On 1 January 2020, the Foreign Investment Law of the People's Republic of China ("FIL") came into force, at the same time, the four-decades old Sino-foreign Equity Joint Venture Law of the People's Republic of China ("EJV Law") and the three-decades-plus old Sino-foreign Co-operative Joint Venture Law of the People' Republic of China ("CJV Law") and their relevant regulations were simultaneously repealed. With respect to the existing c. 125,000 joint ventures already established in accordance with the previous EJV Law or CJV Law and their regulations, the new FIL and its Implementation Regulations provided a 5-year transition period ("Transition Period") for them to make the necessary adjustments and conversion to ensure compliance by the end of 2024.

During the Transition Period, EJV and CJV, as long established types of entity in China, will quickly fade out of people's sight. For those existing EJVs and CJVs which have already adopted limited liability company ("LTD") form, the Company Law of the People's Republic of China ("Company Law") shall universally govern them in the same way as it does domestic Chinese companies; for non-legal person CJV entities, it is necessary to conduct a legal form conversion, i.e. reincorporation as an LTD or restructuring into a limited partnership or general partnership both of which are governed by the Partnership Enterprise Law of the People's Republic of China ("Partnership Law").

In order to help the existing JVs and their investors better understand the impact of the new FIL and its relevant regulations, we hereby set out the main compliance issues to be attended to in the Transition Period, mainly in respect of the corporate governance, foreign exchange and foreign investment reporting obligations etc.

Note: Given that EJVs account for the majority of the existing JVs, we focus on the EJV situation in this article.

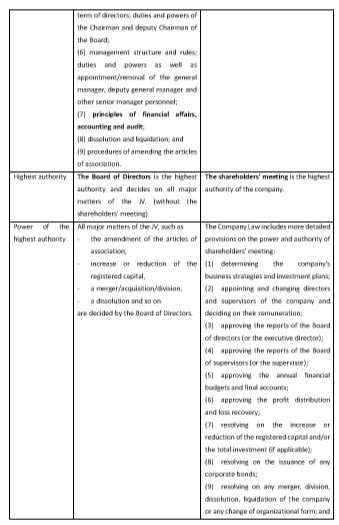

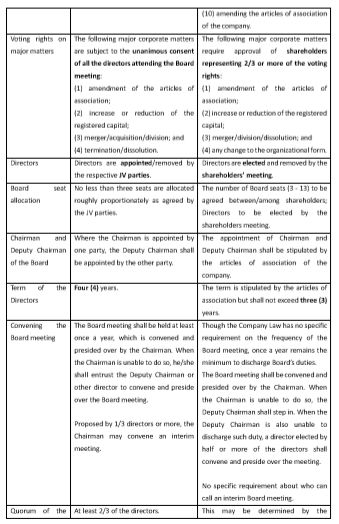

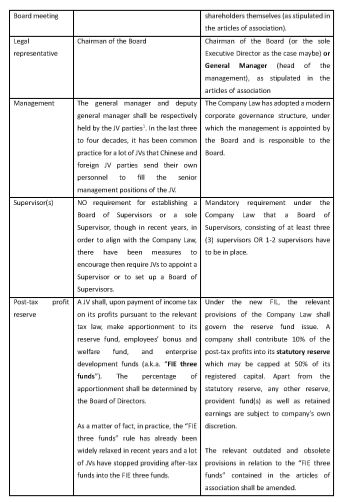

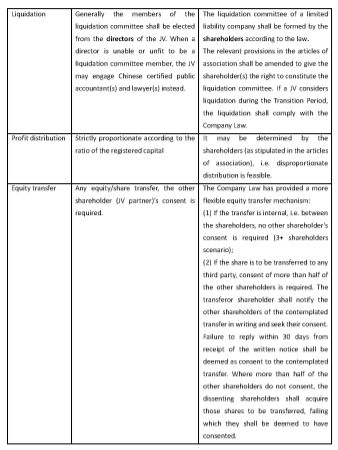

1. Corporate Governance

In order to quickly identify the to-be-complied issues, we have conducted an examination of all the corporate governance aspects under the old EJV Law regime and the new FIL regime. Accordingly we have prepared the below detailed table which sets out the main issues.

2. Joint Venture Contract and Articles of Association

For all existing JVs, the Joint Venture Contract ("JVC") and Articles of Association ("AoA") are the two most important legal documents. The JVC is actually a shareholders' agreement and AoA is a corporate constitution for a JV. On the one hand, it is inevitable that the AoA is amended to achieve the adjustment and updating of the corporate governance of a JV to ensure compliance within the Transition Period; on the other hand, a critical question would be how to ensure the existing JVC remains legally binding and enforceable governing the Chinese and foreign parties' relationship; the key issues concerned mainly include equity transfer procedures, profit distribution and loss sharing, liquidation distribution etc.

