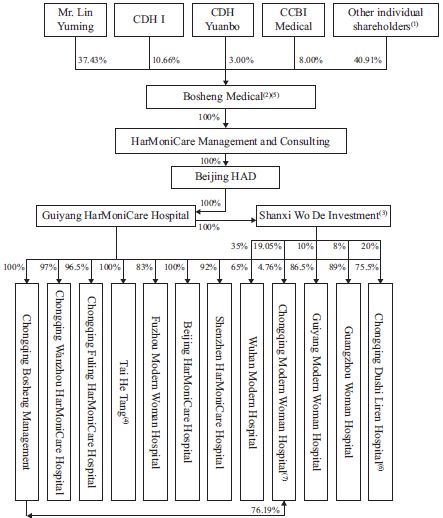

In June 2015, following Phoenix Medical, Harmonicare (01509.HK) was listed on the Hong Kong Stock Exchange as the second domestic hospital concept stock. Harmonicare Holdings Limited ("Harmonicare"), as the foreign listed company, was founded on August 26, 2014 and is the largest maternity hospital group in China. Its member medical institutions are located in Beijing, Guangzhou, Shenzhen, Chongqing, Guiyang, Wuhan, and Fuzhou, etc., most of which specialize in obstetrics and gynecology. The ownership structure of Harmonicare immediately after the pre-IPO restructuring and before the IPO is as below:

As shown in the chart above, prior to listing, Harmonicare Management Consulting Co., Ltd. ("Harmonicare Consulting") was a wholly foreign-owned enterprise and held a 100% equity interest in Beijing Heanda Management Consulting Co., Ltd. ("Beijing Heanda"). Beijing Heanda held a 100% equity interest in Guiyang Harmonicare Maternity Hospital ("Guiyang Harmonicare"), which actually held more than an 80% equity interest in a majority of the domestic hospitals associated with Harmonicare. The issue here is whether this ownership structure violates the 70% equity limitation as stipulated in the Interim Measures?

After the restructuring, the ownership structure of Harmonicare before establishing the overseas red-chip structure is shown below:

The restructuring took place in December 2014 and resulted in a change in the nature of the owners of Guiyang Harmonicare. Before establishing the overseas red-chip structure, Harmonicare Consulting was a wholly domestic-invested enterprise.

| Review of Regulations from Article (I): Policies |

|

The main steps to establish the overseas red chip structure are as follows:

Harmonicare also noted the issue regarding the legality of its indirect holding of more than a 70% equity interest in PRC hospitals. As a result, Harmonicare presented the following comments in its prospectus:

- Harmonicare has held a greater than 70% equity interest in its affiliated PRC hospitals since January 2015. The Catalogue for the Guidance of Foreign Investment Industries (Revised in 2011), which was effective during that period, had no restriction on the foreign ownership of medical institutions. Harmonicare completed the restructuring before the implementation of the Catalogue for the Guidance of Foreign Investment Industries (Revised in 2015).

- Prior to, at the time of and after the restructuring, the direct owners of the affiliated PRC hospitals, as well as the hospitals themselves were not foreign-invested entities. Therefore, the PRC hospitals associated with Harmonicare are not "Sino-foreign joint venture medical institutions" as defined in the Interim Measures.

- The Interim Measures have no limitation on the ownership ratio of foreign enterprises in medical institutions through intermediate PRC affiliates.

In addition, Harmonicare has also committed that it would ensure its compliance with PRC laws and regulations related to foreign investment when establishing or acquiring new hospitals in the future, particularly for plans to introduce minority owners to such new hospitals (including senior management staff and other potential domestic business partners).

Compared with Phoenix Medical, the biggest difference in this case was that the Harmonicare restructuring occurred in December 2014, at the time when the foreign investment policy was at its most open and relaxed stage. However, we understand that there is still room for discussion about this most important comment. In fact, Harmonicare had several affiliated PRC hospitals located in Chongqing, Wuhan and Guiyang, which are not among the seven pilot provinces/municipalities under Circular 244. Strictly speaking, regions other than the seven pilot provinces/municipalities should still have been subject to the Interim Measures. This is one reason why Harmonicare added the two other comments.