The Implementation Regulations for the FIL explicitly provide that after making the necessary adjustments to the organizational form and structure2 of the JV, the existing provisions in respect of equity transfer, profit distribution and liquidation distribution etc agreed by the Chinese and foreign parties in the JVC may continue to be binding and enforceable. That is to say, during the Transition Period, where the JV parties intend to carry out those JVC provisions which might deviate from the Company Law, or a contemplated share transfer desired to be conducted under the procedures set out in the existing JVC, an FIL compliance conversion has to be done first.

3. Foreign Debt Management

Under China's foreign exchange regulatory regime, the foreign debt management system involving the total investment ("????") and the stipulated gap between the registered capital and the total investment ("???") have been in place for many years. A JV is allowed, not obliged, to take out loans and incur foreign debt within such a gap. In 2017, the Notice of the People's Bank of China on Full-coverage Macro-prudent Management of Cross-border Financing specified a new alternative foreign debt management system.

Technically speaking, the total investment and the gap between the registered capital and the total investment are no longer mentioned in either the new FIL or the Company Law. However, the competent authorities have not yet promulgated new regulations formally repealing the old foreign debt management system, i.e. the old and new foreign debt management systems co-exist for the time being. Practically speaking, the total investment provisions in the articles of association may not need any immediate change where a JV prefers at present not to switch to the new system.

There has recently been some kind of transitional regulatory practice. For example, pursuant to a notice issued by SAFE3 Beijing Bureau in March 2020, non-financial enterprises/companies in Beijing may choose to change their current foreign debt regime where the gap between the registered capital and the total investment is essential, to the more flexible Macro-prudent Management of Cross-border Financing System4 which may offer an easier approval/registration process and a higher amount of foreign debt to be raised. It is advisable to pay continuous close attention to the subsequent updates of regulations in this regard.

4. Foreign Investment Report

Since 2016, while the "restricted" foreign investment within the scope of the relevant negative lists continues to be subject to approval of the relevant authorities, "encouraged" and "permitted" foreign investment has been subject to filing requirements.

Effective from 1 January 2020, the Measures on Reporting of Foreign Investment Information ("Reporting Measures") established a new foreign investment information reporting system, under which the JVs shall submit investment information reports (incl. initial report, change report, deregistration report, annual report, etc.) through the online Enterprise Registration System and the Enterprise Credit Information Publicity System.

Pursuant to the Reporting Measures, where there is a registerable change such as the name, address, legal representative, shareholder(s), scope of business, registered capital etc., a JV shall report the same via the Enterprise Registration System at the same time of processing the relevant change(s) registration. Where the change does not involve a registerable item but is subject to the relevant filing requirement, a JV shall report the same via the Enterprise Registration System within twenty (20) working days from the occurrence of the changed matter (e.g. the date of the related resolutions).

The annual report for the preceding year should be submitted before 30 June annually through the National Enterprise Credit Information Publicity System, which may include the JV's basic corporate information, the investors/JV partners and their actual controllers, business conditions, assets and liabilities, etc. Please note that in accordance with the Company Law, a company shall have its annual financial statements audited; however for the time being the reporting obligation might not explicitly require the audited financial statements to be uploaded via the reporting system.

5. Timing Considerations

It is worth noting that

- the FIL is new and Chinese authorities are still in the process of ramping up the necessary implementing rules and measures, practice needs to be time tested;

- although the 5-year Transition Period seems to be plenty of time, a timely compliance conversion has been encouraged by the Chinese authorities;

- 31 December 2024 is a hard deadline; from 1 January 2025 if a JV has not fully complied with the new FIL, the registration window will be closed, thus jeopardizing the foreign investor's investment in that JV and a public notice listing the incompliant companies will be issued.

Undoubtedly with due care penalties for the delay should be avoided.

Footnote

1 From the appointment procedure point of view, the general manager and deputy general manager shall be appointed by the Board according to the EJV Law implementation regulations.

2 The "organizational form" refers to the legal form of an entity, i.e. an LTD or a partnership. As all the EJVs have adopted mandatorily required LTD form since being established, there is no need to adjust "organizational form" any more. It is only necessary for those non-legal person CJVs, i.e. reincorporation as an LTD or restructuring into a limited partnership or general partnership both of which are governed by the Partnership Law. The "organizational structure" ultimately refers to the corporate governance structure. Necessary adjustments have to be made to ensure complying with the new FIL as set out in the table in section 1 of this article.

3 State Administration for Foreign Exchange

4 http://www.safe.gov.cn/beijing/2020/0310/1194.html

Originally published April 2020.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.