Furthermore, both Phoenix Medical and Harmonicare raise the same critical question -what is a "Sino-foreign joint venture medical institution"? According to Article 2 of the Interim Measures, "Sino-foreign joint venture medical institutions and cooperative medical institutions refer to medical institutions established in the form of a joint venture or cooperation by foreign medical institutions, companies, enterprises or other economic organizations (hereinafter referred to as foreign joint venturers or foreign cooperators) with Chinese medical institutions, companies, enterprises or other economic organizations (hereinafter referred to as Chinese joint venturers or cooperators) within the territory of China (excluding Hong Kong, Macao and Taiwan) on the basis of the principle of equality and mutual benefit and on the approval of the Chinese government." Taken literally, since wholly foreign-owned enterprises and Sino-foreign joint venture enterprises are not foreign medical institutions, companies, enterprises or other economic organizations, the medical institutions that such entities jointly establish with Chinese joint venturers or cooperators are certainly not Sino-foreign joint venture medical institutions or cooperative medical institutions. However, we wish to ask whether this interpretation truly reflects legislative intent. We recommend that investors fully consult with the competent health department and commerce department before carrying out similar transactions, in order to reduce the risk of being found to have deliberately evaded mandatory legal provisions. In addition, investors may also refer to the example of Harmonicare and introduce domestic minority owners.

Artemed Hospital in the Shanghai Pilot Free Trade Zone

Different from the previous two cases involving public listings, the Artemed Hospital case is notable because the hospital is known as being the first wholly foreign-owned hospital in mainland China (excluding those wholly owned by Taiwan, Hong Kong or Macao investors).

According to public reports, on July 22, 2014, Artemed Group, Silver Mountain Capital and Shanghai Waigaoqiao Bonded Area Sanlian Development Co., Ltd. and Waigaoqiao Medical Insurance Center signed a strategic cooperation framework agreement with respect to the establishment of Artemed Shanghai Hospital ("Shanghai Artemed Hospital"), which, after completion, is to become the first wholly foreign-owned hospital (excluding Taiwan, Hong Kong and Macao) in the Shanghai pilot free trade zone and across the nation.

According to the information shown on the official Artemed website and inquiry results from the National Enterprise Credit Information Publicity System, the schedule for the Shanghai Atmed Hospital project is as shown in the table below:

| Date | Event | Source |

| 2014.07.22 | Executed the Strategic Cooperation Framework Agreement with respect to establishment of a wholly foreign-owned hospital | Artemed website |

| 2015.11.24 | Obtained the approval to set up medical institution | Artemed website |

| 2015.12.11 | Obtained investment approval for investors from Taiwan, Hong Kong and Macao | Artemed website |

| 2015.12.14 | Obtained a business license with a scope of business for "hospital construction" | National Enterprise Credit Information Publicity System |

| At present | Engineering design stage, plans to break ground by the end of 2016 | Artemed website |

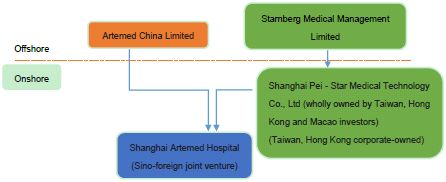

However, as the project progressed, things did not proceed exactly as expected. According to the information shown in the National Enterprise Credit Information Publicity System, Shanghai Artemed Hospital is a limited liability company (Sino-foreign joint venture), whose equity structure is shown as below:

As shown in the above chart, Shanghai Artemed Hospital eventually adopted the form of a Sino-foreign joint venture, with investment from an enterprise wholly-owned by Taiwan, Hong Kong and Macao investors and foreign investors. And the foreign investors referred to in this case may also mean entities incorporated in Taiwan, Hong Kong or Macao (due to limited public information, it is difficult to determine whether they meet relevant conditions to be Taiwan, Hong Kong or Macao service providers). But from this point of view, all of the investors are foreign entities.

The question is why did the company abandon the original wholly foreign-owned structure? Was it because of the re-tightened foreign investment admission policy for medical institutions which was put into force since April 10, 2015? If yes, does Artemed's Sino-foreign joint venture structure, which is wholly-foreign owned when looking through the structure, raise suspicions of evading the 70% foreign equity limitation? If both Artemed China Limited and Starnberg Medical Management satisfy the conditions to be Taiwan, Hong Kong and Macao service providers, can the two entities directly establish a hospital wholly owned by Taiwan, Hong Kong and Macao investors, rather than through the intermediate Shanghai Pei-Star Medical Technology Co., Ltd. (established on August 19, 2015)?

| Review of Regulations in Article (I): Policies |

|

Due to the limited public information available about non-listed companies, we only make above analysis from a legal perspective. In any event, the Artemed Hospital case also touches on the difficult question of "what is a Sino-foreign joint medical institution"? Business practices are constantly changing, we shall see how the legislators and competent authorities respond to this question in the future.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.